CWS Market Review – December 21, 2018

“How did you go bankrupt?”

“Two ways. Gradually, then suddenly.”

― Ernest Hemingway, The Sun Also Rises

After nine-and-a-half years, one of the longest bull markets in history is on life-support. What started out as minor downturn has, since December, turned into a major sell-off. Ever since President Trump referred to himself as “Tariff Man,” the Dow has plunged nearly 3,000 points.

Of course, no downturn has a single cause, and the Federal Reserve’s fingerprints are clearly visible. This week, the Fed raised interest rates yet again, and it sees more hikes coming next year. The market reacted swiftly and negatively.

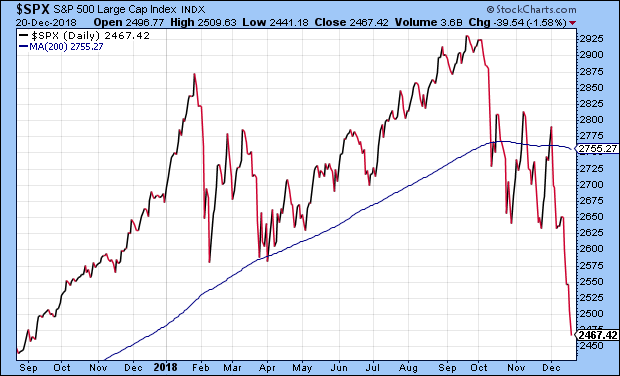

The numbers are remarkable. On Thursday, the S&P 500 closed at its lowest level in 15 months. In the last 12 trading sessions, the S&P 500 has lost 11.6%. The details are even uglier. Within the index, 423 stocks are now trading below their 200-day moving average. On Thursday, new lows beat new highs 175-0.

Never fear. In this week’s issue, I’ll walk you through the mess and explain what to do now. I’ll also fill you in on the recent earnings report from FactSet, which looked pretty good to me even though the stock pulled back. But first, let me remind you that I’m going to send you the 2019 Buy List this Tuesday on Christmas Day. This will be our 14th annual Buy List. I like to unveil the new Buy List a few days before the new year, just to prove to folks that I don’t play any games as far as timing goes.

As always, the new Buy List will have 25 stocks. I’m going to add five new names and I’ll delete five old ones. For tracking purposes, all 25 stocks are equally weighted based on the closing price from 2018. Then on January 2, the first day of trading for the new year, the new Buy List goes into effect. I’ll follow up with complete performance details. Now let’s get to this week’s unpleasantness.

The Fed Raises Rates and the Market Raises Hell

The Federal Reserve met again this week, and for the fourth time this year, the central bank raised interest rates. The target for the Fed funds rate is now 2.25% to 2.50%. As I’ve said before, I think raising rates now is a mistake. It’s true, the economy is getting better, but I still haven’t seen the normal pressures that signal an overheating economy.

The facts are pretty straightforward. Inflation is low. The dollar is strong. The Canadian dollar just hit a new low. Commodity prices are down. The price of crude just fell to a 15-month low. Housing is having a tough year, and some markets are struggling. But for some reason, the Federal Reserve has been determined to raise interest rates. Some folks speculate that they’re trying to prove their independence from a critical White House. Perhaps.

But what really spooked the market is the Fed’s apparent plans for even more hikes next year. The Fed’s policy statement noted that, “the labor market has continued to strengthen and that economic activity has been rising at a strong rate.” The statement also said that “some further gradual increases” are needed. In other words, they ain’t done.

Along with the policy statement, the Fed released its economic projections for the next few years. The Fed members see two more increases next year. I think that’s way off base. In fact, if I were a Fed member (a big if), I would be leaning towards zero hikes for the next six months. Let workers see more gains. That’s more revenue for business.

The Fed is actually moving in the right direction. The forecast from September called for three hikes next year. One member was on record calling for five hikes! So while the Fed is moving in the right direction, they still have a lot more room to go. I like to look at the futures market to see what the serious money thinks, and they don’t see any rate hikes coming next year. (To be precise, it’s almost 50-50 on one hike next December.) In fact, the futures think there’s a very, very slight chance of a rate cut sometime next year.

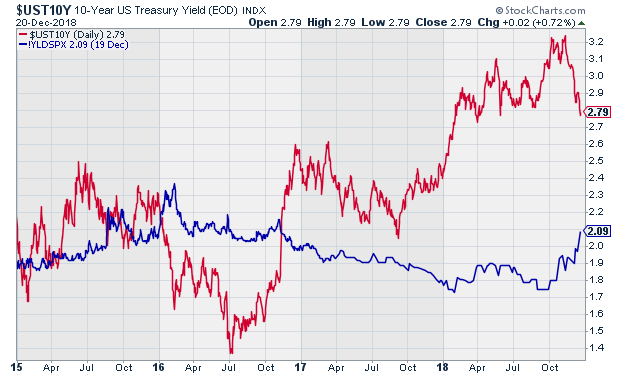

Let me explain why I’m so concerned about rising interest rates from a stock-market perspective. Short-term interest rates are largely determined by the Fed. That, in turn, impacts long-term rates. That, in turn, influences stock valuations. If bond yields fall, then P/E Ratios can go higher. But if yields rise, then P/E Ratios will drop. The relationship is hardly perfect, but it’s good enough for our purposes.

Here’s a chart showing the 10-year Treasury yield in red along with the yield on the S&P 500 in blue. In this example, I’m using dividends instead of earnings, but the same principle holds. Notice how the lines were fairly close to each other in 2015, 2016 and 2017, but a big gap opened up this year. Now the market is adjusting.

Right now, earnings, the E in P/E Ratio, are growing quite nicely. However, rising yields are forcing the P/E Ratio down. The S&P 500 is currently going for about 14 times next year’s earnings. That’s not expensive. A year ago, Moody’s Baa Bond Index was yielding 4.2%. That’s up to 5.0% today. As a result, prices have shifted according to the new competition.

If someone can get 5% from a fairly generic corporate bond, why should he or she bother with stocks? As a result, the price of stocks has gone down to entice investors back. So what’s happening is that the market is shifting towards a more defensive posture. In simple terms, conservative stuff like bonds and defensive stocks are holding up well, while cyclical stocks (Industrials, Energy, Banks) are suffering.

How much longer will this last? Beats me, but I will say that selloffs usually end before anyone realizes it. Since its closing high three months ago, the S&P 500 has lost 15.8%. Traditionally, a 20% drop is considered a bear market. We may get there soon. In the short-term, the key for us to watch is the 200-day moving average. Whenever we’re below the 200-DMA, as we are now (by more than 10%), you know that the seas will be rough. Expect more volatility. We’ll get jerked higher and lower a lot, but once we clear the 200-DMA, things will get a lot calmer.

What to Do Now

The first and most important thing to do is not panic. In fact, that’s so important that I’ll make it the first and the second thing to do. Remember Warren Buffett’s dictum: “Be fearful when others are greedy. Be greedy when others are fearful.” Right now, there’s a lot of fear. I don’t advocate greed, but I do support disciplined buying.

I also don’t want you to concern yourself about waiting for the absolute bottom. In retrospect, people think of “the low” as a big event that…happens. In reality, no one realizes it at the time, and it usually happens a lot faster than you think. You can be sure there will still be people predicting the next big leg down.

In 2008, a major low came on November 20. Although this wasn’t the absolute low, it was a good time to buy. At the time, people were massively freaked out. The VIX was at 80. That’s crazy, but the prices were good.

Right now, investors should focus on high-quality stocks going for discounted prices. Let me touch on a few Buy List names that look particularly good thanks to the selloff. The first is Cognizant Technology Solutions (CTSH). The stock just hit a new 52-week low. The company expects earnings this year of at least $4.50 per share. At this price, that gives them a trailing P/E Ratio of less than 14. I also really like Ross Stores (ROST) below $78 per share. Torchmark (TMK) below $74 is a very compelling buy. TMK may be the most conservative stock on our Buy List. The final one I want to highlight is FactSet, which reported earnings last week.

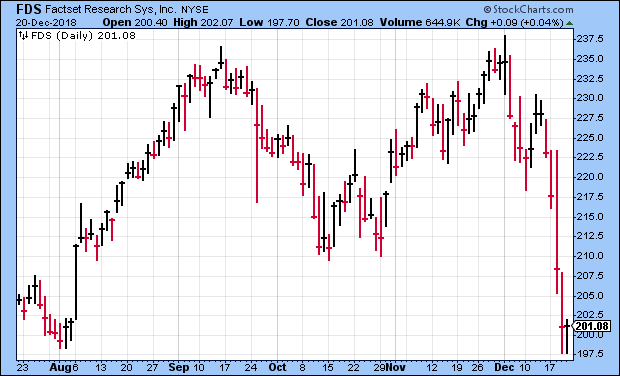

FactSet Beat Earnings but the Shares Dropped

On Tuesday morning, we got our final Buy List earnings report of 2018. FactSet (FDS), reported fiscal Q1 earnings of $2.35 per share. That was a 15.2% increase over last year. It also beat Wall Street’s estimate by six cents per share. Quarterly organic revenue rose 6.4% to $353.1 million.

I’ve looked at the numbers, and they’re pretty good. The key stat for FactSet is Annual Subscription Value, or ASV. At the end of the quarter, ASV increased to $1.42 billion. I was pleased to see that FactSet’s operating margin rose to 28.6%.

“We are pleased with our first-quarter results and are encouraged by continued demand for our data and technology offerings. Our strategy to provide open and flexible solutions positions us well for another successful year of growth,” said Phil Snow, FactSet CEO.

At the end of the quarter, FactSet’s client count stood at nearly 5,300, while user count is now over 115,000. Their annual retention rate is over 95%. People love their service.

When the Q4 earnings report came out three months ago, FactSet gave us guidance for 2019. This week, they reiterated all those projections. The company sees 2019 earnings ranging between $9.45 and $9.65 per share. That’s up from $8.53 per share last year. FactSet also sees organic ASV rising by $75 million to $90 million in 2019, and they see operating margins between 31.5% and 32.5%. That’s quite good.

The market wasn’t pleased with FactSet’s results. The shares fell 4.2% on Tuesday and another 3.5% on Wednesday. Despite the drop, I don’t see anything wrong with the earnings report. FactSet continues to be an excellent company. Now it has a cheaper share price. If you can buy FDS near $200 per share, then you got a good deal.

Buy List Updates

Due to the recent downturn, several of our Buy List stocks are well below their Buy Below prices. For the time being, I’m going to take a light-handed approach to our Buy Below levels because it won’t mean much until the new Buy List goes into effect in January.

This week, Japan Post said that it will buy a $2.4 billion stake in AFLAC (AFL). I touched on this in last week’s issue, but it became a done deal this week. Japan Post now owns 7% of the duck stock.

According to the deal, after four years, Japan Post’s stake will rise to 20% of voting rights without buying any more shares. Once they hit 20%, Japan Post can record AFLAC’s profits as their own. AFLAC has held up relatively well for us recently. I remain a fan.

This week Danaher (DHR) offered its first earnings guidance for 2019. The company sees 2019 earnings ranging between $4.75 and $4.85 per share on revenue growth of 4%.

Thomas P. Joyce, Jr., President and Chief Executive Officer, stated, “We are very pleased with our 2018 performance year-to-date. We delivered strong revenue growth and operating-margin expansion, double-digit earnings per share growth and closed over $2B in acquisitions including IDT, a leading player in the genomics consumables market. We believe this year’s solid cash flow performance — in addition to our exceptional balance-sheet capacity — positions us very well for future strategic capital deployment.”

Joyce continued, “We have transformed Danaher meaningfully over the past several years, evolving into a higher-growth, higher-margin, and higher-recurring-revenue company. We have done this through a combination of organic and inorganic growth initiatives, which have helped drive market-share gains in many of our businesses. Looking ahead, with the power of the Danaher Business System as our foundation we will continue to focus on building a better, stronger Danaher and creating shareholder value for years to come.”

We don’t have the final numbers yet for 2018, but Danaher expects 2018 to be between $4.49 and $4.52 per share. Since only one quarter is missing, that’s probably pretty accurate.

That’s all for now. The stock market will close at 1 p.m. ET on Monday and then be closed all day on Tuesday, Christmas Day. There’s not much expected in the way of economic news. On Thursday, we’ll get jobless claims, housing starts and consumer confidence. Then on Friday, the home-sales report is due out. Be sure to keep checking the blog for daily updates. Stay tuned for the 2019 Buy List on Tuesday, and I want to wish everyone a Merry Christmas.

– Eddy

Posted by Eddy Elfenbein on December 21st, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His