Archive for September, 2011

-

Gold Continues Its Plunge

Eddy Elfenbein, September 26th, 2011 at 10:40 amThanks to the Fed’s Operation Twist, gold continues to fall:

Gold is often sold off as a means of raising dollars when funding conditions deteriorate, much as they did in late 2008 with the onset of the credit crunch that ensued from banks withholding lending because of their concern over counterparty exposure to toxic U.S. mortgage-backed assets.

“Gold is one of the few assets that remains in positive territory this year, in a sense it is one of the last assets standing, and because of this as investors head for cash they sell the assets that have performed. Essentially gold is a victim of its own success as liquidity trumps,” wrote UBS analyst Edel Tully in a note.

Silver came under fire, falling by as much as 16 percent at one point in the day and set for its worst three-day fall on record, having lost more than 25 percent in this period.

The spot price was last down 6.7 percent at $29.00 an ounce, its lowest since last November.

Platinum fell by 3 percent to $1,559.25 an ounce, its lowest since May last year, while palladium recovered from an earlier 5.0-percent fall to trade up 0.4 percent on the day at $637.22 an ounce, around its lowest since last October.

-

Berkshire Hathaway to Buy Back Shares

Eddy Elfenbein, September 26th, 2011 at 10:17 amAs I’ve said many times, I’m not a fan of share buybacks. My view is that companies ought to focus on their businesses and not waste their time trying to financially engineer a higher share price.

When in doubt, excess cash flow should go to investors in the form of dividends. If investors then wish to buy more stock, that’s their decision. I hope that someday the tax fund is more favorable to that decision. I also think companies often use share buybacks to mask the extent to which they’ve diluted their stocks with executive stock options.

As such, I was surprised to see that Berkshire Hathaway ($BRKA) has announced a share repurchase. The stock has been hit hard lately so there’s been more pressure on the company to do something. Berkshire has said that it will spend no more than a 10% premium of book value on share repurchase of the A and B shares.

Berkshire is currently sitting on a war chest of $38 billion. Sometimes I wonder if having too much cash is a problem for companies. It’s as if the giant piggy banks distort their vision and they think they have to spend it all. This leads to poor acquisitions or countless share repurchase programs. The only benefit I see is that they generate positive press releases.

This repurchase is an interesting and surprising move coming from Buffett. He has said that it’s harder for him to see promising acquisition candidates given Berkshire’s size. The company said it won’t have its cash position fall below $20 billion.

The shares are up about $5,000 today.

-

Morning News: September 26, 2011

Eddy Elfenbein, September 26th, 2011 at 5:17 amEurope Stews on Greece, and Markets Sweat Out the Wait

German Government Confident on Euro Rescue Fund

Tokyo Shares End Down; Nikkei Hits 29-Mo Low On Weaker Euro

PBOC’s Zhou Says ‘Too Early’ to Decide How to Aid Europe

Euro Remains Above Average Amid Debt Concerns

Polish Zloty Goes From First to Worst Amid Crisis

As Sides Dig In, Panel on Deficit Has an Uphill Fight

UBS in ‘Disarray,’ Ermotti Named Interim CEO

Record Dividends Lure Morgan Stanley to Asia as Equities Drop

Netflix Secures Streaming Deal With DreamWorks

Samsung’s Legal Woes Threaten to Crimp Tablets, Chips

Boeing Sees 787 as Jet Lineup’s ‘Backbone’ With Delay Set to End

Chevron, Partners Approve $29 Billion LNG Project

Anglo-Dutch Publishing Group Reed Elsevier to Buy Accuity

Europe Plan In Works Is A Game Changer

Joshua Brown: This Trend is Nobody’s Friend

Epicurean Dealmaker: A Victim of Soycumstance

Be sure to follow me on Twitter.

-

BOATLIFT, An Untold Tale of 9/11 Resilience

Eddy Elfenbein, September 25th, 2011 at 1:25 pm -

Emanuel Derman on the Perils of Pragmamorphism

Eddy Elfenbein, September 24th, 2011 at 11:52 amModels are different. Models are metaphors or analogies. Calling the brain an electronic computer is a model. Calling a computer an electronic brain is a model too. These are analogies, based on similarity, not identity. They are graven images, useful but not very accurate.

Models tell you only what something is more or less like. Theories tell you what something actually is.

In economics one can make only models. The Efficient Market Model that has gone so badly awry compares stock prices to smoke diffusing through a room, and models them with the physics of diffusion. But those are flawed analogies, not theory or fact.

Therefore the similarity of physics and finance lies more in their mathematical language, their syntax rather than their semantics. There is no grand unified theory of everything in finance.

The world is not a model.

Read the whole thing.

-

Gold Crashes

Eddy Elfenbein, September 23rd, 2011 at 5:31 pmOn September 6th, the spot price of gold hit an intra-day high of $1,920.94 per ounce. Today, gold crashed over $100 per ounce. This was the third-largest daily percentage loss of the last 20 years.

Gold slumped more than 6 percent at one point — its biggest slide since the financial crisis in 2008 — to hit early-August lows as this week’s losses accelerated. The sell off came even as stock and oil markets stabilized after Thursday’s rout.

Adding to Thursday’s losses, gold is down almost 9 percent over the last two days, while silver has lost nearly 25 percent. In the case of gold particularly, it was the third-sharpest daily loss in the past 20 years.

“I’m sure talk of hedge fund liquidation is helping to pressure things, though there’s no confirmation of any single fund selling,” said Jonathan Jossen, an independent COMEX trader.

Despite its steep losses this week, gold remained up 16 percent year-to-date, thanks to gains from earlier months. But silver turned negative, with the spot price down almost 1 percent for the year.

By 2:45 p.m. EDT, the spot price of bullion was down 5.5 percent at $1,641 an ounce, after falling to a session low under $1,628. The move was more than 5 standard deviations beyond the normal one-day change. At $127 an ounce, the intraday move was the biggest on record in dollar terms.

-

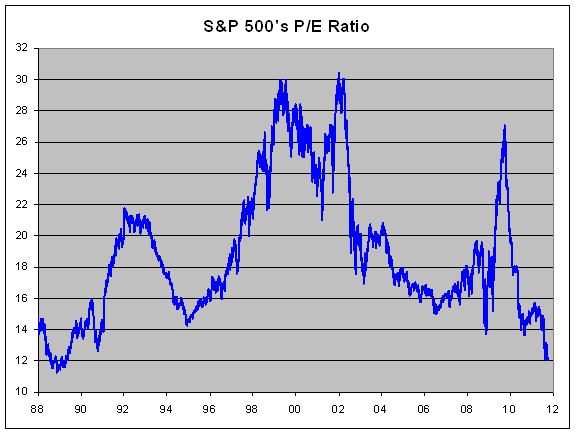

P/E Ratio Hits 22-Year Low

Eddy Elfenbein, September 23rd, 2011 at 11:23 amThanks to the recent plunge in stocks, the P/E Ratio for the S&P 500 fell to 12.05 based on yesterday’s close. That’s the lowest reading since April 17, 1989.

Here’s a look at the S&P 500 (black line, left scale) along with its earnings (gold line, right scale). The two lines are scaled at a ratio of 16-to-1.

-

CWS Market Review – September 23, 2011

Eddy Elfenbein, September 23rd, 2011 at 8:33 amOne day after the Federal Reserve announced “Operation Twist,” the stock market got absolutely slammed. The Dow was dinged for 391 points on Thursday and this comes on top of a 283-point haircut we took on Wednesday, most of which came after the Fed’s announcement.

In the last two days, the S&P 500 has shed 6%. The index closed Thursday’s trading session at 1,129.56 which is the lowest close in a month. We even hit an intra-day low of 1,114.22 which was below the recent closing low of August 8th (1,119.46). However, we haven’t pierced the intra-day low of 1,101.54 from August 9th. At least, not yet. The $VIX, also known as the Fear Index, shot up more than 10% on Thursday to close at 41.35 which is a one-month high.

So what’s going on?

In this issue of CWS Market Review, I’ll give you the low-down on the Fed’s plans and why the market reacted so negatively. Plus, I’ll update you on two very good earnings reports from our Buy List standouts, Oracle ($ORCL) and Bed Bath & Beyond ($BBBY). More importantly, I’ll highlight some outstanding high-yielding stocks that will help us weather the storm.

First, let’s take a closer look at Bernanke’s new plan to get the economy off the mat. At 2:23 pm on Wednesday, the Federal Reserve released its policy statement from this week’s meeting. In it, the Fed said it’s going to replace $400 billion of short-term debt in its portfolio with long-term Treasury debt.

The idea is to push long-term interest rates down with the hope of spurring more borrowing. Ideally, this will also help get the housing market going again. As I explained in the CWS Market Review from two weeks ago, economic recoveries are often led by the housing sector. The problem this time around is that housing is still flat on its back.

Bernanke & Co essentially downgraded the entire U.S. economy. The Fed aims to sell roughly three-fourths of the amount of short-term debt it holds. Investors concluded that if the Fed is going into long-term bonds, well…they might as well ride that wave. So they dumped stocks and crowded into Treasuries. By “crowded,” I mean a massive buying panic.

On Thursday, the yield on the 30-year Treasury plunged to 2.78%. That’s a drop of roughly 50 basis points from Wednesday afternoon. To put that in context, the Long-Term Bond ETF ($TLT) jumped from $114 to $123 in the same time period. (Remember that these are bonds. They’re supposed to be boring and stable.)

As dramatic as the 30-year bond’s drop was, the 10-year plunged to its lowest yield ever. On Thursday, the yield hit 1.72%. That’s a drop of 150 basis points since July 1st. We’re through the looking glass here, people.

I should point out that this recent action is slightly different from the fear trade that I’ve talked about before. The difference is that gold fell on Wednesday and it got hit hard yesterday which is a reflection that real short-term interest rates may rise from the Blutarsky levels they’re at right now. I doubt they’ll go very high, but the Fed is by far the largest player in the T-bill market.

As you might expect, the major losers on Thursday were the cyclical stocks. The Morgan Stanley Cyclical Index (^CYC) dropped 5.22% on Thursday to close at 762.10. Two months ago, the index was at 1,071.84. Both the Energy Sector ETF ($XLE) and Materials Sector ETF ($XLB) lost more than 5.6% on Thursday while defensive areas like Consumer Staples ($XLP) and Healthcare ($XLV) lost “only” 1.90% and 2.02% respectively. (That’s exactly why we call them defensive.)

The folks at Bespoke Investment Group point out that more than half of the stocks in the S&P 500 now yield more than the 10-year Treasury bond.

Some analysts on Wall Street are saying that Operation Twist is a really covert bailout of the big banks. I’m not cynical enough to say that’s the Fed intent, but it will certainly help the banks offload their holdings on Treasury bonds. But I’m doubtful that Operation Twist will spur more mortgage lending or even get people to refinance. Mortgage rates are already at 60-year lows. I don’t see how a few more basis points will help out troubled homeowners.

To be perfectly frank, I think this whole episode shows how limited the Fed’s powers really are. (At the Fed’s website, they included an FAQ on Operation Twist). David Kelly of JPMorgan Funds said, “Ben Bernanke is at least trying to do the right thing. He just doesn’t know what the right thing is.” Ouch!

Still, some of the big banks like Goldman Sachs ($GS) and Morgan Stanley ($MS) plunged to multi-year lows. Bank of America ($BAC) closed at $6.06 on Thursday; Warren Buffett’s warrants have a strike price of $7.14. Our Buy List mega-bank, JPMorgan Chase ($JPM), fell below $30 per share and it now yields 3.42%. JPM is still, by far, the healthiest of the major banks.

I honestly don’t see how Operation Twist will boost the economy, but I’m still not in the Double Dip camp. I think the most likely scenario is that the economy will bounce along at a 1% to 2% growth rate: not enough to get the labor market going but not slow enough to be an official recession.

As rough as this week was for the stock market, I’m happy to say that we had two very good earnings report from our Buy List. After the close on Tuesday, Oracle ($ORCL) reported earnings of 48 cents per share which was two cents better than Wall Street’s forecast.

I was actually expecting even more from Oracle. My mistake was that I didn’t foresee how weak their hardware business would be. Despite my over-optimism, the market reacted positively to the earnings report. On Wednesday, the shares got as high as $30.96. (Bear in mind that they were under $25 just one month ago.) The stock only broke down once the rest of the market did.

Oracle continues to be a very profitable company. Over the past 12 months, Oracle’s cash flow is up 46%. Wall Street was mostly upbeat on the earnings report. For their fiscal second-quarter, which ends in November, Oracle forecasts earnings of 56 – 58 cents per share. That’s a surprisingly narrow range. The Q2 from last year came in at 51 cents per share and that was a very strong quarter; Oracle cautioned investors that the comparisons are much tougher. I continue to rate Oracle a strong buy up to $30 per share.

While I was overly-optimistic on Oracle, I wasn’t optimistic enough on Bed Bath & Beyond ($BBBY). On Wednesday, the company reported fantastic second-quarter earnings of 93 cents per share. That was nine cents more than Wall Street was expecting.

This comes on top of a blow-out earnings report last quarter. BBBY also raised their full-year guidance for the second time this year. Originally, the company told us to expect earnings to grow by 10% – 15% for this year. Then after the big earnings report in June, they raised that forecast to 15% – 20%. Now they’ve bumped that up to 22% – 25%. That translates to full-year earnings of $3.74 – $3.84 per share. In business, good news often leads to good news. Businesses aren’t like ball players who have an “off night” or a “hot hand.” If there’s something good going on, it will tend to last.

At one point on Thursday, BBBY was one of only two stocks in the S&P 500 to be higher for the day. Thanks to Bed Bath & Beyond’s strong earnings and higher guidance, I’m raising my buy price to $60 per share. This is a very solid company.

Some other stocks on my Buy List that look particularly attractive right now (thanks to their high yields) include Abbott Labs ($ABT, yields 3.79%), AFLAC ($AFL, yields 3.75%), Johnson & Johnson ($JNJ, yields 3.68%), Reynolds American ($RAI, yields 5.85%), Sysco ($SYY, yields 4.00%) and Nicholas Financial ($NICK, yields 4.13%).

That’s all for now. Be sure to keep checking the blog for daily updates. Next week is the final week of the third quarter. We’ll also get another revision to the second-quarter GDP report. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: September 23, 2011

Eddy Elfenbein, September 23rd, 2011 at 4:50 amG-20 Vows to Tackle ‘Renewed’ Global Risks

ECB Ready to Act Next Month If Outlook Deteriorates

Europe Mulls Increasing Rescue Fund Firepower

Greece on Edge 24 Centuries After First Default

South Korea Regulator Says Some Banks That Flunked Stress Tests Now Sound

Special Report: How to win business in Libya

Crude Oil Rebounds More Than $1.00 Per Barrel

Fed’s ‘Operation Twist’ Fails to Reassure

Treasury Decline After G-20’s Pledge to Tackle Risks Damps Refuge Demand

Whitman Will Stick to Apotheker’s HP Strategies

Sany Roadshow on Course After $3.3 Billion Share Sale Delay

In Rush to Assist Solyndra, U.S. Missed Warning Signs

Old Saturn Plant Could Get a Second Chance

Todd Sullivan: Temp Staffing & Total Employment & Recessions

Stone Street: Is Our Tax System Fair? If Not, Why? — Veronique de Rugy

Be sure to follow me on Twitter.

-

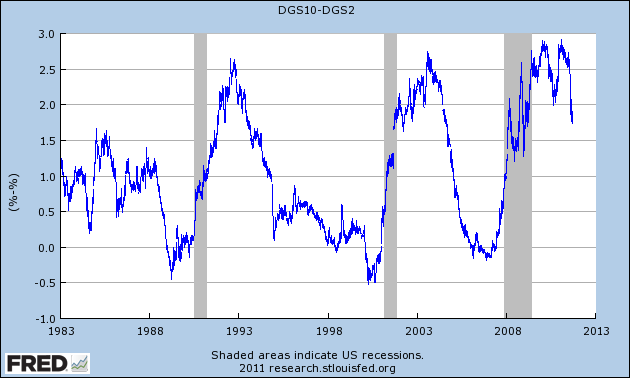

The 2/10 Spread

Eddy Elfenbein, September 22nd, 2011 at 3:52 pmI’m not exactly sure why, but the spread between the two- and ten-year Treasury bonds seems to have a very good track record of predicting recessions.

Notice how the spread goes negative in the months before official recessions (the grey bars). That’s a track record that many economists would envy.

The spread between the two and ten is still wide although it has narrowed over the past several weeks. Still, we’re a long way from the danger zone. That’s why I’m a Double Dip doubter. A recession, of course, will come along eventually, but this point combined with other data (like the ISM) tells me that a Double Dip recession is unlikely in the immediate future.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His