Archive for August, 2008

-

Citigroup Trader “Dooced”

Eddy Elfenbein, August 8th, 2008 at 1:08 pmMichael J. McCarthy aka “Large” has been fired from his job as a Citigroup trader for running his blog, Take A Report.

“This employee was terminated for behavior that violated the firm’s code of conduct and policies,” Citigroup spokeswoman Danielle Romero-Apsilos said. McCarthy, a vice president, declined to comment on his departure from the New York-based bank. Financial industry regulatory records show he’s been at Citigroup for seven years, most recently trading shares of utility and power companies.

“It’s a little over the top,” said Barry Ritholtz, director of equity research for New York-based Fusion IQ, who has looked at the site and has his own financial blog at www.bigpicture.typepad.com. “I can see why a conservative bank is not going to be happy with it. It’s funny as hell.” -

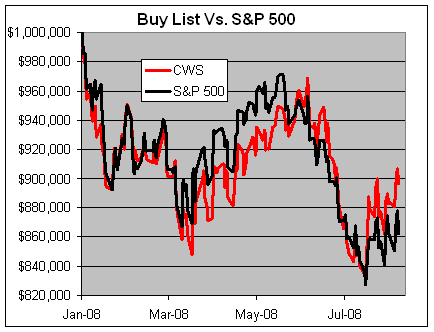

My Buy List YTD

Eddy Elfenbein, August 7th, 2008 at 10:47 pm

Through today, the Buy List is down -10.39% while the S&P 500 is down -13.78%. Neither figure includes dividends. The daily volatility of the Buy List is 7.17% greater than the S&P 500. -

Analyst says Bed Bath & Beyond well positioned

Eddy Elfenbein, August 7th, 2008 at 2:02 pmFrom the AP:

An analyst said Thursday that Bed Bath & Beyond Inc. remains one of the “best operators” in its sector and will likely withstand the nation’s economic downturn better than many of its competitors.

Oppenheimer & Co. analyst Vivian Ma told investors in a research note that the Union, N.J.-based specialty home retailer has no plans to cut back on reinvestments.

“We believe that (Bed Bath & Beyond) remains one of the best operators in the home goods space and should continue to navigate the challenging consumer environment better than the competition,” Ma wrote.

The analyst added that the retailer remains “very focused on superior execution to drive share gains. -

Cramer on Jimmy Carter: “May He Rest in Peace”

Eddy Elfenbein, August 6th, 2008 at 7:15 pm

Listen around the 4:25 mark.

For those of you who don’t remember, Jimmy Carter is the guy who defeated Gerald Ford.

Via: WallBlog.) -

Feel Good News Story of the Day

Eddy Elfenbein, August 6th, 2008 at 12:29 pmCancer survivor wins the CNBC Million Dollar Portfolio Challenge. Bonus points: He’s a member of two tribute bands, one for Queen and another for Led Zeppelin.

About 10 weeks ago, a local man using the online name of CLASSICROCKER began e-mailing friends to update them on his participation in the CNBC.com Million Dollar Portfolio Challenge.

CLASSICROCKER, known in real life as Edward Burke, had positioned himself for a possible cash prize.

On Monday, CNBC made the official announcement — Burke, 54, had won the $500,000 Grand Prize, edging out David Lesser, a mechanic from Kent, Wash., and approximately 254,000 other people.

“They kept us in the dark until the final announcement,” said Burke, a 1974 graduate of Chambersburg Area Senior High School and current Shippensburg resident. “It was suspenseful, but it was easier to take because we both knew we were going to win a quarter of a million at the very least.

“My son, Chase, texted me and said he was crying tears of joy.” -

Let’s Play “Spot the Problem”

Eddy Elfenbein, August 6th, 2008 at 12:25 pmNovember 8, 2008

December 20, 2007

August 5, 2008

-

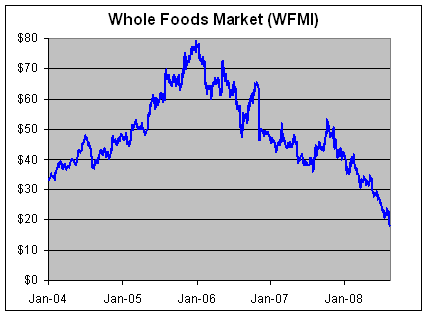

Whole Foods Hits New Low

Eddy Elfenbein, August 6th, 2008 at 12:00 pmWhole Foods Market (WFMI) just reported a rotten quarter. The company’s fiscal Q3 net dropped 31% to 24 cents a share. The Street was looking for 31 cents a share. The company also said that Q4 earnings will be 15 cents a share, which was far below the 27 cents Wall Street was expecting. The shares are down about 16% today and are now at a six-year low.

Nearly three years ago, I called out Whole Foods and its overpriced stock:I’m a big fan of Whole Food Market (WFMI), but this stock is way, WAY over-priced. Last quarter, the company missed earnings by a penny a share. In the past few weeks, Wall Street has lowered this fiscal year’s consensus earnings estimate to $2.86 a share, and the stock is still trading at 53 times that. That’s almost as much as Google (GOOG)!

Look, I like organic kumquats as much as the next guy, but let’s be reasonable. Whole Foods’ earnings will probably grow by about 17%-20%. Not bad at all. The stock, however, is already up over 60% this year.

A stock can’t go up faster than its earnings indefinitely. At some point, something’s gotta give. That’s not finance, it’s physics. Right now, the stock is going up because it’s going up. The price and fundamentals have politely parted company. On Friday, shares of Whole Foods closed at another all-time high.

-

Oh Dear Lord

Eddy Elfenbein, August 6th, 2008 at 10:00 amAccording to sources, Mr. Elfenbein described this as “wicked lame.”

-

Who Needs Diebold

Eddy Elfenbein, August 6th, 2008 at 9:57 amYahoo has updated the results of recent voting by shareholders, revealing that support for the Internet firm’s board is far weaker than it appeared.

Some 200 million votes were mistakenly cast in favor of the re-election of Yahoo chief executive Jerry Yang and board chairman Roy Bostock by an outside company used by a major stockholder.

A revised tally released on Tuesday shows Bostock got the least support, with 60.4 percent of votes in favor of his re-election instead of the 79.5 percent originally reported after the August 1 shareholders meeting.

Yang did not fare much better, winning 66.3 percent of the votes cast as opposed to the 85.6 percent figure in the miscount. Two other Yahoo board members were erroneously given the support of 100 million votes each. -

Inflation and the Markets

Eddy Elfenbein, August 5th, 2008 at 2:24 pmAccording to monthly data from Ibbotson Associates, all of the stock market’s inflation-adjusted gains have come when monthly inflation is below 3.5%.

From 1926 through 2007, there were 984 months. Of those 984 months, 436 months showed an annualized inflation increase of over 3.5%, while the other 548 came in less than 3.5%.

The combined increase of the 436 months with inflation greater than 3.5% is -1.25%. That’s over 36 years worth of data and it’s given investors an inflation-adjusted loss. However, the combined total of the 548 months with inflation under 3.5% is 27,957%. That’s quite a difference. Annualized, that works out to 13.14%.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His