CWS Market Review – August 2, 2022

It’s Been a Good Earnings Season for the Market

We’re still in the middle of earnings season and so far, it’s been a pretty good one. The S&P 500 is currently on track to post Q2 earnings growth of 8.09%. That’s not bad. Not that long ago, Wall Street had been expecting a lousy Q2 earnings season.

So far, 74.8% of companies in the S&P 500 have beaten earnings estimates and 67.9% have beaten sales estimates, although it’s true that Wall Street has lowered its estimates in recent weeks.

That’s an old Wall Street game: keep lowering the bar until you can easily step over and claim victory. I don’t make the rules. Of the companies that have reported so far, 57.2% have beaten on both earnings and sales. For the most part, our Buy List earnings have been quite good.

Here’s a look at the S&P 500 (black line, left scale) along with its earnings (red line, right scale). I scaled the two lines at a ratio of 20-to-1. That means whenever the lines cross, the P/E Ratio is exactly. The orange line is Wall Street’s forecast.

After yesterday’s close, AFLAC (AFL) released a solid report. The duck stock posted operating earnings of $1.46 per share. That was 18 cents above expectations. AFLAC has beaten expectations every quarter for the last five years. That’s why it’s been on our Buy List. Shares of AFLAC gained 3.6% today.

Since last week was so cramped with earnings, I wanted to address the economic news we’ve had. Let’s start with the biggest which was the Federal Reserve’s decision to raise interest rates.

This is important because Jerome Powell appeared to hint that the Fed may be nearing the end of its rate hikes. Or at least, the aggressive portion of those rate hikes. Last Wednesday, the Fed decided to raise short-term interest rates by 0.75%. This is the second meeting in a row in which the Fed raised rates by that amount. The new target range for Fed funds is 2.25% to 2.50% and the vote was unanimous. This was the Fed’s fourth rate hike of this cycle.

Unfortunately, the Federal Reserve doesn’t have a terribly good track record of raising interest rates, slowing inflation and avoiding a recession. Fed Chairman Jerome Powell was clear that the economy is not currently in a recession. While Powell stated the need for ongoing increases in rates, he said that any more unusually large increases would depend on the data.

Investors took that as a hint that the Fed could be easing up soon. The stock market always prefers lower interest rates, and that’s why the S&P 500 rallied strongly on Wednesday afternoon after the policy statement came out. The index closed the day above 4,000 for the first time in seven weeks.

The rally continued through Thursday and Friday, and the S&P 500 closed last week 12.6% above its low from June 16. This makes this the largest rally of this bear market, but we still have a long way to go to reach a new all-time high. July turned out to be the best month for the market since 2020. It was also the market’s fifth-best month in the last 30 years.

The Fed is talking tough, but investors are skeptical. Earlier today, San Francisco Fed President Mary Daly said, “our work is far from done.” Chicago Fed President Charles Evans said that he’s open to another 0.75% increase.

For now, traders aren’t buying it. The futures market now sees a 70% chance of a 0.50% increase at the Fed’s September meeting. That’s probably about right. After that, things start to cool down. Traders see a 0.25% hike coming in November, just a few days before Election Day, followed by another 0.25% increase in December.

But that’s it. After that, the forecast is for the Fed to hold rates steady for several months. Traders even lean toward the Fed cutting rates by next June. That’s a shocker. It’s not unusual for the Fed to pivot abruptly in its policy decisions, but I can’t think of a time when a pivot was expected. There are even people claiming that the Fed misread the entire inflation situation. The Fed doesn’t meet in August, but it will have its traditional shindig in Jackson Hole at the end of this month.

We’re Not in a Recession. For Now.

On Thursday, the government released its initial estimate for Q2 GDP growth, and it showed that the economy contracted by 0.9% during the second three months of the year. This was the second quarter in a row of falling GDP. That’s often used as a short-hand definition of a recession. To be technical, that’s not the precise definition of a recession.

This generated a lot of debate over what is and what is not a recession. To be honest, I’m not much interested in that debate, but the numbers clearly show that the economy is slowing down. In particular, the weak spots are business and residential construction. Consumer spending is positive, but it appears to be slowing down.

My view is that the economy is not currently in a recession, but the odds of a recession starting within the next 12 months are quite high. I’d say 75%.

On Monday, the latest ISM Manufacturing Index came in at 52.8. That was the lowest number in two years. Any number above 50 means the factory sector of the economy is growing.

Earlier today, the Labor Department said there were 10.7 million job openings in June. That’s a big drop from May’s number of 11.3 million. This was the lowest number since September. Despite the big drop, there are still 1.8 job openings for every unemployed worker.

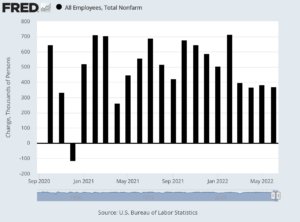

The next big test for the market will be this Friday when the July jobs report comes out. During June, the economy created 372,000 new jobs and the unemployment rate held at 3.6%.

For this Friday, the consensus of economists is that the economy created 258,000 net new jobs during July. If the number comes in weak, that could be more impetus for the Fed to abandon its plans for higher interest rates. In fact, I wouldn’t be surprised to see the market rally on a lower-than-expected jobs report.

Earlier this week, I looked at the historical numbers regarding job growth and recessions. I found that it’s very unusual for the economy to add jobs in a month that’s during an official recession. It’s happened just 20 times in 776 months of growing jobs. Bottom line: If Friday’s jobs report is positive, then it’s very doubtful that we’re in a recession.

As is often pointed out, the Federal Reserve prefers to follow the Personal Consumption Expenditures Price Index for its inflation figure rather than the Consumer Price Index. This has drawn some attention because the PCE has generally been lower than the CPI.

On Friday, we got the latest PCE report, and it showed that inflation is still going strong. For the 12 months ending in June, the PCE Price Index increased by 6.76%. That’s the steepest increase in 40 years.

The PCE increases had peaked in March. That is, until we got Friday’s report for June. The core PCE Price Index is up 4.79% over the last year. That’s still below its peak of 5.31% which it hit in February. In single-month terms, PCE was up 0.95% in June while the core rate was up by 0.59%.

The next inflation report will come out next Wednesday, August 10. This will be the first one that will include the recent drop in gasoline prices. According to GasBuddy, gasoline prices peaked at $5 per gallon in mid-June. Since then, prices have gradually drifted lower and are now at about $4.15 per gallon.

Update on Simulations Plus

In May of 2021, I told you about one of my favorite stocks to watch which is Simulations Plus (SLP). I said that as much as I liked the stock, the price was too high for me. At the time, SLP was going for $57 per share. I said that if SLP “ever drops below $40, it could be a very good buy.”

That was a steep drop I was asking for, and that’s what happened. In fact, SLP fell below $40 per share twice. The last time was earlier this year, and it turns out that that was a very good buying opportunity. Today SLP closed at $64.53 per share.

So what does Simulations Plus do? The company makes software that lets drug companies simulate tests of their products in the virtual world before using any human or animal test subjects. That’s a big cost-saver for drug companies. Simulations Plus helps streamline the R&D process by making it faster and more efficient. Not only is this cost effective, but it also helps drug companies in dealing with time-consuming regulatory hurdles.

There are times when the results from SLP’s products have allowed companies to waive clinical studies. The cost savings are substantial. This means drug companies don’t have to deal with the time and expense of recruiting test subjects and analyzing test results.

By using SLP’s software, drug companies can experiment with many variables like fine tuning dosage amounts. Companies can also see potential harmful side effects. Another important factor is that companies can identify treatments that have no benefits.

The stock has been rallying strongly since mid-June. That was helped by a very good earnings report. In early July, SLP reported its fiscal Q3 earnings for the quarter ending on May 31. Revenue rose 17% to $15 million. The company has two business segments. Software revenue increased 16% to $9.7 million, and Services revenue was up 19% to $5.3 million.

SLP’s gross margins are at 83%. In simpler terms, they can charge six times what it costs them to make their products. Net income was 20 cents per share. That beat the consensus of 17 cents per share.

By the way, I use the term “consensus” very carefully since only four analysts follow the stock. When I first started watching the stock, no one was following it. It’s interesting how coverage only comes after the stock starts to move.

For Q4, which ends later this month, SLP expects revenue growth of 12% to 15%. They didn’t provide an estimate for EPS, but Wall Street expects 25 cents per share. There’s a lot I like about SLP and it will certainly be a candidate for next year’s Buy List.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”

Posted by Eddy Elfenbein on August 2nd, 2022 at 7:23 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His