Archive for February, 2007

-

XM and Sirius to Merge

Eddy Elfenbein, February 19th, 2007 at 2:13 pmThe New York Post reports:

Satellite radio operators Sirius and XM are expected to announce their long-awaited merger today, according to a source familiar with the deal.

The two sides were locked in negotiations over the weekend trying to hammer out a final agreement with an eye toward going public with the merger today in Washington, D.C., where XM is based, this source said.

Talks were still going on at press time and the deal could fall apart at any time. With antitrust issues of paramount importance, this source said lawyers for both companies were working overtime to fine-tune the language of the agreement and frame the discussion around the deal itself and not regulatory concerns.

The transaction is expected to be structured as a merger of equals, but given Sirius’ higher enterprise value, shareholders in the Mel Karmazin-led firm will likely come away with a larger percentage of a combined company.

According to the source, XM Chairman Gary Parsons will retain that title in the combined entity, with Karmazin likely taking the CEO role. It is unclear what role, if any, XM CEO Hugh Panero will play.

Combining Sirius and XM would result in a single satellite radio operator with more than 12 million total subscribers. A deal would also marry Sirius content, such as Howard Stern, Frank Sinatra and Nascar with XM’s Oprah Winfrey, Bob Dylan and Major League Baseball.

More important, analysts widely predict that a deal would also save the two companies nearly $7 billion annually.

Karmazin and Parsons have been dropping hints since last summer about a possible tie-up, believing that competition from terrestrial radio, online radio and mobile music devices such as iPods have not only expanded the marketplace but also lowered the regulatory hurdles to a deal.

In a note on Friday, Bear Stearns analyst Robert Peck speculated that Sirius and XM needed to move quickly before their window of opportunity closed.

Gaining regulatory approval “could take up to 15 months; hence, we think any proposed deal needs to be announced by the end of March to close by mid-2008,” Peck wrote.

On Friday, XM shares hit their lowest point since early November while Sirius shares were approaching 52-week lows. Shares in both companies did trade on heavy volume and ended the session higher, with Sirius gaining 10 cents to close at $3.70 and XM jumping a dollar to $13.98.The appeal of these two stocks simply esacapes me. Neither one has made a dime in profit. And from the looks of things, it’ll be a long time before they do.

-

Happy 275th

Eddy Elfenbein, February 19th, 2007 at 8:32 amLabor to keep alive in your breast that little spark of celestial fire, called conscience. – George Washington

-

The English-Speaking Century

Eddy Elfenbein, February 17th, 2007 at 10:05 pmWinston Churchill spent twenty years on his four-volume A History of the English-Speaking Peoples, which ended with the death of Queen Victoria. Now Andrew Roberts carries on the great man’s work in “A History of the English-Speaking Peoples Since 1900.”

Keith Windschuttle writes:The connection between Protestant individualism and personal responsibility, Roberts argues, also created a favorable environment for the free enterprise that provided the economic base for British and then American economic dominance. Their form of capitalism, free enterprise, free trade, and laissez-faire economics, consistently produced more prosperity than any other model.

The key to this was a Dutch invention, the limited-liability joint-stock company, which in the mid-nineteenth century was perfected by British legislation. As a result, civilizations that had once outstripped the West yet failed to develop private sector companies—notably China and the Islamic world—fell farther and farther behind. Anglo-American capitalism, when allied to the right to own secure property and the rule of law, unleashed the energy and ingenuity of mankind. It formed the basis of the English-speaking peoples’ present global hegemony. -

We’ll Be Together Again

Eddy Elfenbein, February 17th, 2007 at 2:39 pm“Let’s face it. We tenor saxophonists would all play like him, if we could.” — John Coltrane on Stan Getz

-

A Triple High

Eddy Elfenbein, February 16th, 2007 at 2:21 pmDue to my Capitol Hill Odyssey, I neglected to mention Wednesday’s triple high.

For the first time in nine years, the Dow Industrials, Utilities and Transports all closed at all-time record highs. This is only the fourth time this has happened in the last 20 years.

The Dow Jones Industrials (^DJI) closed Wednesday at 12741.86. The Dow Jones Utility Average (^DJU) closed at 477.07. And the Dow Jones Transportation Average (^DJT) closed at 5117.27. -

Banco Bilbao buying Compass Bancshares

Eddy Elfenbein, February 16th, 2007 at 1:12 pmIt happened again! Another one of my favorite banks is getting bought out. Banco Bilbao (BBV) is buying Compass Bancshares (CBSS) for nearly $10 billion.

Just to set the record straight, a Spanish bank is buying out an Alabama bank. Let’s pause and read the sentence again.

Not only is Compass a Dividend Aristocrat, but it’s also in the 10 straight years of increased earnings club. The only other stocks in both groups are Wal-Mart (WMT), Walgreen (WAG) and Synovus (SNV). (Note: There could be a trend here. Synovus is based in Georgia and Wal-Mart hails from Arkansas.)

BBV is offering a 16% premium for Compass. Let’s see if another bidder steps forward.

-

Top Stocks for the Loooooong Haul

Eddy Elfenbein, February 16th, 2007 at 12:17 pmAt the TheStreet.com, James Altucher profiles some stocks that have been around for over one hundred years.

If you haven’t done so yet, I urge you to check out James’ new Stockpickr site, the latest in social networks and stock-picking. -

CAPM: RIP

Eddy Elfenbein, February 16th, 2007 at 10:59 amHere’s a good article from the Financial Times on the demise of CAPM, the Capital Asset Pricing Model. This model tried to explain the trade-off between risk and return in financial markets.

The verdict is that as a theory, it’s all swell. But in practice, CAPM doesn’t explain much. Studies have shown that low-risk stocks (meaning low beta) have done better than they should, and riskier stocks have continually come up short.

Of course, this is hardly the first time that an academic theory has got its ass handed to it by reality. What I find interesting, however, is the use (and abuse) of the concept of risk.

Although we’ve become used to language of risk, it’s actually a rather bizarre idea. Consider that we have just one word for it, but “risk” is used to describe many different things. For example, risk is reflexively assumed to be bad. But what about the risk of missing a great stock? That’s something that I’m always concerned with.

If there’s a trade-off between risk and return, then there’s an assumption that all investors measure risk the same way. The return part is fairly obvious. We can all agree what a 10% move is. But risk is subjective. What I might consider risky, you might not.

Another example is gold. Is gold very risk, or not risky at all? Going by its daily volatility, gold has often been very risky. Gold’s beta, however, is usually negative. I’ve always thought the allure of gold is that it has the least risk of losing its intrinsic value. After all, if we find ourselves living in the post-apocalypse, stocks and bonds aren’t going to be worth much, but gold will still have value (don’t laugh, there are investment advisors who say these things).

Once again, we have one word that’s used to describe many things, and everyone sees it differently. -

Dividend Aristocrats

Eddy Elfenbein, February 16th, 2007 at 8:32 amCoca-Cola (KO) raised its quarterly dividend from 31 cents a share to 34 cents a share. Coke has now raised its dividend for 45 straight years.

While capital gains are my first true love, dividends are like a friend with benefits. S&P has a list of its Dividend Aristocrats, stocks that have increased their dividend every year for the last 25 years.

Here’s the current list:

Abbott Labs (ABT)

Archer-Daniels-Midland (ADM)

Automatic Data Processing (ADP)

Avery Dennison (AVY)

Bank of America (BAC)

BB&T Corporation (BBT)

Bard (C.R.) Inc. (BCR)

Becton, Dickinson (BDX)

Anheuser-Busch (BUD)

Chubb (CB)

Compass Bancshares (CBSS)

Cincinnati Financial (CINF)

Clorox (CLX)

Comerica (CMA)

Century Telephone (CTL)

Dover (DOV)

Consolidated Edison (ED)

Emerson Electric (EMR)

Family Dollar Stores (FDO)

First Horizon National (FHN)

Fifth Third Bancorp (FITB)

Gannett (GCI)

General Electric (GE)

Grainger (W.W.) Inc. (GWW)

Johnson Controls (JCI)

Johnson & Johnson (JNJ)

KeyCorp (KEY)

Kimberly-Clark (KMB)

Coca Cola (KO)

Leggett & Platt (LEG)

Lilly (Eli) & Co. (LLY)

Lowe’s (LOW)

McDonald’s (MCD)

McGraw-Hill (MHP)

3M Company (MMM)

Altria (MO)

M&T Bank (MTB)

Nucor (NUE)

PepsiCo (PEP)

Pfizer (PFE)

Procter & Gamble (PG)

Progressive (PGR)

PPG Industries (PPG)

Regions Financial (RF)

Rohm & Haas (ROH)

Sherwin-Williams (SHW)

Sigma-Aldrich (SIAL)

SLM Corporation (SLM)

Synovus Financial (SNV)

Questar (STR)

State Street (STT)

Supervalu (SVU)

Stanley Works (SWK)

Target (TGT)

U.S. Bancorp (USB)

V.F. Corp. (VFC)

Walgreen (WAG)

Wal-Mart (WMT)

Wrigley (WWY)

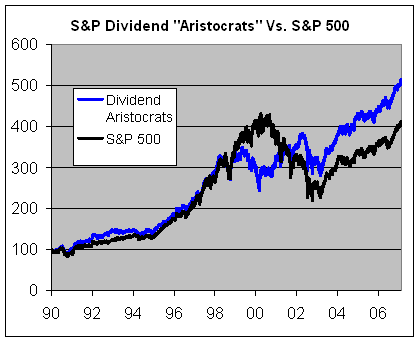

The Dividend Aristocrats Index has not only outperformed the S&P 500, but it’s been less risky as well. Since 1990, the Dividend Aristocrats Index is up over 414%. Throw in dividends and it’s up 725%. The S&P 500 is up 312%, and 485% with dividends. The daily volatility of the Dividend Aristocrats Index has been about 11% less than the S&P 500.

Here’s how the two indexes have performed since 1990 (not including dividends).

-

Erin Burnett, CNBC All-Star

Eddy Elfenbein, February 16th, 2007 at 7:51 am

And second team all-conference in field hockey.*

But first team of our hearts!

* Those sticks scare the fuck out of me. Seriously, I carry one in my car.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His