Posts Tagged ‘bbby’

-

CWS Market Review – October 10, 2014

Eddy Elfenbein, October 10th, 2014 at 7:07 am“There is scarcely an instance of a man who has made a

fortune by speculation and kept it.” – Andrew CarnegieThe stock market decided to get a whole lot more interesting this week. On Thursday, the S&P 500 fell 2.09% for its worst day in six months. This was surprising, considering how calm the markets had been. Earlier this year, there was a three-month stretch when the index never had a 1% day. Now it’s happened four times in the last five days.

During Thursday’s trading, the Volatility Index ($VIX) spiked to over 19. Just a few days ago, it was less than 12. In the last few issues, I’ve talked about the distorting impact that the strong dollar has had on the markets. Now we’re seeing some of the negative fallout. On Thursday, the S&P 500 closed at 1,928.21. That’s a two-month low, and it’s a loss of 4.13% from the all-time high close of September 18. (Notice how the spread between the daily high and low has gradually increased.)

That’s not a big loss, but remember, we haven’t had a 10% correction in three years. I should remind all investors that every few years, stocks go down. It’s just the nature of the beast. But now we’re in earnings season, and this is when every stock is judged by the market. For disciplined investors, we also want to pay close attention to the earnings guidance from our stocks.

In this week’s issue, I’ll walk you through what’s been roiling the market. I’ll also highlight three of our Buy List stocks which have earnings reports coming next week. For the broader market, I’m expecting a mild earnings season. Nothing great, but not terrible either. I’ll also have some updates on our Buy List stocks, but first, let’s look at what has the market so rattled lately.

Volatility Makes a Comeback this Week

Last Friday, the government reported that the U.S. economy created 248,000 jobs last month. That’s a pretty strong number. The Feds also revised higher the figures for July and August, and the unemployment rate dropped down to 5.9%. This was the first time the jobless rate has dipped below 6% since July 2008.

The market briefly enjoyed the good news, and the S&P 500 rallied back over 1,970, but it wasn’t to last. Stocks sunk lower on Monday and Tuesday, but the heated action came on Wednesday and Thursday.

Stocks started out poorly on Wednesday, but that afternoon, the Federal Reserve released the minutes from their last meeting. We never know exactly what happens behind the scenes at these meetings, but three weeks after each one, the Fed releases the minutes. In them, the Fed expressed some concerns about the rising dollar. While a rising dollar carries benefits, it can also impinge on growth and keep inflation down. The Fed has tried desperately to keep the economy afloat, and we know that inflation is running below their target, so you can see their concern.

So does this mean there’s a growing chorus of doves at the Fed? Not exactly. I have to mention that reading the minutes from any Fed meeting is an arcane study in indefinite pronouns; “some participants say” this or “others” say that. In this week’s minutes, the concerns about the strong dollar were aired by “some” and “a couple.” Well, a few of us have a number of concerns some of the time about several of these minutes. What exactly are they saying?

In any case, traders were quite pleased, and the market staged an impressive turnaround on Wednesday afternoon. In fact, it was the best day for the S&P 500 all year. I think they’re correct that the Fed has a bias towards keeping rates low, but we simply can’t say how much they’re weighing the impact of the strong dollar.

Then on Thursday, concerns from Europe sent our stocks lower again. Mario Draghi, the head of the ECB, is clearly frustrated with the European economy. He’s particularly worried about the threat of deflation. The German economy is moving backward and there are concerns about its impact here. The sanctions against Russia aren’t helping either. So we followed the best day of the year with the fourth-worst day of the year. Market historians often tell us that weird things happen in October.

The Fed’s minutes caused a brief pullback from the greenback, but the effects on the strong dollar trade are still evident. Small-caps are doing poorly. The relative strength of the Russell 2000 has been terrible. Gold has been awful, although it got a little bounce this week. Conversely, the dollar fell a little bit, but commodity stocks have lagged badly. The Energy Sector ETF ($XLE) has dropped from over $100 on July 24 to just under $85 on Thursday. The yield on the 10-year Treasury dropped to 2.33%, which is its lowest yield in more than 15 months. At the start of the year, the yield was near 3%. It’s not just Treasuries; 30-year fixed-rated mortgages are back below 4%.

Several of our Buy List stocks got hit hard this week, including some of my favorites. AFLAC ($AFL), CA Technologies ($CA) and Ford Motor ($F) all touched new 52-week lows this week. I was really surprised by the falloff in Ford. The stock had already turned south after the lower guidance, but the selling has continued. A few weeks ago, Ford was closing in on $18 per share, and this week, it dropped below $14 per share. This week, an analyst at Morgan Stanley downgraded the automakers, not because of any weakness in their operations, but because of lower gas prices. The analysts said that cheaper gasoline won’t cause such a rush of buyers to snatch up Ford’s new aluminum trucks. Frankly, I think he’s missing the larger picture. What Ford is doing could be a massive change for the industry. I apologize for the volatility, but I haven’t altered my outlook on Ford. If their forecast for next year is correct, Ford is going for a great price here.

What to do now: Investors should focus on earnings instead of day-to-day volatility. For Q3 earnings season, analysts currently expect profit growth of 4.9%. Three months ago, the expectation was for growth of 7.8%. As I said, I expect mild growth this season. Some of the most attractive Buy List stocks at the moment are Ford Motor ($F), AFLAC ($AFL), eBay ($EBAY), Cognizant ($CTSH) and Microsoft ($MSFT). Now let’s take a look at some earnings reports coming our way next week.

Three Buy List Earnings Reports Next Week

Next week is the start of earnings season for our Buy List. On Tuesday, Wells Fargo ($WFC) will become our first Buy List stock to report. Three months ago, the big bank earned $1.01 per share, which matched expectations. I’ve been impressed by how Wells has managed itself during an important juncture in the industry (see the chart below). Mortgage revenue has plunged, but Wells is well ahead of the curve. The bank has broadened its footprint in credit cards, cars loans and investment banking.

Wells Fargo has managed to increase its earnings for 18 quarters in a row. Until last quarter, they beat expectations for 10 quarters in a row. The consensus on Wall Street is for Wells to earn $1.02 per share for Q3. My numbers say that’s about right. Frankly, the stock isn’t that exciting right now, but that’s a plus in this market. The stock is currently going for 12.4 times earnings, which is quite reasonable. This is a good stock for conservative investors. In a downturn, WFC probably won’t fall as much as other stocks and the dividend is secure. Wells Fargo is a buy up to $54 per share.

On Wednesday, eBay ($EBAY) is due to report. The online auction house has had a rough year, although it’s improved since the spring. The big news recently was the announcement that they’re going to spin off PayPal next year. I think that’s a smart move, and I expect to hear more details about this on the conference call.

For Q2, eBay beat by a penny per share. They said they expect Q3 earnings to range between 65 and 67 cents per share. Since that range is so narrow, I’m assuming that’s what it will be. Honestly, I’m surprised eBay is still below $55 per share. The business looks pretty good right now, and naturally, a stronger economy would help.

For the entire year, eBay sees earnings coming in between $2.95 and $3.00 per share. They see revenues ranging between $18.0 billion and $18.3 billion. I’ll be curious to hear what they have to say about Q4 guidance. Wall Street expects 91 cents per share, but there’s a chance it could be higher. I’m keeping a fairly tight Buy Below here; eBay is a buy up to $55 per share. I may raise it if earnings and guidance are strong.

On Thursday, it’s Stryker’s ($SYK) turn. The orthopedic company rarely surprises us, but they did last earnings season when they lowered the high end of their full-year guidance by ten cents per share. For Q3, they see earnings ranging between $1.12 and $1.16 per share. I think there’s a good chance SYK can top that. For the full year, Stryker projects earnings between $4.75 and 4.80 per share.

I don’t always trust guidance from companies, but in Stryker’s case, I‘m more inclined to believe them. I should also point out that Stryker may be in the works for a merger. I’m not predicting anything will happen, but merger mania seems to be spreading across their industry. If the price is right, a deal might come about. Stryker is a buy up to $87 per share.

Buy List Updates

Shares of Bed Bath & Beyond ($BBBY) spiked higher on Tuesday after rumors broke that Carl Icahn had taken a position in the stock. Let me stress that there’s absolutely zero confirmation that the story is true.

Traders naturally prefer to move first and wait for facts later. Sometimes that works for you, and sometimes it doesn’t. This week, it worked in BBBY’s advantage. Later on in the week, the shares kept their heads while the rest of the market got shaky. I doubt Carl made any move into BBBY, but you never know. Either way, we’re in this for the long term. Despite all the drama in this stock, the company hasn’t altered its long-term guidance. Bed Bath & Beyond remains a buy up to $70 per share.

Earlier this year, Medtronic ($MDT) announced its big “tax inversion” deal with Covidien ($COV), a company based in Ireland. Recently, however, shares of Medtronic pulled back after the Obama administration announced new rules regarding such inversions. Some investors thought that might cause the deal to be scrapped. Not so.

This week, Medtronic said they’re reworking the deal to be in compliance with the new rules. The combined entity will be domiciled on the Emerald Isle, and they’ll probably be able to cut their tax bill as well.

Not to get too technical, but Medtronic was going to use their cash held outside the U.S., and loan that to Covidien to complete the deal. Now Medtronic will use cash from another source. I’ve been impressed by Medtronic’s insistence that they’re doing this deal for operational reasons, not solely for a cheaper tax bill. You’d expect them to say that publicly, but now we have further proof that both companies are on board. Medtronic is a buy up to $67 per share.

That’s all for now. Next week will be about earnings. We’re also going to get important reports on retail sales and industrial production. You can see an earnings calendar for our Buy List stocks. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – September 26, 2014

Eddy Elfenbein, September 26th, 2014 at 7:05 am“The stock market is designed to transfer money from the active to the patient.”

– Warren BuffettThis market continues to be dominated by the strong U.S. dollar. This is a very important point that all investors need to understand. There’s barely a sector of the market that’s not being impacted by the rallying greenback. The difference is that lately, the market’s no longer going higher.

On Thursday, the stock market had its second-biggest drop in the last 24 weeks. The S&P 500 lost 1.62% to close at 1,965.99. That’s a five-week low. The Dow slipped below 17,000, and the Nasdaq Composite was especially hard hit. That index closed below 4,500 for the first time since mid-August.

It was only one week ago that the market reached its “Alibaba Peak.” Last Friday morning, the S&P 500 touched its all-time intra-day high of 2,019.26, and 122 minutes later, Alibaba made its market debut. That may not be a coincidence.

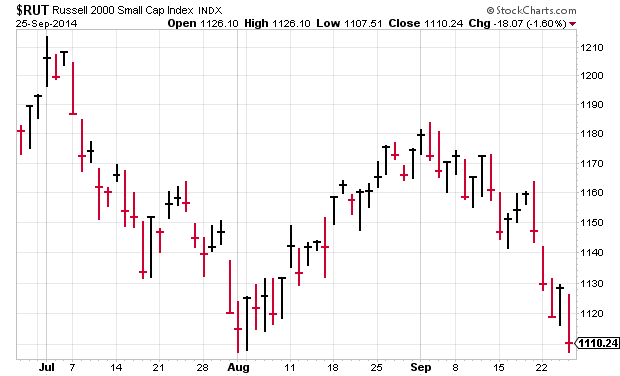

On Thursday, the dollar index broke out to a four-year high, and you can see the evidence everywhere. The yield spread between U.S. and German bonds reached a 15-year high. Gold dropped below $1,210 per ounce for the first time this year, and the small-cap Russell 2000 Index is now down 8.1% since July 3.

In this week’s CWS Market Review, I want to take a closer look at an important issue that has been driving the stock market: share buybacks. For years, Corporate America has been buying back its own shares at an impressive pace. Now, however, the buyback party looks to be coming to an end—and that might be good news. I’ll explain why in a bit.

Later on, we’ll take a look at the solid earnings report from Bed Bath & Beyond. The home-furnishings stores leaped more than 7% on Wednesday after they reported strong quarterly earnings. Speaking of buybacks, a few weeks ago, BBBY went to the bond market to borrow money so they could buy back gobs of their shares, and that’s what helped drive their earnings success. Or I should say their earnings-per-share success. We’ll also take a look at Medtronic’s tax inversion and the dividend increase from McDonald’s (their 38th in a row). But first, let’s look at what’s driving all these buybacks.

Why Share Buybacks Are Beginning to Fade

Anyone else remember when companies used to have lots of shares outstanding? Every quarter, the number of shares has slowly been getting smaller. More and more companies have been using their cash hordes to repurchase their own shares. The benefit for shareholders comes down to simple math. Having fewer shares helps your earnings-per-share, and investors like that. Howard Silverblatt, the main stat guy at S&P, notes that 295 companies in the S&P 500 reduced their share count last quarter.

On one hand, fewer shares is a good thing for investors, as it makes their holdings more valuable. But my take is that I’d prefer to see companies use their cash to expand their operations. That’s the best way to reinvest shareholder money: grow the business. But I can’t fault companies for buying back so much stock. What’s the point of keeping your cash in the bank, where you’d get 0.01%? After all, stocks are cheap and buyback announcements make for great PR.

I have two major complaints with share buybacks. One is that companies shouldn’t be in the stock market game. It’s a great idea to buy back a stock that’s cheap, assuming it rallies later on. But a lot of companies have tossed enormous sums of money at very expensive stocks, only to watch those assets fall. Cisco Systems is a perfect example. Remember a bank called Lehman Brothers? They used to be in the news a lot a few years ago. Anyway, Lehman spent $1 billion buying its own stock during the six months leading up to May 2008. I wince whenever I think about that. The Economist notes, “In all, America’s financial sector repurchased $207 billion of shares between 2006 and 2008. By 2009 taxpayers had had to inject $250 billion into the banks to save them.”

I’m also leery of companies sitting on too much cash. Peter Lynch has referred to this as the “Bladder Theory of Corporate Finance.” Even Apple got complaints from investors like Carl Icahn and David Einhorn for the size of its cash position, and it´s promised to return more money to shareholders. I also don’t like how many companies issue huge amounts of stock options for executive compensation, but they use share buybacks to mask how much they’re diluting their share base. There are exceptions like DirecTV which actually reduce their share count.

But we need to consider the fact that buybacks are popular with investors. Merrill Lynch found that companies with the largest buybacks crushed the market last year. But this year, the biggest repurchasers are performing nearly the same as the rest of the market. Actually, slightly worse. Perhaps, buybacks have lost their cool.

That could be the case. There are early indications that the buyback fever is fading. In Q2, companies in the S&P 500 bought back $116.2 billion worth of stock. That’s a decrease of 1.6% over last year, and a drop of 27.1% from Q1. Of course, stock prices are higher as well.

But that’s not all. Ironically, this could be an optimistic sign, because it means that companies are spending more money on growing their operations. Or, as crazy as this may sound, actually giving raises to their employees! When the financial crisis hit, buybacks were a no-brainer. Also, companies tend to be conservative with their dividend increases because it looks especially bad if you have to cut them later on. It’s generally assumed that a company will maintain its current dividend indefinitely.

There´s basic economics at work here. The U.S. economy has added close to nine million jobs in the last five years (we’ll get another jobs report next week). Those new jobs are an investment in a company’s future, and it’s encouraging to see firms take a more optimistic view of their future. A few days ago, Tesla said it’s building a new battery factory in Nevada. In response, the stock soared. In retrospect, the buyback craze was a result of low prices, low interest rates and a dragging economy. That’s coming to an end, and so, too, is the buyback frenzy. Now let’s take a look at a slumbering Buy List stock that’s taken full advantage of share buybacks.

Bed Buyback & Beyond

After the closing bell on Tuesday, Bed Bath & Beyond ($BBBY) reported earnings for its fiscal second quarter. Earnings announcements have been rather nerve-wracking for the home-furnishings chain; the stock has plunged after the last three earnings reports.

I’m pleased to say that that streak has come to an end. Shares of BBBY jumped more than 7.4% on Wednesday after Bed Bath & Beyond reported quarterly earnings of $1.17 per share. The company had previously said that earnings would range between $1.08 and $1.16 per share. Last week, I said that I expected earnings in the top end of that range, so the results were even better than I was expecting.

What’s interesting about BBBY’s earnings is the impact of buybacks. The company has been gobbling up its own shares at a furious pace. Net earnings fell 10.2% from the same quarter one year ago; however, there were 10.7% fewer shares. Presto! Earnings-per-share rose.

Bed Bath & Beyond recently floated a $1.5 billion bond offering to fund its share buybacks. Last quarter, BBBY spent $1 billion to buy back 16.9 million shares. Working out the math, that means they paid less than $60 per share on average, so they’re already in the money. Once again, it’s basic economics. The bond deal cost BBBY 4.38%, so it’s not exactly a back breaker. In fact, Standard & Poor raised their rating on Bed Bath & Beyond to AAA- from BBB+.

I’ve often said that I’m not a big fan of share buybacks, but I’ll give credit to BBBY for being another firm that´s actually reducing its share count. The company isn’t finished with buybacks either. There’s still another $1.8 billion remaining in the current buyback program. BBBY projects its share count will fall by another 13 million by the end of the fiscal year.

Bed Bath & Beyond gave us guidance for Q3 and Q4. For the third quarter, which ends in November, Bed Bath sees earnings ranging between $1.17 and $1.21 per share. For Q4, which is the all-important holiday season, they see earnings ranging between $1.78 and $1.83 per share. For the entire year, their earnings forecast is $5.00 to $5.08. BBBY sees comparable-store sales rising by 2% to 3% in Q3 and 4% to 5% in Q4.

The full-year forecast is the first time they’ve given us a specific EPS range, but it exactly comports with the “mid-single-digits” language they’ve used for several months. Not once have they budged from that forecast. Since the company made $4.79 per share last year, the current EPS guidance translates to annualized growth of 4.4% to 6.1%.

Adding up the two quarterly guidance ranges gives us a full-year range of $5.04 to $5.13. I’m probably reading too much into that, but it’s something to note. Overall, this was a solid quarter for BBBY. The stock remains a good buy up to $70 per share.

Medtronic Down on Tax-Inversion Rules

This week, Medtronic ($MDT) learned an important lesson that many of us have known for a long time—you simply can’t become Irish because you feel it. Shares of MDT dropped close to 3% on Tuesday, and still more on Wednesday and Thursday, after the government announced new rules for “tax inversions.” That’s what Medtronic is trying to do as it buys Ireland’s Covidien ($COV) and moves its HQ to the Emerald Isle. The move would cut their tax bill by a good amount.

I’ll be honest with you—I don’t know what impact the new rules will have on the MDT/COV deal, and it sounds like no one else knows at this point either. The lawyers are still looking it over. The key issue is a company’s holding of cash outside the United States. In Medtronic’s case, they hold close to $14 billion outside the country. Medtronic wants to loan some of that to their new parent, but the new rules might stop that.

Bloomberg reported that Medtronic released a statement saying, “We are studying the Treasury’s actions. We will release our perspective on any potential impact on our pending acquisition of Covidien following our complete review.” Don’t let the recent sell-off rattle you. Medtronic remains a buy up to $67 per share.

McDonald’s Raises Its Dividend for the 38th Year in a Row

I wanted to say a quick word about McDonald’s ($MCD), which has been a problem child this year. The company has been trying to right itself after several missteps. The results don’t yet reflect this, and the last sales report was truly terrible.

In the CWS Market Review from three weeks ago, I said I was concerned that Mickey D’s wouldn’t raise their dividend this year. I’m pleased to say that that wasn’t the case. Last week, McDonald’s announced that they’re raising their quarterly dividend from 81 to 85 cents per share. The burger giant aims to return $18 billion to $20 billion to shareholders from 2014 through 2016. The new dividend is payable on December 15 to shareholders of record as of December 1. Going by the new dividend and Thursday’s closing price, McDonald’s now yields 3.61%. McDonald’s remains a conservative buy up to $101 per share.

Two more things to mention. DirecTV ($DTV) shareholders approved the AT&T merger with 99% of the vote. Also, Cognizant Technology Solutions ($CTSH) is very cheap at the moment. The shares are at a seven-week low. If you can pick up CTSH below $45, that’s a very good purchase.

That’s all for now. The third quarter comes to a close next Tuesday. After that, we’ll get the important turn-of-the-month economic reports. The September ISM report comes out on Wednesday. There’s a chance it could hit a 10-year high. Also on Wednesday, we’ll get the ADP jobs report. Then on Friday will be the official jobs report from the government. The last report was on the weak side. I doubt that’s the start of a trend. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – September 19, 2014

Eddy Elfenbein, September 19th, 2014 at 7:04 am“The market is fond of making mountains out of molehills and exaggerating

ordinary vicissitudes into major setbacks.” – Benjamin GrahamIs it ever! We all know how the market likes to be a major drama queen, and frankly, that’s what makes investing so much fun. This week, for example, was an exciting week for Wall Street. On Wednesday, Janet Yellen and her buddies on the Federal Open Market Committee decided to taper the Fed’s bond purchases by another $10 billion. Starting in October, the central bank will buy $10 billion in Treasuries and $5 billion in mortgage-backed securities. What this means is that the Fed will almost certainly wrap up Quantitative Easing once and for all at their next meeting in late October.

In addition to their regular policy statement, the Fed threw another statement our way:

A Declaration of Normalization Principles, which describes how the Fed will depart from (as they prefer to phrase it) “monetary accommodation.” I’ll explain what it all means in bit, but skipping all the econo-jargon, it means that we can expect low interest rates to stick around a while longer.That’s good news for investors, and the stock market approved of the Fed’s move. On Thursday, the S&P 500 galloped to 2,011.36, which is the index’s 34th record close of the year. There’s also some relief that the “no” side appears to have won in Scotland’s independence referendum.

Later on in this issue, we’ll look at the recent earnings report from Oracle ($ORCL). The enterprise-software king missed earnings yet again, but the really big news is that Larry Ellison is stepping down as CEO! I’ll tell you what it all means. We also got an 11% dividend increase from Microsoft ($MSFT), which is exactly what I predicted in last week’s CWS Market Review. I’ll also preview the upcoming earnings report from Bed Bath & Beyond ($BBBY). But first, let’s look at why the Fed isn’t going to raise rates anytime soon.

Expect Rates to Stay Low for a Long Time

On Wednesday, the investing world came to a halt to hear what the Federal Open Market Committee had decided. Since there has been some noticeable improvement in the economy, some investors were speculating that the Fed might ditch its key phrase “considerable time” as it pertains to the period between the end of Quantitative Easing and I-Day, the date of the first interest-rate increase. Previously, Janet Yellen described that period as lasting “around six months,” which was a big-time rookie mistake.

As it turns out, the Fed decided to keep its “considerable time” proviso. They also kept the affirmation that “there remains significant underutilization of labor resources,” which is a fancy way of saying there’s still a lot of folks out of work. And that’s certainly true.

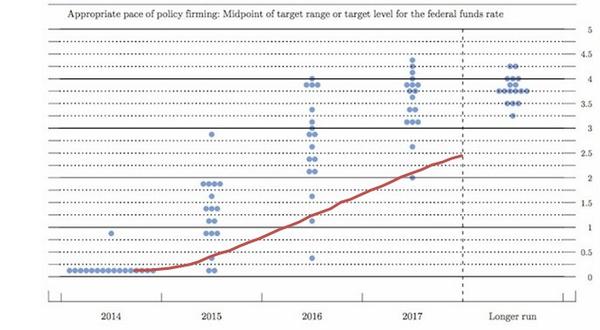

As I mentioned before, the Fed decided to taper its bond purchases, and the next meeting should bring the final taper. So that leads us to wonder: How much longer do we have to wait for rates to rise? We got a hint of that as the Fed also released its projections for the economy and interest rates. The Fed includes a scatter plot of blue dots for each of the 17 FOMC members (not all of whom vote). The most important chart shows where the 17 members of the FOMC see interest rates at year’s end for the next few years, as well as the forecast for the long run.

What I found truly surprising is how hawkish the projections are. Most Committee members see interest rates hitting 1% before the end of next year, and 2.5% before the end of 2016. That’s well ahead of the futures market. I’m surprised to see such a divergence between the Fed and the markets. In fact, it’s a divergence between the Fed and what the Fed has previously said. What’s going on? I noticed that there were two dissenters on the Committee this time, so we may see a growing divide at the Fed. The projections could be an indication that the inflation hawks are growing.

The chart below (courtesy of Jake of EconomPic) shows the FOMC’s projection for interest rates (the blue dots) along with what the futures market currently projects (the red line). Note how much more hawkish the FOMC is.

My view is that there’s no need to raise rates anytime soon. I think mid-2015 would be the earliest possible date. As the policy statement made clear, there’s still a lot of slack in the labor market, and inflation is dead as a doornail. This week, we got more evidence of how tame inflation has been. We actually had deflation last month. The government said that consumer prices fell 0.2% in August. Wall Street had been expecting no change.

Don’t think the low inflation was solely due to lower energy prices, however. The “core rate,” which excludes food and energy prices, was flat last month. Economists had been expecting an increase of 0.2%. This was the lowest core inflation report in more than four years. Remember that with 0% interest rates and deflation, real rates are positive!

There are also plenty of signs that the economy isn’t completely well. Last Friday, the government reported that Industrial Production fell 0.1% last month. This was the first decrease since January. This data series can be a bit bumpy, so it’s too early to say that this could be a sign of trouble. Interestingly, in the Fed’s economic projections this week, the central bank lowered its growth forecasts for next year.

I should also point out an important fact that’s often overlooked. The debate on Wall Street concerns when the Fed will start raising rates. But even when it does, real rates will still be negative, and they’ll probably stay that way for two more years, give or take. Consider that the yield on the five-year TIPs only recently crossed into positive territory.

On Thursday, we got some good news for the labor market. First-time jobless claims dropped to 280,000. That’s one of the lowest reports in the last 40 years. This report, however, can be very noisy, so economists prefer to focus on the four-week moving average. The last jobs report wasn’t very good, so this may be an omen of more strength down the road. As always, it’s important to look at the trend, not just one or two data points. (Naturally we don’t want to exaggerate any ordinary vicissitudes.)

What Does This Mean for Investors?

The market has had an interesting reaction to the Fed this week. In short, what’s been happening has continued to happen, only more so. But I think the market read too much into the Fed’s hawkish projections and assumes higher rates are on the way. Much of the action this week has been the strong-dollar trade (lower gold, lower bonds, higher stocks, large-caps beating small-caps).

The overall stock market responded to the Fed by rallying, but it’s an uneven rally, as we would expect. The spread between large- and small-caps has grown even larger, which is a natural reaction to a stronger dollar. The big boys are leading this rally by a good margin, and the Russell 2000 is actually down for the year. Here’s a remarkable stat: Nearly half of the stocks on the Nasdaq are down by 20% or more. In other words, there’s a stealth bear market going on, even as the broader rally continues.

As I mentioned last week, the U.S. dollar is strong, and it’s getting stronger. The dollar rallied to a six-year high against the Japanese yen. That helped push shares of AFLAC ($AFL) to a new 52-week low on Wednesday. The euro fell to a 14-month low against the dollar.

The same forces are at work in the gold pits. On Thursday, gold fell below $1,220 an ounce for the first time since January. Gold looks ugly, and I think it will get uglier. The Fed’s most important audience, the bond market, responded by selling off. On Thursday, the two-, three- and five-year Treasuries all closed at the highest yield in over three years. But any maturity less than that barely moved. While long-term yields fell for much of this year, they’ve started to rise over the past three weeks. One of the best economic indicators is the spread between the two- and ten-year Treasuries, and that’s increased a bit recently.

What to do now: Investors should continue to focus on high-quality stocks like those on our Buy List. I would pay particular attention to stocks with above-average dividend yields like Ford ($F), Wells Fargo ($WFC) and Microsoft ($MSFT). Now let’s look at one of my favorite tech stocks.

Larry Ellison Steps Down as Oracle’s CEO

After the closing bell on Thursday, Larry Ellison shocked Wall Street by announcing that he’s stepping down as CEO of Oracle ($ORCL). In his place, Mark Hurd and Safra Catz will both become CEO. Interestingly, Oracle’s statement has never referred to them as co-CEOs, which is a concept with a troubled history. Ellison will become Executive Chairman and Chief Technology Officer.

Honestly, I’m not a fan of the dual-CEO concept, and it rarely works. On top of that, no one is truly CEO as long as Larry Ellison is Chairman of the Board. I don’t mean that disrespectfully; I’m a big Larry fan. I like anybody who owns their own MIG-29 or Hawaiian island, but let’s remember that he owns 25% of the shares. I doubt this two-CEO configuration will last more than two years, but I’ll give it a fair shake.

Now on to earnings. For fiscal Q1, Oracle earned 62 cents per share, which was two cents below Wall Street’s estimate. In June, Oracle had given us an earnings range for Q1 of 62 to 66 cents per share. This is the third quarter in a row where Oracle has missed consensus. Quarterly revenues rose 3% to $8.6 billion, which was below the Street’s consensus of $8.78 billion. Oracle had been expecting growth of 4% to 6%.

Hardware continues to be a trouble spot for Oracle. For Q1, hardware sales dropped 8% to $1.2 billion. But there are some bright spots as well. Oracle’s cloud revenue rose more than 30% to $475 million. The company’s cash flow rose 7% to $6.7 billion, which is an all-time record. Oracle also said that it will repurchase $13 billion in shares.

On to guidance. For Q2, which ends in November, Oracle expects earnings to range between 66 and 70 cents per share. Wall Street had been expecting 74 cents per share. Oracle expects top-line growth between 0% and 4%. Frankly, this is a so-so earnings report. It’s not terrible, but it tells me Oracle is still having trouble in key markets. However, I’m not about to abandon them. Oracle remains a buy up to $44 per share.

Bed Bath & Beyond’s Earnings Preview

Bed Bath & Beyond ($BBBY) is due to report fiscal Q2 earnings on Tuesday, September 23. This certainly has a lot of shareholders nervous because the shares have been slammed by the market for the last three earnings reports. It’s clear that the market went overboard last time (down to $55?), and shares of BBBY have slowly inched their way back.

In June, the home-furnishings store told us to expect Q2 earnings to range between $1.08 and $1.16 per share. My numbers say that earnings will come in on the high-end of that range. For all the trouble BBBY has gotten from the market, the company has been consistent with its full-year earnings estimate. It expects earnings growth in the “mid single digits.” If we take that to mean 4% to 6% and apply it to last year’s earnings of $4.79 per share, it gives us a range of $4.98 to $5.08 per share for this year. That means the stock is going for less than 13 times earnings, which is quite reasonable. The company also floated its first bond deal in 20 years to fund $1.1 billion in share buybacks. I can’t say I’m a big fan of that move, but I understand the company’s impatience with the market. Bed Bath & Beyond remains a buy up to $70 per share.

Microsoft Raises Its Dividend By 11%

In last week’s CWS Market Review, I wrote:

Be on the lookout for a dividend increase soon from Microsoft ($MSFT). The software giant isn’t normally thought of as a dividend stock, but they’ve been working to change that. In the last four years, Microsoft has increased its dividend by 115%. The quarterly payout is currently 28 cents per share. I think MSFT will raise it to 31 cents per share.

I was right! After the closing bell on Tuesday, Microsoft ($MSFT) raised its quarterly dividend to 31 cents per share. That’s an increase of 11%. Over the last five years, MSFT has raised its dividend by 138%. The new dividend works out to $1.24 for the year. Going by Thursday’s close and the new dividend, Microsoft now yields 2.66%. Fiscal Q1 earnings are due out in another month. Last Friday, the shares broke above $47 for the first time since Bill Clinton was president. Microsoft remains a very good buy up to $48 per share.

That’s all for now. Next week is the last full week of trading before the end of the third quarter. We’ll get key reports and new and existing home sales. On Thursday, we’ll get the latest report on Durable Goods. Last month’s report was very strong thanks to a surge in aircraft orders. On Friday, the government will update the numbers for Q2 GDP growth. Goldman Sachs said it will be 4.7%, which would make Q2 the best quarter in more than eight years. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – June 27, 2014

Eddy Elfenbein, June 27th, 2014 at 7:07 am“And ye shall hear of wars and rumors of wars: see that ye be not troubled: for

all these things must come to pass, but the end is not yet.” – Matthew 24:6Tomorrow is the 100th anniversary of the assassination of Archduke Franz Ferdinand in Sarajevo. The assassination sparked the July Crisis, which eventually led to the First World War. Once the war started, the New York Stock Exchange decided to close down. No one knew the war would last for so long. Soon traders were meeting outside the exchange to do their business (traders never change, do they?). After four months, the NYSE relented and reopened for business.

One hundred years ago today, the Dow Jones Industrial Average was around 80 (it’s not exactly comparable with today’s index, but close enough for our purposes). Since then, the index has doubled, doubled again, doubled again, and doubled four more times—and it’s close to doubling a fifth time. Last Friday, the Dow reached a new all-time high and came within 22 points of cracking 17,000.

It’s been a good century for investors. Of course, 100 years is, shall we say, a rather optimistic time horizon for an individual investor, but my point is to underscore the power of the long term. That’s what stock investing is all about. To quote the Rolling Stones, “time is on my side.” Time is on the side of all disciplined investors, and that was true even when the world was heading towards disaster.

Fortunately for us, we live in a far more peaceful world, but the lessons are the same. In this week’s CWS Market Review, I want discuss the latest mega-deal for one of our Buy List stocks. Oracle ($ORCL) is on the merger warpath again, and this time, they’re buying Micros Systems ($MCRS) for $5.3 billion.

I’ll also discuss the latest plunge in Bed Bath & Beyond ($BBBY). The home furnishing store disappointed Wall Street yet again. The stock dropped more than 7% on Thursday. Here’s the thing: They actually reaffirmed their full-year earnings. I’ll have full details in a bit.

We’ll also look at the horrible GDP revision for Q1. It turns out the economy had its worst quarter in five years. Fortunately, the news looks much better for the rest of this year. I’ll tell you what it all means, but first, what the heck’s going wrong with Bed Bath & Beyond?

Bloodbath & Beyond

After the close on Wednesday, Bed Bath & Beyond ($BBBY) reported Q1 earnings of 93 cents per share. This was one penny below Wall Street’s forecast, although it was within the company’s guidance of 92 to 97 cents per share. Quarterly sales rose 1.7% to $2.657 billion, and the all-important metric for retailers, comparable-store sales, was up 0.4%.

In my opinion, this was a mildly disappointing earnings report, but it’s far from a disaster. The market, however, was very displeased. Shares of BBBY dropped as much as 10% on Wednesday, and this came at the top of a very bad six months for them. The stock eventually closed the day at $56.70, for a loss of 7.2%. That’s its lowest close in 16 months. Yuck!

I realize I’m starting to sound like a broken record, but the problems Bed Bath & Beyond is having aren’t nearly as severe as the market’s behavior suggests. Yes, they’re in a rough spot, but they’re still very profitable. Unfortunately, this is how markets often behave—a stock can either do nothing right or do nothing wrong. Wall Street traders don’t exactly have a dimmer switch. The truth is that BBBY is a sound company that’s working through some issues. The company has been making investments to modernize its systems, and that’s cut into profit margins. They’ve also been hurt by a weak housing market. These are temporary factors.

Let’s look at its guidance. For Q2 (June, July, August), BBBY sees earnings ranging between $1.08 and $1.16 per share. Wall Street has been expecting $1.16 per share. That probably explains much of Wednesday’s sell-off. But here’s the important part. They kept their full-year guidance exactly the same, calling for a “mid-single digit” increase in earnings-per-share. BBBY made $4.79 per share last year. If we take “mid-single digits” to mean 4% to 6%, that works out to a range of $4.98 to $5.08 per share. In other words, the stock is now going for roughly 11 times forward earnings.

Here’s another important fact. Compared with last year’s first quarter, BBBY has 7.2% fewer weighted shares outstanding. In English, they’re gobbling up their own stock at a rapid clip. Unlike so many other companies, BBBY is truly reducing their share count. Plus, the company also has zero long-term debt. I apologize for the volatility, but I think this is one worth sticking with. This week, I’m lowering our Buy Below to $61 per share.

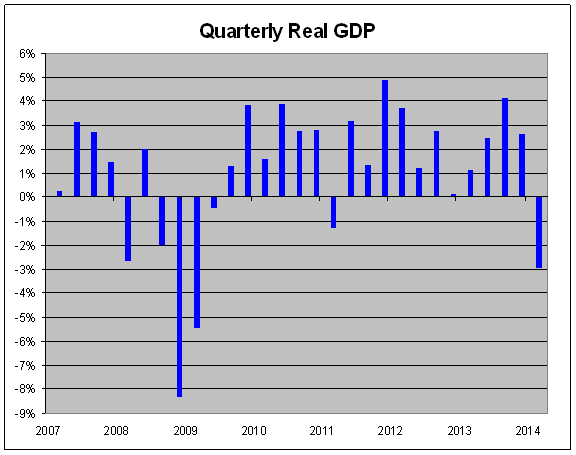

The Economy Dropped by 2.9% in Q1

Wall Street was stunned this week when the government dramatically lowered its report for Q1 GDP growth. The Commerce Department now says that the economy shrank by 2.9% in the first three months of this year (note that GDP figures are annualized and after inflation). That’s the worst quarter for the economy in five years.

Two months ago, the initial report for Q1 GDP showed growth of 0.1%. Last month, that was revised to a drop of 1%. Now it’s down to -2.9%. That’s the biggest downward revision between the second and third reports since records began nearly 40 years ago.

Although these numbers are shocking, I’m pretty skeptical. I’m not saying they’re wrong. I’m just saying…it’s complicated. First, let’s remember that this data is a bit old. It’s for Q1, which was January, February and March, and we’re nearly done with Q2. Also, a huge part of the downward revision had to do with healthcare, since Q1 was the quarter of the Obamacare rollout.

But my major concern is that the GDP numbers don’t line up with more recent data that hint at much stronger growth. Last week, I mentioned that some of the regional Fed surveys are quite optimistic. The trend in jobs is slowly improving. We’ll get the June jobs report next Thursday. Several other metrics like consumer confidence, the ISM reports and industrial production have also looked good. If the economy were truly deteriorating, we would see confirmation in other places. The key weak spot continues to be housing (and by extension, places like BBBY), but that should improve as well.

As investors, our concern isn’t the macro economy but corporate profits. Monday is the end of the second quarter, and soon Corporate America will report earnings results. What’s interesting is that this earnings season will be the first one in several quarters in which we haven’t seen forecasts lowered just before earnings came out. As we all know, Wall Street loves playing the game of guiding analysts lower, then beating those much-reduced expectations.

This time, earnings forecasts have come down some, but not much. The consensus on Wall Street is for the S&P 500 to report earnings of $29.40 for Q2 (that’s an index-adjusted figure). That’s down about 2.5% in the last year, which is very small compared with recent quarters. Typically, analysts overestimate early on, and the forecasts are gradually pared back as earnings season approaches. For now, Wall Street expects full-year earnings of $119.60 for the S&P 500, which means the index is going for about 16.4 times this year’s earnings. That’s slightly on the pricey side, but nowhere near bubble territory.

Next week we’ll get important economic reports that should shed some light on how well Q2 went. Next Tuesday, the June ISM report comes out. The ISM reports have improved for the last four months, and I expect another good number. Due to July 4th´s falling on a Friday, the jobs report for June will come out next Thursday. I think we’ll continue to see improvement of 200,000 to 250,000 jobs. The bottom line is that the Q1 GDP report is an outlier, and it’s old news. The recent data suggest that the economy is poised to grow at 3% annually for the next few quarters.

Oracle Buys Micros for $5.3 Billion

We’ve had a rash of deals on our Buy List. First, DirecTV ($DTV) and AT&T ($T) decided to hook up. Then Medtronic ($MDT) did a big deal with Ireland’s Covidien ($COV). Now Oracle ($ORCL) announces it’s buying Micros Systems ($MCRS) for $5.3 billion.

The deal is for $68 per share, which is a modest premium. However, shares of Micros jumped the Tuesday before last, when initial reports of a deal came out. In the last few years, Oracle has been a merger machine. Over the course of a decade, it has shelled out more than $50 billion to buy about 100 companies. Apparently, Larry Ellison isn’t done. This is Oracle’s biggest deal since they snatched up Sun Microsystems for $7.4 billion four years go. In the last 16 months, Oracle has announced 11 deals.

Micros, by the way, has been an amazing performer. In 1988, the shares were going for just 12.5 cents. The buyout price is 544 times that. Not bad for 26 years. The Micros deal is expected to close by the end of the year. Remember, of course, that any deal has the potential of falling through.

Last week, Oracle missed earnings by three cents per share, and the stock got punished. Fortunately, their guidance was a little better. I think this Micros deal is good for Oracle, and I’m pleased to see them on the offensive. Oracle remains a good buy up to $44 per share.

Buy List Update

This Monday is the final day of trading for the first half of the year. I’ll have a complete review of how the Buy List’s performing. But before then, I can tell you that the Buy List is currently up 1.96% for the year—less than the S&P 500, which has gained 5.89%. Those numbers don’t include dividends. As I’ve mentioned many times, our Buy List has beaten the S&P 500 for the last seven years in a row, and it looks like our streak may be in jeopardy this year. I’m not ready to concede just yet, nor will I depart from our proven strategy, but I want my readers to know exactly where we stand.

Big losers like Bed Bath & Beyond have weighed heavily on our Buy List this year (BBBY is close to a 30% loser YTD). But we’ve also had some bright spots recently. Microsoft ($MSFT), for example, just made another multi-year high on Wednesday. Wells Fargo ($WFC) is also close to a new high. Ford Motor ($F) has shown some strength lately. The automaker just hit an eight-month high on Thursday, and I think it has more room to run. Some of the top bargains on our Buy List include AFLAC ($AFL), Ross Stores ($ROST), eBay ($EBAY) and Cognizant ($CTSH).

That’s all for now. Next week will be an unusual week, since July 4th falls on a Friday. The stock market will be closed on Friday, and it closes at 1 p.m. on Thursday. Expect very light volume, however, since it’s the start of the month. We’ll also be getting the big June jobs report on Thursday morning. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – April 11, 2014

Eddy Elfenbein, April 11th, 2014 at 7:42 am“Individuals who cannot master their emotions are ill-suited

to profit from the investment process.” – Benjamin GrahamThat’s so true. I’ve always thought that if things didn’t work out for Mr. Spock at Starfleet, he would have made a killer value investor. Once again, emotions boiled to the surface on Wall Street this week. Most specifically, the emotion of fear. On Thursday, the S&P 500 lost 2.1%, and the Nasdaq Composite dropped 3.1% for its worst day since 2011. Those two got off easy compared with the Nasdaq Biotech Index, which plunged 5.6%.

Having heard those numbers, you´d probably think the economic news on Thursday was terrible. Not at all. The Department of Labor reported that initial claims for unemployment insurance dropped to their lowest level in seven years. In other words, the jobs market is getting better. On Tuesday, we learned that jobs openings climbed to a six-year high. So why are traders so upset?

In this issue of CWS Market Review, I’ll walk you through Wall Street’s latest panic attack, and more importantly, I’ll tell you what to do about it. I’ll also cover the disappointing earnings guidance from Bed Bath & Beyond, and I’ll preview IBM’s earnings report for next week. This is a crucial time for the market; U.S. corporations are sitting on $1.64 trillion in cash, the Federal Reserve is winding down an unprecedented experiment on the economy and earnings season is upon us. But first, let’s see why Value is beating the stuffing out of Growth.

The Current Sell-Off Is about Valuation, Not the Economy

If it feels like it was less than a week ago that the S&P 500 touched an all-time intra-day high, that’s because it was. From the big-picture perspective, the drop in the past week hasn’t been that much—just under 3%. But what makes it interesting is that the pain hasn’t been evenly distributed.

Here’s what investors need to understand: The current sell-off has been focused on valuation, not on economically-sensitive areas. This is important. Many of the richly valued, raging-bull stocks have been clobbered, while their more reasonably-priced cousins have barely been touched. Stocks like Gilead and Amazon are more than 20% below their 52-week highs.

Some observers have said that that the tech sector has been hit hard, but that’s not quite right. It’s been the big-name and richly-valued tech stocks like Facebook, Twitter and Tesla that have been taken down. But more sensibly valued names like Apple or Buy List favorite IBM have done just fine. Some of our favorite tech stocks like Oracle, Microsoft and Qualcomm have outpaced the Nasdaq over the last several sessions.

We can also see the effect by looking at the environment for Initial Public Offerings. That’s probably the most emotion-based part of the market. Not too long ago, investors were eager to snatch up whatever IPO Wall Street was throwing their way. Not anymore. La Quinta, the hotel franchise, was recently priced below expectations. Ally Financial flopped on its first day of trading, and King Digital, the Candy Crush people, was another disappointment.

We have to remember that the stock market has rallied for five straight years, so naturally investors grow complacent. As the bull market rages, we typically see shares in companies long on promises and short on results grab most of the gains. Now we’re witnessing a swift reaction.

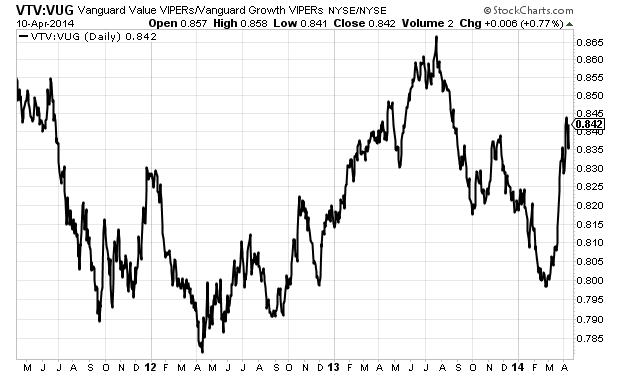

What’s been happening is that the market is shifting from favoring Growth stocks to favoring Value stocks. (One effect of this shift is that large-cap is beating small-cap, but that’s the tail, not the dog.) This shift didn’t surprise me, but its pace and magnitude did. As a proxy for Growth and Value, I like to look at the ETFs run by Vanguard. Since February 25, the Growth ETF ($VUG) has lost 3.8%, while the Value ETF ($VTV) has gained 1.2%. That may sound small, but it’s a dramatic turn for such a short period of time and for such broad categories. Here’s a look at the VTV divided by the VUG. Notice how sharp the spike has been.

Now investors have been flocking to areas of safety (dividends, earnings, strong brands). For example, the S&P 500 Utilities Sector ($XLU) has been one of the top-performing market sectors. This is a direct reaction to the Fed’s policies because folks want to lock in those rich yields before rates go up.

Speaking of which, probably most surprising to many market watchers has been the strength in the bond market, especially at the long end. The yield on the 20- and 30-year Treasuries recently dropped to their lowest levels since July. The Long-Term Treasury ETF ($TLT) has been beating up the stock market this year. The long-term yields were already low, and they’ve gotten lower. The TLT is up 7.8% this year, while the S&P 500 is in the red.

A stronger shift from Growth to Value doesn’t worry me. On balance, it’s good for our Buy List. I would be much more concerned if I saw a rapid deterioration in many cyclical sectors. For example, the Homebuilders ($XHB) have been down, but nowhere near as severely so as the biotechs. The S&P 500 Industrials ($XLI) are also down, but largely in line with the rest of the market. That’s important because the market doesn’t see a broad industrial decline (at least, not yet). Some cyclicals, like our very own Ford, have actually led the market in recent days.

Overall, I think this newfound skepticism is healthy for investors. They’re questioning some of these rich valuations. Later on, I’ll talk about the news from Bed Bath & Beyond, but let’s put this in its proper context. BBBY’s bad news is that their earnings would be as high as we expected. Still, they have no debt, lots of cash and a strong cash flow. Compare that with Twitter, which is expected to make a total profit this year of one penny per share. Twitter´s profit margin for Q4 was -210%. In other words, they spent three times what they took in. So you can understand why investors might have second thoughts about that valuation. As Mr. Spock might say, “it’s only logical.” Now let’s look at some opportunities for bargain hunting in this market.

What to Do Now

Obviously, the first thing investors should do is not panic. For disciplined investors, times like this are your friends. This is also a good time for investors to focus on fundamentals. Not only are dividends in demand, but I think they’re going to be more demand as the year goes on.

We have several stocks on our Buy List with strong dividends, and prospects for even higher dividends. Let’s start with Ford Motor ($F), which increased its dividend by 25% earlier this year. The sales report for March was quite good. The earnings report for Q1 might not be so good, but that’s due to environment, not Ford. The company is improving its operations in Europe. Plus, General Motors has had some high-profile issues of late. The stock is going for eight times next year’s earnings. Ford currently yields 3.2%, and I rate it a very good buy up to $18 per share.

Another solid dividend Buy Lister is Microsoft ($MSFT). Thanks to their new CEO, for the fist time in a generation, Microsoft is hip. The last two earnings reports were quite good, and I’m looking for another one later this month. Last September, Microsoft increased its dividend by 22%. We should see another healthy increase later this year. The stock currently yields 2.8%. Microsoft remains a solid buy up to $43 per share.

I’m writing this to you on Friday morning, ahead of the first-quarter earnings report from Wells Fargo ($WFC). The bank just won approval to raise its dividend by 16.7%. They have plenty of room to raise the dividend even more next year. Wells currently yields 2.9%. WFC is an excellent buy up to $54 per share.

McDonald’s ($MCD) was one of the few stocks that rallied yesterday. That probably has a lot to do with its rich dividend. MCD currently yields 3.3%, which is a good deal in this market; that’s more than a 20-year Treasury. The fast-food chain is working hard to revamp itself. Look for a good earnings report the week after next. MCD is a good buy up to $102 per share.

Bed Bath & Beyond Is a Buy up to $71 per Share

On Wednesday, Bed Bath & Beyond ($BBBY) reported fiscal Q4 earnings of $1.60 per share. The home-furnishings store had said that earnings should come in between $1.57 and $1.61 per share. Clearly, this was a weak quarter for them. BBBY estimates that the lousy weather took six to seven cents per share off their bottom line.

The details weren’t encouraging. Quarterly sales dropped 5.8% to $3.203 billion. Comparable-store sales, which is the key metric for retailers, rose 1.7%. For the full year, BBBY made $4.79 per share, which is up from $4.56 in the year before.

As I’ve mentioned before, the poor Q4 numbers were expected, but I was curious to hear what they had to offer for guidance. For Q1, BBBY expects earnings to range between 92 and 96 cents per share. The consensus on Wall Street was for $1.03 per share. For the year, they expect earnings to rise by “mid-single digits.” If we take that to mean 4% to 6%, then their guidance works out to a range of $4.98 to $5.08 per share. Wall Street had been expecting $5.27 per share.

I’m not pleased with this guidance. The shares took a 6% cut on Thursday. Still, we should focus on some positives; BBBY is a well-run outfit, and they’ve been in tough spots before. The balance sheet is very strong, and they’ve been buying back tons of shares (though at higher prices). I’ll repeat what I said last week: don’t count these guys out. Bed Bath & Beyond remains a good buy up to $71 per share.

Expect Good Earnings from IBM

IBM ($IBM) is slated to report earnings after the closing bell on Wednesday, April 16. In January, Big Blue beat consensus by 14 cents per share, but a lot of that was driven by cost-cutting. Quarterly revenues fell 5.5% to $27.7 billion. That was $600 million below forecast, and it was the seventh-straight quarter of falling sales.

Here’s how I see it: IBM is at a crossroads right now. Much of the world is shifting to cloud-based networks, and a lot of people think IBM is being left behind. But IBM isn’t sitting still. The company is moving towards the cloud, and they’re getting rid of their lower-margin businesses. For example, they recently sold their server business to Lenovo for $2.3 billion. This may surprise a lot of people, but IBM’s cloud revenue rose by 69% last quarter.

For 2013, IBM earned $16.28 per share. They made a bold prediction saying that they expected to earn at least $18 per share this year. Still, Wall Street seems dubious. The consensus for 2014 earnings has slid from $18 per share a few months ago to $17.85 per share today.

For the first time in a long time, the stock is doing well (see above). On Thursday, IBM came close to trading over $200 per share for the first time in nine months. For Q1, Wall Street had set the bar low. Very low. The current consensus is for earnings of $2.54 per share, which is a decline of 15% from last year’s Q1. My numbers say IBM should beat that. I also expect IBM to raise its dividend later this month. The current dividend is 95 cents per share, and I think Big Blue could bump it up to $1.05 per share. The stock is going for about 11 times their own estimate for this year’s earnings. IBM remains a good buy up to $197 per share.

That’s all for now. Next week we’ll get important reports on inflation and industrial production, plus the Fed’s Beige Book (by the way, that’s a great resource for looking at the economy). The stock market will be closed next Friday for Good Friday. This is usually the one day of the year when the market is closed but most government offices are open. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – April 4, 2014

Eddy Elfenbein, April 4th, 2014 at 6:58 am“There will be growth in the spring.” – Chauncey Gardiner

T.S. Eliot famously called April “the cruelest month,” but it’s not so bad for the stock market (Eliot himself was a Lloyd’s Bank employee). Since 1950, the S&P 500 has rallied 44 times in April while losing ground 20 times, and recent Aprils have been especially good. In the last eight years, the S&P 500 has averaged over 3% in April.

This April has gotten off to a good start as well. On Thursday, the S&P 500 got as high as 1,893.80, which is yet another all-time intra-day high. I’m not much of a fan of the Dow Jones, but I should note that until this week, the Dow 30 had failed to break its high from December 31. Some bears claimed that this lack of “confirmation” was a bad omen. Well, that mark fell as well. On Thursday, the Dow broke 16,600 for the first time ever.

What’s the cause for the recent rally? That’s hard to say exactly, but I suspect that the cooling-off of tensions in Eastern Europe has helped a lot. Investors were also buoyed by some remarks made by Fed Chair Janet Yellen. We also got some decent economic news this week, and there seems to be some optimism for Friday’s jobs report (as usual, I’m writing this before the report comes out.)

But the next big event for investors is the Q1 earnings season, which starts next week. We already know that crummy weather held back consumers this winter, but it will be interesting to hear what kind of guidance companies have for the spring. In this week’s CWS Market Review, I’ll preview this earnings season. I’ll also focus on two Buy List earnings reports for next week: Bed Bath & Beyond and Wells Fargo. I also have several new Buy Below prices for you. But first, I want to take a look at a question that keeps popping up on Wall Street.

Are We in Another Bubble?

There’s been a lot of loose talk lately about how today is similar to the Great Millennium Bubble. A few days ago, the New York Times ran a story titled “In Some Ways, It’s Looking Like 1999 in the Stock Market.”

Oh, please. This is nonsense. Sure, stock prices have rallied, and yes, valuations are higher, but c’mon, we’re nowhere close to the kind of crazy numbers we saw in the late 90s. Back then, all you needed was a dot-com address, a sock puppet and some clever ads, and presto, investors would throw billions of dollars your way.

Actually, your company didn’t even need to be that fancy. I’ll give you a good example. General Electric ($GE) is about the bluest blue chip you can find. The stock is currently going for $26.23 per share. That’s half of where it was 14 years ago, yet the company is expected to earn $1.70 per share this year. Compare that to 2000, when GE’s bottom line was $1.27 per share. So profits are up 34% in 14 years (not so good), while the stock price is down by 50%. GE’s Price/Earnings Ratio has dropped from 42 to 15. My point is that people have forgotten what a real bubble looks like.

To be sure, there are areas of the market looking bubbly. Actually, to be more specific, it’s areas outside the market that look troublesome. Tech companies are paying some hefty prices for start-ups with little or no revenue.

Last year, Yahoo shelled out $1.1 billion to buy Tumblr. The company has so little revenue that Yahoo isn’t even required to list it in its financial statements. In business jargon, that’s what we like to call “not good.” A few weeks ago, Facebook paid a massive amount, $19 billion, for WhatsApp, a company with 55 employees. I freely admit that I can’t judge the value of enterprise like that, but there seems to be a fear in Silicon Valley of being left behind in this week’s app of the century, so these prices are getting carried away.

But that’s not the kind of investing we’ve been doing, and our stocks haven’t done many mega-deals lately (though Oracle did a few years ago). My advice is to ignore all the silly bubble talk, and let’s focus on what the numbers say.

Breaking down Q1 Earnings Season

Now let’s take at a look at some current numbers and the outlook for Q1 earnings. Last year, the S&P 500 earned $107.30 (that’s the index-adjusted number; to convert to actual dollar amounts, multiple by 8.9 billion). Currently, Wall Street expects the index make $120.04 for this year and $137.20 for 2015. In my opinion, both numbers are too high, but I’ll get to that in a bit.

For Q1, Wall Street currently expects earnings of $27.60. Those estimates have drifted lower over the past several months. One year ago, the Street had been expecting over $29 for Q1. As a general rule, earnings estimates start high and gradually fall as earnings season gets closer, so don’t be alarmed about the reduced estimates. By the time earnings season arrives, estimates are often too low. This is part of a game the Street likes to play. There’s nothing Wall Street likes better than beating expectations, so companies know how to play the expectations game. The current Q1 estimate of $27.60 works out to an increase of 7.1% over last year’s Q1. That sounds about right. I think we’ll probably be at about $28 by the time all the reports have come in.

I also want to touch on an important and often-overlooked point, which is dividends. Payouts have been growing impressively for the last few quarters. Dividends for the S&P 500 grew by 15.1% for Q1. Technically, I should say “dividends-per-share,” because the stock market has been helped by a reduced share count, thanks to stock buybacks.

Over the last three years, dividends are up by 55%. The S&P 500 paid out $34.99 in dividends last year, and I think it will pay out $40 for this year. Going by Thursday’s close, that gives the index a yield of 2.12%. That’s not bad at all, especially in an environment where interest rates are near 0%, and we know they’ll be stuck on the ground for another year.

Instead of the $120 that Wall Street expects in earnings from the S&P 500, I think $115 is a more reasonable estimate. (I don’t know if it will be more accurate, but I think it’s a safer assumption.) That gives the S&P 500 a forward P/E Ratio of 16.4, which is quite reasonable. Historically, more bull markets are upended by deteriorating fundamentals than by excessive valuations. How far the markets fall, however, is usually determined by valuations. As long as profits continue to grow, the stock market is a good place to be.

Is the U.S. Stock Market Rigged?

This week, Wall Street has been buzzing about Sunday’s 60 Minutes segment with Michael Lewis. He was on to discuss his new book, “Flash Boys,” which covers High Frequency Trading. In the interview, Lewis said that the U.S. stock market is “rigged.” I was disappointed to hear him say that. Lewis is a gifted writer, but I’m afraid he drew an overly simplistic narrative for a complicated issue.

Let me put your fears to rest. The U.S. stock market is not rigged. Individual investors have no reason to fear that a bunch of super computers are ripping them off. There are serious concerns about HFT, but saying that the market is rigged deflects the debate in a pointless direction.

I wanted cover this topic because it’s made so much news on Wall Street this week, including an acrimonious debate on CNBC, and I’m afraid Lewis’s interview rattled investors. The issue with HFT is an issue we often see: technology is changing the way we do business. Some of the changes are good, and some are bad. Instead of having floor traders, guys who make funny hand signals at each other, the modern market is governed by very fast computers. The HFT guys provide liquidity, and they get paid for it. On balance, that’s much better than the system we used to have.

I have concerns about HFT causing more numerous and more severe Flash Crashes, and I like to see that addressed. Fortunately, our strategy isn’t based on trading. I change the Buy List just once a year. I guess you could call us Low Frequency Traders. But I want to assure investors that the U.S. market is not rigged.

Don’t Count out Bed Bath & Beyond

This Wednesday, April 9, Bed Bath & Beyond ($BBBY) will release its fiscal Q4 earnings report. Let me fill you in on the back story. In early January, BBBY cut their Q4 (Dec/Jan/Feb) earnings estimate. They had been expecting earnings to range between $1.70 and $1.77 per share. Now they said it would be between $1.60 and $1.67 per share.

The stock market wrecked the shares. In one day, BBBY plunged from $80 to $70. It continued to fall for the rest of January, and it got as low as $62 per share in early February. If that wasn’t enough, one month ago, the company lowered their Q4 estimates again. This time it was due to the lousy weather. Now they expect earnings between $1.57 and $1.61 per share.

So where do we stand now? I still like Bed Bath & Beyond, and this is why we have a locked-and-sealed Buy List. We didn’t jump ship in a panic, and the shares have started to rebound. Yesterday, BBBY came within a penny of hitting $70 for the first time in three months. I think the market has basically written off the Q4 earnings report and is now focused on their guidance for Q1.

For last year’s Q1, BBBY earned 93 cents per share. The Street currently expects $1.03 per share. I’m going to hold off making a forecast, but I’m still optimistic for BBBY. The company has a rock-solid balance, they’re well run and the recovery in housing is good for them. For now, I’m going to keep our Buy Below for BBBY at $71 per share. Don’t count these guys out.

Wells Fargo Is a Buy up to $54 Per Share

Next Friday, Wells Fargo ($WFC) will be our first Buy List stock to report for this earnings cycle. As I mentioned last week, Wells passed the Federal Reserve’s stress test with flying colors. The Fed also had no objection to WFC’s capital plan, which included a 16.7% increase to their dividend. Wells now pays 35 cents per share each quarter.

In my opinion, Wells is the best-run big bank in America, and it’s better than a lot of small banks. The shares came very close to breaking $50 this week. Wall Street currently expects earnings of 96 cents per share. My numbers say that’s about right, so don’t expect any major earnings beat. The new dividend gives Wells a yield of 2.81%. I’m keeping our Buy Below at $54 per share.

Six New Buy Below Prices

The recent rally has been very good to us. Through Thursday, our Buy List is up 3.29% for the year, which is ahead of the S&P 500’s gain of 2.19%. Three of our stocks, DirecTV ($DTV), Stryker ($SYK) and CR Bard ($BCR), are already up more than 10% this year. Plus, Microsoft ($MSFT) and Wells Fargo ($WFC) aren’t far behind. This week, I’m raising the Buy Belows on six of our stocks.

Two weeks ago, I said that I expected Oracle ($ORCL) to soon break through $40 per share, and that’s exactly what happened. In fact, the stock hit $42 per share on Tuesday. Oracle hasn’t been this high in 14 years. (Remember how the stock dropped after the last earnings report? It’s funny how quickly people forget those short-term reactions.) This week, I’m bumping up my Buy Below on Oracle to $44 per share. I really like this stock.

Ford Motor ($F) has been especially strong lately. Two months ago, the shares pulled back below $14.50, and it recently closed at $16.39. Ford just reported very good sales for March. I’ll repeat what I’ve said before: I think Ford is worth $22 per share. I’m raising my Buy Below on Ford to $18 per share.

Three of our healthcare stocks, CR Bard ($BCR), Medtronic ($MDT) and Stryker ($SYK), broke out to new highs this week. I’m expecting more good earnings news from all of them. I’m raising my Buy Below on Bard to $152 per share. Medtronic is going up to $65, and Stryker’s is rising to $90 per share.

I’ve raised my Buy Below on Qualcomm ($QCOM) for the past two weeks, so I might as well make it three in a row. This stock continues to rally higher for us. On Thursday, QCOM topped $81 per share for another 14-year high. I’m raising Qualcomm’s Buy Below to $87 per share. This could be a break-out star for us.

That’s all for now. First-quarter earnings season kicks off next week. Bed Bath & Beyond reports on Wednesday. Then the big banks start to chime in Friday when Wells Fargo reports. Investors will also be paying attention to the latest Fed minutes, which come out on Wednesday. If you recall, the market was rather confused by Janet Yellen’s press conference. The minutes may clear things up. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – June 28, 2013

Eddy Elfenbein, June 28th, 2013 at 6:48 am“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

– Sam WaltonAfter last week’s temper tantrum from the stock, bond and gold markets, officials at the Federal Reserve spent much of this past week trying to calm everyone down. The good news is that it’s worked. Or at least, it has thus far.

But the Fed is merely trying to save itself from yet another Fed-induced problem. They’re CYA-ing in a big way. While the FOMC’s policy statement was pretty much as expected, the after-meeting presser by Ben Bernanke was surprisingly hawkish. The markets responded quickly. At its recent low, the Dow was 991 points below its May high, and the yield on the 10-year Treasury got as high as 2.66%. That’s a full 1% increase in less than two months. Check out the down-and-up of the S&P 500 over the last few days:

So what’s going on?

In this week’s CWS Market Review, I’ll take a closer look at the market’s latest hissy fit. I also want to highlight the good earnings report from Bed, Bath & Beyond ($BBBY). It’s hard to believe BBBY was going for $57 just four months ago. It’s at $70 today. Our Buy List continues to hold up very well, and stocks like Wells Fargo ($WFC) have broken out to new highs. But first, let’s look at the latest song and dance from the Federal Reserve.

Bernanke’s Just a Guy Thinking about the Future and Stuff

At his June 18th press conference, Ben Bernanke said:

If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.

The financial markets interpreted this to mean that QE would start to taper later this year (probably starting in September) and would end by this time next year. The back story is the belief that the Fed’s policies are the main reason why the bull market has been so strong. In my opinion, Bernanke and Friends have clearly helped, but it doesn’t follow that once the Fed pulls back—or takes its foot off the gas, in Bernanke’s analogy—the market will suddenly collapse.

Traders are capable of anything, but even I was surprised by their skittishness. Considering how many macho people there are in finance, the market as a whole can be one big fraidy cat. In four trading days (last Wednesday to Monday), the S&P 500 lost 5%. I think the folks inside the Fed were genuinely shocked by the market’s strong reaction.

This week, one Fed official after another stressed that no plans are set in stone, and the Fed will alter policy as needed. If you want to hang with the popular kids, the term for this is “data dependent.” In fact, this week’s GDP report was pretty weak, and it most likely will give ammo to folks who think QE needs to go on awhile longer.

Binyamin Appelbaum, the New York Times reporter, got it exactly right when he tweeted, “The Fed’s new message seems to be that Bernanke was just a guy who happened to be thinking out loud about the future and stuff.” Scary, but that’s how they’re acting. The minutes from this past meeting are due out on July 10th, and I think a lot of folks are very curious to hear what was said. But for now, the good news for investors is the Fed realizes how damaging their words can be.

What’s the Fallout?

The Fed did indeed calm the market down. The three-day rally on Tuesday, Wednesday and Thursday caused the S&P 500 to gain more than 2.5%. The Dow once again jumped to over 15,000. Perhaps the most dramatic impact was seeing the Volatility Index ($VIX) drop from nearly 22 on Monday to less than 17 by the end of the day on Thursday.

What investors need to understand is that the Fed is watching the economy, and they’re not about to shut off the spigots while the flow is still needed. The lower rates have greatly helped the interest-rate-sensitive areas of the market. I’ve spoken of this before as the magic equation: any place where consumer spending intersects with finance has been a winner. Examples of this include credit-card companies like Mastercard ($MA) and American Express ($AXP). The homebuilding stocks have also done very well. On our Buy List, the magic equation can be seen in stocks like Ford ($F) and JPMorgan Chase ($JPM).

Since the Fed has its hand in interest rates, it can obviously help those rate-sensitive areas. The question is whether the economy is strong enough that it can go along without the Fed’s help. The big clue for this will be second-quarter earnings season, which begins soon. Almost without anyone’s noticing, Q1 earnings growth was positive, and that didn’t happen in either Q3 or Q4 of last year. In other words, earnings growth is reaccelerating, meaning the rate of growth is itself increasing. We want to see that continue in Q2. Wall Street expects to see earnings growth ramp up pretty quickly in Q3 and Q4. If that does indeed happen, a lot of the Fed’s worries will go away.

I suspect that the S&P 500 will stay at or below its 50-day moving average for a while longer (the 50-DMA is currently at 1,620.42). Our Buy List has held out very well over the last two months, and it will continue to lead the market as investors seek out high-quality names. Please pay close attention to my Buy Below prices on our Buy List.

The key area to watch won’t be the stock market but rather the bond market and its close cousin, the gold market. In fact, gold has been getting crushed lately. On Thursday, the Midas metal dropped below $1,200 per ounce for the first time in nearly three years. The drop in gold is really a rise in short-term real interest rates, meaning the rates after inflation. I think gold is acting as an early warning signal, and within a few months, the interest-rate-sensitive areas will start to lag the market. We’re already seeing signs of this with the Homebuilding Sector ($XHB), thanks to higher mortgage rates. The commodity stocks have also been very poor performers. The Energy Sector ETF ($XLE) and the Materials Sector ETF ($XLB) have badly lagged the market.