CWS Market Review – February 15, 2013

“Individuals who cannot master their emotions are ill-suited to

profit from the investment process.” – Benjamin Graham

Remember when stock prices used to change each day?

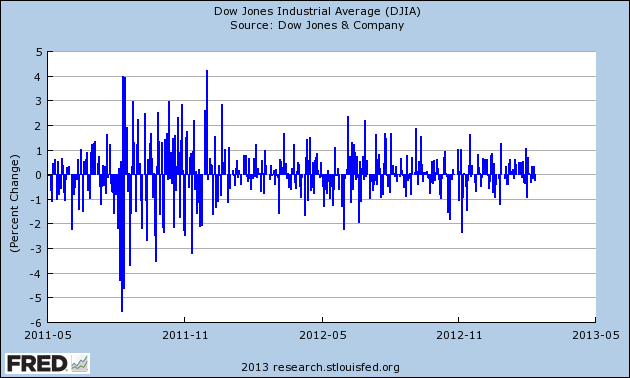

OK, I’m exaggerating…but not by much. Bespoke Investment Group notes that the average daily spread between the high and the low on the Dow Jones is at a 26-year low. Stocks simply ain’t moving around very much these days.

While the stock market got off to a great start this year, since late January it’s nearly slowed down to a complete halt, particularly the intra-day swings. The Volatility Index ($VIX) is near a six-year low. Fortunately, the little volatility there has been has been positive, so the broad market indexes have continued to rise, albeit very slowly. On Thursday, the S&P 500 closed at its highest level since Halloween 2007.

One theme that’s been dominating Wall Street lately is the idea of a Great Rotation, meaning money will massively swarm out of bonds and into stocks. I do think some of that will happen—in fact, it’s currently happening—but I don’t foresee sky-high bond yields anytime soon. The 10-year T-bond is right at 2%, which is pretty darn low. Instead, what we’re seeing is investors gradually becoming bolder and taking on more risk. That’s very good for our style of investing.

In this week’s CWS Market Review, I want to take a closer look at this moribund market. As quiet as it’s been, I don’t think the market’s reticence will last much longer. I also want to highlight an outstanding earnings report from DirecTV ($DTV). The stock crushed Wall Street’s estimate by 42 cents per share! We’ll also focus on Bed, Bath & Beyond ($BBBY), which has finally drifted low enough to be a very compelling buy. But first, let’s look at what’s been happening on the street of dreams.

Investors Need to Focus on High-Quality Stocks

One important development is that economically cyclical stocks are again leading the market. If you recall, the cyclicals began a massive rally last summer right around the time when Mario Draghi promised to do “whatever it takes” to save the euro. The cyclicals were given another boost a few weeks after that when the Fed announced its QE-Infinity program.

Consider this: If the S&P 500 had kept pace with cyclicals, it would be at about 1,750 today instead of 1,521. Cyclical leadership finally petered out in late January but has come back with a vengeance. The Morgan Stanley Cyclical Index (CYC) has outpaced the S&P 500 for five days in a row. The ratio of the Cyclical Index to the S&P 500 is now close to an 18-month high.

I think there are two reasons for this trend. One is simply that many cyclical stocks got very cheap. I think our own Ford Motor ($F) is a perfect example of that. Harris ($HRS) and Moog ($MOG-A) are other good examples. But another reason is that economy is probably better than many analysts realize. The negative GDP report for Q4 understandably upset a lot of folks, but the recent trade numbers will probably cause that negative 0.1% to be revised upward to somewhere around +1.0%.

Earnings for Q4 have been pretty. According to data from Bloomberg, 73% of the 288 companies in the S&P 500 that have reported Q4 earnings have topped estimates; 67% have beaten sales estimates. As I’ve discussed before, the major concern is that corporate profit margins have been stretched about as far as they can go. I’m concerned that Wall Street’s earnings forecasts are too optimistic, and we’re going to see a spate of earnings as the year goes on.

One of the interesting aspects of the recent rally is that the large mega-caps haven’t really joined in. Since the beginning of October, the S&P 100, which is the biggest stocks in the S&P 500, has consistently lagged the S&P 500. That’s not necessarily bad news, but it means that the little guys are getting most of the gains. One possible worry is that the gains are largely going to low-quality names. That’s often a sign of a market peak. Our Buy List, for example, started trailing the overall market in 2007. But when the plunge came, we didn’t fall nearly as much as rest of the market.

Until this sleepy market eventually wakes up, I urge investors to focus on top-quality. Please pay close attention to my Buy Below prices on the Buy List. We don’t want to go chasing after stocks. Let the good stocks come to you. Speaking of which, my favorite satellite TV stock just reported great earnings, and the stock is lower than where it was five months ago.

Buy DirecTV Up to $55 per Share

We had very good news on Thursday when our satellite-TV stock, DirecTV ($DTV), reported blow-out earnings for Q4. The company raked in $1.55 per share for the quarter, which creamed Wall Street’s forecast by 42 cents per share. Wow! For comparison, DTV made $1.02 per share in the fourth quarter of 2011,

So what’s the secret to DirecTV’s success? That’s easy; it’s all about Latin America. DirecTV has done very well in the United States, but that’s a fairly saturated market. Not so in the Latin world, where satellite TV demand is just getting started. DTV now has 10.3 million subscribers in Latin America, up from 7.9 million one year ago. Last quarter, DirecTV added 658,000 customers in Latin America, which was a lot more than expected.

For Q4, DirecTV added 103,000 subscribers in America, which brings their total to 20.1 million. That’s a big business, and I especially like anything involving recurring revenue. The company said it expects to see mid-single-digit revenue growth in the U.S. over the next three years. I was also pleased to see that the cancellation rate in the U.S. dropped from 1.52% to 1.43%. DirecTV has specifically made an effort to increase retention. The cost of adding one new subscriber is far more than that of retaining an existing one. For all of 2012, DTV had a solid year, earning $4.58 per share.

The only negative is that DTV said its earnings will take a one-time hit from the currency devaluation in Venezuela. The company also announced a $4 billion share buyback, which is equivalent to about 13% of DTV’s market value. I think DTV should have little trouble earning $5 per share this year. This is a good stock going for a good value. DirecTV remains an excellent buy up to $55.

Bed, Bath & Beyond Is Finally Looking Cheap

I want to focus on Bed, Bath & Beyond ($BBBY), which had been one of my favorite Buy List stocks, but a string of earnings warnings rocked the shares last year. While 2012 was unpleasant, I think the stock has now fallen back into being a very good buy at this price.

Let’s review what happened last year. In June 2012, Wall Street had been expecting fiscal year earnings (ending February 2013) of $4.63 per share, which represented 14% growth over the year before. But the company surprised investors by telling us to expect earnings growth somewhere between the single digits and the low double digits.

No biggie, right? Guess again. Traders gave BBBY a super-atomic wedgie as the stock got crushed for a 17% loss in one day. Now here’s the odd part: Here we are eight months later, and it looks like BBBY will earn about $4.54 per share for the year, give or take. In other words, that dreaded earnings warning turned out to be about 2% or so.

After the earnings report in September, BBBY got hammered for a 10% one-day loss when it reiterated the exact same full-year forecast. Then, for the December earnings report, BBBY only got nailed for 6.5% after it reiterated, you guessed it, the exact same full-year earnings forecast.

For Q4 (which covers the holidays so it’s the big dog of BBBY’s fiscal year), the company said earnings would range between $1.60 and $1.67 per share. The Street was expecting $1.75 per share. C’mon, this lower guidance isn’t that bad. But traders have lost confidence in BBBY. The shares have plunged from over $75 in June to as low as $55 in December, although it’s come up a bit since then.

Now let’s run some numbers: If Bed, Bath & Beyond can increase earnings by 10% for next fiscal year (which begins in two weeks), that should bring them to roughly $5 per share. That means we’re looking at a stock that’s going for less than 12 times earnings and growing at 10% per year. Furthermore, the recovering housing market should continue to aid them. While BBBY looks cheap, I suspect it will take a while before the stock comes back to life. The earnings warnings really spooked traders. The next earnings call isn’t until April 10. Bed, Bath & Beyond is a good buy up to $60 per share.

That’s all for now. Next week, the stock market will be closed on Monday in honor of George Washington’s birthday. On Tuesday morning, Medtronic ($MDT) will report fiscal Q3 earnings. Last month, MDT bumped up the low end of their fiscal year guidance. We’ll also get the CPI report on Thursday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I recently posted a list of 11 very overpriced stocks that you should sell ASAP.

Posted by Eddy Elfenbein on February 15th, 2013 at 6:07 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His