CWS Market Review – April 15, 2025

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

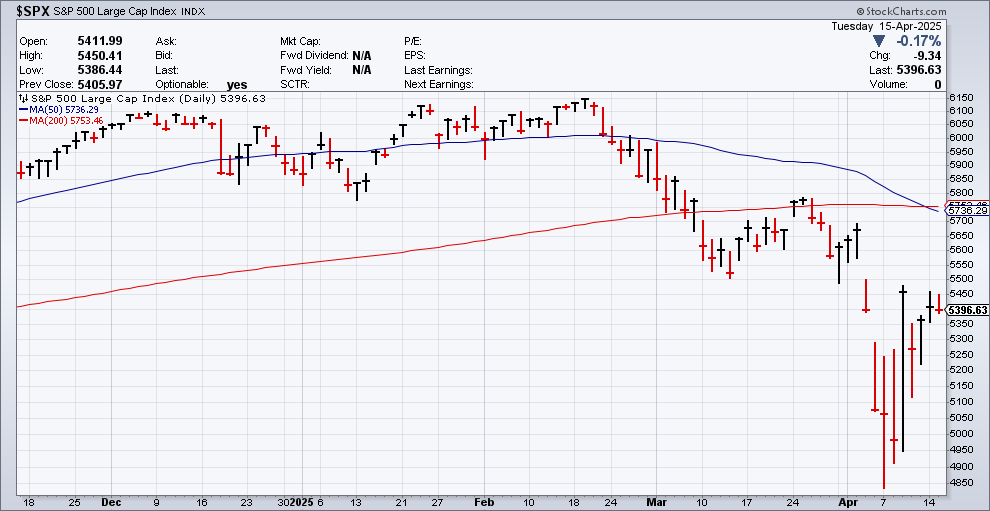

The stock market has seriously chilled out over the last few days. In fact, we’re not that far (-2.3%) from where the market was on March 13, after the S&P 500’s first leg downward.

If some Rumpelstiltskin investor had fallen asleep one month ago and had awoken today, they’d probably conclude that this has been an uneventful four weeks.

We aren’t seeing the big 3%, 5% or even 10% days that we saw not too long ago. For the last two days, the S&P 500 has closed up or down by less than 1%, and today’s change (-0.17%) is the smallest daily move in three weeks.

I like to track the VIX (^VIX) which is the volatility index. Some investors like to call it the “Fear Index,” which is an apt name. Last week, the VIX jumped from 30 to 60. That’s a huge increase, but earlier today, the VIX fell back to 28.

Are we in the clear? Not a chance. Or rather, even if we are, it’s safest to act as if we’re not. The problem for investors is that the market is still beholden to tariff politics. That means that any intemperate threat coming from the White House can upend the market. Morgan Stanley said to expect to be fooled “many more times” regarding tariffs. I think that’s right.

The simple fact is that the S&P 500 is still below its 200-day moving average. Historically, that’s been a trouble area for the market. The index needs to rally more than 6% from here to be above its 200-DMA.

The good news is that we now have other events to share the headlines with the tariff news. The most prominent is that Q1 earnings season is underway and that’s taken some of the spotlight off of tariff politics.

Remember When the Market Doubled in 18 Months?

One of the rules of thumb on Wall Street is that dramatic markets tend to be symmetrical. That’s a fancy way of saying that sharp drops are often followed by sharp recoveries, and long, drawn-out bears are followed by long, drawn-out bulls.

A good example of this came during the Covid bear in 2020. The stock market peaked on February 19. Interestingly, it peaked on the same day this year.

This was one of the fastest drops in Wall Street history. Thirty-three days later, the S&P 500 had shed 33%. But the bulls came roaring back (thanks to a lot of help from Uncle Sam).

By June 8, the market had soared 44% off its low, and by August, the S&P 500 closed at a new record high. It took less than six months to erase one of the most brutal bear markets on record. In fact, it didn’t stop there. It took 18 months for the S&P 500 to double from its low.

Of course, this behavior is only a rule of thumb. We know well that the market gods love to play with our emotions. What I’ve noticed is that when the market is at its low, no one thinks it is. Instead, everyone’s waiting for the next downward move which never comes. As Peter Lynch said, “I’m always fully invested. It’s a great feeling to be caught with your pants up.”

An Early Look at Q1 Earnings

Let’s take an early look at how the Q1 earnings season is playing out. So far, 72.4% of the companies that have reported have beaten their earnings estimates, 69% have topped their revenue estimates. A total of 55.2% have beaten on both.

The S&P 500 is currently tracking at 6.76% earnings growth for Q1. That’s down from 7.03% from one month ago. The good news is that banks are doing a little better than we expected. Expected earnings for financials have been bumped up to 2.30% from 0.87% last month. The weak spot is energy. Last month, earnings for energy sector entities were expected to be down by 16.55%. Now it’s looking like energy’s earnings will be down by 18.87%.

I also noticed that in the earnings calls, several CEOs had bleak outlooks on the economy. A recent poll of more than 300 CEOS found that 62% see a recession coming within the next six months. That’s up from 48% in March.

It’s no secret what CEOs are concerned with. Three-fourths of them said the tariffs will hurt their businesses this year.

Larry Finke, the head honcho over at BlackRock (BLK) said that we’re very close to a recession, “if not in a recession now.” Fink said, “I think you’re going to see, across the board, just a slowdown until there’s more certainty.”

BlackRock is one of the behemoths of Wall Street. The firm currently has $11.58 trillion in assets under management. On Friday, BlackRock said it made $11.30 per share for Q1. That beat Wall Street’s consensus of $10.14 per share. The problem was revenue. BlackRock had $5.28 billion in revenue which was $60 million short of Wall Street’s consensus.

Goldman Sachs (GS) reported a very good quarter. For Q1, the big bank made $14.12 per share compared with estimates of $12.35 per share. That’s an increase of 15% over last year. Revenue rose 6% to $15.06 billion. That topped estimates by $250 million.

Bank of America (BAC) also posted good results. For Q1, BAC made 90 cents per share. That was eight cents more than estimates. Revenue was $27.51 billion. Expectations were for $26.99 billion. Bank of America said its net interest income was helped by lower deposit costs and higher-yielding investments.

JPMorgan Chase (JPM) reported Q1 earnings of $4.91 per share on revenue of $46.01 billion. Wall Street had been expecting $4.61 per share on revenues of $44.11 billion.

The big winner was equities trading. JPM’s revenue there jumped 48% to $3.8 billion. That beat expectations by $560 million.

CEO Jamie Dimon was optimistic for his bank, but like the other CEOs, he was far more cautious on the overall economy. Dimon said, “The economy is facing considerable turbulence (including geopolitics), with the potential positives of tax reform and deregulation and the potential negatives of tariffs and ‘trade wars,’ ongoing sticky inflation, high fiscal deficits and still rather high asset prices and volatility.”

Morgan Stanley (MS) said that its Q1 earnings rose 26% to $2.60 per share for Q1. That beat the Street by 40 cents per share. Equity trading soared 45% to $4.13 billion. That was $840 million more than expected.

Earlier today, Johnson & Johnson (JNJ) said it made $2.77 per share for Q1. That was 17 cents more than estimates. JNJ’s sales rose 2.4% to $21.89 billion. That beat estimates of $21.58 billion.

The company increased its guidance. JNJ now sees 2025 sales ranging between $91 billion and $91.8 billion. The company sees earnings coming in between $10.50 and $10.70 per share.

JNJ also hiked its quarterly dividend from $1.24 to $1.30 per share. The new dividend is payable on June 10, with a record date of May 27. This is the 63rd year in a row that JNJ has increased its dividend. That’s one of the longest such streaks on Wall Street.

There are few things to look out for this week. Tomorrow morning, Abbott Labs (ABT) will report its Q1 earnings. This will be our first Buy List stock to report. The stock is up close to 12% this year.

For this year, Abbott sees its earnings ranging between $5.05 and $5.25 per share. For Q1, Abbott sees earnings between $1.05 and $1.09 per share. Wall Street has split the difference and expects $1.07 per share.

Tomorrow we’ll also get reports on retail sales and industrial production, and Federal Reserve Chairman Jay Powell will be speaking at the Economic Club of Chicago.

The Fed doesn’t meet again for another three weeks, and it’s doubtful they’ll make a move at their May meeting. It will be interesting to hear what Powell has to say, especially about tariffs.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on April 15th, 2025 at 6:11 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His