Bed Bath & Beyond Beats and Guides Higher. Again.

Wow! Bed Bath & Beyond ($BBBY) did it again.

The company just reported fiscal Q2 earnings of 93 cents per share which was a full nine cents more than Wall Street was expecting. This was another outstanding quarter for them. Three months ago when the last earnings report came out, the company told us to expect Q2 earnings to range between 77 and 82 cents per share (I had expected a range of 80 to 85 cents per share).

Well, they blew that forecast out of the water! For last year’s Q2, they earned 70 cents per share. For this year’s Q2, net sales rose 8.2% to $2.314 billion. The all-important comparable store sales figure was 5.6%. Those are solid numbers. Year-over-year operating and net margins increased for the 10th-straight quarter.

For Q3, the current quarter, Bed Bath & Beyond projects earnings of 82 to 87 cents per share. The Street was at 86 cents. BBBY also raised their full-year guidance to earnings growth of 22% to 25%.

If you’re keeping score at home, this is the second time that BBBY has raised their full-year growth forecast this year. They went from forecasting an earnings increase of 10% – 15% to a revised range of 15% – 20% to the current range of 22% – 25%.

Let’s look at the numbers: For 2010, Bed Bath & Beyond earned $3.07 per share, so the updated forecast translates to a range of $3.74 – $3.84 per share.

Just to give you an example of how strong business has been, let’s compare this past quarter’s numbers with the one from exactly two years ago. In two years, sales are up 20.8%. Net margins have increased from 7.1% to 9.9%. That turns a 20.8% sales increase into a 69.2% profit increase.

Here’s a look at BBBY’s quarterly numbers for the past few years:

| Quarter | Sales | Gross Profit | Operating Profit | Net Profit | EPS |

| May-99 | $356,633 | $146,214 | $28,015 | $17,883 | $0.06 |

| Aug-99 | $451,715 | $185,570 | $53,580 | $33,247 | $0.12 |

| Nov-00 | $480,145 | $196,784 | $50,607 | $31,707 | $0.11 |

| Feb-00 | $569,012 | $238,233 | $77,138 | $48,392 | $0.17 |

| May-00 | $459,163 | $187,293 | $36,339 | $23,364 | $0.08 |

| Aug-00 | $589,381 | $241,284 | $70,009 | $43,578 | $0.15 |

| Nov-01 | $602,004 | $246,080 | $64,592 | $40,665 | $0.14 |

| Feb-01 | $746,107 | $311,802 | $101,898 | $64,315 | $0.22 |

| May-01 | $575,833 | $234,959 | $45,602 | $30,007 | $0.10 |

| Aug-01 | $713,636 | $291,342 | $84,672 | $53,954 | $0.18 |

| Nov-02 | $759,438 | $311,030 | $83,749 | $52,964 | $0.18 |

| Feb-02 | $879,055 | $370,235 | $132,077 | $82,674 | $0.28 |

| May-02 | $776,798 | $318,362 | $72,701 | $46,299 | $0.15 |

| Aug-02 | $903,044 | $370,335 | $119,687 | $75,459 | $0.25 |

| Nov-03 | $936,030 | $386,224 | $119,228 | $75,112 | $0.25 |

| Feb-03 | $1,049,292 | $443,626 | $168,441 | $105,309 | $0.35 |

| May-03 | $893,868 | $367,180 | $90,450 | $57,508 | $0.19 |

| Aug-03 | $1,111,445 | $459,145 | $155,867 | $97,208 | $0.32 |

| Nov-04 | $1,174,740 | $486,987 | $161,459 | $100,506 | $0.33 |

| Feb-04 | $1,297,928 | $563,352 | $231,567 | $144,248 | $0.47 |

| May-04 | $1,100,917 | $456,774 | $128,707 | $82,049 | $0.27 |

| Aug-04 | $1,273,960 | $530,829 | $189,108 | $120,008 | $0.39 |

| Nov-05 | $1,305,155 | $548,152 | $190,978 | $121,927 | $0.40 |

| Feb-05 | $1,467,646 | $650,546 | $283,621 | $180,980 | $0.59 |

| May-05 | $1,244,421 | $520,781 | $150,884 | $98,903 | $0.33 |

| Aug-05 | $1,431,182 | $601,784 | $217,877 | $141,402 | $0.47 |

| Nov-06 | $1,448,680 | $615,363 | $205,493 | $134,620 | $0.45 |

| Feb-06 | $1,685,279 | $747,820 | $304,917 | $197,922 | $0.67 |

| May-06 | $1,395,963 | $590,098 | $148,750 | $100,431 | $0.35 |

| Aug-06 | $1,607,239 | $678,249 | $219,622 | $145,535 | $0.51 |

| Nov-07 | $1,619,240 | $704,073 | $211,134 | $142,436 | $0.50 |

| Feb-07 | $1,994,987 | $862,982 | $309,895 | $205,842 | $0.72 |

| May-07 | $1,553,293 | $646,109 | $154,391 | $104,647 | $0.38 |

| Aug-07 | $1,767,716 | $732,158 | $211,037 | $147,008 | $0.55 |

| Nov-08 | $1,794,747 | $747,866 | $203,152 | $138,232 | $0.52 |

| Feb-08 | $1,933,186 | $799,098 | $259,442 | $172,921 | $0.66 |

| May-08 | $1,648,491 | $656,000 | $118,819 | $76,777 | $0.30 |

| Aug-08 | $1,853,892 | $739,321 | $187,421 | $119,268 | $0.46 |

| Nov-08 | $1,782,683 | $692,857 | $136,374 | $87,700 | $0.34 |

| Feb-09 | $1,923,274 | $785,058 | $231,282 | $141,378 | $0.55 |

| May-09 | $1,694,340 | $666,818 | $142,304 | $87,172 | $0.34 |

| Aug-09 | $1,914,909 | $773,393 | $222,031 | $135,531 | $0.52 |

| Nov-09 | $1,975,465 | $812,412 | $245,611 | $151,288 | $0.58 |

| Feb-10 | $2,244,079 | $955,496 | $370,741 | $226,042 | $0.86 |

| May-10 | $1,923,051 | $775,036 | $225,394 | $137,553 | $0.52 |

| Aug-10 | $2,136,730 | $874,918 | $296,902 | $181,755 | $0.70 |

| Nov-10 | $2,193,755 | $896,508 | $305,110 | $188,574 | $0.74 |

| Feb-11 | $2,504,967 | $1,076,467 | $461,052 | $283,451 | $1.12 |

| May-11 | $2,109,951 | $857,572 | $288,948 | $180,578 | $0.72 |

| Aug-11 | $2,314,064 | $950,999 | $371,636 | $229,372 | $0.93 |

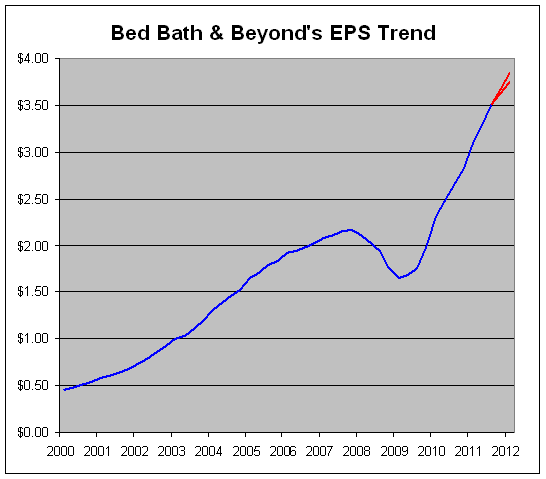

Here’s a look at the company’s recent trailing four-quarter earnings-per-share trend. As you can see, BBBY has bounced back very well since the recession.

The red lines represents the high and low ends of the company’s forecast. Judging by the trend, today’s forecast seems rather conservative. Earnings for the first half are up 35% so a forecast of 22% – 25% for the entire year seems very doable.

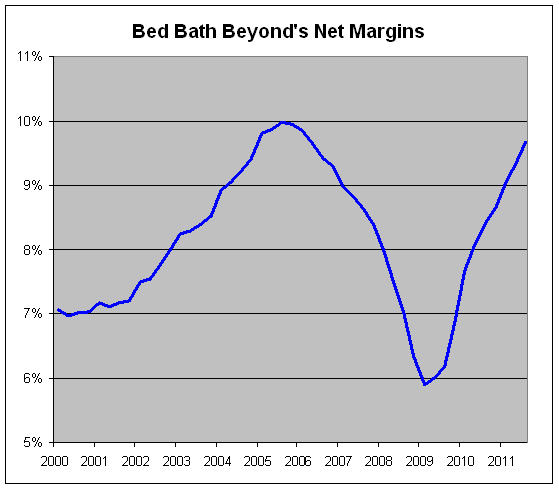

I’m growing slightly cautious about BBBY’s outlook. Not that things are about to go bad. Instead, I think it’s prudent to assume that the company is closer to the top of its business cycle than the bottom. For example, here’s a look at BBBY’s trailing four-quarter net profit margin:

The net margins seem to top off around 10% or so and we’re getting close to that. This means that the enormous tailwind the earnings get from smaller sales increases will start to fade. Also, the company’s sales growth rate, while still healthy, has noticeably decelerated.

Don’t be too afraid of a downturn in the earnings cycle. Bear in mind that the earnings peaked in the last cycle 15 quarters ago. Since then, BBBY’s earnings are up close to 62% which is 13.7% annualized. That’s pretty darn good.

Here’s a key section from the earnings call, courtesy of Seeking Alpha.

The following are our major planning assumptions for the remainder of fiscal 2011: one, including the 24 stores opened so far this year, we anticipate that the total number of new store openings will now be approximately 40 stores across all of our concepts. Currently, we believe our fiscal 2011’s store openings by concept will be substantially similar to fiscal 2010, with a slight shift to several more buybuy BABY stores and slightly fewer Bed Bath & Beyond stores.

As the year progresses, and we gain greater visibility, the total number of stores that we will open may be updated. We will continue to place Harmon Face Values health and beauty care offerings in stores across all of our concepts. As always, we remain flexible to take advantage of real estate opportunities that may arise; two, we expect to continue our program of expanding, renovating and/or relocating a number of our stores in fiscal 2011; three, we are modeling a 2 to 4 percentage increase in comparable store sales for the third and fourth quarters of fiscal 2011; four, based on these comparable store sales assumptions, we are modeling consolidated net sales to increase by 5% to 7% in the third quarter and by 4% to 6% in the fourth quarter; five, assuming these sales levels, in addition to planning the continuation of the shift and the mix of merchandise sold to lower margin categories, we are modeling our operating profit margin to slightly leverage for the fiscal third and fourth quarters; six, the third and fourth quarter tax provisions are estimated in the mid-to high 30s percent range — percentage range, with expected variability as taxable events occur; seven, capital expenditures for fiscal 2011, principally for new stores, existing store refurbishment, information technology enhancements, including increased spending on our interactive platforms and other projects, continue to be planned at approximately $250 million, but may reach as high as $300 million, depending on the composition and ultimate timing of projects; eight, depreciation for fiscal 2011 is now estimated to be in the range of approximately $180 million to $190 million; nine, we expect to generate positive operating cash flow in fiscal 2011 and continue to fund operations entirely from internally-generated sources; 10, we expect to continue our share repurchase program, which may be influenced by several factors, including business and market conditions and continue to model completion of the current authorization to early fiscal 2013.

Based on these and the other planning assumptions, we are now modeling net earnings per diluted share to be in the range of approximately $0.82 to $0.87 for the fiscal third quarter of 2011. For all of fiscal 2011, we are modeling net earnings per diluted share to increase in the range of approximately 22% to 25%, up from the previous model of approximately 15% to 20%.

Before concluding this afternoon’s call, a few additional comments relative to our recently concluded fiscal second quarter. Our balance sheet and cash flows remain strong. We ended the fiscal second quarter with cash and cash equivalents and investment securities of approximately $1.9 billion.

Posted by Eddy Elfenbein on September 21st, 2011 at 4:36 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

Tickers: bbby

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His