Posts Tagged ‘CTSH’

-

CWS Market Review – February 6, 2015

Eddy Elfenbein, February 6th, 2015 at 7:08 am“When it comes to investing, my suggestion is to first understand your strengths and weaknesses, and then devise a simple strategy so that you can sleep at night.”

– Walter SchlossOur Buy List is starting to respond well to earnings. On Wednesday, shares of Cognizant Technology Solutions ($CTSH) gapped up more than 5% after the company’s earnings report. Then on Thursday, Snap-on ($SNA) and Ball Corp. ($BLL) both surged higher. At one point, Ball was up more than 11% on the day.

Earlier in the week, AFLAC ($AFL) gained strength after its earnings report came out, as did Fiserv ($FISV) which broke out to a new 52-week high. For the first four days of this week, our Buy List gained 5.03%, outpacing the 3.38% from the S&P 500. We have a modest profit on the year, and we’re beating the market as well. As always, we don’t want to get too excited about short-term victories. Instead, we’re focused on the long-term.

In this week’s CWS Market Review, I want to run down our recent earnings reports. It’s been a busy week. But first, I want to discuss an important shift that’s happening in the economy.

Expect Flat Earnings Growth This Year

What’s happened lately with the economy is that consumers and businesses have basically switched places. From 2010 through 2013, corporate profits were very strong, but consumers were struggling. There seemed to be a big disconnect between Main Street and Wall Street as the stock market zoomed ahead while wages and job growth stagnated. I think that may have played a part in the emergence of the Occupy Wall Street movement.

Lately, however, consumers have woken up. The unemployment rate is below 6%, and last year was the best year for payroll employment growth since 1999. Mind you, I’m not saying all is well for the economy, but I am saying that some lines have finally started moving in the right direction.

For businesses, it’s been a different story. The last two reports on durable goods were negative. Industrial production and factory orders are down as well. The recent ISM was decent, but nothing great. But the biggest change has been the dramatic lowering of earnings expectations. Just a few weeks ago, Wall Street had been very optimistic for Q4 earnings. It’s like having a first and goal on the five-yard line with 1:06 to play. What’s the worst that could happen?

Well, the dollar—that’s what. The surging U.S. dollar and collapsing oil prices have dramatically changed the outlook for corporate earnings growth. Guidance from companies hasn’t been this poor since the depths of the Financial Crisis. At the end of the Q3, Wall Street had been expecting Q4 earnings of $32.24 (that’s the index-adjusted number). Now it looks like it will be about $27.64. That’s a big cut. At the end of Q3, the Street was expecting full-year earnings for 2015 of $136.07. That’s now down to $119.76. That’s a 12% cut in four months. Stock prices haven’t responded nearly as much.

The lion’s share of that cutting has been in energy stocks. Three months ago, Wall Street had been expecting ExxonMobil ($XOM) to earn $7.50 per share for 2015. That’s now down to $5.41 per share. People don’t exactly sympathize when Big Oil is struggling, but remember that Exxon’s woes will translate into lower capex spending which will eventually be felt across the broader economy.

The question now is, how much will corporate earnings suffer? I suspect that the benefits of lower oil will largely cancel out the costs of the rising greenback. For the next few quarters, I think overall corporate profit growth will be low but positive. Think 2% to 5%. Of course, some companies will manage themselves better than others during a flat environment. In fact, we’re starting to notice that with the results of our Buy List stocks. Having said that, let’s take a closer look at our recent earnings news.

Our Recent Buy List Earnings Reports

Last Friday, Moog ($MOG-A) reported fiscal Q1 earnings of 86 cents per share. It’s interesting how this earnings report was a microcosm of so much that’s been going on. Sales for the quarter dropped 2% compared with a year ago, but that was largely due to the dollar. Net earnings rose 10%, but earnings per share was up 23%. Why? Because Moog has been gobbling back its own shares at a rapid clip.

Last quarter’s earnings were basically fine. Moog missed consensus by a penny per share. It’s basically good execution, but in a poor environment. The bad news was their guidance. In October, Moog projected full-year earnings of $4.25 per share. Now they’re saying it will be $3.85 per share—$3.95 if you include buybacks. They earned $3.52 per share last year.

CEO John Scannell said, “On a positive note, earnings came in slightly ahead of our forecast, and cash was very strong. However, during the quarter we started to feel the impact of three macroeconomic headwinds, the strengthening of the U.S. dollar, the industrial malaise outside the U.S. and the sharp and sustained drop in the price of oil. As a result, we are introducing some caution in our forecast and revising our outlook for the remainder of fiscal ’15 downward. Despite these challenges, we are still forecasting fiscal ’15 to be another year of strong cash flow and record earnings per share.”

The stock got tripped up after the earnings report, but it’s since stabilized in the low $70’s. There’s nothing at all wrong with Moog, but I’m going to lower my Buy Below price to $76 per share. This is a good, conservative stock.

On Tuesday, Fiserv ($FISV) reported Q4 earnings of 89 cents per share, which hit expectations on the nose. I like this company a lot. For all of 2014, they earned $3.37 per share, to notch their 29th year in a row of double-digit adjusted EPS growth. That’s amazing.

In last week’s CWS Market Review, I said I was curious to hear any guidance for this year. This week, Fiserv said they expect internal revenue growth of 5% to 6% for 2015. They also expect earnings per share to range between $3.73 and $3.83. That represents a growth rate of 11% to 14%, so the earnings streak should continue. The shares gapped up more than 4% this week, and on Thursday, Fiserv hit a new all-time high. This week, I’m raising our Buy Below on Fiserv to $80 per share. This is a solid stock.

Also on Tuesday, AFLAC ($AFL) reported more of the same. On a nuts-and-bolts basis, the duck stock is doing just fine; the problem is the weak yen. For Q4, AFLAC reported operating earnings of $1.29 per share. For insurance companies, it’s better to look at operating earnings rather than net earnings. That result also matched Wall Street’s estimate. AFLAC said that the weak yen cost them eight cents per share quarter. That’s actually lower than I thought.

For all of 2014, AFLAC had operating earnings of $6.16 per share. The weak yen knocked off 26 cents per share. If we ignore currency, which is admittedly hard to do, AFLAC’s earnings were up 3.9% last year. Dan Amos, AFLAC’s CEO, said that their goal is to grow earnings by 2% to 7% on a currency-neutral basis. The problem, of course, is that currency will have an impact. Fortunately, AFLAC broke down their expectations. Here’s a chart of AFLAC’s expected operating earnings per share based on different yen/dollar exchange ratios.

Yen/Dollar Ratio EPS Range Yen Impact 100 $6.46 to $6.77 $0.18 100.46 $6.29 to $6.59 — 115 $6.01 to $6.31 ($0.28) 125 $5.77 to $6.07 ($0.52) 135 $5.56 to $5.86 ($0.73) The stock rallied after the earnings report and closed at its highest level in a month. AFLAC remains a good buy up to $63 per share.

Going into earnings season, investors appeared to be a little skittish on Cognizant Technology Solutions ($CTSH), but the IT outsourcer delivered yet again. For Q4, Cognizant earned 67 cents per share which was two cents better than estimates. Quarterly revenues jumped 16.4% to $2.74 billion. The company has been helped by its aggressive expansion into healthcare.

Now for guidance. Cognizant said they see Q1 earnings of at least 69 cents per share. That was a penny below consensus (note they said “at least”). They also see Q1 revenues of at least $2.88 billion, which was just above consensus of $2.86 billion.

For all of 2014, Cognizant projects earnings of at least $2.91 per share. That’s five cents below consensus. They see revenues of at least $12.21 billion, which was higher than the consensus of $12.16 billion. The shares jumped 5% on Wednesday. This is already our top-performing stock this year, with a 9.45% YTD gain (Fiserv is #2). I’m raising my Buy Below on Cognizant to $60 per share.

Now for two of our newbies, Ball Corp. ($BLL) and Snap-on ($SNA). Both companies reported before the opening bell on Thursday. Ball had Q4 earnings of 84 cents per share, which was one penny below expectations. Revenues rose 1.8% to $2.03 billion, which was $50 million more than consensus. Even though Ball missed earnings, they wrapped up a very strong year. For all of 2014, the can maker earned $3.88 per share, which compares with $3.28 per share they made in 2013. The earnings growth was so good that Ball said they’ll have a tough time hitting their 10% to 15% long-term growth target for 2015.

But the really big news is that Ball confirmed they’re in talks to buy Rexam, an aluminum can-maker in Britain. The potential deal could be worth $6.5 billion. The deal would be two-thirds in cash and one-third in stock, and it would combine two of the largest beverage can makers in the world. I like to see deals done in cash as much as possible. Shares of Rexam soared 23% in London. In the U.S., the market loved the news. Shares of Ball rallied nearly 9% on the day. I’m raising my Buy Below on Ball by $3. Ball is a buy any time the shares are below $75.

Snap-On reported very good earnings for Q4. The diversified manufacturer made $1.97 per share last quarter. That topped expectations by 16 cents per share. For the year, Snap-on made $7.14 per share, which is a very nice increase over the $5.93 per share they made in 2014. On Thursday, shares of SNA rallied for a 6.3% gain. I’m raising my Buy Below on Snap-on to $145 per share.

Before I go, I wanted to give you an update on Ford Motor ($F). I’ve been telling investors not to worry too much about last quarter’s earnings and that the earnings from now on will be very important. What’s interesting is that the automaker shrugged off last week’s earnings report, which was mostly good. But the stock really responded to the monthly sales report which came out on Tuesday. Ford’s sales rose 15.3% in January. From the low last Thursday to yesterday’s high, Ford rallied more than 12%. It’s good to see some strength in Ford. Let’s not chase it. I’m keeping our Buy Below at $16 per share.

That’s all for now. Outside of more Q4 earnings reports, next week should be fairly quiet on Wall Street. None of our Buy List stocks are due to report. On Tuesday, we’ll get another update on crude inventories. Then on Thursday, the Census Bureau will release its report on retail sales for January. It will be interesting to see how busy shoppers have been. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

CWS Market Review – November 7, 2014

Eddy Elfenbein, November 7th, 2014 at 7:10 am“Experience is the name everyone gives to their mistakes.” – Oscar Wilde

The stock market rally isn’t showing any signs of slowing down. On Thursday, the S&P rallied to yet another new all-time high. The index finished the day at 2,031.21 for its eleventh daily gain in the last 16 trading sessions. The Dow Jones Industrial Average hit its 21st record close of the year.

The S&P 500 is now up 9.9% on the year. Of course, nearly every penny of that has come in the last three weeks. On October 15, the S&P 500 was up just 0.76% on the year. I continue to be impressed by the market’s resiliency. On Wednesday, the S&P 500 along with the Dow Industrials, Dow Transports and Dow Utilities all closed at record highs. That hasn’t happened in more than 16 years.

Our Buy List continues to do well, but I have to face the fact that we’re most likely going to underperform the market this year, though not by much. The last time we trailed the market was 2006. Through Thursday, our set-and-forget Buy List is up 6.3% on the year which is about 3.6% points behind the overall market.

The big news this week was the mid-term elections. The Republicans took over the U.S. Senate and they look to have a generational high in the House. There’s been a lot of “what this means” chatter, most of it is sadly mistaken. I’ll give you my thoughts in a bit. I’ll also highlight the last batch of earnings reports. We had some strong reports from Moog and Cognizant, but Qualcomm was our big dud. I’ll run through the details. I’ll also bring you-up-to-speed on the last economic reports. But first, let’s look at how the shakeup in Washington affects our portfolios.

What the GOP Wave Means for Investors

Richard Nixon was once asked what he would do if he weren’t president. Nixon said that he’d probably be down on Wall Street buying stocks. That led one old-time Wall Streeter to say that if Nixon weren’t president he, too, would be buying stocks.

I live a few blocks from the White House and I’m guessing President Obama didn’t have an enjoyable evening on Tuesday night. The Republicans rolled up some impressive victories. We don’t have all the results in yet, but it appears that the GOP will have 53 seats in the Senate and about 250 seats in the House. The latter figure will be their best showing in 86 years. The Republicans also did quite well at the state and local levels.

So what does this all mean for the stock market and our portfolios? Honestly, it doesn’t mean much. One of the great myths about the stock market is that it cares about politics. It’s just not so. By politics, I mean the daily back-and-forth between the two major parties. The market is mostly non-partisan although there are some exceptions.

Let me be clear that the government policy does impact the economy, and by extension, the stock market. But those policy decisions are usually well removed from the standard partisan debate. Of course, what the Federal Reserve does is important, but that’s rarely an election issue. Plus, there’s no reason to think that a change on Capitol Hill will have a great impact on monetary policy.

Mitch McConnell, the new Senate majority leader, quickly made it clear that there would be no government shutdown; nor would he try to abolish all of Obamacare. The government shutdown is a good example of a partisan effort that riled investors, but even that didn’t last long.

One issue that may be positive for our Buy List is an attempt by Congress to repeal the medical device tax. This impacts companies like Medtronic, Stryker and CR Bard. Interestingly, all of those stocks did well on Wednesday. This week, I’m also raising some Buy Below prices for our healthcare stocks (details to follow).

If the American people gave the Radical Marxist Socialist I Hate My Parents party a big majority in Congress, then sure, it would change things. But let’s remember that 89 senators from last session will be returning next year. What we call a big shakeup is when there are 11 new faces. Of course, that’s exactly how the system was designed. The changing passions of the people are supposed to be muted in the halls of government. Contrast that with Wall Street which is nothing but the passion of the people. Or at least, of traders.

I see too many investors let their political leanings interfere with their investments. That’s a bad move. The stock market has done well under both parties and it’s done poorly under both parties. Trying to build an investing strategy based on politics misses what truly drives the market.

There are some people who claim that DC gridlock is good for the market because nothing gets done. Perhaps, but that’s a very minor factor. The stock market will continue to be driven by the fundamentals. That’s why I talk so much about earnings. A lousy stock can rally on terrible earnings. Or in the case of Amazon, not much earnings at all. But a company with decent earnings will eventually do well. It just takes some patience.

Speaking of earnings, let’s look at this earnings season. We’re nearing the end of Q3 earnings season and 80% of companies in the S&P 500 have topped expectations while 61% have topped their sales estimates. Those are good results, but again, these companies are beating reduced estimates.

Wall Street continues to be buoyed by the Strong Dollar Trade. In Europe, Mario Draghi is increasingly frustrated with the Continent’s sluggish economy. He’s willing to follow more unconventional policies to get the European economy back on its feet. That probably means he won’t mind seeing the euro drift lower. The euro just fell to a two-year low against the dollar. We’re also seeing the same thing in Japan. All of this is propelling the dollar higher.

Investors need to understand the impact of the Strong Dollar Trade because that’s been the dominant theme in the markets. The price of gold seems to be in freefall. (Silver, too.) Energy stocks can’t catch a break. Oil is now below $78 per barrel. That’s down $25 per barrel in four months. Small-caps had a brief outperformance surge last month, but that seems to have passed. I should note that the relative performance of active managers tends to be strongly correlated with the relative performance of the small-cap sectors. Note that the Strong Dollar Trade isn’t necessarily good for the overall market. Rather, it makes its impact felt within the market.

The economic news was mixed this week. On the plus side, the ISM Manufacturing Index is still holding up well. The ISM for October was 59.0 which is tied for the best in the last three years. The bad news was that Construction Spending dropped 0.4% in September.

The October jobs report is due out Friday morning. Traditionally, the monthly jobs report has been the most important economic report on the calendar. While it’s still a biggie, I think it’s not quite as important as it used to be. I expect the October report to be a continuation of the trend that’s been in place for several months now, meaning about 200,000 to 250,000 new jobs each month. The ADP report said that the economy created 230,000 private sector jobs last month. Also, the initial claims reports have been quite strong. Now let’s look at some of our recent earnings reports.

Moog Soars to a New High

Shortly after I sent out last week’s CWS Market Review, Moog ($MOG-A) reported its fiscal Q4 earnings. The company had a very good quarter. For Q4, Moog earned $1.12 per share which was four cents better than estimates.

CEO John Scannell said, “Earnings were up and cash flow was very strong. Our financial position allowed us to buy back 4 million shares of stock. In a year with little top-line growth, our employees put in a tremendous effort to deliver on our commitments to both our customers and our investors and I thank them for their hard work and dedication. As we look forward, we are projecting a stronger fiscal ’15 with earnings per share of $4.25, up 21% from fiscal ’14 on sales growth of about 1%.”

For the fiscal year, Moog earned $3.52 per share which is an increase from $3.26 the year before. Additionally, Moog expects to make $4.25 per share this coming year. The shares have rallied impressively over the past few weeks. I’m raising my Buy Below on Moog to $78 per share.

Cognizant Rallies 21% in 13 Days

Our big star this earnings season was Cognizant Technology Solutions ($CTSH). The IT outsourcer raked in 66 cents per share last quarter which was seven cents better than estimates. Quarterly revenues jumped 11.9% to $2.58 billion.

For Q4, Cognizant sees earnings of at least 63 cents per share. Wall Street had only been expecting 59 cents per share. That would bring full-year earnings to at least $2.57 per share. CTSH also said they expect revenues to range between $2.61 and $2.64 billion. That was above the Street’s forecast of $2.59 billion. When CTSH was hit three months ago, it was due to concerns about their top-line growth.

“Revenue growth was slightly ahead of our revised forecast and, as expected, non-GAAP operating margins were within our target range of 19-20% as we absorbed the impact of annual wage increases during Q3,” said Karen McLoughlin, Chief Financial Officer. “Our balance sheet remains strong as cash and short term investments increased during the quarter by almost $500 million to $4.6 billion. Later this quarter, we anticipate utilizing $1.7 billion of this cash, in addition to $1 billion of floating rate debt through a syndicated term loan, to fund the previously announced acquisition of TriZetto.”

In the 11 days going into the earnings report, Cognizant rallied 11%. Then it jumped another 8% after the earnings announcement. It’s about time this stock got some love. I’m raising my Buy Below on Cognizant to $55 per share.

Qualcomm Disappoints

After IBM, we had been having a great run through earnings season, but Qualcomm ($QCOM) had to trip us up. The chipmaker reported fiscal Q4 earnings of $1.26 per share. That missed consensus by five cents per share. Revenue rose 3% to $6.69 billion which was below consensus estimates of $7.016 billion. The stock was dinged for an 8.6% loss on Thursday.

Let’s run through some numbers. For this quarter (ending in December), Qualcomm sees EPS ranging between $1.18 and $1.30. Wall Street had been expecting $1.43 per share. They expect sales to range between $6.6 billion and $7.2 billion.

The big headache for Qualcomm is their conflict with the Chinese government, and there’s not much the company can do. My guess is that the Chinese government will level a big fine on them, and they’ll have to pay it and move on. Qualcomm also disclosed that it’s facing anti-trust investigations by the FTC and by the EU.

For this current fiscal year (ending September 2015), Qualcomm expects earnings between $5.05 and $5.35 per share, and revenue between $26.8 billion and $28.8 billion. Wall Street had been expecting earnings of $5.58 per share on sales of $28.91 billion.

Let’s remember that Qualcomm has tons of cash, no debt and strong free cash flow. They’re not going broke anytime soon. Still, this was a painful report. I’m lowering my Buy Below price on Qualcomm to $75 per share.

DirecTV Is a Buy up to $90 per Share

DirecTV ($DTV) had another good quarter. The satellite-TV operator earned $1.33 per share for Q3 which was three cents better than estimates. Revenue came in at $8.37 billion which was $60 million better than estimates.

As I’ve mentioned before, shares of DTV and AT&T are basically joined at the hip. After AT&T’s poor earnings report, its shares fell below $34.90 which is the lower bound of the merger deal.

Here’s how it works: The merger deal calls for DTV shareholders to get $28.50 in cash, plus 1.905 shares of AT&T if that stock goes below $34.90. In simpler terms, if AT&T hits $34.90 or more, then the merger price for DTV is $95. Recently, AT&T fell as low as $33.10 per share. Fortunately, it’s recovered so that good for DTV. DirecTV remains a good buy up to $90 per share.

Buy List Updates

I also want to highlight a few more of our Buy List stocks. CA Technologies ($CA) and eBay ($EBAY) have bounced back impressively since mid-October. Shares of CA are up more than 16% since October 16.

Bed Bath & Beyond ($BBBY) continues to recover. On Thursday, the stock got as high as $69.98 per share. That’s a seven-month high! This is exactly why I like to stick with strong companies when they hit rough patches. I’m raising my Buy Below on BBBY to $72 per share.

Also in the retail sector, Ross Stores ($ROST) just touched a new 52-week high. Ross reports earnings later this month. I’m keeping our Buy Below at $83 per share.

Shares of Microsoft ($MSFT) just closed at a 14-year high. The stock has had an incredible run this year. The stock is now a 30% winner on the year for us. MSFT is a buy up to $50 per share.

Our healthcare stocks have been doing very well lately. I want to raise a few of our Buy Below prices. This week, I’m raising the Buy Below on Medtronic ($MDT) to $70 per share. I’m lifting CR Bard ($BCR) to $165 per share. I’m raising Stryker ($SYK) to $90 per share. Finally, I’m raising Express Scripts ($ESRX) to $80 per share.

That’s all for now. Next week should be mostly quiet. Most of the earnings reports are in, but we’ll get a few key economic reports. I’ll be most interested to see the Retail Sales report which comes out on Monday. With gas prices down, that gives consumers more money which they tend to spend quickly. This will also give us a hint of how optimistic shoppers are going into the all-important holiday shopping season. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

CWS Market Review – August 8, 2014

Eddy Elfenbein, August 8th, 2014 at 7:26 am“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” – Peter Lynch

After a very subdued June and July, the stock market has suddenly gotten a lot more interesting. The S&P 500 had gone 62 trading days in a row without a daily move, up or down, of more than 1%. That was the longest streak of its kind in nearly 20 years. Then we had three such days within two weeks, and we came very close to a fourth on Tuesday.

On Thursday, the S&P 500 fell to a two-month low of 1,909.57. In an apparent homage to Black Monday, the index reached its closing high of 1,987.98 on July 24. We’re now down 3.94% from that mark. Last week, the S&P 500 broke below its 50-day moving average last week, and we’re only 2.6% above the 200-DMA. It’s been 21 months since the S&P 500 last closed below its 200-DMA.

There are lots of reasons for the market’s new-found case of anxiety: Ebola, Putin, Hamas, ISIS. From its July low to its August high, the Volatility Index ($VIX) soared 66%. Gold has been creeping up as well. Despite the increase in worrying, the fundamentals of the economy and stock market are sound.

Last Friday, for example, we had another good jobs report: the U.S. economy created 209,000 net new jobs in July. This is the first time in 17 years that the economy has created more than 200,000 jobs for six months in a row, and I think we can expect a seventh. On Thursday, the Labor Department reported that the four-week moving average of jobless claims fell to an eight-year low. We also learned last week that the ISM Manufacturing Index jumped to 57.1, which is its highest level in more than three years. There are lots of problems in the world, but an imminent recession in the U.S. isn’t one of them.

We’re nearing the end of second-quarter earnings season, and it’s mostly been a good one. Of the S&P 500 companies that have reported so far, 75% have beaten their earnings expectations, while 65% have beaten on sales. For Q2, the S&P 500 is on track to report earnings growth of 9.4% and sales growth of 4.2%. Despite all the loose talk of a new bubble, valuations haven’t changed much in the past year.

Our Buy List nearly made it through earnings season without a dud, but Cognizant Technology ($CTSH) had to ruin it for us. On Wednesday, the IT outsourcer beat estimates by four cents per share, but it lowered its sales guidance. Traders didn’t like that at all, and by the closing bell, CTSH lost 12.6%. I’ll have a complete rundown in just a bit (Spoiler Alert: I’m still a Cognizant fan.) I also want to review some Buy List members who may not make it onto next year’s list. We’re still a few months away from making our selections, but I want to share some thoughts with you. But first, let’s look at this newly volatile market.

What Are the Side Effects of QE?

Despite the big loss from Cognizant, our Buy List has been outperforming the overall stock market lately. Since we focus on high-quality stocks, we usually outperform the market during “worrying” stretches like we’ve seen recently.

Through Thursday, our Buy List is trailing the S&P 500 for the year (3.31% for the S&P 500 to -0.32% for us, not including dividends). Part of our underperformance this year is due to the rally being overfed by a lot of low-quality, crappy stocks. Even Janet Yellen recently said, while defending the overall market’s valuation, that “valuation metrics in some sectors do appear substantially stretched, particularly those for smaller firms in the social media and biotechnology industries.”

She’s absolutely right. Look at a stock like Amazon.com ($AMZN) which is down more than 23% from its high, and it’s still trading at 150 times next year’s earnings (the company will probably lose money this year). Last month, I mentioned the outrageous case of Cynk Technology ($CYNK). The shares are down 97% since then.

This is a paradox of the market. On one hand, we want to see lower-quality names do well so capital can reach marginal businesses (and borrowers). But we don’t want to see the trend go overboard and cause investors to leave the good stuff behind. That’s partly what happened during the Credit Bubble. I remember how our Buy List trailed the market in 2006 and kept slightly ahead in 2007. But once the Financial Crisis took hold and all those garbage stocks got called out, our Buy List fell far less than the market. We recovered much more quickly as well. Why? Because we never bought the junk, so when the House of Cards tumbled over, our relative performance was outstanding.

This leads me to one of the big questions on the minds of professional investors: what are the side effects of the Federal Reserve’s unprecedented policies? The Fed has kept short-term interest rates near 0% for a long time. Naturally, any Fed policy will distort the market. I think, too, that some investors view this phenomenon in overly sinister tones, but I tend to view it rather dispassionately. The central bank is powerful, and it’s trying to entice investors to be more confident. That’s not easy to do, and 0% interest rates is a start.

One side effect is that investors grew too fond of junk bonds. Since the start of July, junk bonds have taken a sharp turn for the worse, and that’s probably a healthy sign. This is an important sector for investors to watch, even if you’re not invested there, because it tells us how the marginal borrower is doing. When junk bonds perform as well as other bonds, or even outperform them, that’s usually an optimistic sign for the economy. It hints that business is going well, and will probably continue to improve. But again, it shouldn’t be used to fund shady operations.

I’m also concerned that low rates have made share repurchases too easy to resist. I have no problem with companies borrowing money to fund their operations. But I’m concerned that easy credit has allowed too many companies to boost their EPS, not by growing their earnings but by reducing their share count.

This has also been a lousy year for small-cap stocks, and I can’t help but think it’s related to the Fed’s winding down of QE. Not that smaller companies benefit from the bond buying, but they prosper as the risks have been partly covered by the Fed. Why not, then, go for more aggressive names? But since July 3, the small-cap Russell 2000 is down 7.3%, nearly twice as much as the S&P 500. Investors want more safety, and they’re willing to pay for it.

What does this mean for us? Investors should focus on higher-quality names, especially dividend payers. Some Buy List stocks I like right now include Ford Motor ($F), which is especially good below $17 per share. Oracle ($ORCL) is a bargain below $40 per share. Ross Stores ($ROST) can’t seem to catch a break, but if you’re able to get it under $65, you got a good deal. Earnings are due out soon. Now let’s take a look at our big flop of this earnings season.

Cognizant Technology Plunges after Earnings

On Wednesday, shares of Cognizant Technology Solutions ($CTSH) got nailed for a 12.6% loss. At one point, the shares were down 17% on the day. The interesting part is that their Q2 earnings were quite good. Cognizant earned 66 cents per share, which topped Wall Street’s consensus by four cents per share, and quarterly revenues rose by 16.5% to $2.52 billion.

What caused traders so much grief wasn’t the earnings; it was Cognizant’s guidance. Actually, it wasn’t the earnings guidance—that was the same. It was their sales guidance that caused so much grief.

For Q3, Cognizant now expects earnings of at least 63 cents per share. Wall Street had been expecting 65 cents per share. But the company is keeping their full-year guidance at $2.54 per share, which is the same as it’s been. For Q3 sales, Cognizant now expects a range between $2.55 billion and $2.58 billion. Wall Street had been expecting $2.66 billion. For full-year sales, CTSH lowered their growth rate from 16.5% to 14%.

Cognizant’s CEO Francisco D’Souza said, “Due to weakness at certain clients and longer-than-anticipated sales cycles for certain large integrated deals, we are adopting a more conservative stance for the remainder of the year and revising our 2014 revenue guidance to growth of at least 14% over the prior year, while maintaining our full-year non-GAAP EPS guidance of $2.54.”

I can hardly say that I’m worried about a company that’s beating earnings and growing its top line by 14%. After Wednesday’s damage, CTSH is going for about 17.5 times this year’s estimate, which is a very good price. To reflect the selloff, I’m lowering my Buy Below on Cognizant to $48 per share.

Potential Buy List Deletions

According to the rules of our Buy List, the 20 stocks are locked and sealed for the entire year. No matter how much I want to make a move, I can’t touch any of the stocks until the end of the year. As usual, I only add and delete five stocks.

Now that we’re in the middle of summer, I want to share some of my preliminary thoughts on which stocks may not be around next year. Please understand that these are early indications, and I may change my mind before December. This also doesn’t mean that I don’t like these stocks at the moment. They’re simply on the short list to be cut next year. Ideally, when I make the change at the end of the year, the decisions shouldn’t come as a big surprise to regular readers.

At the top of the list is DirecTV ($DTV). It’s here not because it’s done poorly, but because it’s done very well for us. Thanks to the deal with AT&T, it’s not clear how much longer DTV will go on as an independent company. I can’t make any predictions on the AT&T deal falling though, or when it might be completed, but I’d prefer to congratulate DTV, and move on to a new stock. DTV has been a big winner for us.

Unfortunately, CA Technologies ($CA) has been much weaker than I expected. Quarterly revenues have dropped for nine quarters in a row, and will be probably do so again. We’ve been patient with CA, but the company’s problems run deep. I like the rich dividend, but frankly, not much else.

Moog ($MOG-A) dropped sharply in February, but recovered very nicely this spring. The recent guidance, however, was not what I was expecting.

I haven’t given up on McDonald’s ($MCD). The stock is cheap, but the problems for the burger giant are bigger than I expected. I think management realizes this, but turning around a company of this size won’t be easy. I still like MCD, but I want to see signs of improvement.

Medtronic ($MDT) is a long-time favorite of mine, and the stock has done well for us. My concern is that the Covidien deal is a major undertaking, and the new entity will be quite different from the old Medtronic. I understand why Medtronic wants to do this deal, and it probably makes sense, but it may not be the company we want on our Buy List.

All 16 of the Buy List stocks with quarters ending in June have new reported earnings. There are only two Buy List stocks that have quarters ending in July, Medtronic ($MDT) and Ross Stores ($ROST). Medtronic is due to report on August 19, and Ross Stores will follow two days later. I’ll have more to say about both stocks next week. Before I go, I also want to lower my Buy Below on Qualcomm to $79 per share. The stock has continued to drift lower after the earnings report. I like QCOM a lot and expect it to recover.

That’s all for now. Next week will be a fairly slow week for economic reports. I’ll be curious to see Wednesday’s retail sales report. Consumer spending hasn’t been as strong as I’d like to see. On Friday, we’ll get the report on Industrial Production. The last three reports haven’t been that great. I’d like to see some improvement here. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

CWS Market Review – May 9, 2014

Eddy Elfenbein, May 9th, 2014 at 7:09 am“It never was my thinking that made the big money for me. It always was my sitting.” – Jesse Livermore

Welcome to the Revenge of the Boring Stocks. The stock market’s rotation continues, as former high-flyers have been getting punished, while boring old dividend-payers are suddenly popular. What’s happening is that there’s been a resurgence of rationalism, sobriety and prudent investing. No one saw this coming.

Last week, I said that Friday’s jobs report could be a big one, and I was right. The economy created 288,000 jobs in April. That’s the biggest gain in more than two years. But here’s the odd part: the bond market has rallied ever since. The yield on the 10-year Treasury finally broke below 2.6% this week and touched its lowest point since October. Despite many predictions of its imminent demise, the boring T-bond market is well ahead of the stock market this year.

The big news for our Buy List is that DirecTV officially said they’re looking at a possible merger with AT&T. On Wednesday, shares of DTV gapped up 8% to hit a new all-time high. I think they’re in a position of strength in any merger negotiation. We’re now sitting on a 23.2% gain YTD. I’ll have all the details on DTV in a bit.

In addition to a good earnings report from DirecTV, we also saw good earnings from Cognizant Technology, although traders took the shares down. Not to worry. I’ll explain why CTSH is as strong as ever. I’ll also preview next week’s earnings report from CA Technologies (which now yields 3.4%). But first, let’s look at the market’s rotation and why the cool stocks are finally getting their comeuppance.

The Revenge of Boring Stocks

On the surface, the stock market seems to be pretty tame, and there’s not a lot of volatility. But just below the surface, there’s been a major correction unfolding that’s manifested itself in several different ways.

The best way I can describe this phenomenon is that boring stocks have suddenly become popular, while formerly popular stocks are now hated. I described last year’s market as a massive chilling out. It was a reaction against the earlier flight to ultra-conservative investments. In 2013, investors cautiously moved into riskier assets. That was good for us, but what we’re seeing this year is a reaction against the excesses of last year’s rotation.

As a result, we’re seeing a market that’s frustrated a lot of folks. The guys at Bespoke Investment Group point out that in the last two months, the stocks that analysts like the most are down the most, while the stocks they hate the most are up the most. Goldman Sachs notes that “nearly 90% of large-cap growth mutual funds and 90% of value funds were underperforming their benchmarks year-to-date.”

Let’s look at some examples. On Thursday, shares of Tesla, the electronic-car stock, dropped 11.3% after the company said it beat earnings estimates by 20%. Analysts are worried about rising costs, but my point is that in this market, an earnings beat isn’t enough to help a stock that’s zoomed in the past year. Look at Twitter which lost 18% after its “lock-up” period expired. The company recently reported Q1 earnings of $183,000. That’s about one-thirtieth of a penny per share. That’s not enough to buy even one share of Berkshire Hathaway. Or look at Amazon which is now 30% off its high. It’s all the way down to 489 times last year’s earnings. And it’s not just tech stocks; it’s any hi-flier that’s richly valued. Whole Foods Market is now 40% off its high. The P/E Ratio of the Nasdaq is twice that of the rest of the market.

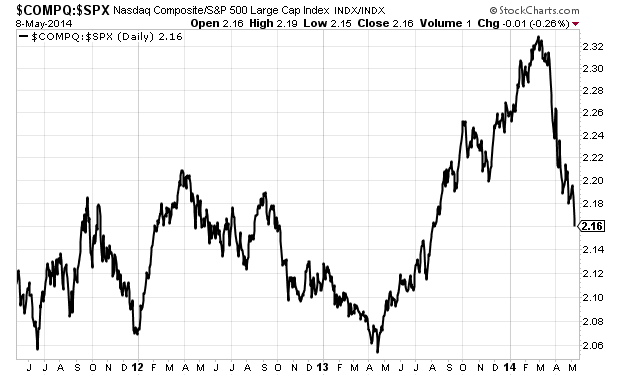

Check out this chart which shows the Nasdaq Composite divided by the S&P 500. You can see how the Nasdaq creamed the S&P 500 last year but has been flattened by it lately.

This anti-pricey-stock sell-off has distorted market perceptions because it’s affected the stocks that individual investors love so much. The boring stocks have been doing just fine, especially if they pay a dividend.

James Saft at Reuters notes that “according to Societe Generale data, the single most important characteristic driving equity returns in the past month has been dividend yields.” That makes sense. Utilities, for example, have been doing very well this year. The Utility ETF ($XLU) is up 13% YTD, and the Vanguard REIT ETF ($VNQ) is up 15% this year. Bespoke gives us another great factoid: The 300 stocks in the Russell 1000 that don’t pay a dividend are down 7.21% since March 5, while the 300 highest-yielding stocks are up 2.11%. The dividend is the difference.What’s also interesting is that the market’s breadth has badly deteriorated. At recent market peaks, the number of stocks making new 52-week highs has gradually fallen. In other words, a smaller and smaller group of stocks is doing the heavy lifting. If you glance at a list of stocks reaching new 52-week highs, it’s likely to be almost entirely oil stocks, with DirecTV and Apple thrown in. The average stock in the Russell 1000 is now down 11.4% from its 52-week high, even though the entire index is down 1.5% from its high.

Another area where we can see the rotation is in small-caps, which have badly underperformed. On Tuesday, traders were rattled when the Russell 2000 closed below its 200-day moving average. That hasn’t happened in more than 17 months. Half of the stocks in the Russell 2000 are more than 20% off their highs. In contrast, the mega-caps in the Dow 30 have barely budged.

This rotation isn’t done yet. Investors should make sure they have high-quality dividend stocks in their portfolios. Some of our Buy List stocks with rich yields include Microsoft (2.8%), CA Technologies (3.4%), McDonald’s (3.2%) and Ford (3.2%). Now let’s look at our star stock of the week.

DirecTV Soars on Possible Merger News

In last week’s CWS Market Review, I mentioned how shares of DirecTV ($DTV) jumped on news that AT&T had been talking with DTV about a possible merger. This week, it got much more serious. Shortly before the closing bell on Wednesday, news broke that DirecTV is working with Goldman Sachs to look at such a deal. If Goldie’s involved, you can be sure it’s serious.

Ever since the Comcast/Time Warner Cable deal was announced, a response deal between AT&T and DirecTV has made a lot of sense. I suspect that until now, DTV hasn’t been terribly interested in a merger. In business, of course, everyone has a price. I won’t predict whether something will come about, but I’ll add that a deal would certainly help out AT&T at a crucial time for them. The good news for us is that DirecTV is in the position of strength. The only worry is that they don’t get too greedy as regards price because DISH is waiting in the wings.

On Tuesday, DirecTV reported another solid quarter. The satellite-TV operator earned $1.63 per share for Q1. That beat estimates by 15 cents per share. The company added 361,000 subscribers in Latin America, which was far more than analysts’ estimates of 227,000. DirecTV now has 20.3 million subscribers in the U.S. (You can see why AT&T wants that.)

DirecTV has been our top-performing stock this year, up 23.2% YTD. This week, I’m raising our Buy Below on DirecTV to $89 per share. What a great stock.

Cognizant Technology Raises Full-Year Guidance

On Wednesday, Cognizant Technology Solutions ($CTSH) reported Q1 earnings of 62 cents per share. That’s pretty good. Three months ago, the IT-services company told us to expect earnings of 59 cents per share. Quarterly revenue rose 19.9% to $2.42 billion.

For Q2, Cognizant sees revenues coming in between $2.50 billion and $2.53 billion, and EPS of 62 cents. The Street had been expecting 63 cents per share. For all of 2014, Cognizant projects revenue of at least $10.3 billion and earnings of at least $2.54 per share. Three months ago, CTSH had disappointed investors when they projected 2014 earnings of at least $2.51 per share, while the Street had expected $2.54 per share. In other words, the estimate is back where we started.

Gordon Coburn, Cognizant’s president, said, “We remain confident in the overall demand environment and in our ability to deliver our previously stated revenue guidance of at least $10.3 billion for 2014, up at least 16.5% over 2013.”

Even though these numbers were pretty good, the stock dropped 4.4% after the earnings report. That’s partly a reflection of the turn against growth companies (CTSH doesn’t pay a dividend). Fortunately, on Thursday, CTSH made back about half of Wednesday’s loss. Granted, it’s a pricey stock. The current price is about 19 times earnings, but their business is growing rapidly. Cognizant remains a very good buy up to $52 per share.

CA Technologies Is a Buy up to $34 per Share

CA Technologies ($CA) reported blow-out earnings in January. The company earned 84 cents per share for their fiscal Q3, which was 14 cents better than estimates. CA said they see full-year earnings ranging between $3.05 and $3.12 per share. Since they’ve already made $2.48 for the first three quarters, that forecast implies 57 to 64 cents per share for Q4. Wall Street expects 58 cents per share.

As I highlighted earlier, CA pays a generous quarterly dividend of 25 cents per share. In fact, I think they could afford to bump that up to 30 cents per share. The stock has been meandering lower recently. On Wednesday, CA touched its lowest point since mid-October. Thanks to the lower share price, CA’s yield is up to 3.4%, going by Thursday’s close. Earnings are due to come out on Thursday morning, May 15. This is an excellent stock for income-oriented investors. CA Technologies remains a good buy up to $34 per share.

Buy List Updates

Before I go, I want to update you on some of our Buy List stocks. I’m ready to pound the tables for Bed Bath & Beyond ($BBBY). The stock has sunk down to a very attractive price. The last earnings report and guidance for fiscal Q2 have convinced me that they can bounce back. The store has a solid balance sheet, and earnings of $5 per share are very doable. I’m lowering my Buy Below to $66 per share, but if you’re able to get BBBY below $61, then you got a very good deal.

Another retailer I like here is Ross Stores ($ROST), which will be reporting fiscal Q1 earnings on May 22. Wall Street’s consensus is for $1.15 per share. The discount retailer also said that Barbara Rentler will become their new CEO on June 1. She’ll become the 25th female CEO in the Fortune 500. I’m keeping my Buy Below on ROST at $76 per share.

In January, shares of Moog ($MOG-A) got hit hard after they lowered their full-year guidance. At the time, I wrote, “While this news is disappointing, it doesn’t change my fundamental opinion of the company.”

This is why we like high-quality stocks. They bend but rarely break. I’m happy to say that Moog has bounced back. Yesterday, the stock got as high as $69.57 per share, which is a 22% gain from its February low. Last week, I raised our Buy Below to $69, and this week, I’m upping it to $72 per share. Moog is a solid, boring stock. Last year, that was an insult. This year, it’s a compliment.

At this week’s Ford ($F) shareholder meeting, CEO Alan Mulally got a standing ovation. Not many corporate executives get that nowadays, but Mulally has delivered the goods. In the last five years, Ford has made $42.3 billion.

The automaker just announced a $1.8 billion share-buyback program. The goal is to reduce share count by 3%. Ford also reported that sales in China were up 29% in April and are up 41% YTD. Ford is a still a very good buy up to $18 per share.

That’s all for now. Next week, we get important economic reports on retail sales and industrial production. The government will also report on consumer and wholesale inflation. So far, inflation has been tame, but I’ll be curious to see if there’s any indication of higher prices. Also, stay tuned for earnings from CA Technologies, which will come out Thursday morning, May 15. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

CWS Market Review – August 9, 2013

Eddy Elfenbein, August 9th, 2013 at 7:28 am“I made my money by selling too soon.” – Bernard Baruch

As I expected, this was a quiet week on Wall Street. Consider this: Tuesday was the S&P 500’s worst day since June 24th, but the more arresting fact is that that terrible, awful plunge was a loss of a mere -0.57%. Yes, that was our worst loss in a span of 30 trading days! Sheesh, going by recent history, -0.57% doesn’t even scratch the paint. In 2008, the S&P 500 lost more than -0.57% in a single day 38% of the time. How times have changed.

Much of the calmness is certainly due to the wrapping up of Q2 earnings season. I’m happy to say that this earnings season was a good one. So far, 443 stocks in the S&P 500 have reported earnings; 72% have beaten earnings expectations, and 55% have beaten their sales expectations. We had two very good earnings reports this past week. Cognizant Technology Solutions ($CTSH) smashed analysts’ estimates by 10 cents per share, and they guided higher for the year. Also, Nicholas Financial ($NICK) churned out another stellar quarter. I’ll have more on these two in a bit, plus higher Buy Below prices.

I was pleased to see a strong trade report this week. Exports are at a record high, and the U.S. trade deficit is the narrowest it’s been since 2009. The trade report will probably cause the number crunchers to revise the Q2 GDP report higher by 0.5% to 1.0%. That’s also more in line with the earnings reports we’ve seen from the private sector. Also, the ISM Non-Manufacturing Index from earlier this week was particularly strong.

In this week’s CWS Market Review, I want to bring you up to speed on several of our Buy List stocks. It turns out that Ford ($F) is having trouble keeping up with demand. The automaker literally can’t build its cars fast enough! But first, let’s look at the outstanding earnings report from Cognizant Technology.

Cognizant Technology Is a Buy up to $78 Per Share

In April, shares of Cognizant Technology Solutions ($CTSH) got treated to a first-class beat-down. The stock, which had cracked $81 in March, was wallowing below $62 by late April. Of course, one of the benefits of our set-and-forget Buy List is that we don’t get scared out of plunging stocks. We stand firm and watch the storm clouds pass us by.

What freaked out the market was poor earnings by Cognizant’s competitors. There were also concerns that Congress’s pending immigration legislation would be bad for the outsourcing business. The good news came in May, when Cognizant beat earnings by eight cents per share and delivered positive guidance for Q2.

Despite the impressive outlook, the stock didn’t do much. I knew it was time to strike. In the June 28th issue of CWS Market Review, I highlighted Cognizant as being “particularly attractive at the moment.” Sure enough, the stock started to rally in July, and it soon broke $74 per share.

This past Tuesday, we got another solid earnings report from Cognizant, plus strong guidance. For Q2, CTSH earned $1.07 per share, which was ten cents better than estimates. Quarterly revenue rose 20.4% to $2.16 billion, which was $30 million better than expectations.

Cognizant now sees full-year earnings of at least $4.32 per share on revenue of $8.74 billion. That’s revenue growth of 19%. For Q3, CTSH sees earnings of $1.09 per share. Wall Street had been expecting $1.03 per share. The stock gapped up over $76 on Tuesday, although it later gave back much of those gains. Don’t think you’re too late to party. I’m raising Cognizant’s Buy Below to $78. CTSH remains a very good buy.

I’m Raising NICK’s Buy Below to $17 Per Share

Also on Tuesday, Nicholas Financial ($NICK) reported fiscal first-quarter earnings of 46 cents per share. That’s basically in line with what I was expecting. As things stand now, the used-car lender can keep churning out profits of 40 to 45 cents per share for a long time. The economy continues to improve, and this means their loan portfolio is getting stronger. We also have the Fed’s commitment to keep short-term rates low for an extended time. That’s good for NICK.

Looking at the numbers, it appears that NICK benefited from about four cents per share after taxes, thanks to the interest-rate-swap agreement. I can’t find the details yet, because it looks like there’s been an accounting change which adds about $3 million to quarterly revenues. NICK’s stock didn’t react strongly to the earnings news, which is fine by me. With smaller-cap stocks, there’s often a delayed reaction of a few days after a good earnings report.

One thing I’d like to see NICK do is raise its quarterly dividend. The current dividend is 12 cents per share, or 48 cents for the year. At Thursday’s closing price, that works out to 3.1%. I think NICK can raise its dividend as high as 15 cents per share. The company has previously announced its dividend after the conclusion of the shareholder meeting, which is usually in August. This year, the meeting will be held in December. I’m going to raise my Buy Below on NICK to $17 per share. Nicholas Financial is an excellent buy.

Updates on Our Buy List Stocks

I want to add a few updates on some Buy List stocks.

After its great earnings report, Fiserv ($FISV) keeps on rallying. The shares got as high as $101.85 on Thursday. The company just announced a new share-repurchase authorization for 10 million shares, which is about 8% of their outstanding shares. This is a very strong company.

Our healthcare stocks like Stryker ($SYK), Medtronic ($MDT) and CR Bard ($BCR) have been doing quite well lately. MDT nearly got to $56 this week. A judge just ordered Zimmer Holdings to pay Stryker $228 million to settle a patent suit. That’s nice to hear. CR Bard seems to go up every day. The stock just hit another 52-week high. BCR is up nearly 20% since April 24th.

Ted Reed at TheStreet.com had an interesting article on Ford ($F). It turns out that Ford is actually having trouble making its cars fast enough to meet demand. Ford’s inventory is running dangerously low. Reed says, “Ford’s Fusion supply is down to 30 days, about half the industry average, while the Escape supply is around 40 days.” The good news is that Ford is expanding to meet demand.

JPMorgan ($JPM) revealed this week that the bank faces civil and criminal charges over sales of its mortgage-backed securities between 2005 and 2007. The stock slumped a bit on the news. For now, I don’t want to comment on the potential impact of this, since it’s too early to say. I don’t have any reason to believe it will impact the long-term profitability of JPM. But now is a good time to reiterate my belief that Jamie Dimon should step aside.

We’re now done with earnings reports for Buy List stocks that have a June reporting period. We have two Buy List stocks, Ross Stores ($ROST) and Medtronic ($MDT), that ended their quarters in July. Those two should be reporting their earnings in two weeks.

Through Thursday, our Buy List is up 24.13% for the year, compared with 19.02% for the S&P 500 (not including dividends). That’s our biggest lead of the year. If all goes well, this will be our seventh straight year of beating the S&P 500.

That’s all for now. Next week, we’ll get some important economic reports. On Tuesday, the Census Bureau reports on retail sales. This will give us a look at how strong the consumer is. Then on Thursday, we’ll get the inflation report for July. Also on Thursday, the Federal Reserve reports on Industrial Production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Cognizant Beats By 10 Cents Per Share

Eddy Elfenbein, August 6th, 2013 at 11:20 amThe stock market is pulling back this morning. The S&P 500 is currently back below 1,700. Retail stocks are under heat today as American Eagle ($AEO) reported disappointing results. AEO is down about 16% on the day. Wall Street assumes that if one company in a sector is having trouble, then they all must be in trouble. As a result, shares of Ross Stores ($ROST) are also down today. ROST is currently down about 2%. The company will report its second-quarter earnings two weeks from tomorrow.

The big economic news this morning is that the trade deficit dropped to $34.2 billion for June. That’s the lowest since October 2009. Exports rose 2.2% to $191.2 billion which is an all-time record. Imports fell 2.5% to $225.4 billion.

This trade data will probably lead the number crunchers in the government to revise the Q2 GDP figures higher. The initial report said that the economy grew, in real terms, by a measly 1.7% for the June quarter. Today’s report suggests the GDP report could be revised as high as 2.5%. The next GDP report will come out at the end of the month.

Dish Network ($DISH), the big rival of DirecTV ($DTV), reported lousy results for Q2. The company lost 78,000 customers in the quarter. There’s mounting pressure on DISH to sell itself to DTV. I don’t know if that will happen, but it’s definitely being talked about.

The best news for us today is that Cognizant Technology Solutions ($CTSH) had a great earnings report, plus they raised full-year guidance. For Q2, CTSH earned $1.07 per share which was ten cents better than the estimates. Quarterly revenue rose 20.4% to $2.16 billion which was $30 million better than expectations.

Cognizant now sees full-year earnings of at least $4.32 per share on revenue of $8.74 billion. That’s revenue growth of 19%. For Q3, CTSH sees earnings of $1.09 per share. Wall Street had been expecting $1.03 per share. Shares of CTSH are up about 2.86% today.

CWS Market Review – June 28, 2013

Eddy Elfenbein, June 28th, 2013 at 6:48 am“There is only one boss. The customer. And he can fire everybody in the company from the chairman on down, simply by spending his money somewhere else.”

– Sam WaltonAfter last week’s temper tantrum from the stock, bond and gold markets, officials at the Federal Reserve spent much of this past week trying to calm everyone down. The good news is that it’s worked. Or at least, it has thus far.

But the Fed is merely trying to save itself from yet another Fed-induced problem. They’re CYA-ing in a big way. While the FOMC’s policy statement was pretty much as expected, the after-meeting presser by Ben Bernanke was surprisingly hawkish. The markets responded quickly. At its recent low, the Dow was 991 points below its May high, and the yield on the 10-year Treasury got as high as 2.66%. That’s a full 1% increase in less than two months. Check out the down-and-up of the S&P 500 over the last few days:

So what’s going on?

In this week’s CWS Market Review, I’ll take a closer look at the market’s latest hissy fit. I also want to highlight the good earnings report from Bed, Bath & Beyond ($BBBY). It’s hard to believe BBBY was going for $57 just four months ago. It’s at $70 today. Our Buy List continues to hold up very well, and stocks like Wells Fargo ($WFC) have broken out to new highs. But first, let’s look at the latest song and dance from the Federal Reserve.

Bernanke’s Just a Guy Thinking about the Future and Stuff

At his June 18th press conference, Ben Bernanke said:

If the incoming data are broadly consistent with this forecast, the Committee currently anticipates that it would be appropriate to moderate the monthly pace of purchases later this year. And if the subsequent data remain broadly aligned with our current expectations for the economy, we would continue to reduce the pace of purchases in measured steps through the first half of next year, ending purchases around midyear.

The financial markets interpreted this to mean that QE would start to taper later this year (probably starting in September) and would end by this time next year. The back story is the belief that the Fed’s policies are the main reason why the bull market has been so strong. In my opinion, Bernanke and Friends have clearly helped, but it doesn’t follow that once the Fed pulls back—or takes its foot off the gas, in Bernanke’s analogy—the market will suddenly collapse.

Traders are capable of anything, but even I was surprised by their skittishness. Considering how many macho people there are in finance, the market as a whole can be one big fraidy cat. In four trading days (last Wednesday to Monday), the S&P 500 lost 5%. I think the folks inside the Fed were genuinely shocked by the market’s strong reaction.

This week, one Fed official after another stressed that no plans are set in stone, and the Fed will alter policy as needed. If you want to hang with the popular kids, the term for this is “data dependent.” In fact, this week’s GDP report was pretty weak, and it most likely will give ammo to folks who think QE needs to go on awhile longer.

Binyamin Appelbaum, the New York Times reporter, got it exactly right when he tweeted, “The Fed’s new message seems to be that Bernanke was just a guy who happened to be thinking out loud about the future and stuff.” Scary, but that’s how they’re acting. The minutes from this past meeting are due out on July 10th, and I think a lot of folks are very curious to hear what was said. But for now, the good news for investors is the Fed realizes how damaging their words can be.

What’s the Fallout?

The Fed did indeed calm the market down. The three-day rally on Tuesday, Wednesday and Thursday caused the S&P 500 to gain more than 2.5%. The Dow once again jumped to over 15,000. Perhaps the most dramatic impact was seeing the Volatility Index ($VIX) drop from nearly 22 on Monday to less than 17 by the end of the day on Thursday.

What investors need to understand is that the Fed is watching the economy, and they’re not about to shut off the spigots while the flow is still needed. The lower rates have greatly helped the interest-rate-sensitive areas of the market. I’ve spoken of this before as the magic equation: any place where consumer spending intersects with finance has been a winner. Examples of this include credit-card companies like Mastercard ($MA) and American Express ($AXP). The homebuilding stocks have also done very well. On our Buy List, the magic equation can be seen in stocks like Ford ($F) and JPMorgan Chase ($JPM).

Since the Fed has its hand in interest rates, it can obviously help those rate-sensitive areas. The question is whether the economy is strong enough that it can go along without the Fed’s help. The big clue for this will be second-quarter earnings season, which begins soon. Almost without anyone’s noticing, Q1 earnings growth was positive, and that didn’t happen in either Q3 or Q4 of last year. In other words, earnings growth is reaccelerating, meaning the rate of growth is itself increasing. We want to see that continue in Q2. Wall Street expects to see earnings growth ramp up pretty quickly in Q3 and Q4. If that does indeed happen, a lot of the Fed’s worries will go away.

I suspect that the S&P 500 will stay at or below its 50-day moving average for a while longer (the 50-DMA is currently at 1,620.42). Our Buy List has held out very well over the last two months, and it will continue to lead the market as investors seek out high-quality names. Please pay close attention to my Buy Below prices on our Buy List.

The key area to watch won’t be the stock market but rather the bond market and its close cousin, the gold market. In fact, gold has been getting crushed lately. On Thursday, the Midas metal dropped below $1,200 per ounce for the first time in nearly three years. The drop in gold is really a rise in short-term real interest rates, meaning the rates after inflation. I think gold is acting as an early warning signal, and within a few months, the interest-rate-sensitive areas will start to lag the market. We’re already seeing signs of this with the Homebuilding Sector ($XHB), thanks to higher mortgage rates. The commodity stocks have also been very poor performers. The Energy Sector ETF ($XLE) and the Materials Sector ETF ($XLB) have badly lagged the market.

A major trend for next year may be consumer staples stocks, but we’re far too early to see that kind of rotation. For now, investors should continue to focus on high-quality names. One stock on our Buy List that looks particularly attractive at the moment is Cognizant Technology Solutions ($CTSH). The shares got beat up in April, but now the dust has settled. CTSH is a very good buy up to $70 per share.

Bed Bath & Beyond Is a Buy up to $73 per Share

After the market closed on Wednesday, Bed Bath & Beyond ($BBBY) reported fiscal Q1 earnings of 93 cents per share. That hit Wall Street’s forecast square on the nose. On the conference call back in April, the home furnisher told us to expect Q1 earnings between 88 and 94 cents per share. I said in last week’s issue that I was expecting them to come in near the high end of that range, and that proved to be the case.

Let’s look at the numbers. BBBY earned 89 cents per share for last year’s Q1. For this year, quarterly sales rose 17.8%, to $2.612 billion. But the most important metric for retailers is comparable-store sales, and that rose a healthy 3.4% last quarter.

With a company like BBBY, I’m not too concerned about their missing or beating expectations by a few pennies per share. That’s no big deal. What’s important to me is that the general trend is upward.

If you remember, the shares got pummeled last year (a few times actually). But here’s the thing: yes, the company had some minor short-term issues, but this is a very well-run outfit, and they’ve worked to correct that. The stock dropped to $57 earlier this year, and in the February 15 issue, I said BBBY had become a very good buy.

For Q2, Bed Bath & Beyond sees earnings ranging between $1.11 and $1.16 per share. Wall Street had been expecting $1.15 per share, so this was in range. For the entire year, BBBY sees earnings between $4.84 and $5.01 per share (they made $4.56 per share last year). That number for the low end is way too low. Wall Street had been expecting $5.01 per share. I had said I was expecting $5 per share.

As you’ve probably heard me say many times before, I’m not a big fan of share buybacks. However, BBBY does it in a way that actually reduces share count, so I’ll give them credit for that. Their balance sheet is rock solid, with no debt and lots of cash. We have a nice 25% YTD profit in this stock. BBBY is an excellent buy up to $73 per share.

Moog Is a Buy up to $55 per Share

Before I go, I’m raising the Buy Below price on Moog ($MOG-A) to $55 per share. The stock has been holding strong lately, above $50 per share. The company had a good earnings report for Q1, and the CEO said business should improve for the second half of the year. Moog is a solid buy.

There’s also one small item about DirecTV ($DTV). The satellite-TV operator overstated the number of subscribers it has in Brazil. This appears to be an honest mistake. The stock dropped sharply at the open on Thursday, but rallied back as the day wore on. DTC continues to be a good buy up to $67 per share.

That’s all for now. Next week will be a rather unusual week in that the stock market will close early on Wednesday, July 3rd and will be closed all day on July 4th. There will only be three full trading days over a nine-day stretch. Despite the limited exchange hours, the ISM report will come out on Monday. The ADP report comes out on Wednesday, and finally the big jobs report is due out on Friday, July 5th. Traders will definitely be monitoring the progress of the labor market. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

CWS Market Review – February 8, 2013

Eddy Elfenbein, February 8th, 2013 at 8:12 amThat money talks I’ll not deny,

I heard it once: It said, “Goodbye.”

-Richard ArmourLast Friday, the Dow pierced 14,000 for the first time in five years. But as I suspected, investors got a case of the jitters, and the Dow hasn’t been able to hold 14,000. We even had a small uptick in volatility as the S&P 500 had three straight moves of greater than 1%. One money manager said, “We’ve moved so far so fast that the market’s just looking for any kind of sign to take something off the table.” I think that’s exactly right.

Wall Street is still focused on earnings. While fourth-quarter earnings season has been good (not great), I’m starting to have concerns that Wall Street’s earnings outlook is too optimistic. According to the Street, earnings growth will accelerate, meaning the pace of growth itself will increase, throughout 2013. That’s certainly possible, but I see that as a best-case scenario. More likely, earnings growth will flat-line or grow rather modestly.

That’s not necessarily awful news. Corporate America has been raking it in lately. The companies in the S&P 500 will probably net a cool $1 trillion this year. But we have to face the fact that the easy money in this bull market has already been made. Stocks have more than doubled in less than four years. The next four years won’t be so fortunate.

That’s why I urge all investors to focus on high-quality stocks for the long term like the stocks on our Buy List. We had more good news this week, including a 21% dividend increase from Ross Stores ($ROST), and JPMorgan ($JPM) reached yet another 52-week high. Now let’s look at some of our earnings reports this week.

AFLAC Is a Buy up to $54 per Share

After the close on Tuesday, AFLAC ($AFL) reported fourth-quarter earnings of $1.48 per share. Make no mistake: this was a solid quarter for the duck stock, and it was squarely in line with what they told us to expect. Three months ago, AFLAC said Q4 EPS should range between $1.46 and $1.51.

But here’s the issue for us: Since most of AFLAC’s business comes from Japan, their bottom line can be adversely impacted (or helped) by fluctuations in the yen/dollar exchange rate. Lately, the government in Japan has aggressively stated its intention of pursuing a pro-inflation policy. That’s caused the yen to tank against the dollar. In response, the Nikkei Index has soared.

As I said, AFLAC as a business is fine and dandy and as strong as it’s ever been. I want to make it clear that I’m not overly worried about the exchange rate, but I have to say that it’s an issue for investors. AFLAC said the falling yen cost dinged their Q4 by four cents per share. Not fun, but not a disaster either. Bear in mind that AFLAC’s full-year earnings for 2012 were actually helped by one penny per share, thanks to the exchange rate. So it works in both directions.

For all of 2012, AFLAC made $6.60 per share in operating earnings. The company said it sees operating earnings growth of 4% to 7% for this year. On a currency-neutral basis, that means operating earnings of $6.86 to $7.06 per share.

Now here’s the tricky part (warning: math ahead). Each move in the exchange rate of one yen from 78.5 will cost AFLAC 4.3 cents per share for the year. So if the exchange rate averages 90 for the entire year, that will cost AFLAC 49.45 cents per share (11.5 times 4.3). That stings, but it’s roughly 50 cents per share out of $7 of earnings. It’s not enough for me to change my opinion that AFLAC is a very solid stock to own. And of course, I have no idea what the exchange rate will do this year. However, I suspect that most of the damage to the yen has already been done.

Shares of AFL pulled back after the earnings report, but the stock is basically where it was three months ago. AFLAC remains an excellent company. Due to the recent pullback, I’m going to lower my Buy Below to $54 per share.

Good News from FISV and CTSH, Bad News from WXS

Also on Tuesday, Fiserv ($FISV) reported Q4 earnings of $1.39 per share, which exactly matched Wall Street’s forecast. The company already told us that this was going to be a good quarter. Remarkably, this is Fiserv’s 27th-straight year of double-digit earnings growth. There aren’t many companies that can boost a record like that.

For 2012, Fiserv earned $5.13 per share, which is a very nice increase over the $4.58 per share they made in 2011. Fiserv said that they expect growth of 15% to 18% for this year, and they specified an earnings range of $5.88 to $6.07 per share. If that’s correct, FISV is going for less than 14 times this year’s earnings. This is a solid stock. Fiserv is a buy up to $88 per share.

We had a great earnings report from Cognizant Technology Solutions ($CTSH) on Thursday. The company reported Q4 earnings of 99 cents per share, which is up from 84 cents for Q4 of 2011. That’s eight cents more than the Street had been expecting. Quarterly revenue rose 17.1% to $1.95 billion. For all of 2012, revenue rose 20% to $7.35 billion, and earnings-per-share increased from $3.07 in 2011 to $3.70 for 2012. This is clearly a rapidly-growing outfit.

Cognizant also offered very impressive guidance for Q1 and all of 2013. The company sees Q1 revenue rising by 20% to “at least” $2 billion and expects earnings-per-share to hit $1.01. Wall Street had been expecting 93 cents per share. For the whole year, CTSH sees revenue climbing to “at least” $8.6 billion. That’s an increase of 17%. Cognizant also sees earnings-per-share of at least $4.31. That’s a big increase over Wall Street’s expectation of $4.00 per share. CTSH is an excellent buy anytime you see it below $81.

Our dud this week came from WEX Inc. ($WXS). The company reported fourth-quarter earnings of $1.07 per share, which was a penny below consensus. Quarterly revenue rose 20.9% to $169 million.

But the earnings weren’t the bad part; it was the guidance. For Q1, WXS expects earnings to range between 89 cents and 96 cents per share. The Street had been expecting $1.08 per share. For all of 2013, WXS sees earnings between $4.30 and $4.50 per share. The Street was expecting $4.88 per share. For all of 2012, WXS made $4.06 per share which was a nice increase from $3.64 per share on 2011.

Frankly, this guidance is very disappointing news. I’m not ready to toss in the towel with WXS; the stock has been a huge winner for us over the last eight months. But for now, I’m going to lower the Buy Below price to $72.

Ross Stores Is a Buy up to $62

Ross Stores ($ROST) gave us great news this week. The retailer reported blowout sales for January, and thanks to the rush of business, Ross sees Q4 earnings coming in at $1.06 to $1.07 per share, and $3.52 to $3.53 per share for the entire year. (Note that like a lot of retailers, Ross ends their fiscal year at the end of January.) The earnings report should be out in mid-March.

But the best news is that Ross raised their quarterly dividend from 14 cents to 17 cents per share. That’s a 21% hike. Ross pays out a very small amount of their profits as dividends to shareholders (about 20%). Based on Thursday’s closing price, Ross yields 1.13%. That’s obviously not a very high yield, but the dividend increase and strong sales news are a good omen for Ross Stores. ROST remains a very good buy up to $62.

Before I go, I want to highlight two Buy List stocks that look especially attractive. Again, Microsoft ($MSFT) looks very good here. The pullback in Harris ($HRS) seems about done. Shares of HRS got hit hard for a modest decrease in guidance.

That’s all for now. Next week, we get important reports on retail sales and industrial production. Our final earnings report of this cycle will be from DirecTV ($DTV) on Wednesday, February 13th. Wall Street expects $1.13 per share. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Cognizant Guides Higher for 2013

Eddy Elfenbein, February 7th, 2013 at 10:49 amBefore the opening bell, Cognizant Technology Solutions ($CTSH) reported Q4 earnings of 99 cents per share which is up from 84 cents for Q4 of 2011. That’s eight cents more than the Street had been expecting. Quarterly revenue rose 17.1% to $1.95 billion. For all of 2012, revenue rose 20% to $7.35 billion, and earnings-per-share increased from $3.07 in 2011 to $3.70 for 2012. As you can see, this is a rapidly-growing outfit.

Cognizant also offered very strong guidance for Q1 and all of 2013. The company sees Q1 revenue rising by 20% to “at least” $2 billion and earnings-per-share hitting $1.01. Wall Street had been expecting 93 cents per share. For the whole year, CTSH sees revenue climbing to “at least” $8.6 billion. That’s an increase of 17%. Cognizant also sees earnings-per-share of at least $4.31. The Street had been expecting $4.00 per share.

Cognizant Technology Hits 52-Week High

Eddy Elfenbein, January 11th, 2013 at 11:06 amIn addition to the record earnings from Wells Fargo ($WFC), more good Buy List news is that Cognizant Technology ($CTSH) is at a new high this morning thanks to strong earnings from one its rivals. Generally, good news from one stock in a sector helps everyone in the sector. Infosys (INFY) beat earnings expectations and the shares are currently up 17% today. CTSH is up about 4% and it’s due to report earnings in another month.

In other Buy List news, Ford Motor ($F) announced that it’s hiring 2,200 white collar workers. This is the biggest such increase in over a decade. The stock broke $14 this morning. The last time Ford was over $14 was July 7, 2011.

- Tweets by @EddyElfenbein

-

-

Archives

- April 2024

- March 2024