Posts Tagged ‘mdt’

-

CWS Market Review – August 16, 2013

Eddy Elfenbein, August 16th, 2013 at 7:14 am“The voice of reason is small, but persistent.” – Sigmund Freud

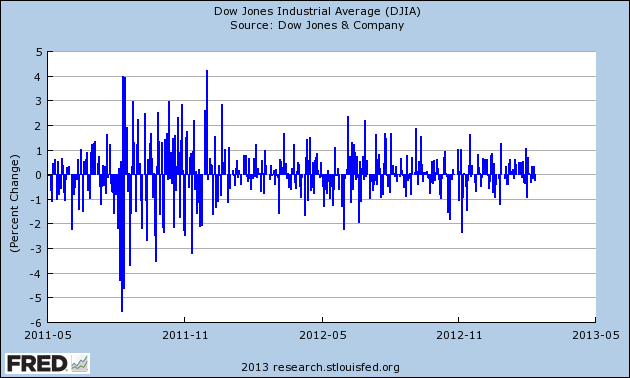

Youch! Thursday was the worst day for the S&P 500 in nearly two months. By the time the closing bell rang, the index had dropped 1.43% for the day and was back to 1,661.32. Of course, we’re still higher than we were on July 4th. If you take a step back and look at the larger picture, Thursday’s loss was small potatoes. In fact, the most prominent feature of the recent rally is how tame it’s been.

Let’s look at some facts: Morgan Housel notes that 2013 is on track to have the fewest daily swings of 1% or more since 1995. Going by that measure, this year could be the seventh-least-volatile year since 1928.

What’s also interesting is that the stock market rally has been remarkably consistent. The S&P 500 has traded above its 150-day moving average every day for the last eight months. This is the ninth-longest such streak since 1980. In plainer terms, the market has climbed slowly upward almost nonstop since the election. It’s been so placid that this recent break appears more dramatic than the numbers say.

In this issue of CWS Market Review, we’ll take a look at what caused Thursday’s market headache. We’re only five weeks away from the Fed’s September meeting, and more folks on Wall Street think the guardians of the temple will start pulling back on their bond-buying program. We’ll also focus on the upcoming earnings reports from Medtronic ($MDT) and Ross Stores ($ROST). But first, let’s look at why good news for the jobs market is apparently bad news for investors.

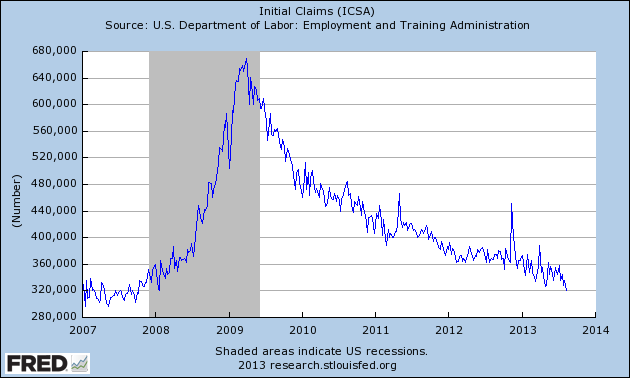

Initial Jobless Claims Lowest Since 2007

I’m always suspicious of any pat explanation for why the market does this or that on a given day. Just because some market activity coincides with some bit of news doesn’t mean the news is the cause. Oftentimes, traders are looking for an excuse to do something, and if some event in the larger world vaguely resembles a reason, they’ll take it.

On Thursday morning, we actually got a piece of very good news. The government reported that initial claims for unemployment had dropped to 320,000. This is significant because that’s the lowest reading since October 2007, which was the top of the market.

Any news about the labor market has to be viewed in the context of the Federal Reserve’s plans for later this year. The Fed has already told us that they’re looking to taper their bond purchases at some point, and that will largely be determined by how strong the jobs market is. So traders probably took the good news about yesterday’s jobless claims as evidence that the Fed will begin paring back on their bond purchases.

I’ve said before that I disagree with the view that the stock market will be stranded without the Fed’s help. The Fed is merely discussing pulling back on the level of support they’re giving investors. No one is pulling the rug out from under the market. As a general rule of thumb, investors place far too much emphasis on what the Fed does (I know, this is a screaming heresy to a lot of folks on Wall Street).

I’m also a doubter that the Fed will make any tapering decision at its September 17-18 meeting. I appear to be in the minority on this point. I should also add that my views on what the Fed will do have been pretty off the mark this year. The good news for us is that forecasting what government eggheads will do isn’t a prerequisite for being a good investor.

This leads to an odd situation where good news on the jobs market leads to bad news for investors, because it signals that the end of QE is within sight. The more dramatic response to any shift in Fed policy hasn’t been in the stock market, but in the bond market. On Thursday, the yield on the 10-year Treasury bond topped 2.8% for the first time in two years. The yield has nearly doubled in the last year. More broadly, last summer may have marked the peak of an astonishing 31-year rally for bonds.

The importance of long-term bond yields is that they usually (though not always) coincide with outperformance of cyclical stocks. They’re called cyclical for a reason, and if the cycle is in their favor, they can do very well. Two summers ago, the bond market gave the stock market a world-class beat down, and the cyclicals got hammered hardest of all.

If there’s any evidence against the Fed making a move next month, we got it with two reports this week. The first was a rather lackluster report on retail sales. This is usually a good clue on how strong consumer spending is. It also tells us how well some of our Buy List stocks, like Bed Bath & Beyond ($BBBY) or Ross Stores ($ROST), are doing.

I was also disappointed by this week’s report on industrial production. This is a key data series watched by the people who decide whether there’s a recession or not. Industrial production has been noticeably flat for the past five months. If there’s going to be a second-half pickup, we should see it soon.

As impressive as the market’s rally has been, a lot of it has been based on earnings growth ramping up later this year. As I’ve said, if that’s the case, the stock market is still quite cheap. But if that thesis doesn’t play out, stocks could take a tumble. The Street’s earnings estimates for Q3 have dropped from $30.27 in March 2012 to $27.17 today. The Q4 estimate is down, but not as much, falling from $31.18 in March 2012 to $29.13 today. Analysts now expect the S&P 500 to earn $108.51 this year, and $122.37 next year. As always, I caution against putting too much faith in estimates beyond a few months out.

What to do now: Our strategy is to be focused on high-quality stocks. Our Buy List has had a very good run since April, so we can expect it to catch its breath. Right now, I think Cognizant Technology Solutions ($CTSH) is a solid value. I also think Oracle ($ORCL) looks good below $33 per share. Please don’t get too worried about what the Fed may or may not do. Good companies can do well in any environment. Now let’s look at our Buy List earnings coming next week.

Medtronic Is a Buy up to $57 per Share

Medtronic ($MDT) is due to report its earnings next Tuesday, August 20th. The Street currently expects 88 cents per share. That sounds about right to me. I was very impressed by MDT’s last earnings report in May. The medical-device company topped consensus by seven cents per share.

The big surprise last quarter was that sales of pacemakers and defibrillators rose. Pretty much everyone was expecting more declines. Sales of defibrillators rose by 1.5%, and pacemakers were up by 2.6%. Company-wide, revenues were up by 3.8%. Medtronic’s CEO said that for the first time in four and a half years, sales of defibrillators and spinal products rose in the U.S. in the same quarter.

For their last fiscal year, which ended in April, Medtronic made $3.75 per share, which is up from $3.46 per share for the year before. In May, the company said it sees FY 2014 earnings ranging between $3.80 and $3.85 per share. Last week, MDT came within two cents of hitting $56 per share. The shares have pulled back with the market’s recent slide, but it’s nothing too severe. Remember that a few weeks ago, Medtronic raised its quarterly dividend for the 36th year in a row. Not many companies can say they’ve done that. Medtronic remains a very good buy up to $57 per share.

Ross Stores Is a Buy Below $70 per Share

Ross Stores ($ROST) is due to report earnings next Thursday, August 22nd. Unfortunately, the discount retailer has gotten punished over the last few days. At the beginning of August, ROST was closing in on $70 and threatening to make a new 52-week high. But some bad news for the retail sector, including disappointing earnings from Walmart and a tepid retail-sales report, brought shares of ROST down to $64.89 by the closing bell on Thursday.

Make no mistake, Ross is a very well-run outfit, and I’m not at all worried about its prospects. In May, the company reported fiscal Q1 earnings of $1.07 per share, which matched forecasts. Quarterly sales rose 8% to 2.54 billion, and same-store sales were up 3%.

Ross said that it sees Q2 earnings coming in between 89 and 93 cents per share. The Street foresees 93 cents per share, which may be a penny or two too high. But bear in mind that this is still a pretty nice increase over the 81 cents Ross earned in last year’s Q2. For the entire year, Ross projects earnings between $3.70 and $3.81 per share. Ross Stores is a very good buy up to $70 per share, and it’s especially good if you can get it below $65.

Nicholas Financial Announces Dividend of 12 Cents per Share

On Tuesday, Nicholas Financial ($NICK) said they’d be paying out another 12-cent quarterly dividend. I thought there was a chance they might increase their dividend. I think we may see a two- or three-cent-per-share increase this December, at the time of their shareholder meeting. Going by Thursday’s close, NICK now yields 3.16%.

That’s all for now. Next week will probably be another quiet week on Wall Street. All the big money guys are chillaxing at their cribs in the Hamptons. On Wednesday, the Fed will release the minutes from their last meeting. This might contain clues to what they have planned for their September meeting. Expect folks to read too much into it. We also have earnings reports from Medtronic and Ross Stores. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – June 21, 2013

Eddy Elfenbein, June 21st, 2013 at 7:48 am“The best thing that happens to us is when a great company gets into

temporary trouble … We want to buy them when they’re on the operating table.”

– Warren BuffettIn last week’s CWS Market Review, I said there’s an unacknowledged member of the Federal Reserve who has the most important vote of all—the market. On Thursday, Mr. Market got a chance to vote, and he gave a massive thumbs down to the Fed’s most recent policy decision.

In this week’s issue, I’ll explain what happened and what investors should do now. I’ll also review some of our recent Buy List earnings reports. Oracle just gave us a big disappointment. But first, let’s review Thursday’s damage.

The Taper Tantrum

On Thursday, the stock market had its worst day in 19 months. Ugh, it was just ugly. The Dow lost 353 points and the S&P 500 dropped 2.5%. There was no refuge in bonds, either. The yield on the 10-year Treasury jumped to 2.45%. That’s up more than 80 basis points from last month’s low, and it’s the highest yield in close to two years. But stocks and bonds got off easy compared with the super-atomic wedgie gold was given. The contract for June delivery plunged $87.70 on Thursday, or 6.4%. Gold fell below $1,300 for the first time since 2010. Check out this weekly chart going back two years.

So what happened? The Fed held its two-day meeting this past week on Tuesday and Wednesday. The anticipation was that the Fed would discuss scaling back on its asset purchases. I didn’t think they would stop any bond buying just yet, and the post-meeting policy statement proved me right.

But in the post-meeting press conference, Ben Bernanke talked about downsizing the bond buying, and that caught everyone’s attention. He said that the Fed expects to continue buying bonds as long as the unemployment rate is over 7%. More specifically, Bernanke said that if the economy continues to improve, as they expect, the Fed will start to moderate bond purchases later this year and wind down the purchases by the middle of next year. I was a bit surprised that he’s apparently not concerned about inflation trending below his targeted range.

Bernanke was clear that this outline isn’t set in stone, and they’ll keep an eye on the data. The key here is that the Fed sees the economy doing better going forward. Bernanke used the metaphor of a car—they’re taking their foot off the gas, not slamming on the brakes. Incidentally, Bernanke also made it clear that he’s out the door when his term expires this January so he’s not going to be making these QE-ending calls.

On Wednesday and Thursday, the financial markets reacted dramatically. The movement in the five-year Treasury was most interesting. The yield jumped from 1.07% on Tuesday to 1.31% on Thursday. The maturities shorter than that showed almost no change.

I think the markets are making a few mistakes here. First, too many people assume that without the Fed’s help, the stock market is toast. The Fed has obviously helped the market so far, but that started when the economy was flat on its back. That simply isn’t the case now.

The other mistake is thinking the Fed is running away. Not so! Short-term rates are still going to be near 0%. The bond buying is going to continue. It will just be in progressively smaller amounts. Remember that all of this is predicated on pretty optimistic economic projections. In the policy statement, the Fed said that downside risks to the economy have diminished. Let’s hope they’re right.

What To Do Now

In the near term, I think the market will be a bit rough. We had a strong run this year, so it’s natural to take a breather. I don’t think the bulls will be back in charge until the S&P 500 breaks above its 50-day moving average, which is currently at 1,618.

Investors should expect more volatility in the next few weeks. We’ll know a lot more about how our stocks are doing when second-quarter earnings season begins next month. Don’t expect stocks to surge like they did earlier this year. Investors should focus on high-quality stocks like the names on our Buy List.

I should mention that our stocks tend to show their mettle when the rest of the market gets nervous. While the S&P 500 fell -2.50% on Thursday, our Buy List only fell by -1.88%. Obviously, our goal isn’t to be less worse than everyone else but I want to show you how investors gravitate towards high quality when they get nervous.

Some of the names on the Buy List I like right now include Microsoft ($MSFT), Cognizant Technology ($CTSH), Ford ($F) and Wells Fargo ($WFC). Be sure to keep an eye on my Buy Below prices. Now let’s look at some recent earnings news.

FactSet Research Earned $1.15 per Share

On Tuesday, FactSet Research Systems ($FDS) reported fiscal Q3 earnings of $1.15 per share which matched Wall Street’s estimate. This was their 12th-straight quarter of double-digit earnings growth. Revenue rose 6% to $214.6 million, which was a little bit below the Street.

Frankly, this was a good quarter but not a great one. I’m not disappointed at all by FactSet’s results but I think traders were expecting a little more. That’s why the stock pulled back after the earnings report. But the shares are basically where they were at the start of the month.

For Q4, FDS sees earnings ranging between $1.18 and $1.21 per share. The Street had been expecting $1.18 per share. FactSet is doing just fine. FDS continues to be a solid buy up to $108 per share.

Oracle Is a Buy Up to $35

The big disappointment for us came from Oracle ($ORCL) after the close on Thursday. This is especially frustrating for me because I was expecting a big earnings beat from them.

For their fiscal fourth quarter, Oracle earned 87 cents per share which matched the Street’s expectations. Three months ago, they told us to expect earnings to range between 85 and 91 cents per share. For the whole year, Oracle made $2.68 per share which was up from $2.46 per share last year. The trouble spot was at the top line. Quarterly revenue rose to $10.9 billion, which was the same as last year, and $200 million below expectations. New software sales rose by just 1% which traders didn’t like at all. This is the second quarter in a row that Oracle has disappointed investors with their software sales.

The company said weak sales in Asia and Latin America were to blame. This is where it gets tricky because Oracle claims the problems are economic, and the market is starting to think it’s about competitiveness. For Q1, Oracle said new software sales will rise between 0% and 8%, and earnings will be between 56 and 59 cents per share. That guidance isn’t particularly strong. The consensus on Wall Street was for 58 cents per share.

Interestingly, Oracle said they’re leaving the Nasdaq stock market and heading over to the NYSE. The ticker symbol will stay the same, and ORCL will start trading on the NYSE on July 15th. Perhaps the best news is that Oracle doubled the quarterly dividend to 12 cents per share. The stock still doesn’t yield very much, but it’s a sign of confidence from the company. In Thursday’s after-hours trading, Oracle dropped down to $30 per share. I apologize for the volatility. I know it’s no fun, but I’m still an Oracle fan. I’m lowering my Buy Below to $35 per share.

Medtronic Raises Dividend for 36th Year in a Row

Before I go, I wanted to highlight a small but important bit of news. Medtronic ($MDT) raised their dividend for the 36th year in a row. The quarterly dividend will rise two cents to 28 cents per share. That’s an increase of 7.7%. Naturally, this isn’t the kind of news that grabs the attention of traders. But as disciplined investors, we should acknowledge how remarkable a streak this is. Well done, MDT! Medtronic is an excellent buy up to $57 per share.

That’s all for now. Next week is the final week of Q2. Can you believe the year is nearly halfway done? Earnings season isn’t far away. On Tuesday, we’ll get an important report on durable goods. Then on Wednesday, the government will revise the Q1 GDP report. Bed Bath & Beyond ($BBBY) will report fiscal Q1 earnings on Wednesday. The company said to expect earnings to range between 88 and 94 cents per share. I think results will be at the high end of that range. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Good Earnings for Medtronic

Eddy Elfenbein, May 21st, 2013 at 10:43 amThis morning, Medtronic ($MDT) reported its fiscal fourth-quarter earnings. Excluding special items, MDT made $1.10 per share which beat Wall Street’s consensus by seven cents per share. Frankly, this was a bit of a shock to me. I knew business was going well for Medtronic but this number was better than I was expecting.

Digging into the numbers, the big surprise was that sales of pacemakers and defibrillators rose. Pretty much everyone was expecting continued declines. Sales of defibrillators rose by 1.5%, and pacemakers were up by 2.6%. Company-wide, revenues were up by 3.8% last quarter. Medtronic’s CEO, Omar Ishrak, said that for the first time in 4-and-a-half-years, sales of defibrillators and spinal products rose in the U.S. in the same quarter.

For the year, Medtronic made $3.75 per share. That’s up from $3.46 per share in 2012. Some history: Last May, MDT originally saw earnings for this year coming in between $3.62 and $3.70 per share. In January, they raised the range to $3.66 — $3.70 per share.

For fiscal 2014, Medtronic projects earnings between $3.80 and $3.85 per share. Wall Street had been expecting $3.84 per share. Traders are very pleased with today’s news. Shares of MDT are up more than 6.5% this morning. The shares are at their highest point since September 2008.

Sometime next month, MDT will raise its dividend for the 36th year in a row.

-

Medtronic Earns 93 Cents Per Share

Eddy Elfenbein, February 19th, 2013 at 10:35 amThe stock market is doing well this morning. The S&P 500 has been as high as 1,526.82, which is yet another multi-year high. The market is trying to extend its weekly winning streak to eight. This is a good way to start.

Investors have impressively run past a lot of minor negatives that easily could have hurt stocks in previous markets. The earnings news continues to be decent. The latest numbers show that 388 companies in the S&P 500 have reported Q4 earnings. Of that, 69.8% have beaten expectations. Compare that with the long-run average of 62%. Earnings are up 5.6% from one year ago, and 1.9% above expectations.

Our latest Buy List stock to report earnings was Medtronic ($MDT). For their fiscal third quarter, Medtronic earned 93 cents per share which was two cents better than Wall Street’s forecast. That’s an increase from 84 cents per share a year ago. Sales rose 2.8% to $4.03 billion which was $10 million below forecasts.

Medtronic once again reiterated their full-year earnings forecast of $3.66 to $3.70 per share. For clarity, Medtronic’s fiscal year ends in April. MDT is our first Buy List stock in the January-April-July-October cycle to report earnings. The shares are currently down about 3.3% although I don’t see why. In today’s earnings release, the CEO said:

“We are playing a leading role in transforming global healthcare by implementing our long-term strategies of economic value and globalization,” said Ishrak. “We are only at the beginning of establishing our track record, but we believe that crisp execution of both our baseline and long-term growth strategies, combined with strong and disciplined capital allocation, will enable us to create long-term dependable value in healthcare.”

Shawn Tully at CNN/Money makes a good point about Medtronic. The dividend yield is 2.3% and the repurchases come to 3.7% for a total shareholder yield of 6.0%.

-

CWS Market Review – February 15, 2013

Eddy Elfenbein, February 15th, 2013 at 6:07 am“Individuals who cannot master their emotions are ill-suited to

profit from the investment process.” – Benjamin GrahamRemember when stock prices used to change each day?

OK, I’m exaggerating…but not by much. Bespoke Investment Group notes that the average daily spread between the high and the low on the Dow Jones is at a 26-year low. Stocks simply ain’t moving around very much these days.

While the stock market got off to a great start this year, since late January it’s nearly slowed down to a complete halt, particularly the intra-day swings. The Volatility Index ($VIX) is near a six-year low. Fortunately, the little volatility there has been has been positive, so the broad market indexes have continued to rise, albeit very slowly. On Thursday, the S&P 500 closed at its highest level since Halloween 2007.

One theme that’s been dominating Wall Street lately is the idea of a Great Rotation, meaning money will massively swarm out of bonds and into stocks. I do think some of that will happen—in fact, it’s currently happening—but I don’t foresee sky-high bond yields anytime soon. The 10-year T-bond is right at 2%, which is pretty darn low. Instead, what we’re seeing is investors gradually becoming bolder and taking on more risk. That’s very good for our style of investing.

In this week’s CWS Market Review, I want to take a closer look at this moribund market. As quiet as it’s been, I don’t think the market’s reticence will last much longer. I also want to highlight an outstanding earnings report from DirecTV ($DTV). The stock crushed Wall Street’s estimate by 42 cents per share! We’ll also focus on Bed, Bath & Beyond ($BBBY), which has finally drifted low enough to be a very compelling buy. But first, let’s look at what’s been happening on the street of dreams.

Investors Need to Focus on High-Quality Stocks

One important development is that economically cyclical stocks are again leading the market. If you recall, the cyclicals began a massive rally last summer right around the time when Mario Draghi promised to do “whatever it takes” to save the euro. The cyclicals were given another boost a few weeks after that when the Fed announced its QE-Infinity program.

Consider this: If the S&P 500 had kept pace with cyclicals, it would be at about 1,750 today instead of 1,521. Cyclical leadership finally petered out in late January but has come back with a vengeance. The Morgan Stanley Cyclical Index (CYC) has outpaced the S&P 500 for five days in a row. The ratio of the Cyclical Index to the S&P 500 is now close to an 18-month high.

I think there are two reasons for this trend. One is simply that many cyclical stocks got very cheap. I think our own Ford Motor ($F) is a perfect example of that. Harris ($HRS) and Moog ($MOG-A) are other good examples. But another reason is that economy is probably better than many analysts realize. The negative GDP report for Q4 understandably upset a lot of folks, but the recent trade numbers will probably cause that negative 0.1% to be revised upward to somewhere around +1.0%.

Earnings for Q4 have been pretty. According to data from Bloomberg, 73% of the 288 companies in the S&P 500 that have reported Q4 earnings have topped estimates; 67% have beaten sales estimates. As I’ve discussed before, the major concern is that corporate profit margins have been stretched about as far as they can go. I’m concerned that Wall Street’s earnings forecasts are too optimistic, and we’re going to see a spate of earnings as the year goes on.

One of the interesting aspects of the recent rally is that the large mega-caps haven’t really joined in. Since the beginning of October, the S&P 100, which is the biggest stocks in the S&P 500, has consistently lagged the S&P 500. That’s not necessarily bad news, but it means that the little guys are getting most of the gains. One possible worry is that the gains are largely going to low-quality names. That’s often a sign of a market peak. Our Buy List, for example, started trailing the overall market in 2007. But when the plunge came, we didn’t fall nearly as much as rest of the market.

Until this sleepy market eventually wakes up, I urge investors to focus on top-quality. Please pay close attention to my Buy Below prices on the Buy List. We don’t want to go chasing after stocks. Let the good stocks come to you. Speaking of which, my favorite satellite TV stock just reported great earnings, and the stock is lower than where it was five months ago.

Buy DirecTV Up to $55 per Share

We had very good news on Thursday when our satellite-TV stock, DirecTV ($DTV), reported blow-out earnings for Q4. The company raked in $1.55 per share for the quarter, which creamed Wall Street’s forecast by 42 cents per share. Wow! For comparison, DTV made $1.02 per share in the fourth quarter of 2011,

So what’s the secret to DirecTV’s success? That’s easy; it’s all about Latin America. DirecTV has done very well in the United States, but that’s a fairly saturated market. Not so in the Latin world, where satellite TV demand is just getting started. DTV now has 10.3 million subscribers in Latin America, up from 7.9 million one year ago. Last quarter, DirecTV added 658,000 customers in Latin America, which was a lot more than expected.

For Q4, DirecTV added 103,000 subscribers in America, which brings their total to 20.1 million. That’s a big business, and I especially like anything involving recurring revenue. The company said it expects to see mid-single-digit revenue growth in the U.S. over the next three years. I was also pleased to see that the cancellation rate in the U.S. dropped from 1.52% to 1.43%. DirecTV has specifically made an effort to increase retention. The cost of adding one new subscriber is far more than that of retaining an existing one. For all of 2012, DTV had a solid year, earning $4.58 per share.

The only negative is that DTV said its earnings will take a one-time hit from the currency devaluation in Venezuela. The company also announced a $4 billion share buyback, which is equivalent to about 13% of DTV’s market value. I think DTV should have little trouble earning $5 per share this year. This is a good stock going for a good value. DirecTV remains an excellent buy up to $55.

Bed, Bath & Beyond Is Finally Looking Cheap

I want to focus on Bed, Bath & Beyond ($BBBY), which had been one of my favorite Buy List stocks, but a string of earnings warnings rocked the shares last year. While 2012 was unpleasant, I think the stock has now fallen back into being a very good buy at this price.

Let’s review what happened last year. In June 2012, Wall Street had been expecting fiscal year earnings (ending February 2013) of $4.63 per share, which represented 14% growth over the year before. But the company surprised investors by telling us to expect earnings growth somewhere between the single digits and the low double digits.

No biggie, right? Guess again. Traders gave BBBY a super-atomic wedgie as the stock got crushed for a 17% loss in one day. Now here’s the odd part: Here we are eight months later, and it looks like BBBY will earn about $4.54 per share for the year, give or take. In other words, that dreaded earnings warning turned out to be about 2% or so.

After the earnings report in September, BBBY got hammered for a 10% one-day loss when it reiterated the exact same full-year forecast. Then, for the December earnings report, BBBY only got nailed for 6.5% after it reiterated, you guessed it, the exact same full-year earnings forecast.

For Q4 (which covers the holidays so it’s the big dog of BBBY’s fiscal year), the company said earnings would range between $1.60 and $1.67 per share. The Street was expecting $1.75 per share. C’mon, this lower guidance isn’t that bad. But traders have lost confidence in BBBY. The shares have plunged from over $75 in June to as low as $55 in December, although it’s come up a bit since then.

Now let’s run some numbers: If Bed, Bath & Beyond can increase earnings by 10% for next fiscal year (which begins in two weeks), that should bring them to roughly $5 per share. That means we’re looking at a stock that’s going for less than 12 times earnings and growing at 10% per year. Furthermore, the recovering housing market should continue to aid them. While BBBY looks cheap, I suspect it will take a while before the stock comes back to life. The earnings warnings really spooked traders. The next earnings call isn’t until April 10. Bed, Bath & Beyond is a good buy up to $60 per share.

That’s all for now. Next week, the stock market will be closed on Monday in honor of George Washington’s birthday. On Tuesday morning, Medtronic ($MDT) will report fiscal Q3 earnings. Last month, MDT bumped up the low end of their fiscal year guidance. We’ll also get the CPI report on Thursday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

P.S. I recently posted a list of 11 very overpriced stocks that you should sell ASAP.

-

CWS Market Review – January 11, 2013

Eddy Elfenbein, January 11th, 2013 at 7:42 am“The key to making money in stocks is not to get scared out of them.” – Peter Lynch

I’ll sum up this market up in four words: Fear is melting away. Wall Street continues to rally as the fear that gripped the market so intensely slowly fades away. This has been great news for the broader market—and especially for our new Buy List.

On Thursday, the S&P 500 closed at its highest level in more than five years. What’s even more impressive is that the Volatility Index ($VIX), also known as the Fear Index, recently dropped to its lowest level in five-and-a-half years. After seven days of trading, our Buy List is already up 4.34% for the year, which is 1.12% ahead of the S&P 500.

Earnings season is about to start, and we’ve had a flurry of good news this week. Both Stryker ($SYK) and Medtronic ($MDT) raised the low end of their full-year guidance. DirecTV ($DTV) rallied after the company said it had added 100,000 new subscribers in Q4.

How about Nicholas Financial ($NICK)? The little powerhouse came close to breaking through $14 per share. On Thursday, Oracle ($ORCL), Fiserv ($FISV) and Stryker ($SYK) all made fresh 52-week highs. (Is it me, or didn’t Oracle just break $30 a few weeks ago—and it’s already closing on $35?)

Perhaps the best news of all came from Ford ($F). The automaker said it’s doubling its dividend. In the CWS Market Review from a month ago, I said it is possible Ford could sweeten its dividend, but honestly, I was expecting something minor. Not doubling! This is an excellent sign of confidence from Ford. The stock got as high as $13.94 on Thursday, which is an 18-month high.

The End of the Fear Trade

Before we get too carried away, I want to warn you that this is a tricky market. Last week, I mentioned that we’re witnessing a “high-beta rally,” which means that a lot of bad stuff is getting pulled along with the good stuff. Fortunately, we have the good stuff.

What’s interesting is that the most-hated stocks on Wall Street, meaning those that are “shorted” the most, have been doing the best. The folks who have been short this market have been getting squeezed. This means they have to cover their shorts, and that’s propelling those hated stocks even higher.

I’ll explain what’s going on with a simple example. Let’s say you have two stocks that are perfectly equal in every way. Same industry, same finances, same logos, you name it, they’re exactly alike. Both are expected to earn $1 per share this year. However, there’s one difference. Stock A is expected to earn $1 per share, plus or minus two cents per share, while Stock B is expect to earn $1 per share, plus or minus 30 cents per share.

So which stock is going to be worth more? The answer is that in most cases Stock A will be worth more. It’s not entirely logical, but investors are more scared of the downside than they are optimistic for the upside.

But here’s the important part investors need to understand: While Stock A will usually be worth more than Stock B, that gap will fluctuate a lot. Sometimes, the crowd turns fearful and the A/B gap will open wide. But other times, when folks are more confident, that gap will narrow. The A/B gap will move according to the crowd’s fear level.

Now let’s bring our thought exercise back to the real world. What happened over the past few years is that the whole world got terrified. The A/B gap opened to ridiculous levels. Any investment that wasn’t a surefire guarantee got dumped. It wasn’t just stocks: we saw it in bonds as well. High-grade corporates lagged Treasuries, and junk bonds lagged high-grades.

As the fear is slinking away, the fear gap is closing up. As a result, the Stock Bs of the world are outperforming the Stock As. Meaning that anything that’s seen as carrying higher risk has been doing well. In the real world, we can see that in the fact that small-cap indexes like the Russell 2000 ($RUT) and S&P Small-Cap 600 (^SML) have recently hit all-time highs, even though the S&P 500 still has a way to go to match its all-time high. Even the Mid-Cap 400 (^MID) is at a new high. Last week, I showed you how well the High-Beta ETF ($SPHB) has performed.

This chart shows you that since mid-November, small-caps have done the best, followed by the mids, followed by large. Performance has been perfectly ordered by size (or risk, B to A).

Let me caution investors not to be too impressed by some of the stocks that they’ll see rally. Facebook ($FB), for example, is back over $30. FB is horribly overpriced, and there are lots of stocks rallying that are even worse. Don’t chase them. Instead, investors should stick with high-quality stocks like the names you’ll find on our Buy List. Now let’s look at some of the recent good news from our stocks.

Stryker and Medtronic Raise Guidance

Even though earnings season hasn’t begun yet for our Buy List, two of our stocks got ahead of the game by raising their full-year guidance forecasts. I should add that I like stocks that provide full-year forecasts. Companies aren’t required to do this, so it’s nice to see firms give more information to the public.

On Monday, Medtronic ($MDT) raised its full-year forecast to a range of $3.66 to $3.70 per share. That’s an increase of four cents per share to the low end. Medtronic has stuck by its original forecast since May, which is commendable. The increase is due to a research tax credit.

Note that Medtronic’s fiscal year ends in April, so Q3 earnings are due in about six weeks. For the first six months of this fiscal year, Medtronic earned $1.73 per share. That means we can expect $1.93 to $1.97 for the back end. Medtronic earned $3.46 per share last year. Medtronic remains a good buy up to $44 per share.

On Wednesday, Stryker ($SYK) raised the low end of their full-year guidance by one penny per share. The company now sees full-year earnings ranging between $4.05 and $4.07 per share. Stryker also said that sales for Q4 rose by 5.5%, while the Street had been expecting an increase of 2%. For 2013, Stryker reiterated its full-year forecast for earnings of $4.25 to $4.40 per share. Wall Street is expecting $4.30 per share. Earnings are due out on January 22nd. The shares closed Thursday at $58.84, which is a new 52-week high. I’m raising my Buy-Below on Stryker to $62.

Ford Doubles Dividend

After the South Sea Bubble went ka-blamo in the early 18th century, Sir Isaac Newton famously said, “I can predict the movement of heavenly bodies, but not the madness of crowds.” Ike, my man, I feel you.

Long-term readers of CWS Market Review know how much I like Ford ($F). When the stock dropped below $9 last summer, I thought either Wall Street or I had lost our marbles. Possibly both.

The numbers said Ford was cheap, and we stuck to our guns. Today, suddenly Ford is one of the hottest stocks on Wall Street. The stock got another big boost this week when the automaker said that it’s doubling its quarterly dividend from five cents to ten cents per share. The dividend hasn’t been this high in seven years. Going by Thursday’s close, Ford yields 2.89%. The stock jumped to an 18-month high. I rate Ford an excellent buy up to $15.

New Buy Below Prices

Thanks to our Buy List’s strong performance, I want to adjust several of our Buy Below prices. Remember, these aren’t price targets; they’re guidance for what’s a good entry point. This week, I’m raising Oracle’s ($ORCL) Buy Below by $2 to $37 per share. As I mentioned earlier, I’m raising Stryker ($SYK) to $62. I’m also raising Fiserv ($FISV) to $88 and WEX ($WXS) to $82. Quiet, unassuming Moog ($MOG-A) is our third-best performer this year, with a 7.24% YTD gain. Moog’s new Buy Below is $46. I’m raising CR Bard ($BCR) to $108.

JPMorgan Chase ($JPM) is due to report earnings next Wednesday, January 16th. The Street currently expects earnings of $1.20 per share. My numbers say that’s too low. For now, I’ll raise my Buy Below to $47 per share, which is just above the current price. Let’s see how the earnings shake out before we make a larger move.

That’s all for now. Earnings season starts to heat up next week. Remember JPM reports on Wednesday. We’ll also get important reports on inflation and industrial production. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

CWS Market Review – December 7, 2012

Eddy Elfenbein, December 7th, 2012 at 6:07 am“If you can look into the seeds of time,

And say which grain will grow and which will not,

Speak then to me.”

– Macbeth, Act 1, Scene 3And to me, too, while you’re at it. After a nice recovery since mid-November, the S&P 500 has settled into a narrow trading range. For the last seven days running, the index has closed between 1,407 and 1,417. Chart watchers generally think this is a positive sign because stocks haven’t immediately surrendered their gains and dipped to a new low. My advice for investors is to ignore this silly Fiscal Cliff alarmism and expect a strong rally ahead. I continue to be bullish on the market and think we’ll break 1,500 sometime early in 2013.

Stay Tuned for the 2013 Buy List

Before I get into today’s CWS Market Review, I want to announce that I’ll unveil next year’s Buy List two weeks from today, on Friday, December 21, 2012. As usual, the new Buy List will have 20 stocks, and as usual, I’ll take off five stocks and add five new ones. We try to keep our turnover low. I always unveil the new Buy List a few days before the end of the year so no one can claim I’m getting an unfair jump on investors.

Once the changes are made, the Buy List is locked and sealed for the next 12 months and I’m not allowed to make any changes until next December. I’ll start tracking the new list at the start of trading on January 2nd. My purpose with the Buy List is to show investors that with patience and discipline, any investor can consistently beat the stock market with a user-friendly portfolio. I’m very fortunate that we’ve had great success at Crossing Wall Street. If all goes well, 2012 will be the sixth year in a row that we’ve beaten the S&P 500.

The 2012 Buy List So Far

Through Thursday, our 2012 Buy List is up 13.21% for the year (not including dividends), which is slightly more than the S&P 500. I’ll include dividends in the final numbers. The good news is that the second half of the year has been very friendly to us. Remember that you can see exactly how our Buy List is doing at any time during the year at our Buy List page. I try to make investing as transparent as possible. I also have my Buy Below prices there so you’ll know exactly what’s a good entry point.

Let’s look at some of our recent Buy List standouts. Fiserv ($FISV) just broke $80 per share, which is an all-time high. The stock is a 36% winner for us this year. AFLAC ($AFL) finished the day on Thursday at $53.80, which is its highest close since May 17, 2011. I’m a big fan of the duck stock. Sysco ($SYY), one of the most stable stocks on our Buy List, also finished Thursday at an 18-month high. SYY currently yields 3.51%.

How about little Nicholas Financial ($NICK)? The stock dropped sharply after what some believed were poor earnings. They weren’t poor at all (perhaps mildly disappointing), and with a little patience, NICK has nearly made back all it lost. Even after the recent rally, NICK yields 3.6%. Nicholas Financial is a great buy up to $15 per share.

The Great Special Dividend Rush of 2012

Recently you’ve heard me complain about the careless media alarmism about the impending Fiscal Cliff. One starts to wonder whether CNBC now stands for “Cliff, Nothing But Cliff.” Trust me: you can ignore all that.

Wall Street has also been distracted by some turbulence in shares of Apple ($AAPL). Truthfully, the recent downturn in Apple isn’t all that surprising. Bespoke Investment Group points out that this is Apple’s 10th 20% correction in the last 10 years. As Josh Brown recently pointed out, the difference this time is that Apple’s correction begins at a very high nominal price.

One truly important effect of the impending Fiscal Cliff is that companies have been rushing to pay special dividends to shareholders before the end the year, as dividend taxes are expected to rise. This is especially the case for cash-rich companies and firms with high insider ownership. So far, U.S. companies have announced $21 billion in special dividends. Other companies, like Walmart ($WMT), have moved up their dividend-payout dates.

On our Buy List, Oracle ($ORCL) announced that they will pay out their next three quarterly dividends before the end of the year. To clear up any confusion, Oracle’s fiscal year ends in May, so they’re paying out their second-, third- and fourth-quarter dividends all at once. The quarterly dividends are six cents per share, so the total payment for this month will be 18 cents per share. That works out to a cool $200 million for CEO Larry Ellison.

Oracle’s fiscal Q2 earnings report is due after the close on Tuesday, December 18th. I’m expecting a good report. During the earnings call in September, Oracle said Q2 earnings should range between 59 and 63 cents per share. That’s a nice increase from the 54 cents per share they made in last year’s Q2. Wall Street’s consensus is at the dead center of the range, at 61 cents per share. Earlier this week, Oracle’s stock got as high as $32.50, which is an 11-week high. Oracle remains a strong buy any time it’s below $35 per share.

The day after Oracle reports, Bed Bath & Beyond ($BBBY) will report its fiscal Q3 earnings. An important earnings call will follow because BBBY will give their initial planning assumptions for next year. Wall Street currently expects earnings of $5.15 per share for next year, and I suspect that’s too high. Unfortunately, this will be the last we hear from BBBY for awhile. The company’s Q4 is hugely important for them: about one-third of their annual profits come during the holiday quarter. But that report won’t come out until early April. Until then, we won’t hear much of anything from BBBY. This is still a solid company. Bed Bath & Beyond is a good buy up to $62 per share.

Stryker Raises Dividend By 25%

In last week’s CWS Market Review, I said I expected Stryker ($SYK) to raise its quarterly dividend soon, and sure enough, I was right.

I had said that I expected Stryker to increase its payout from 21.25 cents per share to around 23 cents per share. It turns out, I wasn’t optimistic enough. The company just announced that the dividend will rise 25% to 26.5 cents per share. That brings the annual dividend to $1.06 per share. At Thursday’s close, Stryker now yields 1.95%.

Stryker’s board also approved a $405 million increase in the share buyback program, which brings the total to $1 billion.

“Given the considerable strength of our balance sheet and strong cash flow generation, we are well positioned to pursue a capital allocation strategy that includes highly focused M&A, an increasingly robust dividend and share buybacks,” said Kevin A. Lobo, President and Chief Executive Officer of Stryker. “We are committed to a strategy that will help drive our sales and earnings growth while simultaneously returning capital to shareholders at meaningful and consistent levels. ”

Stryker has raised its dividend every year since 1995. The stock is a buy up to $57.

Not to be outdone, Medtronic ($MDT) also announced an accelerated dividend payment. The company usually pays its fiscal third-quarter dividend in early January. On Thursday, Medtronic said that it will pay out the dividend in December in order to avoid the taxman. If you recall, in June, Medtronic raised its dividend for the 35th year in a row. The company recently had a good earnings report and reiterated full-year guidance. Medtronic is a buy up to $44 per share.

Before I go, I want to highlight the good sales report from Ford ($F). For November, vehicle sales were up 6%, and sales of the F-series trucks were up 18%. This was the best November for trucks in seven years. Ford also set a record for hybrid sales, but that’s a very small part of their overall business. I was pleased to see the company plans to build 750,000 vehicles in North America for Q1. That’s an 11% increase over last year.

I think it’s possible we may even see a dividend increase from Ford. The company currently pays a nickel per share, which comes to an annual yield of 1.8%. Ford is on track to earn about $1.35 per share this year, so they can easily afford an increase. Ford is a good buy up to $13 per share.

That’s all for now. Next week, we’ll get important reports on industrial production and retail sales. Also, the Fed meets on Tuesday and Wednesday. Following the meeting, Bernanke will hold a press conference. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Best Day Since the Election

Eddy Elfenbein, November 19th, 2012 at 12:01 pmI expect this week to be a rather slow week for trading stocks. The good news is that we’re off to a good start. The S&P 500 is currently up over 1.4%, which, if it holds up, would make today the best day since the election.

So far, the cyclicals are leading the show. The materials and energy sectors are both up nicely, and the techs are also doing very well. The tech sector has been doing very poorly recently. The Nasdaq, in fact, dropped over 10% which usually marks the point at which folks declare a correction.

I’m impressed to see Lowe’s ($LOW) doing well today. The company reported very good quarterly results. We’re moving into the “off-cycle” part of earnings season where companies whose quarter ends in October report their earnings. This is a small minority of companies on Wall Street, but a few like Medtronic ($MDT) and Lowe’s are worth watching. I think the Lowe’s news is more confirmation that housing is helping consumers.

-

CWS Market Review – November 16, 2012

Eddy Elfenbein, November 16th, 2012 at 7:17 am“Investing is where you find a few great companies and then sit on your ass.” – Charlie Munger

So true, Charlie. So true. Unfortunately, sitting on our rear ends has been rather unpleasant lately as the stock market has thrown yet another temper tantrum. On Thursday, the S&P 500 broke below 1,350 for the first time since late July.

For several weeks now, I’ve warned investors to be prepared for a difficult market this autumn. The hour cometh, and now is. The day after the election, the S&P 500 dropped 2.37% for its second-worst day of the year. This was unusual because the electoral results were largely expected. The next day, the index closed below its 200-day moving average for the first time since June. That apparently gave the bears a shot of confidence. Yesterday, the index fell to its lowest level since July 26th.

In this week’s CWS Market Review, we’ll take a closer look at what has the market so grumpy. The good news is that it shouldn’t last much longer; I expect a strong year-end rally to begin soon. I’ll also highlight Medtronic’s ($MDT) upcoming earnings report. I’m a big fan of this medical devices company which has increased its dividend for 35 years in a row! Plus, I’ll show you some Buy List stocks that look especially good right now. But first, let’s look at why the market’s recent downturn is running out of steam.

Why This Sell-Off Will End Soon

Measuring from the market’s closing peak on September 14th, the S&P 500 is now down 7.64%. That’s hardly a horrifying drop especially considering the market’s tremendous run over the last three-and-a-half years, but it caught a lot of professionals off guard. Actually, it’s not even the worst drop this year. We’re still short of the 9.93% sell-off the S&P 500 put on between April 2nd and June 1st.

If we dig beneath the numbers of this current sell-off, we can see it has been unusual which leads to me believe that it’s a reaction against events rather than a sober judgment of future corporate cash flow. As sophisticated as we may think Wall Street is, the truth is that traders often act like hyperactive children at a swimming pool (“hey, look at me, look at me, are you looking??”). Simply put, this market is an attention whore.

I’ll give you an example. When the market initially broke down, the Financial sector led the way. That’s to be expected. But what’s interesting is that it didn’t last long. After two weeks, the financials turned around and started leading the market (meaning, not falling as much). That’s unusual. Investors don’t normally turn to financial stocks for comfort during stressful periods.

Broadly speaking, the cyclicals have had similar reactions. For example, the Industrials have been particularly strong and until very recently, the homebuilders were acting like all-stars. We can also see a lot of strength in the Transportation sector. Again, that’s not the usual pattern that a recession is on the way. The economic data continues to suggest that housing is helping consumer spending get back on its feet.

Nor has the bond market reacted as strongly as you would expect. The yield on the 10-year Treasury is back below 1.6%, but it is well above the ultra-low yields we saw this summer. Furthermore, the volatility of Treasury bonds has nearly dried up. Despite the problems in Europe, our economy continues to recover, albeit at a tepid pace. Expect to see Treasury yields gradually creep higher as investors migrate towards bargain stocks.

A worrying market would be when investors bail out of Financials and Cyclicals and crowd into bonds and Defensive stocks. That’s pretty much what we saw during the spring. This time around, the laggards have largely concentrated on the Tech space. This is where things get truly weird. Intel ($INTC) dropped for nine days in a row and now yields 4.5%. Microsoft ($MSFT) is at its low for the year. And look at Apple ($AAPL). Heavens to Murgatroyd! That stock is down more than $180 in less than two months. That’s a loss of $170 billion in market value, or $540 per every American.

But our Buy List continues to motor along. Since October 15th, the S&P 500 is off by 6.03% while our Buy List is down by 4.40%. Obviously, our goal is to profit, not lose by less, but it’s a good sign that our conservative approach holds up well when Wall Street decides to be a drama queen. We have an excellent shot of beating the market for the sixth year in a row.

Another reason for optimism is that downward momentum is starting to exhaust itself. An important gauge that a lot of chart watchers like to follow is the 14-day relative-strength index. The 14-day RSI closed below 30 for the first time since June. This may cause some bulls to jump back into the fray. Plus, the earnings outlook is holding its own. While earnings estimates for Q4 have come down, the consensus on Wall Street still expects growth of 9.4% which is a nice change from the earnings decline of 3.5% for Q3.

Investors are clearly concerned about a number of political factors. For one, there’s the prospect another stand off between the White House and Congress over the impending “fiscal cliff.” Personally, I doubt this will be as serious as some people fear. The business community is clearly not in the mood for more political drama. I have to think that some sort of deal will be reached before any economy-wrecking plans take effect. There’s too much to lose.

Investors need to be disciplined and not expect the market to gain 20% overnight. Our Buy List is poised to do well, and we just had another good earnings season. Continue to focus on strong dividends, especially companies with long histories of raising their payouts. Speaking of which, we have an earnings report coming next week from one of my favorite dividend champions.

Medtronic Is a Buy Below $44

Medtronic ($MDT) is due to report its earnings on Tuesday, November 20th. If you’re not familiar with them, Medtronic makes medical devices such as products that treat diabetes. The company has increased its dividend every year for the last 35 years.

This earnings report will be for their fiscal second quarter which ended in October. Wall Street currently expects earnings of 88 cents per share which would be a small increase over the 84 cents per share from last year’s second quarter. Medtronic’s earnings reports are usually very close to expectations. If not dead on, it’s rarely more than one or two pennies per share off. In fact, that’s one of the reasons why I like MDT.

Medtronic used to be a glamour stock but it’s lost a lot of its luster. The P/E Ratio has been massively squeezed but the company still churns out steady earnings growth. I was pleased to see Medtronic’s stock turn a corner earlier this year. As traders got nervous and bailed out of riskier bets, Medtronic’s stability suddenly become attractive. From June 4th to October 4th, MDT jumped 24%, although it has given back 8.5% since then.

Medtronic sees earnings ranging between $3.62 and $3.70 per share for this fiscal year. That works out to growth of 5% to 7%, and it means the stock is going for 11 times FY 2013 earnings. The company seems to be on track towards hitting their target. This is a very good stock but I don’t want you to chase it. I’m lowering my Buy Below price to $44 per share.

Some Buy List Bargains

The market’s recent downturn has given us several attractive stocks on the Buy List. If you’re looking for income, Reynolds American ($RAI) currently yields 5.9%. Nicholas Financial ($NICK) is now below $12 per share which gives the stock a yield above 4%. As I predicted two weeks ago, Sysco ($SYY) raised their dividend by a penny per share. That makes 43 dividend increases in a row. SYY now yields 3.7%.

Moog ($MOG-A) currently looks very cheap. The stock just dipped to a new 52-week low. That’s odd because Moog just had a good earnings report and they reiterated their earnings guidance of $3.50 to $3.70 per share. I think Moog can be a $45 stock within a year. Just to be safe, I’m going to lower my Buy Below price to $38 due to the recent sell-off.

Oracle ($ORCL) just dropped below $30 per share. This is a very good company. Oracle is now going for about 10 times next year’s earnings. Oracle is a strong buy up to $35 per share.

I also want to tighten up a few Buy Below prices due to the market’s recent sell-off. I’m lowering Bed, Bath & Beyond’s ($BBBY) Buy Below to $62. (How’s that for alliteration?) I’m also paring back CA Technologies ($CA) to a strong buy below $24. We have a lot of excellent stocks on our Buy List so per dear old Charlie, sitting on our asses is a wise strategy.

That’s all for now. Next week should be fairly quiet. The market will be closed on Thursday for Thanksgiving. On Friday, there will be an abbreviated session that ends at 1 p.m. This is usually one of the lightest volume days of the year. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Durable Goods Orders Jump 9.9%

Eddy Elfenbein, October 25th, 2012 at 10:09 amThe stock market is gaining back some lost territory this morning. The S&P 500 is currently up about 10 points. Yesterday, the index closed at a seven-week low.

This morning, the Labor Department reported that jobless claims dropped by 23,000. I should caution you that that number has been swinging wildly in recent weeks. Economists have been closely watching the jobs figures for any sign confirming the improving trend in employment. Next Friday, we’ll get the jobs report for October and that will tell us a lot more.

Also this morning, the Commerce Department said that orders for durable goods soared 9.9% last month. That’s the biggest jump since January 2010.

The market is intensely focused on Apple’s ($AAPL) earnings which will come out after the close. I think the financial media greatly distorts the impact of well-known stocks. Apple is certainly important but please, there’s still another 97% of the stock market.

A few items for our Buy List.

Ford ($F) said it’s going to lose $1.5 billion in Europe this year. That’s much higher than their previous forecasts. The company is working to restructure its European operations which include shutting down a plant in Belgium in 2014. This is unfortunate but it has less to do with Ford and more to do with the weakness in Europe.

Medtronic ($MDT) is under fire this morning. The company is accused of manipulating studies on bone growth after spinal surgery.

The doctors and researchers who were the authors of the studies were part of a $210 million consulting and royalty payments program by Minneapolis-based Medtronic and never disclosed their ties or the company’s influence in their papers, the panel said in its report.

“Medtronic’s actions violate the trust patients have in their medical care,” Senator Max Baucus, a Montana Democrat and committee chairman, said in a statement. “Medical journal articles should convey an accurate picture of the risks and benefits of drugs and medical devices, but patients are at serious risk when companies distort the facts the way Medtronic has.”

I can’t speak to the accusation but Medtronic has strongly denied doing anything wrong. The stock is currently up this morning.

Lastly, CA Technologies ($CA) will report after the close.

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His