Archive for July, 2008

-

Markets in Everything

Eddy Elfenbein, July 17th, 2008 at 2:05 pmAt Intrade, Senator Obama’s contract to win the presidency is up to 66.1 and McCain’s is at 29.8.

But here’s the noteworthy part. Hillary’s contract is still around and it’s at 4.6; Gore’s is at 2.0. Yesterday, a trade for Hillary went off at 6.9.

Obviously, a tragic event isn’t the only scenario in mind. But still, is the unthinkable really that probable? -

Danaher and Math

Eddy Elfenbein, July 17th, 2008 at 1:03 pmMaybe I’m missing something, but I’m going through Danaher’s (DHR) earnings report and the numbers don’t add up. For the second quarter, the company earned $363.448 million and the number of diluted shares is 336.551. That comes to $1.08 a share while the company lists it as $1.09. I know it’s just a penny, but there shouldn’t be any mistakes here. That really undermines my faith in a company.

Am I missing something? -

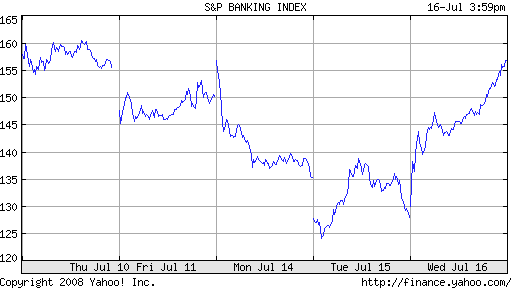

Banking Index +22%

Eddy Elfenbein, July 16th, 2008 at 5:41 pmThe S&P Banking Index (^BIX) jumped 22% today. That’s not one stock; that’s the entire index!

-

Is it Time to Raise Rates?

Eddy Elfenbein, July 16th, 2008 at 1:19 pmMegan McArdle says yes. Today’s inflation report shows that consumer prices rose by 1.1% last month which is the largest jump in 26 years. For the last 12 months, the headline rate has been 5.02% while the core rate is 2.41%. With the Fed at 2%, this means that real interest rates are still negative.

The market isn’t expecting the Fed to raise rates anytime soon. According to the Cleveland Fed, the futures market is pretty much convinced (over 80%) that the Fed will hold steady at its August meeting.

Going by Professor Mankiw’s Fed Funds Rate equation, the Fed is way too loose. His equations is:Federal funds rate = 8.5 + 1.4 (Core inflation – Unemployment)

Let’s plug in the numbers the numbers from June:

Federal funds rate = 8.5 + 1.4 (2.41 – 5.50)

That comes to a rate of 4.174% which is more than double where the Fed is.

-

Buy List Earnings

Eddy Elfenbein, July 16th, 2008 at 10:13 amThe next few days will be busy for a few stocks on our Buy List. Here are some upcoming earnings dates and Wall Street’s current estimate.

Amphenol (APH)……………..….….July 17…………..$0.58

Danaher (DHR)………………..…….July 17…………..$1.06

Harley-Davidson (HOG).….…….July 17…………..$0.76

Stryker (SYK)…………………….….July 17…………..$0.73

Lincare (LNCR)………………..…….July 21…………..$0.71

Unitedhealth Group (UNH)….….July 22…………..$0.65

AFLAC (AFL)………………………….July 23…………..$1.01

SEI Investments (SEIC)………….July 23…………..$0.33

WR Berkley (WRB)…………..…….July 23…………..$0.85

Fiserv (FISV)………………………….July 29…………..$0.80 -

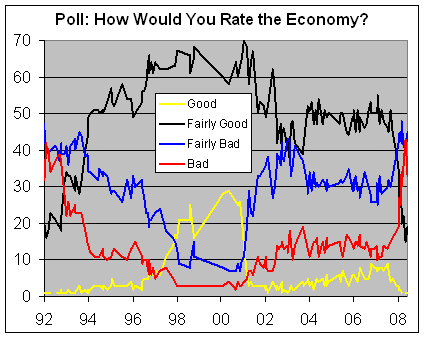

Poll: How Would You Rate the Economy?

Eddy Elfenbein, July 15th, 2008 at 11:04 pmLook at the enormous recent change in perceptions of the economy.

Nearly 40% of the public has shifted its opinion of the economy in the last 12 months. -

Citigroup Shares Fall to Lowest Since Company Formed in 1998

Eddy Elfenbein, July 15th, 2008 at 11:15 amCitigroup Inc., the biggest U.S. bank, fell to the lowest level in New York trading since former Chairman and Chief Executive Officer Sanford Weill created the company through a merger in October 1998.

Citigroup, which has lost almost half its value on the New York Stock Exchange this year, dropped 43 cents to $14.79 at 9:31 a.m., the lowest since Oct. 8, 1998, the day the New York-based bank was formed through the $36 billion combination of Travelers Group Inc. and Citicorp.It’s rail on Citigroup Day at Crossing Wall Street. It turns out the bank also likes to keep a couple of assets “off the balance sheet.” By couple, I mean $1.1 trillion.

When talking about Citigroup, it’s hard to explain how large this company—and I think its size is part of the problem. Citi has 374,000 employees which isn’t much less than the size of Washington. Citi’s payroll, however, will be declining over the next few months.

According to Citi’s most recent balance sheet, the company has assets of $2.187 trillion, and liabilities of $2.087 trillion. That’s amazingly large, and that’s just the stuff on the books.

The company is due to report earnings on Friday and it won’t be pretty. The analysts are all over the map on this one, but the consensus is listed as -61 cents a share. I think taking the under is a pretty safe bet.

Six months ago, the company reported a loss of nearly $10 billion. Three months ago, Citi reported a loss of $5 billion. -

The S&P 500 Bounces Off 1,200

Eddy Elfenbein, July 15th, 2008 at 10:52 amThe S&P 500 hit a low of 1200.43 this morning. The index hasn’t broken through 1,200 since Halloween 2005. We first broke 1,200 on December 23, 1998.

The VIX also above 30 for the first time since March. -

Ben’s Testimony

Eddy Elfenbein, July 15th, 2008 at 10:40 amHere’s part of today’s testimony from Ben Bernanke:

The U.S. economy and financial system have confronted some significant challenges thus far in 2008. The contraction in housing activity that began in 2006 and the associated deterioration in mortgage markets that became evident last year have led to sizable losses at financial institutions and a sharp tightening in overall credit conditions. The effects of the housing contraction and of the financial headwinds on spending and economic activity have been compounded by rapid increases in the prices of energy and other commodities, which have sapped household purchasing power even as they have boosted inflation. Against this backdrop, economic activity has advanced at a sluggish pace during the first half of this year, while inflation has remained elevated.

Following a significant reduction in its policy rate over the second half of 2007, the Federal Open Market Committee (FOMC) eased policy considerably further through the spring to counter actual and expected weakness in economic growth and to mitigate downside risks to economic activity. In addition, the Federal Reserve expanded some of the special liquidity programs that were established last year and implemented additional facilities to support the functioning of financial markets and foster financial stability. Although these policy actions have had positive effects, the economy continues to face numerous difficulties, including ongoing strains in financial markets, declining house prices, a softening labor market, and rising prices of oil, food, and some other commodities. Let me now turn to a more detailed discussion of some of these key issues.

Developments in financial markets and their implications for the macroeconomic outlook have been a focus of monetary policy makers over the past year. In the second half of 2007, the deteriorating performance of subprime mortgages in the United States triggered turbulence in domestic and international financial markets as investors became markedly less willing to bear credit risks of any type. In the first quarter of 2008, reports of further losses and write-downs at financial institutions intensified investor concerns and resulted in further sharp reductions in market liquidity. By March, many dealers and other institutions, even those that had relied heavily on short-term secured financing, were facing much more stringent borrowing conditions.

In mid-March, a major investment bank, The Bear Stearns Companies, Inc., was pushed to the brink of failure after suddenly losing access to short-term financing markets. The Federal Reserve judged that a disorderly failure of Bear Stearns would pose a serious threat to overall financial stability and would most likely have significant adverse implications for the U.S. economy. After discussions with the Securities and Exchange Commission and in consultation with the Treasury, we invoked emergency authorities to provide special financing to facilitate the acquisition of Bear Stearns by JPMorgan Chase & Co. In addition, the Federal Reserve used emergency authorities to establish two new facilities to provide backstop liquidity to primary dealers, with the goals of stabilizing financial conditions and increasing the availability of credit to the broader economy. We have also taken additional steps to address liquidity pressures in the banking system, including a further easing of the terms for bank borrowing at the discount window and increases in the amount of credit made available to banks through the Term Auction Facility. The FOMC also authorized expansions of its currency swap arrangements with the European Central Bank and the Swiss National Bank to facilitate increased dollar lending by those institutions to banks in their jurisdictions.

These steps to address liquidity pressures coupled with monetary easing seem to have been helpful in mitigating some market strains. During the second quarter, credit spreads generally narrowed, liquidity pressures ebbed, and a number of financial institutions raised new capital. However, as events in recent weeks have demonstrated, many financial markets and institutions remain under considerable stress, in part because the outlook for the economy, and thus for credit quality, remains uncertain. In recent days, investors became particularly concerned about the financial condition of the government-sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. In view of this development, and given the importance of these firms to the mortgage market, the Treasury announced a legislative proposal to bolster their capital, access to liquidity, and regulatory oversight. As a supplement to the Treasury’s existing authority to lend to the GSEs and as a bridge to the time when the Congress decides how to proceed on these matters, the Board of Governors authorized the Federal Reserve Bank of New York to lend to Fannie Mae and Freddie Mac, should that become necessary. Any lending would be collateralized by U.S. government and federal agency securities. In general, healthy economic growth depends on well-functioning financial markets. Consequently, helping the financial markets to return to more normal functioning will continue to be a top priority of the Federal Reserve. -

Jim Rogers Lets Loose

Eddy Elfenbein, July 14th, 2008 at 12:16 pmJim Rogers overcomes his shyness to express some dissatisfaction with the government:

U.S. investor Jim Rogers said the U.S. government’s plan to bolster Fannie Mae and Freddie Mac is an “unmitigated disaster.”

The largest U.S. mortgage lenders are “basically insolvent” after the collapse of the subprime mortgage market, said Rogers, who in April 2006 correctly predicted oil would reach $100 a barrel and gold $1,000 an ounce.

Taxpayers will be saddled with debt if Congress approves Treasury Secretary Henry Paulson’s request for the authority to buy unlimited stakes in and lend to the beleaguered companies that purchase or finance almost half of the $12 trillion in U.S. home loans, Rogers said.

“These companies were going to go bankrupt if they hadn’t stepped in to do something, and they should go bankrupt,” Rogers said.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His