Archive for August, 2010

-

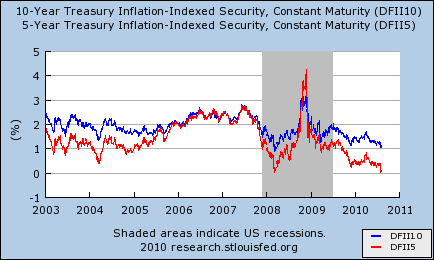

The 5-Year TIPs Have Gone Blutarsky

Eddy Elfenbein, August 11th, 2010 at 2:22 pmThe yield on the 5-Year Treasury Inflation Protected Bond has dropped to 0.0. Here’s a chart of the 5-year and 10-year TIPs (Felix’s chart is much bigger).

To me, this is pretty astounding. There are investors who are willing to stash their money away for five years, just to get no real return for it. They’re terrified to step off the pier even a tiny bit. -

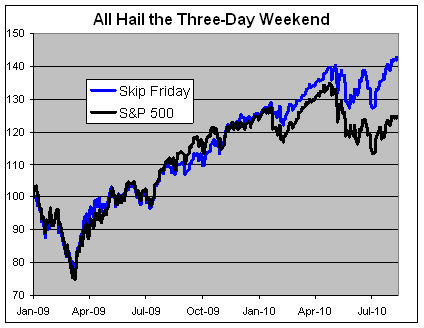

The Four-Day Work Week

Eddy Elfenbein, August 11th, 2010 at 12:52 pmI’ve long argued that being lazy is an advantage with investing.

Spurred on by my previous post showing how the market has performed this year by each day of the week, I looked at how the S&P 500 performed has performed since the beginning of 2009 if we were to exclude all Fridays.

I should add that these numbers don’t include transaction costs. It seems that investors have grown leery of holding stocks going into the weekend. -

Thank God It’s…Monday?

Eddy Elfenbein, August 11th, 2010 at 10:38 amHere’s how the S&P 500 has performed this year by day of the week:

Monday: +13.36%

Tuesday: -1.30%

Wednesday: +4.16%

Thursday: -2.04%

Friday: -11.94% -

Why I’m Not a Day Trader

Eddy Elfenbein, August 11th, 2010 at 10:20 amOn July 27, Wright Express (WXS) came out with a good earnings report. The stock then dropped 5.4% that day.

The market then had second thoughts. From July 28 to this past Monday, WXS rallied nearly 9% to reach a new 52-week high.

The stock dropped 3.7% yesterday and it’s down over 4% today. Despite the ups and downs, there hasn’t been a major piece of news or information to judge Wright’s business since the earnings came out. -

AFLAC Raises Dividend

Eddy Elfenbein, August 11th, 2010 at 9:29 amAs promised, AFLAC (AFL) just announced a dividend increase for the fourth quarter of 30 cents per share. This is an increase of 7.1% over the current dividend of 28 cents per share.

This is AFLAC’s 28th consecutive annual dividend increase and it will continue AFLAC’s membership in the S&P Dividend Aristocrats. This dividend, however, is a rather wimpy and back-handed way to deliver your 28th in a row. They’re doing it just so they can say they’ve done it.

The downside is that AFLAC waited until the fourth quarter to increase its dividend. Also, the dividend increase is much smaller than what AFL has been churning out. The company had raised its dividend by at least 12% every year since 1991.

AFLAC also said that it’s resuming it share repurchase program after suspending it during the financial crisis. Dan Amos, the CEO, said, “Depending on market conditions, we may purchase up to three million shares as early as the fourth quarter of this year. We currently anticipate buying six to 12 million shares in 2011.”

That’s equal to $300 million to $600 million, or roughly 64 cents per share to $1.28 per share. I would much rather see that go to cash dividends. -

Larry Ellison Defends Mark Hurd

Eddy Elfenbein, August 11th, 2010 at 8:59 amThe CEO of Oracle writes the NYT: “The HP board just made the worst personnel decision since the idiots on the Apple board fired Steve Jobs many years ago.”

Mr Hurd resigned from the world’s largest maker of personal computers on Friday night after an internal investigation, sparked by sexual harassment allegations from former HP contractor Jodie Fisher. The investigation found him not to have breached any harassment guidelines but to have broken the company’s business standards conduct after allegedly falsifying expenses claims to cover up his friendship with Ms Fisher.

Mr Ellison claimed HP’s board voted 6-4 in favour of going public with Ms Fisher’s claims. “In losing Mark Hurd, the HP board failed to act in the best interest of HP’s employees, shareholders, customers and partners,” he continued. “Publishing known false sexual harassment claims is not good corporate governance; it’s cowardly corporate political correctness.”

Ms Fisher said in her own statement that she did not have an “intimate sexual relationship” with Mr Hurd and that the pair have settled her claim privately.

Mr Ellison also said that his friend did not commit expense fraud, saying such claims were “not credible” and showed the “HP board desperately grasping at straw in trying to publicly explain the unexplainable”. -

Fed Statement

Eddy Elfenbein, August 10th, 2010 at 2:00 pmInformation received since the Federal Open Market Committee met in June indicates that the pace of recovery in output and employment has slowed in recent months. Household spending is increasing gradually, but remains constrained by high unemployment, modest income growth, lower housing wealth, and tight credit. Business spending on equipment and software is rising; however, investment in nonresidential structures continues to be weak and employers remain reluctant to add to payrolls. Housing starts remain at a depressed level. Bank lending has continued to contract. Nonetheless, the Committee anticipates a gradual return to higher levels of resource utilization in a context of price stability, although the pace of economic recovery is likely to be more modest in the near term than had been anticipated.

Measures of underlying inflation have trended lower in recent quarters and, with substantial resource slack continuing to restrain cost pressures and longer-term inflation expectations stable, inflation is likely to be subdued for some time.

The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and continues to anticipate that economic conditions, including low rates of resource utilization, subdued inflation trends, and stable inflation expectations, are likely to warrant exceptionally low levels of the federal funds rate for an extended period.

To help support the economic recovery in a context of price stability, the Committee will keep constant the Federal Reserve’s holdings of securities at their current level by reinvesting principal payments from agency debt and agency mortgage-backed securities in longer-term Treasury securities.1 The Committee will continue to roll over the Federal Reserve’s holdings of Treasury securities as they mature.

The Committee will continue to monitor the economic outlook and financial developments and will employ its policy tools as necessary to promote economic recovery and price stability.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; James Bullard; Elizabeth A. Duke; Donald L. Kohn; Sandra Pianalto; Eric S. Rosengren; Daniel K. Tarullo; and Kevin M. Warsh.

Voting against the policy was Thomas M. Hoenig, who judges that the economy is recovering modestly, as projected. Accordingly, he believed that continuing to express the expectation of exceptionally low levels of the federal funds rate for an extended period was no longer warranted and limits the Committee’s ability to adjust policy when needed. In addition, given economic and financial conditions, Mr. Hoenig did not believe that keeping constant the size of the Federal Reserve’s holdings of longer-term securities at their current level was required to support a return to the Committee’s policy objectives.It looks like a modest victory for the doves. The market is rallying slightly but it could turn into something more.

-

95 Degrees

Eddy Elfenbein, August 10th, 2010 at 1:44 pmSorry, light blogging today. It’s 95 degrees outside so I left my spacious office on the 87th floor of the Crossing Wall Street Tower a bit early to hop in the pool.

The 10-year T-Bond is again pushing lower. It’s around 2.8% which means that after 10 years you’ll only make a lousy 28% on your money. Stocks are down today as the Labor Department said that productivity fell 0.9% last quarter.

The Fed is meeting again and we should find out what their plans are for the second half of the year. Thus far, Bernanke has been saying that things are getting better, but there’s been more evidence that things may fall apart again.

I’m not really sure what will happen, but I suspect that the Fed isn’t impressed with a double-dip scenario. We’ll know more at 2:15. -

Time to Buy Hewlett-Packard?

Eddy Elfenbein, August 9th, 2010 at 2:15 pmNow that shares of Hewlett-Packard (HPQ) are getting knocked down due to the resignation of CEO Mark Hurd, is the stock worth buying?

Just looking at the numbers, HPQ is a bargain stock. The earnings line was only barely impacted by the recession, and the shares are going for less than 10 times the estimate for this fiscal year’s earnings.

The problem, however, is that the stock has low-quality earnings. Herb Greenberg shines the spotlight:Consider that much of the growth under Hurd was through acquisitions, culminating with its 2008 acquisition of EDS and more recently such controversial deals as 3Com and Palm. Including those three deals, HP did more than 30 acquisitions under Hurd at a cost of more than $25 billion, or roughly half the company’s current market value (earlier post misstated the figure as $50 billion). That’s roughly double the prior five years, according to a listing of deals on HP’s Web site.

But while the more than $25 billion may have helped push the stock higher, consider that:

* The companies HP acquired since 2005 generated revenue of around $25 billion (based on a rough calculation using publicly available data on the biggest deals since the end of fiscal 2004 – or around five months before Hurd arrived.)

* Total revenue increase during the same span was around $34.5 billion or an impressive 44 percent or around an average of 9 percent a year. Put another way, without the acquisitions revenue would be up just 9.5 billion or just 11 percent — or barely an annual average of 2 percent a year.

Meanwhile, earnings per share during the Hurd era posted compounded average annual growth of 22.5 percent a year. But a chunk of that is related to:

* Merger-related cost-cutting.

* A decline in shares outstanding, thanks largely to buybacks.

* An 18 percent drop in research and development spending, not necessarily an admirable trend for a tech company.

But, wait, there’s more:

* Sales at four of five operating units, including PCs and printers, have tumbled an average of 15 percent from pre-recessionary 2008 peaks. (The noticeable exception is the services business, whose revenue roughly doubled after the EDS acquisitions.)

* Profits at those same operating units fell an average of 18 percent during the same period.

* Finally – and this gets to the heart of our earnings quality question, which I focused on in a column here in June — HP has conditioned Wall Street to view it on a non-GAAP (or other than Generally Accepted Accounting Principles) basis, and investors have gullibly gone along with the game.It looks like the market wasn’t much fooled. Here’s a look at HPQ’s share price (blue line, left scale) along with its earnings-per-share (yellow line, right scale) plus the the projected EPS (red line).

The lines are scaled at a ratio of 10 to 1 which means whenever the lines cross, the P/E is exactly 10. The next earnings report is due in just 10 days. For now, I’d stay away from Hewlett-Packard. -

Eye the Sky Follow-Up

Eddy Elfenbein, August 9th, 2010 at 11:44 amIn March, I took a looking at the “Coming Satellite Image Boom.” These are companies that provide customers with satellite images, like you see on Google Earth. There are only two companies (that I know of) who operate in this field—GeoEye (GEOY) and DigitalGlobe (DGI).

This is what I wrote in March:This is an appealing business because it has many applications from oil & gas to disaster rescue and government intelligence. What strikes me is that this could be a great business model because the entry costs are high (getting a satellite up there) and the variables costs are low (click!).

I also highlighted a Denver Business Journal article from April 2009 which showed how much the government in getting involved in this industry. One analyst said, “The federal government appears to have decided to stop dating the industry and marry it.”

Why do I bring this up today? Because both stocks are soaring today on the heels of a government contract:Shares of DigitalGlobe (DGI.N) and GeoEye Inc (GEOY.O) soared on Monday, after both companies received orders from the U.S. National Geospatial Intelligence Agency (NGA) to supply satellite imagery.

DigitalGlobe inked a $3.55 billion deal with the NGA under its latest EnhancedView program and raised the lower end of its 2010 revenue and earnings view ranges, it said in a statement.

According to the NGA website, the GeoEye contract is valued at $3.80 billion.

The companies would also immediately begin work on their new satellites as part of the contract, they said.

EnhancedView, also called the ‘two-plus-two’ program, is a U.S. government initiative to increase the use of imagery procured through the only two commercial providers – DigitalGlobe and GeoEye.

DigitalGlobe said it will supply satellite imagery deliveries to NGA from the WorldView satellite constellation under a service level agreement (SLA) amounting to $2.8 billion.

The EnhancedView SLA portion of the contract is sized $250 million annually, or $20.8 million per month, for the first four contract years, the company said.

The agreement also provides for up to $750 million for value added products, infrastructure enhancements and other services, Digital Globe said.

The deal, which will be effective Sept. 1, has a 10-year term, the company said.

The company now sees 2010 earnings of 40 cents to 55 cents a share, up from its prior estimates of 25 cents to 55 cents a share.

DigitalGlobe also raised the lower end of its revenue outlook range by $10 million, and now expects 2010 revenue of $340 million to $360 million.

Analysts were expecting earnings of 38 cents a share, on revenue of $341.8 million according to Thomson Reuters I/B/E/S.DigitalGlobe has been up as much as 14% today, and GeoEye has been up as much as 19%.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His