Archive for September, 2007

-

The Money Honey Turns 40

Eddy Elfenbein, September 10th, 2007 at 3:44 pm

Happy Birthday Maria from everyone at Crossing Wall Street! -

The Infantilization of Corporate America.

Eddy Elfenbein, September 10th, 2007 at 3:21 pmIn the Weekly Standard, Matt Labash has a sharp take on how Corporate America forces the fun on its employees.

There is, of course, a consultant for everything these days. Professional consultant-basher Martin Kihn, who is himself a consultant, and who wrote House of Lies: How Management Consultants Steal Your Watch and Then Tell You the Time, writes of everything from flag consultants to compost consultants to Satanic consultants who don’t actually worship Lucifer (consultants tend not to believe in anything). So it stands to reason that with the new core value of fun on the ascent, there would be fun consultants. They don’t have a trade association yet, and they go by all sorts of different names, usually with “fun” as a prefix (funsultants, funcilitators, etc). But if you had to distill what they do in one word, “fun” would be your best bet.

A considerable corpus of literature on their discipline is amassing. I use the word “literature” loosely, to mean a series of often ungrammatical double-spaced sentences put on paper, slapped between festively colored covers, and sold to mouth-readers with too much discretionary income. While most business books, according to Kihn, are written on about a 7th-grade level (there are exceptions like Who Moved My Cheese? for Teens that are written on a 5th-grade level), the funsultant literature regresses all the way back to primary school. Since we all forget to play as adults, as funsultants repeatedly tell us, they seem intent on speaking to us as though we’re children.

Their books are thick with instances of how successful businessmen keep things loosey-goosey at work. Forget industriousness, talent, and know-how–the wellspring of employees’ satisfaction, creativity, and prosperity is fun. In Mike Veeck’s Fun Is Good, the cofounder of Hooters Restaurants reveals, “I don’t know if we could’ve survived without humor,” whereas to the untrained eye it looked like Buffalo Chicken Strips served with large sides of waitress’s breasts were the secret to his success. Whatever. “Fun” is the cure-all for anything that ails your company. -

Could We Be in a Recession Right Now?

Eddy Elfenbein, September 10th, 2007 at 2:56 pmIn the wake of Friday’s dismal jobs report, Kevin Hassett explains the Hamilton model:

The Hamilton model is intuitively quite simple, but in practice it has had a revolutionary impact on the way economists view recessions.

The model works like this: Assume that God sits in a room with two urns (colored red and black) before him. Each urn is filled with little balls that have numbers written on them. In the black urn, the average number on the balls is about 2 1/2, but the numbers vary widely. In the red urn, the average number on the balls is about negative 1/2, though the numbers also vary.

Each quarter, God pulls a number out of one of the urns, and that number becomes U.S. gross domestic product growth for that three-month period. In addition, he tends to take a ball from the urn he drew from in the previous period.

In this setting, the problem for the econometrician is relatively simple. He must identify at any given time whether God is drawing from the red or the black urn. Say we observe a negative GDP number. It might be that the number is from the red urn, and that we have entered a recession. It may also be that the draw was from the black urn, and was just negative because of noise.

Next Report Crucial

How can you tell if the number was drawn from the red “recession urn”? Hamilton’s model tells us that the key is what happens next. If God made a bad draw from the good urn, then the next draw will be back around 2 1/2. If he made a bad draw from the other urn, then the next draw will be negative as well. As the sequence of negative numbers builds up, our feeling that God is drawing from the bad urn grows.

So a crucial thing to watch will be the next report. If it, too, is negative, then we will have had two such employment reports in a row. Since 1960, we have never had two consecutive negative employment months, except for during or shortly after a recession. One could reasonably conclude that God has turned to the red urn. There will be lots of public opinion about a recession between now and then, yet we won’t know until we see the number.Basically, what he’s saying is that the economy operates on two distributions, one for expansions and another for contracts. Due to the deviations, one might be disguised as the other. We’ll know more with more data. Obviously, getting two lousy reports during an expansion is very rare. In fact, we might be in a recession right now.

For the last five quarters, the economy has grown by 2.54% which is nearly 0.5 standard deviations below the mean. -

Hard Times for Title Insurers

Eddy Elfenbein, September 10th, 2007 at 9:44 amOne of my favorite industries to watch is title insurance. Yes, it’s boring but it’s also a low-risk business with steady and consistent and variables. (Here’s an earlier post on the sector.)

Right now, however, is a rotten time for the sector. Stocks like Fidelity National (FNF) and First American (FAF) are down a lot and going for very low valuations. FNF is going for less than 10 times trailing earnings and it pays a dividend of 7%. It looks like earnings aren’t going to get better soon.

Today, the WSJ took a closer look at the problems facing title insurers:“In times of economic loss, title claims go up,” says Theodore L. Chandler Jr., chief executive of LandAmerica Financial Group Inc., another big title insurer based in Richmond, Va. There was a severe spike in claims, for instance, during the recession in the early 1990s.

Moreover, some title insurers are reporting a drop in new business. While that might not sound particularly surprising, given the real-estate slowdown, it could be a glimpse of more trouble ahead: Title-search orders usually come at least several weeks before a buyer takes out a mortgage.

“If you want to know what’s going on with mortgage activity, you look at title orders,” says Nik Fisken, an insurance-industry analyst at Stephens Inc.

First American says average daily title orders were down 6% in July from June and that preliminary results indicate another 9.3% drop from July to August. Fidelity National Financial, a major title insurer based in Jacksonville, Fla., says there was a nearly 8% decline between April and June.

Fidelity National hasn’t disclosed additional data about more recent months. But Chief Financial Officer Anthony Park says, “It’s slowed down considerably, particularly in the month of August.”I can’t say when yet, but sometime soon will be a great buying opportunity.

-

Worst. Credit Card. Ever.

Eddy Elfenbein, September 10th, 2007 at 9:25 amLadies and Gentlemen, put your hands together for the Continental Finance MasterCard. This one is truly awful. Here are the details:

* Account setup fee: $99

* Program participation fee: $89

* Annual fee: $49

* Account maintenance fee: $120 (charged @ $10/month)

* Purchase APR: 19.92%

* Authorized user fee: $30 (great! seems like $53 credit is a bit too much for a single person to handle)

* Credit limit increase fee: $25 (and you don’t even have to ask for it!) You need to call these people and ask them to stop; otherwise, they are automatically going to increase the limit by $100 each time and charge you the $25 fee.

* Internet payment fee: $4 for each authorized internet payment. I just don’t get this – why are people with bad credit charged for paying their bills online? .. probably to make sure that they don’t start paying their bills automatically or something?

-

Greenspan Compares Current Market to 1837

Eddy Elfenbein, September 9th, 2007 at 9:39 pmMr Greenspan said: “The behaviour in what we are observing in the last seven weeks is identical in many respects to what we saw in 1998, what we saw in the stock-market crash of 1987, I suspect what we saw in the land-boom collapse of 1837 and certainly [the bank panic of] 1907.”

I’m skeptical of comparing markets against five years ago. At 170 years, I not only stop listening to the comparison, but also the guy doing the comparing.

-

Harley Drops Its Forecast

Eddy Elfenbein, September 7th, 2007 at 10:31 amThe Milwaukee-based manufacturer said it now expects 2007 earnings of $3.69 a share to $3.77 a share, well below the average forecast of $4.12 a share in a survey of analysts by Thomson Financial.

Moreover, Harley-Davidson reduced its estimate for third-quarter shipments to a range of 86,000 to 88,000 units, from 91,000 to 95,000 previously.

“Initial reports about our 2008 model-year motorcycles from our dealers and the media have been excellent, but this is a difficult time for the U.S. consumer,” said CEO Jim Ziemer in a statement. “However, our U.S. dealers’ retail sales have fallen sharply during August.”

Against the current economic background, Harley-Davidson said it no longer expects worldwide dealer retail sales to increase during the second half of this year, with a “modest” revenue decline for 2007 and earnings per share falling 4% to 6%.

For 2008, management now expects the U.S. retail environment to continue to be challenging for motorcycle sales, with moderate revenue growth, narrower operating margins and earnings-per-share growth between 4% and 7%.

Analysts have been expecting 2008 earnings of $4.51 a share, on average.

Harley-Davidson also withdrew its financial forecast for 2009. -

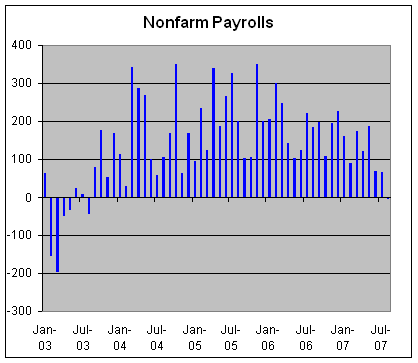

Today’s Jobs Report

Eddy Elfenbein, September 7th, 2007 at 9:13 amThis morning’s jobs report was a bit of a surprise. The economy lost 4,000 jobs last month. This is the first job loss in four years. Of course, the initial jobs report gets revised again and again, but this is the first serious evidence that the economy is going into, or perhaps is already in a recession. The economy needs to produce about 150,000 new jobs each month just to absorb population growth.

Here’s a look a monthly nonfarm payroll gains. And losses.

The economy has created far fewer jobs in this expansion than in the previous one. Some observers have thought this signals underlying weakness in the economy. I wasn’t so sure. Not all economies look the same, and this current one has been marked by strong growth in corporate profits but timid job growth. Instead of making grandiose political claims, I simply think that’s the style of this recovery.

The unemployment rate stayed the same at 4.6%. I looked at the raw numbers and the unemployment actually had a teeny decline from 4.6472% in July to 4.6419 in August.

Let’s remember that we had nearly 24 straight years where the unemployment was never this low. A lot of that time was quite good for equity prices. -

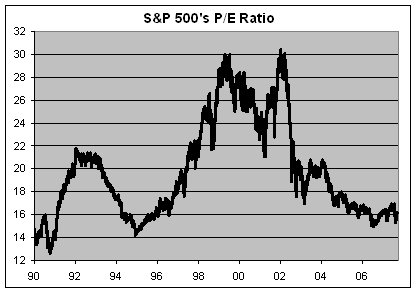

Does This Look Like a Bubble to You?

Eddy Elfenbein, September 6th, 2007 at 7:48 pmNot to me but a lot of folks would say yes.

-

Radio Silence

Eddy Elfenbein, September 6th, 2007 at 4:07 pmSorry for the lack of postings today. I was at the DC Money Show which is just a few blocks from Crossing Wall Street Global HQ.

I saw many of the famous names (Forbes, Battipaglia, Kudlow). I’m not sure what to make of this but I also saw a well-dressed woman in her golden years…well-dressed except for her lime green Crocs. I think that may be the sign of a top.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His