Archive for July, 2007

-

Dow Jones & News Corp. Reach Possible Deal

Eddy Elfenbein, July 17th, 2007 at 7:36 amIt could really be happening. The Dow Jones (DJ) board will be meeting tonight to decide on Rupert Murdoch’s $5 billion offer.

This deal should have happened three months, but it’s been needlessly held up by members of the Bancroft family. Murdoch offered them a 67% premium for a stock that has done nothing for years. No, that wasn’t good enough for them.

The problem is these super voting shares of stock give unfair say to family members. These shares, which have ten times the voting power of regular shares, are perfectly legal, but I don’t see how much good comes from them.

Christopher Bancroft is trying to sink the deal by running to every hedge fund manager so he can buy more super-voting shares. Time is running out and I hope the board approves Murdoch’s offer. Ultimately, a company should be run by its shareholders. -

KKR Cancels Loan Deal for Maxeda

Eddy Elfenbein, July 16th, 2007 at 10:49 amHere’s a small story that could be the start of a much larger story (cue scary music).

Kohlberg Kravis Roberts just canceled plans to sell $1.4 billion in loans for Maxeda, a Dutch department store. The reason is that investors are turning away from risky debt. This could snowball as risk-averse investors gradually turn away marginal borrowers. People who were burned on subprime don’t want it to happen again.

Bloomberg reports:The deal is the third to be postponed or restructured by KKR in as many weeks as losses from the U.S. subprime mortgage rout make investors wary of financing leveraged buyouts. New York-based KKR is trying to raise 9 billion pounds ($18 billion) this week to finance its takeover of Nottingham, England-based drugstore chain Alliance Boots Plc.

KKR abandoned the debt sale for Amsterdam-based Maxeda after failing to entice investors by reducing prices for the debt and introducing covenants to restrict future borrowing. Citigroup Inc. and ABN Amro Holding NV have guaranteed to provide the financing.

“Due to current volatility of the credit markets, Citigroup and ABN Amro have decided to postpone syndication to a later stage when they expect markets to have stabilized,” Maxeda spokesman Arnold Drijver said today. The company’s financing “is in place,” he said.I wish them well. The sad part is that they’re being punished for the lousy decisions of others.

-

Waitress Wins CNBC Stock-Picking Contest

Eddy Elfenbein, July 16th, 2007 at 7:08 amCongratulations to Mary Sue Williams of St. Clairsville, OH.

The waitress and former welder (no really) won CNBC’s Million Dollar Portfolio Contest. Williams said she’s never watched the network or bought a stock in her life. Somehow, she overcame this to win the contest (that’s sarcasm).

By the way, several contestants were disqualified for cheating. I’m guessing they have bought stocks and watch CNBC all the time. -

Robert M. Solow on Joseph Schumpeter

Eddy Elfenbein, July 14th, 2007 at 11:51 pmFrom the New Republic:

In my view — and that of most contemporary economists, I believe — Schumpeter’s most original and most lastingly significant book was Theory of Economic Development, which appeared in 1911 (and was translated into English in 1934). It was at the University of Czernowitz, not far from the beginning of his career as an economist, that he worked out his conception of the entrepreneur, the maker of “new combinations,” as the driving force and characteristic figure of the fits-and-starts evolution of the capitalist economy. He was explicit that, while technological innovation was in the long run the most important function of the entrepreneur, organizational innovation in governance, finance, and management was comparable in significance.

-

The Stock Market Moves Closer to Fairly Valued

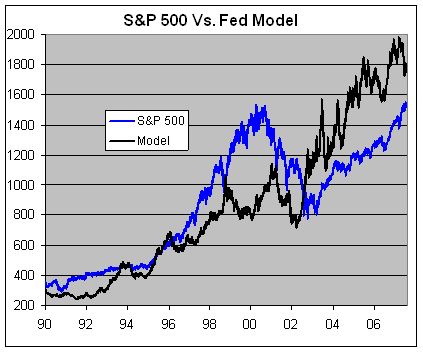

Eddy Elfenbein, July 13th, 2007 at 6:19 amAccording to the “Fed Model,” the stock market is still undervalued but a lot less than it was a few weeks ago.

Thanks to yesterday’s big market move and the recent uptick in long-term rates, the stock market is currently 12.5% undervalued according to the Fed Model compared with over 30% just four months ago.

There are many variations on the Fed Model. For our purposes, I use the trailing twelve months of smoothed operating earnings and the 10-year Treasury bond. The current yield on the T-bond is 5.116% so the inverse works out to a P/E ratio of 19.55, and the market’s P/E ratio is 17.09.

Here’s a look at the S&P 500 and the Fed Model.

The market has been undervalued for five straight years.

Preemptive Strike on Critics: No, I’m not saying this is the perfect measure of the market. It’s simply one measure (a good one) and should always be seen in context of other measures of valuation.

Obviously, it can also be saying that the bond market is overpriced. Also, “overpriced” doesn’t have a big impact on what the market actually does. In fact, only when the market is 41% or more overpriced does history suggest that it’s worth selling. -

Rahodeb Greatest Hits

Eddy Elfenbein, July 12th, 2007 at 8:36 pmEarlier, it was reported that Whole Foods CEO John Mackey was posting under the name “rahodeb” on Yahoo Finance message boards.

If you think I have so little to do but find his most obnoxious posts…you know me too well.

Pull up a chair and an organic kumquat, here we go:

#1:Thanks for your pity. I don’t need it though. If I told you how many shares in Whole Foods I actually own you wouldn’t believe me.

#2:

I like Mackey’s haircut. I think he looks cute! If his hair bothers you now you should have seen what it looked like 10 years ago! The guy was/is clearly into alternative lifestyles and is one of Paul Ray’s Cultural Creatives I outlined in my 2 posts to Hedge.

You must not patronize any of WFMI’s stores. Tatoos, piercings, unusual dress, and interesting haircuts are everywhere in the stores. In comparison, Mackey looks like a model for Brooks Brothers!

#3:

Oh yes, “the John Mackey identity theory”. I’ve heard it a few times before on this Board. Believe it if you wish since it enhances the value of what I write.

#4:

Surgeon Genrl,

I’ve stated my identity on this board before, but no one apparently believed me. I am George W. Bush and a long-time customer of Whole Foods Market. I own quite a bit of stock in the company and have owned it since the IPO back in 1992. HOG152 is my father, George H.W. Bush.

Ideas are ideas, facts are facts, and arguments are arguments. They all stand (or fall) on their own regardless of their source. At the end of the day it doesn’t matter what my non-screen identity really is or what yours is or who anyone else’s is on this board. dcc7 has claimed that my true identity is John Mackey. You can believe that one or not. Doesn’t matter to me. If I really am Mackey then I’m the ultimate insider at Whole Foods and you would be well served to pay attention to what I have to say on this board. If you don’t believe I’m Mackey (admittedly the idea seems pretty far fetched) then you should still pay attention to what I have to say on this board if my ideas and arguments make sense. If they don’t make sense or you disagree with me–well that’s what bulletin boards like this are all about.

#5:

Hey, we aren’t a first name basis!

I’m

glad you’ve got a category for me! Gosh, so I’m a New

Ager! I wondered what I was. Now that you’ve got a

category for me I guess my ideas and arguments don’t need

to really be taken seriously. FYI–I don’t think of

myself as a “New Ager”. Where I live I will keep

private. While I’m not a “Mackey groupie”, I do

admire

what the man has accomplished–building a $1.6 billion

business from scratch is quite an achievement. What have

you accomplished in comparison whtmewrry 99? If you

want to understand WFMI’s past, current, and

future

success you will need to understand that there are about

50 million adults in the United States who share

very similar lifestyles and values to myself. Paul

Ray’s research strongly supports this proposition. Who

is Paul Ray? He has a Ph.D in sociology and

is

the executive vice president of American LIVES, a

research firm in Oakland, CA. His 160 page study on the

Integral Cultural Survey can be found at the Institute of

Noetic Sciences–415-331-5650. His summary of this study

was written in the February 1997 issue of American

Demographics. Two recent articles by Ray can be found in the

Natural Business LOHAS Journal–303-442-8983. He has a

book on his research due to be published sometime

in

2000. -

Charge!

Eddy Elfenbein, July 12th, 2007 at 7:28 pm

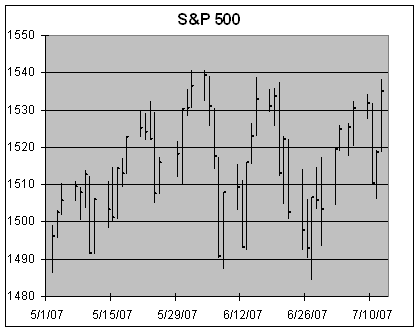

I defended the bull market on October 25 when the S&P 500 was at 1382. I did it again on February 22 when the S&P was at 1456.

Today, the S&P 500 closed at 1547.70.

Here’s how the entire S&P 500 did today. -

Nice Turnaround

Eddy Elfenbein, July 12th, 2007 at 2:24 pm

Just 28 hours ago, the S&P 500 looked like it was going to fall below 1,500, and now we’re close to a new all-time high. The previous high was 1539.18 reached on June 4. -

It’s Over: Biomet Shareholders Accept $46 Offer

Eddy Elfenbein, July 12th, 2007 at 12:50 pmThey needed 75% and they got 83%.

Biomet Inc. shareholders accepted a $11.4 billion buyout offer from a private equity consortium attempting to acquire the medical device maker.

The consortium, LVB Acquisition LLC, announced Thursday that nearly 83 percent of Biomet’s shares were tendered. The company needed at least 75 percent for the deal to go forward. The offer expired midnight Wednesday.

In June, LVB Acquisition offered $46 a share to buy the Warsaw, Ind.-based company, which closed the day prior at $45.48 per share. Biomet shares traded up 13 cents midday Wednesday to $45.92.

The private equity group includes Biomet founder and former chief executive Dane A. Miller and affiliates of the Blackstone Group, Goldman Sachs Capital Partners, Kohlberg Kravis Roberts & Co. and TPG.

Biomet spokesman Greg Sasso said the deal would close by the end of the calendar year, but he declined to give a more specific time frame. -

John Mackey Channels Patrick Byrne

Eddy Elfenbein, July 12th, 2007 at 11:14 amFrom DealBook:

John P. Mackey, the co-founder of Whole Foods Market, has never lacked for personality. As it turns out, that was only the half of it. For seven years, Mr. Mackey had an online alter ego.

Using the pseudonym Rahodeb — a variation of Deborah, his wife’s name — Mr. Mackey typed out more than 1,100 entries on Yahoo Finance’s bulletin board over a seven-year period, championing his company’s stock and occasionally blasting a rival, Wild Oats Markets, that his company later went on to buy. The story was first disclosed on The Wall Street Journal’s Web site last night.

Responding to a posting on March 28, 2006, Rahodeb wrote: “OATS has lost their way and no longer has a sense of mission or even a well-thought-out theory of the business. They lack a viable business model that they can replicate. They are floundering around hoping to find a viable strategy that may stop their erosion. Problem is that they lack the time and the capital now.”

Mr. Mackey apparently did not fool participants on the forum, who occasionally tried to out Rahodeb. In one instance, he responded by saying that he was in fact George W. Bush.

The attacks were made on Yahoo! financial forums, under the name “Rahodeb,” and included such postings as “Would Whole Foods buy OATS? Almost surely not at current prices…What would they gain? OATS locations are too small.” Rahodeb also said Wild Oats’ management “clearly doesn’t know what it is doing.” The company, he wrote, “has no value and no future.”

In February, Whole Foods announced it would buy Wild Oats for about $565 million, or $18.50 per share.

Mr. Mackey declined an interview request from The Wall Street Journal but did post on the company Website saying that the F.T.C. was quoting Rahodeb “to embarrass both me and Whole Foods.” He also said: “I posted on Yahoo! under a pseudonym because I had fun doing it. Many people post on bulletin boards using pseudonyms…I never intended any of those postings to be identified with me.”

Mr. Mackey’s post continued: “The views articulated by rahodeb sometimes represent what I actually believed and sometimes they didn’t. Sometimes I simply played ‘devil’s advocate’ for the sheer fun of arguing. Anyone who knows me realizes that I frequently do this in person, too.”

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His