Archive for January, 2008

-

Discover’s Horrible Spin-Off

Eddy Elfenbein, January 18th, 2008 at 10:05 amLast month, Morgan Stanley’s CFO, Colm Kelleher, said “If you were to normalize our business and take out this $9.4 billion charge, you would see that we had a record year across the whole enterprise.”

In other words, if you ignore the losses, we’re doing quite well. Somehow, the market wasn’t terribly impressed. Since July, Morgan’s stock has plunged from $70 to $45.

But here’s the thing, their performance is even worse if you recall that Morgan spun-off Discover Financial Services (DFS). I’m usually a big fan of spin-offs, but Discovery has been a disaster. Since its July debut at $26, shares of DFS have plunged to $13 today. -

CEO of the Princeton Economics Department

Eddy Elfenbein, January 18th, 2008 at 6:31 am

Notice that GS ticks down a penny when she mentions it, then up a penny when he corrects her. Score one for EMH.

(Via Mankiw) -

Quote of the Day

Eddy Elfenbein, January 17th, 2008 at 5:57 pmBen Bernanke on growing up Jewish in South Carolina:

Being a member of a minority taught him about discrimination and prejudice. “There was more than one request to see my horns,” he said years later.

-

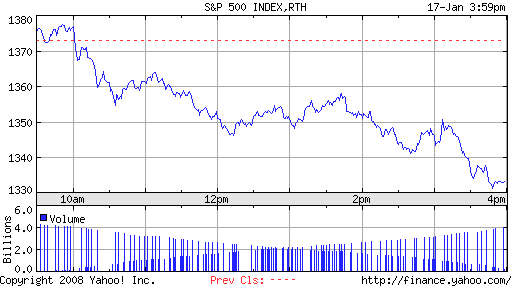

Dow -309.95

Eddy Elfenbein, January 17th, 2008 at 5:23 pmWow…that sucked.

-

The Ballad of Jim Cramer

Eddy Elfenbein, January 17th, 2008 at 3:30 pm

That’s really good. I like the catchy tune. -

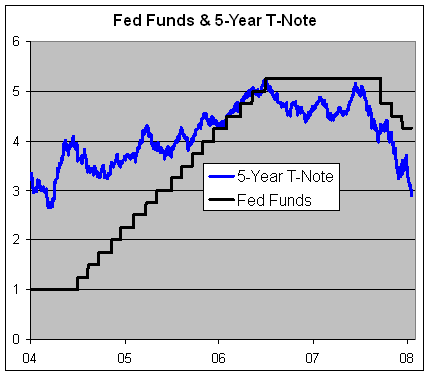

The Bond Bubble Grows

Eddy Elfenbein, January 17th, 2008 at 2:08 pmThe five-year T-note (^FVX) is under 3% today. Six months ago, it was going for 5%. Notice how you never hear the media talk about “irrational exuberance” or “runaway bubbles” in the bond market. Bond traders are always assumed to be right.

This is obviously theoretical, but if I ran a bank, I’d rather short the five-year note than borrow at the Fed Funds rate.

-

Earnings from Amphenol and Clarcor

Eddy Elfenbein, January 17th, 2008 at 11:20 amTwo earnings reports from Buy List stocks to pass along.

Amphenol (APH) had a great report but the stock is pulling back this morning. For Q4, APH earned 55 cents a share, three cents more than the Street was expecting. Last year, APH made 43 cents a share for Q4. Even better, the company gave good guidance going forward:For 2008, the company expects a profit between $2.18 and $2.25 per share on revenue between $3.1 billion and $3.18 billion. Last year, profit reached $353.2 million, or $1.94 per share, and sales hit $2.85 billion.

Analysts project earnings of $2.22 and revenue at $3.13 billion, according to Thomson Financial.

“We are cautiously optimistic (Yuck! I hate the phrase! – EE) about continuing improvement in the short term and very confident about the long term outlook for continued growth and profitability,” the company said in a statement.

For the current quarter, Amphenol anticipates net income of 50 cents to 52 cents per share and revenue between $740 million and $755 million.

Analysts expect a profit of 51 cents per share and revenue of $741 million.Personally, I was looking for a little better guidance than what we got. Although, APH had a pretty strong run from August to December, so maybe it’s simply profit-taking today. Assuming $2.22 a share for 2008, that’s a P/E of 16.5, which isn’t bad for APH.

After the closing bell yesterday, Clarcor (CLC) reported earnings of 53 cents a share.For the quarter ended Dec. 1, Clarcor earned $26.7 million, or 53 cents per share, compared with $26.7 million, or 52 cents per share, for the same quarter in 2006. The company had fewer shares outstanding in the recent period.

Analysts polled by Thomson Financial expected income of 51 cents per share.

Sales rose 2.4 percent to $238.3 million from $232.6 million in the year-ago period.

Operating margins were 16.8 percent in both periods. Clarcor said foreign currency fluctuations improved the recent quarter’s sales by $6 million.

For the full year, Clarcor earned $90.7 million, or $1.78 per share, compared with $82.7 million, or $1.59 per share, for 2006. Sales rose to $921.2 million from $904.3 million the year before.The company also said that it expects 2008 EPS of $1.85 to $2.05 (sheesh, kinda wide range). The Street consensus is for $1.92.

Here’s a spreadsheet of Clarcor’s results for the past few years. -

The Education of Ben Bernanke

Eddy Elfenbein, January 17th, 2008 at 8:07 amBehold! Roger Lowestein’s 8,000 word article on Ben Bernanke. Here’s a very small sample:

Bernanke grew up in the small town of Dillon, S.C., at the tail end of the segregation era (in high school he wrote a schoolboy’s novel about whites and blacks coming together on the basketball team). His father and his uncle ran a local drug store. Folks trustingly called them Dr. Phil and Dr. Mort. Ben, who skipped first grade, was obviously smart from the get-go. He played the saxophone, just as Greenspan did, and waited tables two summers and worked construction another. The Bernankes were observant Jews, and Ben’s folks fretted when he got into Harvard that if he strayed from home he might wander from his religious teachings. It was never a risk. Judaism is important to Bernanke, though, as with other personal subjects, he does not discuss it. As a doctoral candidate at M.I.T., he blossomed into a star, and at the tender age of 31 he received a tenured position in the economics department at Princeton.

His academic research was steeped in the increasingly sophisticated discipline of econometrics, which uses computer models to simulate (and predict) the economy. By contrast, Greenspan often relied on his hunches. The difference is partly generational, but Bernanke is clearly more comfortable working with mathematical formulas than with anecdotal examples. (One looks in vain in his Depression writings for stories of banks that failed or of workers who lost their jobs.) -

“The first thing we do, let’s kill all the lawyers”

Eddy Elfenbein, January 17th, 2008 at 7:14 amRetirees claim Morgan Stanley broker gave bad advice

ROCHESTER, N.Y. (AP) – A group of investors is suing Morgan Stanley, claiming a broker gave them bad financial advice when he persuaded them to retire early from Eastman Kodak Company and Xerox Corporation.

In a lawsuit filed today in state court, seven former employees maintain that they were promised ample savings for early retirement by broker Michael James Kazacos. They say the savings never materialized and many of them are now almost broke.

The lawsuit seeks more than $$140 million in compensatory damages and class-action status. It claims the retirees were persuaded to retire beginning in the late 1990s and told they could live off the returns their money would generate if invested with Morgan Stanley. -

Market Hits New Low

Eddy Elfenbein, January 16th, 2008 at 4:24 pmThe S&P 500 closed today at 1373.20, the lowest close since November 3, 2006 which was the Friday before the mid-term election.

July 1, 1999 was the first time the S&P 500 closed above this level.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His