Archive for August, 2009

-

Warren Buffett’s New Buy

Eddy Elfenbein, August 17th, 2009 at 9:58 amWe were very pleased to see that Warren Buffett’s Berkshire Hathaway (BRKA) has added Becton, Dickinson (BDX), one of our Buy List stocks, to his portfolio. Obviously, Warren must be a regular reader.

There is one thing that troubles us. On the SEC filing, the company is listed as Beckton Dickson & Co.

See for yourself. -

The Market’s Excessive P/E Ratio

Eddy Elfenbein, August 17th, 2009 at 9:37 amThere’s recently been some commentary on the stock market’s elevated P/E Ratio (see here and here).

I think this is a good instance where the P/E Ratio fails to tell us much. We have to remember that the P/E Ratio is an unusual statistic because it looks at the relationship between two different kinds of the numbers. A stock’s price is a fixed-point number, which means you know exactly what a price is at any given time, but earnings is a rate, meaning it must be defined at something that only exists between two certain points in time.

There’s nothing inherently wrong about combining two different kinds of numbers though we should be bear in mind its limitations and this is one such time. The reason is that earnings took such a bath in the fourth quarter of 2008. Operating earnings for the S&P 500 were $-0.09 for Q4 of 2008 and reported earnings were $-23.25. As long as we’re carrying that dud quarter in our trailing four quarters, earnings will look very depressed.

Those losses are massive outliers. The good news is that they’re also past us. At the end of the third quarter, the S&P’s trailing four-quarter operating earnings will probably be around $40, at by the end of the fourth quarter, they’ll vault up to $55. That’s simply because we’re subtracting an awful quarter and adding on a more typical quarter. We can expect that the market’s P/E Ratio will dramatically plunge, but that won’t mean that the market is suddenly becoming a good value. -

Play the Federal Reserve Game

Eddy Elfenbein, August 14th, 2009 at 9:02 pmThe San Francisco Fed has created perhaps the wonkiest video game world history—it’s the Federal Reserve Game!

Haven’t you always wanted to test your monetary policy skillz online? Well, now you can! Set rates too high and you’ll cause a recession. Go too low and inflation will creep up.

See if you have….

the cool judgment of an Arthur Burns.

the sober confidence of a William McChesney Martin

or the raw sexuality of a Marriner Eccles

Note: I tried to audit the game but kept getting an error message.

(Via: Economix via Carney) -

16 Companies that Have Raised Their Dividend by 10% or More for the Last Nine Years

Eddy Elfenbein, August 14th, 2009 at 5:15 pmLet me add a disclaimer at the start of this post. This is the result of a data dump so the numbers may not be correct. I searched for companies that have increased their dividend by at least 10% for the last nine straight years. I haven’t doubled-checked the data off another source, but here are the initial results.

Federated Investors (FII)

Linear Technology (LLTC)

Bank of Kentucky Financial (BKYF)

C.H. Robinson Worldwide (CHRW)

Expeditors International of Washington (EXPD)

AFLAC (AFL)

TJX Cos. (TJX)

Brown & Brown (BRO)

Novo Nordisk (NVO)

Fastenal (FAST)

John Wiley & Sons (JW-A)

Johnson & Johnson (JNJ)

Pfizer (PFE)

Mercury General (MCY)

Polaris Industries (PII)

LSB Financial (LSBI)

The current year isn’t included since we’re not done, but a few stocks may fall off the list by year’s end.

The ones that really stand out are Pfizer, Johnson & Johnson and AFLAC. According to my data, these have raised their dividend by 10% or more for at least 18 years. Pfizer cut its dividend in half this year so it’s due to fall off the list.

The smallest dividend increase for AFLAC has been 12%. The company has already raised its dividend by 16% this year, plus the stock is going for about nine times this year’s earnings forecast (not the Street’s forecast, but AFL’s).

J&J increased its dividend by only 6.5% earlier this year so it’s also in trouble. The company has, however, raised its dividend for 47 straight years.

Let me add a special shout out to LSB Financial which is the holding company for Lafayette Savings Bank. This isn’t a micro-cap, it’s a nano-cap. It’s a 140-year-old Indiana-based thrift with a market cap of just $17 million. That’s about 25 minutes worth of sales at Wal-Mart (WMT). LSBI has no analysts who follow it. Sadly, it will fall off the list this year — like many financial firms, the thrift chopped its dividend in half. -

Coolest Map of Bank Failures You’ll See All Day

Eddy Elfenbein, August 14th, 2009 at 2:34 pmFrom The Wall Street Journal. You can really tell when WaMu went under.

(Via: Clusterstock) -

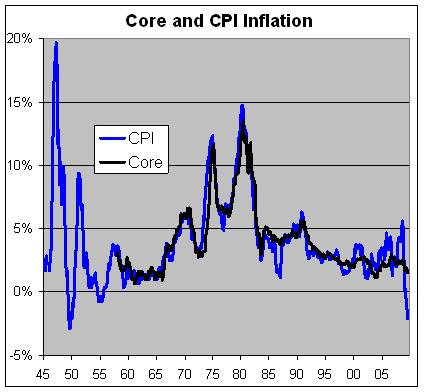

Headline CPI Unchanged; Core +0.1%

Eddy Elfenbein, August 14th, 2009 at 8:44 amYear-over-year consumer prices are down 2.1% which is the biggest drop since 1950.

-

Wow

Eddy Elfenbein, August 13th, 2009 at 7:54 pm -

Academic Report: Having Chicks on Your Board Is Bad for Your Stock

Eddy Elfenbein, August 13th, 2009 at 1:41 pmThe Telegraph:

Companies with women directors perform badly on stock market, report claims

Those companies that have just one female director on their board are considerably undervalued – in terms of their share price – compared with companies run entirely by men.

The study by the University of Exeter, published in the British Journal of Management, makes clear, however, that companies with women directors perform just as well when it comes to making profits.

Prof Alex Haslam, a psychologist at the University of Exeter, said the lengthy study had tried to strip out any coincidental factors, such as women tending to run retail and technology companies, which might have performed badly during the period of the study: 2001 to 2006.

“However, the evidence is very strong that gender is the unique factor in this pattern.

“The market very clearly responds to women’s appointments to boards in an adverse way. Or – to put it another way – they like to back all-male boards. Maybe investors see them as a safe bet.”

The study examined FTSE 100 companies, Britain’s biggest companies listed on the stock market. At the start of the study, half of all of the companies had all-male boards, but by 2006 just 15 per cent did, suggesting that a quiet revolution had happened during the time, with more female executives making it to the top even if only a handful made it to the very top job of cheif executive. Marjorie Scardino at Pearson and Rose Marie Bravo at Burberry were, at one stage, the only two women to head a FTSE 100 company.

However, companies with all-male boards had a market valuation equivalent to 166 per cent of their book value, while companies with at least one female board member had a market value equal to just 121 per cent of book value.Also…have you seen them drive?

-

Buffett Admits Berkshire Goofed on Derivative

Eddy Elfenbein, August 13th, 2009 at 1:34 pmWarren Buffett’s Berkshire Hathaway Inc (BRKa.N)(BRKb.N) underestimated the risks of falling stock prices to its billions of dollars of derivatives bets, yet still believes it is valuing the contracts fairly.

Berkshire revealed its error in a June 26 letter to the U.S. Securities and Exchange Commission, one of several pieces of correspondence with the regulator about the company’s annual report, and made public on Thursday.

It also agreed to SEC demands for more explanation on $1.8 billion of writedowns on stock investments, and $2.7 billion of auction-rate and other municipal debt holdings. On June 29, the SEC said it completed its review without further comment.

The correspondence shows Omaha, Nebraska-based Berkshire, which has close to 80 businesses and ended June with more than $136 billion of stocks, bonds and cash, is struggling to comply with SEC requirements to disclose enough about its finances.

This issue had surfaced in June 2008, when the regulator demanded “a more robust disclosure” of how the insurance and investment company values its derivatives. Buffett did provide some additional disclosure, in what he called “excruciating detail,” in his annual shareholder letter in February. -

Ever Wanted to Ring the Opening Bell?

Eddy Elfenbein, August 13th, 2009 at 11:03 am

- Tweets by @EddyElfenbein

-

-

Archives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His