CWS Market Review – May 19, 2017

“Pride of opinion has been responsible for the downfall of more men on Wall Street than any other factor.” – Charles Dow

Wall Street’s deep sleep came to an end this week. The S&P 500 had a run of 16 straight days in which it never traded outside a band that was a little more than 1% wide. Then on Wednesday, the index suddenly dropped 1.8% for its biggest plunge all year.

Of course, that drop was from an all-time high close, so we can hardly say that there’s been a lot of pain on Wall Street. The major indexes are still having a very good year, and it’s only May. The move was such a shock since everything had, until then, been so complacent.

But here’s the key, Wednesday’s drop wasn’t spread out evenly. Many of the stocks that characterized the Trump Rally, like the big banks, fell the most. At the other end, defensive stocks fell the least. Some, like Hormel Foods, even rose a tad.

What does this all mean? There’s been a lot of talk that this is Wall Street’s verdict on President Trump. I don’t buy that at all. What’s really going on is that Wall Street is suddenly getting cold feet about another Fed rate hike. I’ve been warning that a rate increase next month would be a mistake. Some folks, apparently, are coming around to my side. I’ll have more on that in a bit.

On the earnings front, we got a very good report from Ross Stores, plus higher full-year guidance. I love it when that happens. Ross seems to be one of the players that’s standing up to the great Retail Apocalypse. I’ll also preview two Buy List earnings reports headed our way next week, from HEICO and Hormel. But first, let’s take a closer look at Wall Street’s worst day since September.

Wednesday’s Selloff Was about the Fed, Not Trump

In recent issues, I’ve said that it would be a mistake for the Federal Reserve to raise interest rates next month. The economy, sadly, just isn’t strong enough. Since I’m not a member of the Federal Open Market Committee, my views on the matter don’t count for much. But this week, the world may have shifted in my direction.

According to the latest futures prices, the market is placing 73.8% odds on a rate increase in June. That’s high, but it was even higher not too long ago. That’s why Wednesday’s selloff caught my attention. The worst performers were big banks and financial institutions. The best performers were high-dividend stocks like REITs and utilities, with some consumer cyclicals.

Whenever you see banks and dividend stocks move in opposite directions like that, you know that the market is arguing about the direction of short-term interest rates. Banks want short rates to go up. Dividend-payers want them to go down. When it’s a big drop like this, it’s almost as if the market is begging the Fed for some relief. I don’t know if they’re listening.

What makes this more interesting is that the economic news has been getting a little better recently. Still not enough to justify a rate hike, in my opinion, but we must consider all the evidence. For example, on Monday, the industrial production report was quite good. Economists had been expecting industrial production to show a 0.4% rise for April. Instead, it was up a full 1%. That’s the biggest increase in three years. Importantly, it’s for the month of April, which is in Q2.

A few weeks ago, we learned that the U.S. economy grew by a meager 0.7% for Q1. That’s pretty bad. Next week, we’ll get an update. But now we’re starting to get a few clues for what the Q2 numbers will be like. The Atlanta Fed has its GDPNow forecasting tool, which says that Q2 GDP is currently tracking at 4.1%. I have to be honest: that shocked me. I hope they’re right, but we still need to see more data.

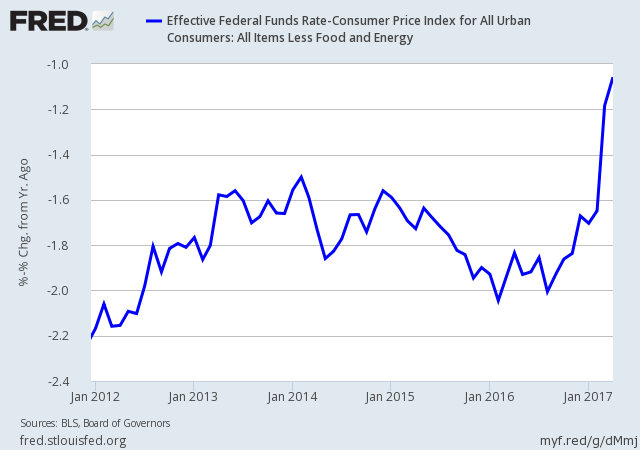

Last Friday, shortly after I sent out the newsletter, the government released the inflation report for April. If you recall, the report for March was light—very light. Core inflation had its steepest drop in 35 years. The numbers for April were higher, but still quite subdued. Headline inflation rose by 0.17% for April, and core inflation was up by 0.07%. Except for March, that’s the softest in four years. No matter how you look at it, inflation just isn’t out there.

What’s interesting is that if the Federal Reserve were doing nothing, then it would, in effect, be tightening. Stable rates plus falling prices means higher real rates, and that’s what puts the brakes on the economy. That’s what’s been happening (see above), and it needs to stop. Don’t believe the hype that the stock market is revolting against Trump. It’s upset with a short-sighted Fed policy. The sooner the Fed changes course, the better. Now, let’s check out the strong earnings report from Ross Stores.

Ross Stores Earned 82 Cents per Share

After the closing bell on Thursday, Ross Stores (ROST) reported fiscal first-quarter earnings of 82 cents per share. This is for the months of February, March and April, which is typically the slowest time of year for Ross.

Ross had been expecting Q1 earnings between 76 and 79 cents per share and comparable-store sales growth of 1% to 2%. In last week’s issue, I said, “This strikes me as conservative.” I was right, but I can’t take too much credit. We know that Ross likes to keep expectations low.

Barbara Rentler, Chief Executive Officer, commented, “We achieved respectable growth in both sales and earnings during the first quarter despite the uncertainty and volatility in the external environment. Operating margin of 15.2% exceeded our expectations due to above-plan sales and merchandise margin.”

I’m especially impressed by that operating margin number. Retail is all about keeping control of costs, especially for a deep discounter like Ross. The retail sector has been getting creamed lately, but Ross is one of the few that have been holding up relatively well. As I’ve long believed, Ross is a rare retailer that’s Amazon-resistant.

Now let’s look at guidance. For Q2, which ends on July 29, Ross sees EPS ranging between 73 and 76 cents per share. That’s compared with 71 cents per share for last year’s Q2. Ross sees comparable-store sales growth of 1% to 2%.

Now for the good news. Ross is raising its full-year earnings forecast. The company now projects 2017 earnings between $3.07 and $3.17 per share. That’s an increase from the previous range of $3.02 to $3.15 per share. Ross made $2.83 per share last year; however this year will include an extra business week. Ross estimates that adds eight cents per share.

Ross recently increased its quarterly dividend from 13.5 to 16 cents per share. That’s an increase of 18.5%. Over the last seven years, the company has raised its dividend by 300%. Ross is on track to buy back $875 million in stock this year. Ross Stores remains a buy up to $70 per share.

Earnings from HEICO and Hormel

We have two more Buy List earnings reports coming next week, from HEICO and Hormel Foods. Both companies ended their fiscal second quarters in April.

HEICO (HEI) is one of my favorite little companies. They make replacement parts for the aircraft industry. It was our top-performing stock last year, and it’s doing pretty well this year. The company is due to report its earnings on Tuesday, May 23.

In February, HEICO had Q1 earnings of 59 cents per share. That was five cents more than estimates. I was very pleased to see that cash flow rose 24%. The company provides guidance for several metrics, except earnings-per-share, so we need to make a few guesses. But the good news in February was that they raised their 2017 guidance.

Previously, HEICO expected full-year sales growth of 5% to 7% and net income growth of 7% to 10%. Now they see sales growth of 6% to 8% and net income growth of 9% to 11%. Assuming share count doesn’t meaningfully change, that’s probably about $2.02 to $2.05 per share. HEICO also recently split its stock 5-for-4.

The consensus on Wall Street (that’s only six analysts) is for Q2 earnings of 50 cents per share. This stock has an amazing long-term record. If you had invested $100,000 in HEICO in 1990, today it would be worth $18.7 million. For now, I’m keeping my Buy Below for HEICO at $72. I may raise it depending on the earnings report.

In February, Hormel Foods (HRL) missed earnings for the second time in a row. For Q1, the Spam stock earned 44 cents per share which was one penny below estimates. At the time, Hormel also lowered its full-year guidance to $1.65 to $1.71 per share, a decrease of three cents to both ends of the range.

The company cited “challenging market conditions in the turkey industry,” which, I have to admit, sounds kind of funny. Despite the earnings miss, the first quarter was Hormel’s 15th record quarter in a row. The fiscal Q2 earnings report is due out before the opening bell on Thursday, May 25. The consensus on Wall Street is for 40 cents per share.

Buy List Updates

On Monday, Moody’s (MCO) announced that they bought a Dutch company, Bureau van Dijk, for $3.1 billion. Moody’s will finance the deal with $1.3 billion in cash parked overseas plus a $2 billion debt offering. They expect the deal to close in the third quarter. Bureau van Dijk is a global business-intelligence and company-information provider. Shares of MCO rallied on the news.

I also want to make a few adjustments to some of our Buy Below prices. This week, I’m lowering my Buy Below on Cinemark (CNK) to $43 per share. I’m also dropping Alliance Data Systems (ADS) to $249 per share.

That’s all for now. Next week will be the last work week prior to the Memorial Day weekend, which is the traditional start of summer. On Tuesday, we’ll get the new-home sales report followed by the existing-home sales report on Wednesday. I’ll be particularly interested to see Friday’s update to the Q1 GDP report. The initial report showed real growth of just 0.7% which was the weakest report in three years. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on May 19th, 2017 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His