Archive for January, 2012

-

Goldman Says to Short the 10-year Treasury

Eddy Elfenbein, January 23rd, 2012 at 12:16 pmAt Business Insider, Joe Weisenthal points us toward this note from Goldman Sachs, which supports our thesis of higher long-term yields. Goldman is now urging clients to short the 10-year U.S. Treasury.

Go Short 10-yr US Treasuries

Since the end of last August, we have argued that 10-yr US Treasury yields would not be able to sustain levels much below 2% in this cycle. Yields have traded in a tight range around an average 2% since September, including so far into 2012. We are now of the view that a break to the upside, to 2.25-2.50%, is likely and recommend going tactically short. Using Mar-12 futures contracts, which closed on Friday at 130-08, we would aim for a target of 126-00 and stops on a close above 132-00. Our rationale is as follows.

At this stage of the cycle, growth expectations are in the driver’s seat: The value of intermediate maturity government bonds can be related to expectations of future policy rates, activity growth and inflation, and a ‘risk factor’ highly correlated across the main countries. These simple relationships are captured by our Sudoku econometric framework for 10-yr maturity yields. In coming months, we expect effective overnight rates to remain close to zero in the main currency blocs (US, Japan, Euroland, and UK) and retail price inflation to hover around 1.5-2.0% – consistent with the forwards and central banks’ objectives. With policy rates and inflation ‘dormant’ at this stage of the business cycle, bond yields (and the 2-10-yr slope of the yield curve) will likely react mostly to shifts in growth expectations.

Bond valuations are already stretched relative to consensus growth expectations: Around the turn of the year, the outlook on economic activity was buffeted by cross-currents reflecting the adverse credit conditions in the Euro area on the one hand, and the upward revisions to US GDP growth on the other. Our Sudoku model, which helps us trade-off these shifts, indicates that 10-yr government bond yields are currently trading too low (to the tune of 50-75bp) when mapped against prevailing macro expectations. Taking into account the cumulative impact of the Fed’s security purchases, the degree of mis-valuation of 10-yr bonds is roughly the same across the main regions.

I think this is right. What I find unusual is that it hasn’t already happened especially considering the continued rise in cyclical stocks versus the broader market. The Morgan Stanley Cyclical Index ($CYC) got as high as 982 today which is a 33% run from October 3rd.

-

Stock Trading Is Lowest in U.S. Since 2008

Eddy Elfenbein, January 23rd, 2012 at 10:03 amTrading in U.S. stocks fell to the lowest level since at least 2008 amid mutual fund withdrawals and Wall Street job cuts.

An average of 6.69 billion shares changed hands on U.S. exchanges in the 50 days ended Jan. 18, the fewest on record in Bloomberg data starting three years ago that excludes over-the- counter venues. On the New York Stock Exchange, volume has tumbled to the lowest level since 1999, the data show.

The slowdown in trading shows that investors remain skittish after five years of withdrawals from mutual funds that buy U.S. equities and one of the most volatile years on record for the Standard & Poor’s 500 Index. While the benchmark index is having its best January rally since 1997, securities firms around the world cut more than 200,000 jobs last year.

“Investor confidence is shaky at the very least,” Mark Turner, head of U.S. sales trading at Instinet Inc. in New York, said in a telephone interview on Jan. 20. His firm handles about 4 percent of the total daily U.S. equity volume. “We need to see the U.S. economy improve. We need to see some sort of a plan in place to deal with Europe’s debt crisis before the market gains some confidence. At that point, we’ll start to see an increase in volume.”

Daily equity trading approached 12 billion shares in May 2009, near the start of a three-year bull market in which the S&P 500 has almost doubled. The total is based on the 50-day average volume on venues including those run by NYSE Euronext, Nasdaq OMX Group Inc., Bats Global Markets Inc. and Direct Edge Holdings LLC.

-

Greece to Be Saved…Again

Eddy Elfenbein, January 23rd, 2012 at 9:45 amToday is the day that finance ministers in the euro zone are going to decide exactly what to do with Greece. If you’re keeping score, this is the second time they’re trying to settle this question once-and-for-all. The hard part is to get the people Greece owes to accept the idea that they’re not getting all of their money back. Rough, I know. The early indications are that the bondholders are going to get about one-third back. I’m actually surprised it’s that high.

The market is basically unchanged so far this morning. I see that Ford ($F) seems to be extending its gains from last week. It’s good to see that investors are ready to dump all the profits they made recently. Tomorrow is going to be a very big earnings day for us.

There’s also talk of when the Fed will embark on its third round of quantitative easing. Frankly, I’m a doubter. Not only is it politically unpopular, but also it may not be needed.

-

Morning News: January 23, 2012

Eddy Elfenbein, January 23rd, 2012 at 5:26 amEuro Leaders Seek Crisis Fix as Greek Talks Drag On

Europe Heads to Davos Surprising Doomsayers

U.K. Dividends Increase to Record in 2011

Europe Stocks Cheapest to U.S. Since 2004

Saudi Market to Let Foreign Shares Dual-List

EU Diplomats Agree on Iran Oil Embargo

U.S. Gasoline Price Rises to $3.39 a Gallon, Lundberg Survey Shows

Fed Inflation-Unemployment Mandate Shows Bernanke’s Model Better in Crisis

Fed Begins an Effort to Remove All Doubt on What It’s Doing

Apache Reaches Oil Deal on Home Turf

U.S. Gas Glut Favors Would-Be Exporter

Thyssen, Outokumpu Discuss Stainless Steel Tie-up

More Lockouts as Companies Battle Unions

Bowing to Critics and Market Forces, RIM’s Co-Chiefs Step Aside

Epicurean Dealmaker: All Together Now

Be sure to follow me on Twitter.

-

RIP: Etta James

Eddy Elfenbein, January 20th, 2012 at 4:01 pmThe weekend is here. Let the great Etta James show you how to do the Eagles right.

-

CWS Market Review – January 20, 2012

Eddy Elfenbein, January 20th, 2012 at 5:37 amHuzzahs are in order! The S&P 500 just closed at its highest level in five months. We only need another 4% push to hit a new post-crash high. That’s the odd thing about investing: last year most everyone looked pretty clueless, but this year, suddenly everyone’s a genius. Funny how that happens.

All joking aside, the numbers are pretty impressive. The stock market is off to its best start in 15 years. Consider that the S&P 500 closed higher on seven of the first eight trading days of this year. That’s only happened eight times since 1900. The Nasdaq 100 Index just hit a 10-year high. For the time being, the bulls are in charge and that’s a pleasant change from the tug-of-war market we saw last year.

But what I find most interesting is that 2012 is almost a mirror image of 2011. By that I mean that some of the worst performers from last year are among the best performers this year, and some of last year’s stars are among the also-rans for this year. In more concrete terms, this means that sectors like industrials, homebuilders, materials and financials are finally doing well. On the other side, treasuries are off to their worst start in nine years. I believe this is the result of the market shaking off the worn-out thesis it desperately held on to for several months.

Let me explain this in a little more detail. I’ve recently discussed how the American stock market has been in the process of disentangling itself from the mess in Europe. This is very important and every investor needs to understand what’s happening.

Not very long ago, an investor didn’t even need to look at share prices to see what the U.S. market was doing on any given day. All he or she needed to do was look at the euro. I’m really not exaggerating. But this euro/stock battle isn’t the case anymore. Bloomberg notes that the 30-day correlation between the euro and the S&P 500 dropped from 0.91 in November to 0.66 today. In my opinion that’s still too high, but the message is clear: the old game no longer works.

So what is working? I’m happy to report that our strategy of focusing on high-quality stocks is working very well. As well as the overall market has performed this year, our Buy List has done even better. In fact, we’ve increased our lead this past week.

Through Thursday, the Crossing Wall Street Buy List is up 5.22% for 2012 which is 69 basis points more than the S&P 500. Four of our stocks are already double-digit winners. Ford Motor ($F) is our biggest winner for the year with a gain of 17.19%. I think it may break 20% very soon.

In last week’s CWS Market Review, I focused on JPMorgan Chase’s ($JPM) earnings report. Even though the earnings matched expectations, it was a modestly disappointing report, and Jamie Dimon said as much. The stock took a hit for a few days but here’s the interesting part. Once the selling faded, JPM’s stock quickly regained what it lost and on Thursday it closed at a three-month high. This signals to me that investors are interested in holding on to high-quality stocks even though they’ve become more price-sensitive. Before, investors were primarily interested in holding safe assets and they were prepared to pay any price. I noticed the irony that investors were taking enormous gambles in order to avoid risk. All that jittery volatility is getting pushed out of the market. On Thursday, the Volatility Index ($VIX) closed below 20 for the first time in six months.

Nearly the exact same story as JPMorgan played itself out at Bed Bath & Beyond ($BBBY). Last month, the share price got nicked after the company reporting earnings. What’s frustrating is that I thought it was a decent report. Traders, however, disagreed. Still, once the dust settled some rationality returned to the market and the stock made up lost ground. On Thursday, Bed Bath & Beyond closed at $63.19 which is just 25 cents from an all-time high close.

I had previously told investors not to chase BBBY and instead to wait for a pullback below $60. I think the changing market environment will be good for this stock so I’m raising my buy-below price to $66 per share. (Please note that the buy prices I give are not price targets. They’re merely good entry points. I consider all of the stocks on the Buy List to be good buys.)

The most important story on Wall Street right now is earnings season. The early indications are that it’s not going terribly well. The S&P 500 has topped expectations for the last 11 quarters in a row. I’m not sure we’re going to see #12. In fact, I think it’s very possible that earnings for Q4 will come in below the earnings for Q3.

We’re heading into the peak of earnings season next week and the following week. Not all of our Buy List stocks have said when they’ll report earnings but I do know that next week will be a busy earnings week for us. On Tuesday, three Buy List stocks will report earnings; CA Technologies ($CA), Johnson & Johnson ($JNJ) and Stryker ($SYK). All three are excellent stocks and Stryker already told us to expect good news in this report.

Last October, CA Technologies told us to expect earnings-per-share to range between $2.13 and $2.18 for its 2012 fiscal year (ending in March). On Tuesday’s earnings report, I think there’s a good chance the company will raise the lower bound of that range. The stock is a very good buy up to $24 per share.

On Wednesday, Hudson City Bancorp ($HCBK) is set to report its Q4 earnings. This is a stock you should pay close attention to, but you want to ignore next week’s earnings report because it won’t be pretty. The good news will come in future quarters. Hudson City currently yields 4.69%.

Before I go, I want to highlight a few other stocks. I was pleased to see AFLAC ($AFL) burst through $47 per share on Thursday. It’s about time! The duck stock will report earnings on January 31st. Look for another solid report.

Oracle ($ORCL) is another stock that’s quietly recovering from an earnings disappointment. Smart investors know to never count this company out. Oracle is a good buy up to $30 per share.

I usually don’t pay too much attention to the weekly jobless claims reports but the trend continues to be very positive. Thursday’s report showed the fewest claims in nearly four years. This should bode well for the next employment report in early February.

That’s all for now. Earnings will dominate the headlines next week. We’ll also have a Fed meeting (snore! don’t expect much), and on Friday we’ll get our first look at the Q4 GDP report. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: January 20, 2012

Eddy Elfenbein, January 20th, 2012 at 5:37 amEU Toughens Fiscal Pact Bowing to ECB Objection, Draft Shows

‘Substantial’ Greek Debt Talks Continue for Third Day

New Normal on Wall Street: Smaller and Restrained

U.S. Jobless Claims Fall Sharply

Dodd Calls for Hollywood and Silicon Valley to Meet

Microsoft Leads ‘Old Dogs’ in Topping Estimates; Google Dips

Google Ad-Price Drop Leads to Page’s First Earnings Disappointment as CEO

Intel Forecasts Revenue That May Exceed Analysts’ Estimates

GM is Again the World’s Largest Automaker

Southwest Posts Strong Profit Despite Rising Fuel Expenses

Sears Rises on Report CIT Approving Orders as Early as Today

Can Bankruptcy Filing Save Kodak?

Roger Nusbaum: Market Favoring Risk Assets Right Now

Paul Kedrosky: Benford’s Law, and Worldwide Illicit Financial Flows

Be sure to follow me on Twitter.

-

Correlation of IQ and Stock Ownership

Eddy Elfenbein, January 20th, 2012 at 2:23 amFrom Bloomberg:

The smarter you are, the more stock you probably own, according to researchers who say they found a direct link between IQ and equity market participation.

Intelligence, as measured by tests given to 158,044 Finnish soldiers over 19 years, outweighed income in determining whether someone owns shares and how many companies he invests in. Among draftees scoring highest on the exams, the rate of ownership later in life was 21 percentage points above those who tested lowest, researchers found. The study, published in last month’s Journal of Finance, ignored bonds and other investments.

-

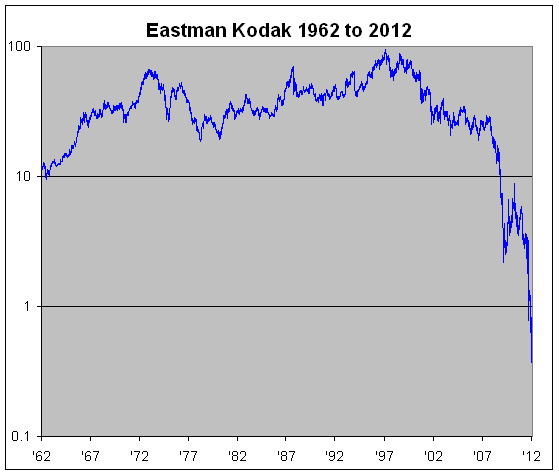

Eastman Kodak Files for Bankruptcy

Eddy Elfenbein, January 19th, 2012 at 10:11 amAfter 131 years in business, Eastman Kodak ($EK) has filed for Chapter 11. Actually, I’m surprised they made it this long.

Kodak’s story should be a reminder to fans of all fast-growing companies. EK was one of the most popular glamour stocks of the 1960s and early 1970s. The stock went from $10 in 1962 to $66 by 1972.

Ultimately, what did in Kodak wasn’t greed or avarice or even poor management (though that may have played a role). Instead, someone came along and built a better mousetrap.

When looking at stock charts, there’s a strong temptation to see the end result as perfectly obvious to the past. Consider that as late as October 2007, EK was going for $28 per share. What were they possibly thinking?

Over the last 40 years, EK has almost always lagged the market. The stock briefly outperformed the market in the early 1980s and again in the mid-1990s as it tried to reform itself.

You can see on the chart when EK spun off Eastman Chemicals ($EMN) in 1994 for about $12 per share. That stock lagged the market as well until 2000. Since then, it has beaten the S&P 500.

-

Best Stocks Under Obama

Eddy Elfenbein, January 19th, 2012 at 9:53 amHere are the 250 best-performing stocks since Barack Obama became president. The stocks are sorted by total return. I’ve also included each stock’s capital gain.

Stock Symbol 1/20/2009 1/18/2012 Cap Gain Total Return Dollar Thrifty Automotive DTG $1.11 $73.18 6,492.80 6,492.80 Pier 1 Imports Inc. PIR $0.41 $15.27 3,624.39 3,624.39 Cardtronics Inc. CATM $0.92 $26.59 2,790.21 2,790.21 Dana Holding Corp. DAN $0.55 $14.51 2,538.18 2,538.18 Pharmasset Inc. VRUS $5.33 $136.97 2,471.27 2,471.27 Avis Budget Group Inc. CAR $0.66 $12.98 1,866.66 1,866.66 Jazz Pharmaceuticals Inc. JAZZ $1.20 $47.34 1,739.74 1,739.74 Boise Inc. BZ $0.47 $7.73 1,544.68 1,712.56 Valassis Communications Inc. VCI $1.20 $20.61 1,617.50 1,617.50 Liberty Media Corp LMCA $5.10 $85.45 1,575.49 1,575.49 TriMas Corp. TRS $1.18 $19.51 1,553.39 1,553.39 Tenneco Inc. TEN $1.88 $29.80 1,485.10 1,485.10 Crocs Inc. CROX $1.19 $18.79 1,478.99 1,478.99 Ulta Salon Cosmetics & Fragrance ULTA $5.94 $75.75 1,175.25 1,175.25 Entropic Communications Inc. ENTR $0.43 $5.41 1,158.14 1,158.14 Dillard’s Inc. Cl A DDS $3.79 $46.29 1,121.37 1,153.25 Ariad Pharmaceuticals Inc. ARIA $1.18 $14.45 1,124.58 1,124.58 Buckeye Technologies Inc. BKI $3.06 $36.22 1,083.66 1,099.88 Virtus Investment Partners Inc. VRTS $6.92 $79.58 1,050.00 1,050.00 TRW Automotive Holdings Corp. TRW $3.61 $37.54 939.89 939.89 Tempur-Pedic International Inc. TPX $6.05 $60.60 901.65 901.65 Temple-Inland Inc. TIN $3.50 $31.80 808.57 889.33 Dupont Fabros Technology Inc. DFT $2.56 $24.13 842.58 885.37 The Providence Service Corp. PRSC $1.51 $14.80 880.13 880.13 Northern Oil & Gas Inc. NOG $2.70 $26.00 862.96 862.96 Cirrus Logic Inc. CRUS $2.22 $20.75 834.68 834.68 Aruba Networks Inc. ARUN $2.16 $20.18 834.26 834.26 Las Vegas Sands Corp. LVS $5.04 $46.83 829.17 829.17 Rackspace Hosting Inc. RAX $4.66 $43.28 828.76 828.76 Quantum Corp. QTM $0.29 $2.63 806.90 806.90 KapStone Paper & Packaging KS $1.99 $17.89 799.00 799.00 Gulfport Energy Corp. GPOR $3.66 $32.47 787.16 787.16 La-Z-Boy Inc. LZB $1.49 $13.17 783.89 783.89 American Axle & Manufacturing AXL $1.30 $11.14 756.92 756.92 Inhibitex Inc. INHX $0.33 $24.86 742.71 742.71 Allied Nevada Gold Corp. ANV $3.90 $32.84 742.05 742.05 Oxford Industries Inc. OXM $6.25 $48.85 681.60 730.72 Polypore International Inc. PPO $6.61 $54.09 718.31 718.31 VeriFone Systems Inc. PAY $4.92 $39.18 696.34 696.34 Berry Petroleum Co. Cl A BRY $6.05 $46.38 666.61 696.11 Rosetta Resources Inc. ROSE $5.85 $46.03 686.84 686.84 priceline.com Inc. PCLN $66.04 $518.83 685.63 685.63 NewMarket Corp. NEU $27.91 $209.66 651.20 685.42 Clearwater Paper Corp. CLW $4.73 $37.00 683.07 683.07 W.R. Grace & CO. GRA $6.30 $49.10 679.36 679.36 Chart Industries Inc. GTLS $7.91 $61.45 676.87 676.87 Acme Packet Inc. APKT $3.64 $28.10 671.98 671.98 XL Group PLC XL $2.88 $20.06 596.53 662.32 Golar LNG Ltd. GLNG $5.94 $39.65 591.12 660.69 Brunswick Corp. BC $2.73 $20.29 643.22 651.11 Fossil Inc. FOSL $12.16 $90.49 644.16 644.16 Kulicke & Soffa Industries Inc. KLIC $1.49 $10.97 636.24 636.24 CAI International Inc. CAP $2.40 $17.54 630.83 630.83 Asbury Automotive Group Inc. ABG $3.26 $23.58 623.31 623.31 Chipotle Mexican Grill Inc. CMG $49.60 $356.82 619.40 619.40 Twin Disc Inc. TWIN $6.00 $40.37 572.83 616.55 Whole Foods Market Inc. WFM $11.22 $77.87 594.03 600.11 Ashland Inc. ASH $9.11 $61.17 571.46 599.01 SuccessFactors Inc. SFSF $5.72 $39.91 597.73 597.73 RightNow Technologies Inc. RNOW $6.15 $42.76 595.29 595.29 Wyndham Worldwide Corp. WYN $6.08 $39.43 548.52 587.17 Pioneer Natural Resources Co. PXD $14.65 $99.60 579.86 583.71 Sinclair Broadcast Group Inc. Cl A SBGI $2.05 $12.64 516.58 582.78 Limited Brands Inc. LTD $8.22 $41.61 406.20 581.97 HSN Inc. HSNI $5.42 $36.64 576.01 578.38 Ashford Hospitality Trust AHT $1.30 $8.40 546.15 574.59 B&G Foods Inc. BGS $4.27 $23.62 453.16 571.76 National Financial Partners Corp. NFP $2.32 $15.29 559.05 559.05 Virgin Media Inc. VMED $3.80 $23.86 527.89 549.47 Sirius XM Radio Inc. SIRI $0.11 $2.16 548.54 548.54 Sonic Automotive Inc. Cl A SAH $2.57 $16.16 528.79 534.79 Ruby Tuesday Inc. RT $1.16 $7.33 531.90 531.90 Rockwood Holdings Inc. ROC $7.18 $45.15 528.83 528.83 Group 1 Automotive Inc. GPI $8.80 $54.39 518.07 526.74 Herbalife Ltd. HLF $9.80 $57.18 483.47 522.26 Green Mountain Coffee Roasters GMCR $8.26 $51.39 521.82 521.82 NxStage Medical Inc. NXTM $2.96 $18.36 520.27 520.27 Polaris Industries Inc. PII $11.04 $62.22 463.84 519.44 lululemon athletica inc. LULU $3.32 $60.51 519.31 519.31 Riverbed Technology Inc. RVBD $4.51 $27.77 516.43 516.43 MCG Capital Corp. MCGC $0.85 $4.31 407.06 513.29 PolyOne Corp. POL $2.33 $14.04 502.58 510.28 United Rentals Inc. URI $5.70 $34.77 510.00 510.00 Salix Pharmaceuticals Ltd. SLXP $8.04 $49.00 509.45 509.45 DineEquity Inc. DIN $7.60 $46.11 506.71 506.71 Domino’s Pizza Inc. DPZ $5.44 $32.77 502.39 502.39 Graphic Packaging Holding Co. GPK $0.81 $4.85 498.77 498.77 Measurement Specialties Inc. MEAS $5.19 $30.93 495.95 495.95 Sauer-Danfoss Inc. SHS $7.41 $44.08 494.87 494.87 Elizabeth Arden Inc. RDEN $5.97 $35.44 493.64 493.64 Ford Motor Co. F $2.13 $12.34 479.34 479.34 Liberty Interactive LINTA $2.98 $17.25 478.86 478.86 Questcor Pharmaceuticals Inc. QCOR $6.56 $37.68 474.39 474.39 Sourcefire Inc. FIRE $5.55 $31.82 473.33 473.33 Stein Mart Inc. SMRT $1.23 $6.68 443.09 473.19 Sunrise Senior Living Inc. SRZ $1.14 $6.52 471.93 471.93 Incyte Corp. INCY $3.08 $17.57 470.45 470.45 Acacia Research ACTG $2.97 $42.69 461.71 461.71 Ruth’s Hospitality Group Inc. RUTH $1.10 $6.17 461.69 461.69 Starbucks Corp. SBUX $8.89 $48.04 440.38 456.24 IPG Photonics Corp. IPGP $9.37 $52.00 454.96 454.96 3D Systems Corp. DDD $3.15 $17.45 453.97 453.97 Wellcare Health Plans Inc. WCG $10.58 $58.57 453.59 453.59 Liquidity Services Inc. LQDT $6.64 $36.62 451.51 451.51 Universal Display Corp. PANL $7.39 $40.75 451.42 451.42 DSW Inc. Cl A DSW $9.22 $48.42 425.16 451.20 Williams-Sonoma Inc. WSM $6.85 $34.86 408.90 449.79 Apple Inc. AAPL $78.20 $429.11 448.73 448.73 SL Green Realty Corp. SLG $13.77 $71.37 418.30 446.69 CVR Energy Inc. CVI $4.40 $23.99 445.23 445.23 OYO Geospace Corp. OYOG $16.10 $87.72 444.84 444.84 Advance America Cash Advance AEA $1.74 $7.84 350.58 443.85 Signet Jewelers Ltd. SIG $8.32 $45.11 442.19 443.46 Nu Skin Enterprises Inc. Cl A NUS $9.65 $48.61 403.73 436.83 Akorn Inc. AKRX $2.16 $11.56 435.18 435.18 Entegris Inc. ENTG $1.82 $9.74 435.16 435.16 MIPS Technologies Inc. MIPS $1.06 $5.57 425.47 425.47 Louisiana-Pacific Corp. LPX $1.74 $9.02 418.39 418.39 NetSuite Inc. N $7.92 $40.89 416.29 416.29 BE Aerospace Inc. BEAV $8.15 $41.96 414.85 414.85 Ann Inc. ANN $4.62 $23.74 413.85 413.85 Regeneron Pharmaceuticals Inc. REGN $15.38 $78.92 413.13 413.13 CEVA Inc. CEVA $5.50 $28.05 410.00 410.00 Concho Resources Inc. CXO $19.85 $100.94 408.51 408.51 Safeguard Scientifics Inc. SFE $3.30 $16.74 407.27 407.27 Tractor Supply Co. TSCO $16.28 $81.29 399.32 406.93 Krispy Kreme Doughnuts Inc. KKD $1.40 $7.07 405.00 405.00 F5 Networks Inc. FFIV $21.51 $108.46 404.23 404.23 Wright Express Corp. WXS $11.20 $56.39 403.48 403.48 NetLogic Microsystems Inc. NETL $9.94 $49.80 401.26 401.26 Domtar Corp. UFS $17.88 $86.67 384.73 397.93 Intuitive Surgical Inc. ISRG $94.65 $470.86 397.48 397.48 Credit Acceptance Corp. CACC $16.50 $81.60 394.55 394.55 Veeco Instruments Inc. VECO $4.97 $24.44 391.75 391.75 Ultimate Software Group Inc. ULTI $13.70 $67.14 390.07 390.07 Casual Male Retail Group Inc. CMRG $0.40 $3.28 388.31 388.31 CBRE Group Inc CBG $3.50 $17.05 387.14 387.14 Lattice Semiconductor Corp. LSCC $1.41 $6.85 385.82 385.82 SanDisk Corp. SNDK $10.74 $52.07 384.82 384.82 Taleo Corp. (Cl A) TLEO $7.61 $36.87 384.49 384.49 Rex Energy Corp. REXX $2.27 $10.99 384.14 384.14 Bottomline Technologies Inc. EPAY $5.47 $26.48 384.09 384.09 CTC Media Inc. CTCM $3.26 $9.50 379.14 383.08 Venoco Inc. VQ $2.15 $10.38 382.79 382.79 Lufkin Industries Inc. LUFK $15.95 $73.74 362.47 382.47 RF Micro Devices Inc. RFMD $1.01 $4.85 380.20 380.20 ION Geophysical Corp. IO $1.54 $7.39 379.87 379.87 BJ’s Restaurants Inc. BJRI $9.50 $45.50 378.95 378.95 Cabela’s Inc. CAB $5.24 $25.05 378.05 378.05 Epoch Holding Corp. EPHC $5.64 $23.04 308.51 377.22 Cepheid CPHD $7.37 $35.05 375.58 375.58 TIBCO Software Inc. TIBX $5.07 $24.11 375.54 375.54 Amerigon Inc. ARGN $3.10 $14.65 372.58 372.58 Skyworks Solutions Inc. SWKS $4.07 $19.08 368.80 368.80 Approach Resources Inc. AREX $7.05 $32.93 367.09 367.09 MercadoLibre Inc. MELI $12.47 $86.95 366.32 366.32 LSB Industries Inc. LXU $7.34 $34.17 365.53 365.53 Greenbrier Cos. Inc. GBX $5.27 $24.36 362.24 365.44 Deckers Outdoor Corp. DECK $18.10 $83.85 363.26 363.26 Complete Production Services CPX $7.04 $32.55 362.36 362.36 CBS Corp (Cl B) CBS $6.48 $28.29 336.57 362.31 Steven Madden Ltd. SHOO $8.20 $37.88 361.70 361.70 Loral Space and Communications LORL $14.41 $66.49 361.42 361.42 Dorman Products Inc. DORM $8.65 $39.79 360.00 360.00 Strategic Hotels & Resorts Inc. BEE $1.27 $5.84 359.84 359.84 CarMax Inc. KMX $7.22 $33.02 357.34 357.34 GeoResources Inc. GEOI $6.52 $29.80 357.06 357.06 Oil States International Inc. OIS $17.64 $80.55 356.63 356.63 Estee Lauder Cos. Cl A EL $26.12 $115.49 342.15 356.02 OPNET Technologies Inc. OPNT $8.17 $32.90 302.69 354.91 G-III Apparel Group Ltd. GIII $4.90 $22.18 352.65 352.65 Stamps.com Inc. STMP $7.83 $30.83 293.74 352.20 SM Energy Co. SM $16.86 $75.52 347.92 351.50 Belo Corp. (Series A) BLC $1.82 $7.37 304.95 351.45 Liz Claiborne Inc. LIZ $2.09 $9.39 349.28 349.28 Key Energy Services Inc. KEG $3.36 $15.08 348.81 348.81 Kansas City Southern KSU $15.98 $71.69 348.62 348.62 Cavium Inc. CAVM $7.61 $34.08 347.77 347.77 Interactive Intelligence Group Inc. ININ $6.01 $26.86 346.92 346.92 AutoNation Inc. AN $7.91 $35.33 346.65 346.65 Power-One Inc. PWER $1.07 $4.77 345.79 345.79 Air Methods Corp. AIRM $18.13 $80.74 345.34 345.34 Huntsman Corp. HUN $2.88 $11.21 289.24 344.61 Cypress Semiconductor Corp. CY $4.27 $18.68 337.47 344.52 Celanese Corp. (Series A) CE $11.22 $49.00 336.72 344.52 Nordstrom Inc. JWN $12.01 $49.64 313.32 343.75 PriceSmart Inc. PSMT $15.85 $65.98 316.28 343.21 MarketAxess Holdings Inc. MKTX $7.40 $31.45 325.00 341.44 iStar Financial Inc. SFI $1.57 $6.93 341.40 341.40 Cummins Inc. CMI $24.05 $101.32 321.29 341.19 Volterra Semiconductor Corp. VLTR $6.39 $28.19 341.16 341.16 Solutia Inc. SOA $4.19 $18.41 339.38 339.38 Sally Beauty Holdings Inc. SBH $4.65 $20.42 339.14 339.14 Genesco Inc. GCO $13.61 $59.75 339.02 339.02 Jabil Circuit Inc. JBL $5.46 $22.36 309.52 338.37 PVH Corp. PVH $17.56 $76.01 332.86 337.26 Human Genome Sciences Inc. HGSI $2.04 $8.92 337.26 337.26 BorgWarner Inc. BWA $17.25 $74.86 333.97 336.86 Tenet Healthcare Corp. THC $1.15 $5.02 336.52 336.52 BLYTH Inc. BTH $16.16 $64.04 296.29 335.31 Ariba Inc. ARBA $6.69 $28.97 333.03 333.03 Photronics Inc. PLAB $1.70 $7.32 330.59 330.59 Alexion Pharmaceuticals Inc. ALXN $17.90 $76.99 330.23 330.23 OSI Systems Inc. OSIS $12.65 $54.17 328.22 328.22 Middleby Corp. MIDD $22.64 $96.52 326.33 326.33 Finish Line Inc. Cl A FINL $4.82 $19.70 308.71 325.48 Freeport-McMoRan FCX $11.07 $44.47 301.72 325.18 Opko Health Inc. OPK $1.29 $5.48 324.81 324.81 Diodes Inc. DIOD $5.59 $23.69 323.79 323.79 VirnetX Holding Corp. VHC $1.44 $26.20 290.46 323.27 FMC Technologies Inc. FTI $12.46 $52.52 321.51 321.51 VMware Inc. VMW $20.28 $85.46 321.40 321.40 Macy’s Inc. M $8.73 $35.37 305.15 321.11 Coach Inc. COH $15.87 $64.55 306.74 320.72 Westlake Chemical Corp. WLK $13.69 $56.01 309.13 320.58 Sotheby’s BID $8.15 $32.70 301.23 319.73 Vishay Intertechnology Inc. VSH $3.01 $11.43 319.69 319.69 Rite Aid Corp. RAD $0.33 $1.38 318.18 318.18 Continental Resources CLR $18.46 $77.16 317.98 317.98 Hi-Tech Pharmacal Co. Inc. HITK $5.22 $37.03 316.07 316.07 Charming Shoppes Inc. CHRS $1.19 $4.93 314.29 314.29 Maxwell Technologies Inc. MXWL $4.65 $19.25 313.98 313.98 FARO Technologies Inc. FARO $13.48 $55.73 313.43 313.43 Salesforce.com Inc. CRM $26.07 $107.70 313.12 313.12 E.W. Scripps Co. Cl A SSP $2.01 $8.30 312.93 312.93 Sirona Dental Systems Inc. SIRO $11.20 $46.01 310.80 310.80 Joy Global Inc. JOY $21.33 $83.86 293.15 310.61 iRobot Corp. IRBT $7.64 $31.34 310.21 310.21 Zumiez Inc. ZUMZ $7.32 $29.89 308.33 308.33 Ascena Retail Group Inc. ASNA $8.66 $35.27 307.27 307.27 OraSure Technologies Inc. OSUR $2.67 $10.84 305.99 305.99 Federal-Mogul Corp. FDML $4.07 $16.51 305.65 305.65 Expedia Inc. EXPE $16.28 $30.88 295.41 304.59 Hexcel Corp. HXL $6.31 $25.44 303.17 303.17 Seagate Technology Inc. STX $3.88 $19.75 295.62 302.42 ACCO Brands Corp. ABD $2.41 $9.67 301.24 301.24 Genworth Financial Inc. Cl A GNW $1.97 $7.82 296.95 296.95 America’s Car-Mart Inc. CRMT $10.08 $40.01 296.92 296.92 Ralph Lauren Corporation RL $37.25 $145.71 291.17 296.90 Zoll Medical Corp. ZOLL $16.89 $67.00 296.68 296.68 World Acceptance Corp. WRLD $17.33 $67.95 292.09 292.09 MBIA Inc. MBI $3.23 $12.66 291.95 291.95 CommVault Systems Inc. CVLT $12.11 $47.42 291.58 291.58 Dendreon Corp. DNDN $3.58 $14.01 291.34 291.34 Amazon.com Inc. AMZN $48.44 $189.44 291.08 291.08 Advisory Board Co. ABCO $20.09 $77.75 287.01 287.01 Health Management Associates HMA $1.53 $5.92 286.93 286.93 General Moly Inc. GMO $0.85 $3.28 285.88 285.88 Under Armour Inc. Cl A UA $18.98 $73.24 285.88 285.88 TerreStar Corp. TSTRQ $0.40 $0.00 285.00 285.00

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His