CWS Market Review – September 20, 2022

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

Our ETF Turns Six Years Old

Do you remember

The 21st night of September?

Love was changin’ the minds of pretenders

While chasin’ the clouds away

Tomorrow is the sixth birthday of our exchange-traded fund, the AdvisorShares Focused Equity ETF (CWS). We started trading at $25 per share on September 21, 2016. I normally steer clear of discussing the ETF, but in the event of our birthday, I hope you don’t mind a little grandstanding.

I want to thank all our supporters. Every year, hundreds of ETFs start, and hundreds go bust, but we’re still going strong. Until the market broke earlier this year, we reached all-time highs for net asset value per share and total assets under management. Over the last six years, we’ve made millions of dollars for our shareholders, and we’re aiming to make millions more.

If you’re not familiar with the ETF, it’s based on our Buy List, but it’s not an exact replica. The SEC will come after me if I say it’s the exact same thing, but we work hard to make it as close as possible and I think we do a good job.

I also want to mention that we’ve been beating the market in recent months. Not only that, but we’ve been beating net of fees. This has been some of the strongest relative strength in the history of the fund. This really is our type of market.

I’ll remind investors that the fund is completely transparent. You always know exactly what’s in the fund. We make our portfolio changes once a year; five stocks go in and five stocks go out. That’s a turnover rate of just 20%. That’s not that far from the S&P 500.

The fund is also tax-efficient, and we were the first ETF to use a fulcrum fee. In plain English, a fulcrum fee means you get a discount if I underperform the S&P 500, and I get a bonus if I beat the index. That way, I have “skin in the game.”

I promise you I won’t give you the hard sell. Check out the fund and see if it’s for you. If not, that’s fine. If you have any questions, we have a great customer service team you can reach at 1-877-843-3831. There are more stats and info at our website.

The Federal Reserve Needs to Get Serious

Enough of that, let’s look at Wall Street. Today was the first day of the Federal Reserve’s meeting. I almost feel that the actual meeting is a bit of an anti-climax. This meeting has been one of the most debated and analyzed Fed meetings in recent memory.

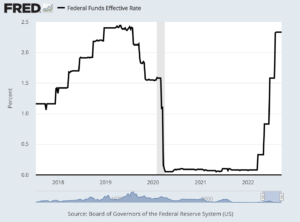

Despite all the attention, the consensus is that the Fed will raise interest rates by 0.75%. That will bring the target rate for the Fed funds rate to 3.00% to 3.25%. There’s a small minority holding out for a full 1% hike, but I doubt that will happen. The Fed doesn’t like to be unpredictable. The Fed is happiest when it’s boring everyone.

The market will be paying attention just as much attention to the press conference by the Fed chairman as it will to the rate decision itself. At this meeting, the Fed will also update its economic projections for the next few years.

Historically, the Fed’s projections are notoriously bad. Even for economists, they’re bad. But the projections could be of interest this time. That’s because there will eventually be some pushback within the Fed at its rate-hiking policy. I doubt it will show up at this meeting, but at a future meeting, some Fed members will express their reservations about the path of interest rates. That’s only natural. For now, Jerome Powell has the political cover to raise rates. That’s why the lousy CPI report was such a big deal. Consumers are fed up with rising prices.

The Fed will probably hike by another 0.75% in November. After that, things are unclear. At that point, the Fed will probably be close to its ceiling for interest rates. I could see rates going higher in 2023, but not much higher. The famous 2/10 Spread is already negative. Plus, the U.S. dollar is hitting long-time highs against currencies like the pound and the euro. That’s not good for the U.S. economy, and the effect will soon be felt.

The problem with the Fed is that its interest rate hikes are a blunt instrument. People think the Fed has some magic ray gun that can easily zap a bubble without causing any collateral damage to the rest of the economy. Sadly, that’s not the case. The housing market is usually the major casualty.

For tomorrow, expect a 0.75% rate increase. The market has rallied on every rate hike day this year. I think Powell will continue his tough talk at the press conference, but the stock market is clearly nervous. The S&P 500 closed today at its lowest point since July 18, and the 10-year yield just touched its highest level since April 2011. In the last five weeks, the S&P 500 has lost 10.4%.

The Fed has been willing to talk tough, but following through with painful rate hikes is a different matter. Let’s see what Powell does.

Looking Ahead to Q3 Earnings Season

The third-quarter earnings season won’t begin for another three weeks, but I wanted to look at what we can expect.

Unfortunately, Wall Street has been slashing its estimates for Q3. On June 30, at the end of Q2, Wall Street had been expecting the S&P 500 to report earnings of $59.23 per share (that’s the index-adjusted number). Since then, the estimate has been pared back to $55.69 per share. That’s a drop of 6% in less than two months. That may sound small, but it can have a big impact on the market.

It’s not a secret what’s happening. Wall Street is growing concerned about the state of the economy. The Fed’s rate hikes are having an impact. It’s doubly worse for the stock market. That’s because earnings are going down as interest rates are going up. That means that lower earnings are being discounted at a faster rate. That adds up to lower share prices and that’s exactly what we’ve been seeing.

It doesn’t end there. We’re also seeing revisions to Q4 earnings and for 2023. Since June 30, Wall Street has lowered its outlook for Q4 by 4.5%. Analysts now expect the S&P 500 to earn $209.66 per share this year. For 2023, Wall Street sees earnings of $240.36 per share. That’s still a growth rate of a little under 15%. The S&P 500 is currently trading at 16 times next year’s earnings.

Interestingly, companies in the S&P 500 have cut back on their share buybacks. During Q2, companies repurchased $219.6 billion shares of their own stock. That’s down 21.8% from the pace set in Q1.

During the 12 months ending in June, companies bought a little more than $1 trillion of their own stock. During Q2, dividend payouts rose only 2.1% to $140.6 billion.

Consider that the interest rate on the two-year Treasury recently hit 4%. Is it worth it to some people to sit out of the market for one year and collect an easy 4%? That’s over 1,200 Dow points for doing nothing. Personally, it doesn’t appeal to me but I’m sure it does to some investors. Valuations won’t save this market. The outlook won’t be sunny again until investors are convinced that earnings are growing rapidly again.

The Market Often Turns in Mid-Term Years

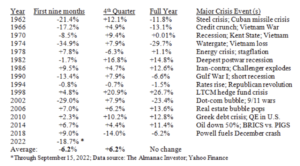

We’re coming up on what’s historically been an important turning point in the stock market. Historically, there’s been an unusual effect during mid-term election years: the long-term average shows a pattern of a terrible first nine months of the year followed by a very strong last three months of the year.

My friend, Gary Alexander, compiled the data and found that the stock market has averaged a loss of 6.2% through the first three quarters of the mid-term election year. The fourth quarter averages a gain of 6.2%. As a result, the average of the mid-term year is flat.

You can see that Q4 of 2018 was an outlier. It was not a good market that year. Interestingly, Jerome Powell gave us two rate hikes during that quarter.

What leads to the Mid-Term Effect? There are a few theories. Historically, it could be that the market reacts negatively to the new president’s agenda. As the election day approaches, the president, fearful of the polls, changes course and the market rallies. At least, that’s the theory.

So far, the stock market has had a lousy 2022. The bulls will return at some point. Going by history, that day may soon be upon us.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on September 20th, 2022 at 5:15 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His