Archive for May, 2011

-

Will the 90s Ever End?

Eddy Elfenbein, May 19th, 2011 at 2:57 pmI think we have a full mania on our hands.

Jim Cramer has already said that LNKD’s valuation is crazy. Earlier today, Barry Ritholtz posted a list of prominent IPO runups between 1975 and 2006.

I scanned the list and the biggest one-day pop seems to belong to theglobe on November 13, 1998. I had completely forgotten about them. The stock was priced at $9, got as high as $97 and closed the first day of trading at $63.50. Then in May 1999, the stock split 2-for-1 (why?). By 9/11/2001, theglobe was worth less than 10 cents per share. The company ceased operations in 2008. Today the shares are on the Pink Sheets going for 0.2 cents per share.

-

The Obama Portfolio

Eddy Elfenbein, May 19th, 2011 at 12:02 pmCarla Fried looks at President Obama’s portfolio:

Ben Bernanke might not be ready to raise the federal funds rate just yet, but the Obamas sure seem to be anticipating bond rates heading higher (and thus prices taking a fall). They report having between $1.1 million-$5.25 million invested in Treasury bills and another $1 million to $5 million in Treasury notes. T-bills have a maximum maturity of one year, while T-notes have maturities between 2 and 10 years. There were no longer-term bond holdings listed. Maybe it’s just easier and patriotic to stick with Treasuries when you’re the Obamas, but if your household taxable income was north of $1.3 million in 2010, as the Obamas’ was, you should probably give tax-exempt municipal bonds a look see.

Even presidents need a personal emergency fund. The Obamas reported having between $250,001-$500,000 sitting in a checking account at JP Morgan Chase Private Client Asset Management account. They also stated that they earned less than $1,000 in interest on their checking account. Even if we assume they are closer to the $250,000 side of that range, that amount of interest sounds incredibly low. If the President and First Lady followed the advice of MoneyWatch’s Allan Roth, they could have earned triple that amount on their cash.

I may be the leader of the free world, but when it comes to stocks, I invest passively. The Obamas report having between $200,000-$450,000 invested in the Vanguard 500 Index Fund. Clearly the Obamas are hip to cost controls within their own financial lives. The annual expense ratio they pay is 0.06 percent, since with more than $10,000 invested, they qualify for Vanguard’s lowest cost Admiral share class. That means they spend about 1 percentage point less a year than do investors in the average stock fund, a huge advantage when you consider that plenty of folks are telling us we’ll be lucky to earn 5 or 6 percent a year from stocks in the coming years. Too bad neither the Obama administration nor the folks on Capitol Hill have seen their way to make it law that every 401(k) must offer participants at least one low-cost index fund.

-

Was LinkedIn Screwed By Its Underwriters?

Eddy Elfenbein, May 19th, 2011 at 11:09 amSo with LinkedIn‘s ($LNKD) monster IPO surge this morning, we should ask if this means that they were let down by their underwriters. Bear in mind that the offering range was already raised by about 30% just before it was priced. If you price at $45 and the stock soars to $90 or so, that means the company left all the money on the table.

Or maybe not. At Business Insider, Pascal-Emmanuel Gobry writes:

In fact, it’s probably because they were AFRAID of having a pop that they upped the price early on to mop up demand.

But here’s the thing. Along with designer handbags, stock is the only good where demand goes up with price.

Economics 101 says that when demand for something limited is high, the price will go up, which will lower demand to match the supply. But that’s not how the stock market works, is it? When the price gets high, more people buy, and the price gets higher.

Excitement about the LinkedIn IPO was always high but it started becoming feverish after LinkedIn’s underwriters bumped it up to 40. “There’s so much demand! It means it’s going to be a huge IPO!” Which, of course, became a self-fulfilling prophecy. A person close to big investors told us that they couldn’t even get shares in the IPO because it was so oversubscribed.

There’s a frenzy because there’s a frenzy which in turn leads to a bigger frenzy. This is why I steer clear of most IPOs.

-

LinkedIn Soars

Eddy Elfenbein, May 19th, 2011 at 10:11 amI haven’t written about the LinkedIn ($LNKD) IPO since, honestly, I don’t know much about these types of businesses. It’s rare for people who write about investments to confess their ignorance, so I may be breaking some sort of rule.

Nevertheless, shares of LNKD were priced at $45 yesterday.

The opening trade = $83. Bespoke notes that at this rate, LNKD will be bigger than 136 companies in the S&P 500.

The stock has now gotten as high as $90. This means that a company worth $8.5 billion made a grand total of $15 million last year.

-

Morning News: May 19, 2011

Eddy Elfenbein, May 19th, 2011 at 7:20 amGermany Backs a European for IMF Head Replacement

France’s Lagarde May Stake Claim as First Female IMF Chief

Yen Falls as Japan Enters Recession

Asian Shares End Mixed; Grim GDP Data Weigh Tokyo Shares

IEA Calls on Oil Producers to Act as Prices Risk Recovery

Oil in N.Y. Trades Near Highest in More Than a Week on U.S. Supply Decline

LinkedIn’s Biggest Backers Will Own $2.5 Billion Stake After Initial Sale

Glencore Rises After $10 Billion I.P.O.

Air France Posts Annual Profit on Economy

Sears Swings To 1Q Loss But Revenue Falls Less Than Expected

Takeda Signs Deal To Buy Nycomed For EUR9.6 Billion

World’s Second Largest Brewer SABMiller Full-Year Profit Beats Estimates

Delta-Northwest Merger’s Long and Complex Path

Howard Lindzon: Chasing…a Tactic, not a Strategy!

Be sure to follow me on Twitter.

-

S&P Sectors Year-To-Date

Eddy Elfenbein, May 18th, 2011 at 9:52 pmOur Buy List is heavily tilted toward healthcare stocks. That wasn’t a smart move in previous years but it’s helping out this year.

Index Name Market Cap Index Level 1 Day MTD QTD YTD Total Return S&P 500 (TR) N/A 2,270.57 0.90% -1.53% 1.39% 7.39% Price Return S&P 500 $12,221,340.74 1,340.68 0.88% -1.68% 1.12% 6.60% Sectors Healthcare $1,444,958.57 420.57 0.78% 3.18% 9.81% 15.29% Energy $1,506,967.27 554.08 1.97% -7.35% -5.98% 9.34% Staples $1,324,423.86 331.90 0.20% 2.30% 7.47% 9.33% Discretionary $1,315,259.47 319.92 1.15% -0.14% 3.74% 8.25% Utilities $411,564.56 172.23 -0.34% 2.45% 6.37% 8.09% Industrials $1,351,418.87 323.85 1.11% -3.20% -0.60% 7.55% Telecom $371,777.50 134.60 0.29% 0.34% 1.01% 4.55% Tech $2,192,686.04 419.77 0.74% -2.34% 0.51% 3.76% Materials $432,495.54 241.82 2.10% -4.98% -3.02% 0.92% Financials $1,869,789.06 214.39 0.49% -2.77% -2.86% -0.18% AFLAC Down on Lower Guidance

Eddy Elfenbein, May 18th, 2011 at 12:45 pmAFLAC ($AFL), one of my favorite stocks, is down sharply today due to a lower forecast from the company. Dan Amos, the CEO, told a dinner audience last night that the company is expecting to grow its earnings by 0% to 5% next year.

Let’s remember that the company said it expects to earn between $6.09 and $6.34 per share for this year. Wall Street’s consensus for 2011 is currently $6.22 but I think $6.30 is probably more accurate. At 0% to 5%, that implies 2012 earnings of $6.30 to $6.61 per share. Wall Street had been expecting $6.64 per share.

Market Watch noted these comments from Randy Binner at FBR Capital Markets:

“While we believe the guidance may be overly conservative and there were positive comments on 2Q11 sales growth and de-risking activities, we believe Aflac shares trade based on EPS,” Binner wrote in a note to investors Wednesday. “As such, we would expect shares to adjust to the lower EPS outlook.”

I agree that this forecast is overly conservative. This would be the slowest growth in AFLAC’s history. Ultimately, they may hit Wall Street’s forecast (which will soon be lowered) of $6.64 per share.

Still, 2012 is a long way away and AFLAC is sticking with its growth forecast for 2011. AFLAC has set the bar low and now it’s up to them to surpass it.

The important news is that AFLAC is working to “de-risk” its portfolio:

Insurer Aflac Inc. said it will incur a loss of about $31 million before taxes in the second quarter as it sells off some investments that had been flagged as problematic by analysts and investors.

The largest loss, of $72 million, is tied to the sale of holdings in Irish Life and Permanent Group Holdings PLC (IL0.DB), according to a regulatory filing Tuesday. The company also sold off sovereign debt from Tunisia at a pre-tax loss of $5 million.

Those losses were offset by gains of $18 million from the sale of perpetual securities issued by Lloyds Banking Group PLC (LLOY.LN) and $28 million of perpetual securities from Royal Bank of Scotland Group PLC (RBS.LN).

The asset sales are part of Aflac’s ongoing effort to unload some of its sovereign and bank debt from financially stressed regions, and reduce the size of the largest positions in its investment portfolio. The company sold off Greek debt in the first quarter.Such investments have made some investors and analysts nervous in recent years, first amid the 2008 financial crisis and later when the European Union grappled with the mounting debts of Greece and other member nations last year.

AFLAC has said that it’s looking to increase its dividend by 1% to 10% this year and next year. Plus, the company projects repurchasing 3 million to 12 million shares this year and zero to 12 million next year.

The yen’s impact on 2011’s operating earnings is pretty straightforward. At an exchange rate of 87.69 yen per dollar, the earnings will grow by 8% to $5.97 per share for 2011. Every one point below that adds roughly five cents per share to AFL’s bottom line. Currently, the exchange rate is 81.4 so that’s good for us.

The stock has been as low as $50 today. There’s no reason to sell AFLAC based on today’s news. The company is still fundamentally sound. They’re merely preparing themselves for what may be a more difficult environment.

The Tax Preference Economy

Eddy Elfenbein, May 18th, 2011 at 10:54 amHere’s an email from a reader on Google’s ($GOOG) tax strategy.

GOOG may not be betting on lower actual corporate tax rates. Like a lot of sophisticated U.S. companies that defer taxes by parking profits overseas, they may be waiting for the government to allow yet another “tax amnesty” repatriation scheme. That’s legislation that provides companies with a temporary period in which to repatriate assets while incurring lower taxes than they otherwise would. This has happened before, and there’s currently some lukewarm lobbying to make it happen again.

Tax deferral for profits held overseas is – for better or worse – most likely a HUGE part of why many major companies have been accumulating tons of cash on their balance sheets.

Tax preferences like this are lurking behind just about every weird financial distortion in the U.S. economy. Tax preferences for employer-provided healthcare. Tax preferences for interest on home mortgage indebtedness. Tax preferences for corporate debt over equity (that one’s debatable). Eventually, the muni market may be severely dislocated by the fact that municipal debt is overwhelmingly funded by a single class of investor: high-income individuals who justifiably wish to escape some income taxation on interest from municipal bonds. I haven’t seen anything particularly strange created by tax preferences for individual long-term cap gains over short-term cap gains, but I wouldn’t be surprised if it’s in there somewhere.

“What Is the Fed?” Starring Ben Bernanke

Eddy Elfenbein, May 18th, 2011 at 10:46 amThe Breakdown in Cyclicals

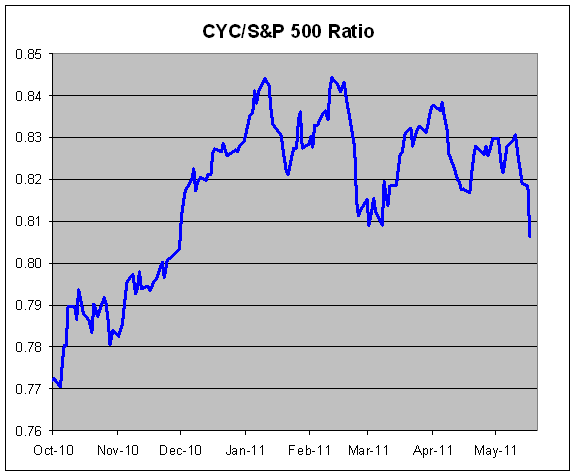

Eddy Elfenbein, May 18th, 2011 at 10:20 amI’ve been talking about the dangers in owning cyclical stocks and the breakdown is finally happening. Below is a chart of the Morgan Stanley Cyclical Index (^CYC) divided by the S&P 500. When the line is rising, cyclicals are outperforming. When it’s falling, cyclicals are trailing.

The ratio had an explosive rally beginning in March 2009 and it reached an all-time high on of 0.8441 January 10, 2011 before pulling back. The ratio rallied again and just barely made a new all-time high on February 11 of 0.8442. The new high was made by slightly more than one-ten-thousandth of a point.

In mid-February, cyclicals pulled back sharply then tried one more rally in March. Ultimately, the ratio failed to make a new high. But only in the last week have cyclicals started to fall apart.

The cyclicals have now trailed the S&P 500 for five straight days and yesterday was the worst day relative to the rest of the market in more than two-and-a-half months. While the S&P 500 lost just 0.04% yesterday, the CYC lost 1.51%. I think we’re in for a multi-year period of cyclical underperformance.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His