Archive for April, 2015

-

Software Can’t Catch to Explosion of Trading in China

Eddy Elfenbein, April 20th, 2015 at 9:47 amThe Chinese market has doubled in the last six months. Turnover in Shanghai and Shenzhen surpassed the NYSE and Nasdaq last month. Apparently, this is causing some problems.

China’s stock trading fever has made the Shanghai Stock Exchange the world’s biggest in terms of turnover, surpassing the New York Stock Exchange, but the explosion in volumes has exceeded the ability of the exchange’s software to report it.

The exchange’s trading turnover exceeded 1 trillion yuan ($161.28 billion) for the first time on Monday, but the data could not be properly displayed because its software was not designed to report numbers that high.

“This is a software configuration issue, not a technical glitch,” the Shanghai Stock Exchange said in a statement, adding that trading and price quotes for individual stocks were not affected.

The exchange said it would need to replace its current software files that handle volume reporting to resolve the issue.

One of the forgotten episodes on Wall Street was the paperwork crisis on the late 1960s. The NYSE had to shorten trading hours so brokerage houses could catch up.

-

The Illusion of Control

Eddy Elfenbein, April 20th, 2015 at 8:56 amFrom Jason Zweig’s The Intelligent Investor:

And a streak of being right can make anyone forget how important luck is in determining the outcome.

Research led by psychologist Ellen Langer, now at Harvard University, shows that when people who predict the tosses of a coin are told they got eight out of their first 10 flips correct, they conclude that they are significantly better than average at calling heads or tails—and that they could get well over half their guesses right if the coin were tossed another 100 times.

Prof. Langer called these incorrect beliefs “the illusion of control.”

If, however, people either get most of their early guesses wrong or win and lose in a random pattern, they don’t believe they have any special gift for calling heads or tails; nor do they remember being correct more often than they were.

Guarding against the illusion of control takes constant vigilance. The longer you’ve been right, the harder it gets.

-

Morning News: April 20, 2015

Eddy Elfenbein, April 20th, 2015 at 7:09 amEuro Area Seeks Greece Roadmap to May Agreement

Greece Flashes Warning Signals About Its Debt

Bond Yields Vanish Across Euro Zone on Grexit Worries

For the People’s Bank of China, Bond Buying Is Both Easy and Hard

China Really Wants a Rising Stock Market

China’s Reserve Cut Move Boosts Oil Price

Prologis, Norway Buy KTR Real Estate for $5.9 Billion

Liberty Global’s Subsidiary Telenet to Acquire BASE

Comcast, Time Warner Cable to Meet Regulators in Bid to Save Merger

Morgan Stanley Profit Jumps 60% on Trading Revenue

Shanghai GM to Spend $16 Billion Developing New Vehicles

Europe’s Used Jets Luring U.S. Bargain Buyers With Strong Dollar

Cullen Roche: Finding Religion on “Crowding Out”

Jeff Miller: Weighing the Week Ahead: A Geopolitical Risk to U.S. Stocks?

Be sure to follow me on Twitter.

-

March CPI Rose 0.2%

Eddy Elfenbein, April 17th, 2015 at 10:48 amThe Fed seems to have been right — our decent bout of deflation has passed. The March CPI report said consumer prices rose 0.2%. The core rate, which excludes food and energy, also rose by 0.2%.

Here’s a look at the headline rate in blue and the core rate in red.

-

CWS Market Review – April 17, 2015

Eddy Elfenbein, April 17th, 2015 at 7:03 am“To be an investor you must be a believer in a better tomorrow.” – Benjamin Graham

We’re moving into the heart of Q1 earnings season. So far, we had a good earnings report from Wells Fargo (WFC). The big bank beat estimates by six cents per share. But get ready for an earnings blizzard. Next week, eight Buy List stocks report, including big names like Microsoft (MSFT), eBay (EBAY) and Qualcomm (QCOM). I’ll preview all the reports in a bit.

Going into earnings season, traders weren’t expecting much. Thanks to the surging dollar, analysts expect that earnings fell 5.8% during the first three months of this year. The early evidence shows that it might not be that bad. So far, 36 stocks in the S&P 500 have reported, and 81% have beaten estimates. For comparison, the average “beat rate” is about 63%. (That’s right; on Wall Street you’re expected to beat expectations.) As a result, the S&P 500 is back over 2,100 and not far from a new all-time high. The index has now stayed close between 2,040 and 2,120 for 51 straight days (see below).

While the S&P 500 is still below its all-time high, broader indexes like the Russell 3000 came within inches of a new high. The reason is that small-caps have been leading the charge. If you remember, small-caps dramatically underperformed during the first three quarters of 2014. But since October, they’ve been ruling the roost.

Before I get to the Buy List earnings reports, let’s take a look at some of the recent economic news.

Are We Close to a Recession?

The economy seems to have hit a rough patch. The economy grew by just 2.2% in Q4, and the last jobs report was well below expectations. This week, we got more negative news. Housing starts were poor. This was the second month in a row they badly missed expectations.

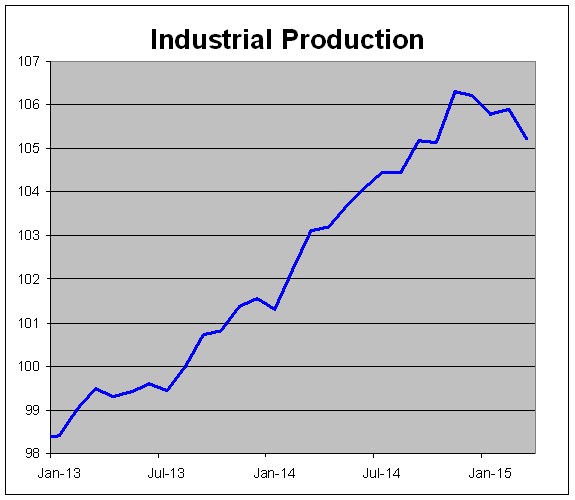

On Wednesday, we learned that industrial production fell by 0.6% in March. This comes on the heels of a 0.1% drop in February and a 0.4% drop in January. This was the first quarterly decline for IP since 2009. Not surprisingly, the weak link is the oil and gas industry. The government will release its first estimate of Q1 GDP on April 29, but the consensus of economists on Wall Street expects an increase of just 2%.

Combined with the retrenchment in earnings, some folks are beginning to wonder if this is enough to push us into a recession. My view is that it’s highly doubtful. These recent issues are mostly bumps and hiccups as the economy tries to expand. Lousy weather played a part, as did the dollar. There were also some port disruptions on the West Coast due to a labor dispute. That’s now passed. The evidence still suggests that we’re a long way from a recession.

This week’s retail sales report, for example, was a bright spot. For March, shoppers pushed sales up by 0.9%. This was the first increase in retail sales since November. This tells me that consumers are still out there willing to shop, but they’re more price-conscious. I thought it was interesting that sales at clothing stores were up 1.2% (think Ross Stores). But the good retail numbers for March were probably too late to make a sizable bump in Q1 GDP.

Another possible sign of consumer strength is that oil is rising again. On Thursday, West Texas Intermediate closed at $56.53 per barrel. That’s the highest close this year. Oil is up $14 in a month. For the first time in several months, energy stocks have also been doing well.

This week’s Beige Book (by the way, the Beige Book report is a very good wonky look at the economy) was mildly positive. Basically, it said that the economy is growing, albeit slowly. Despite the poor March jobs report, the initial claims continue to show a positive trend. The four-week moving average recently dipped to a 15-year low. It’s important to note that household finances are also much healthier. Speaking of which, let’s take a look at the recent earnings report from Wells Fargo.

Wells Fargo Beats Earnings

I like Wells Fargo (WFC) a lot, but we have to concede an important fact: this is a much tougher environment for banks. The mortgage market is especially tough, and I think we’ll see some pain in oil-rich states. Layoffs in the oil sector have already topped 91,000.

On Tuesday, Wells reported Q1 earnings of $1.04 per share. That beat Wall Street’s consensus by six cents per share and my estimate by four cents per share. This was their first year-over-year drop in profits since 2008.

Digging into the details, we can see come cracks. One troubling sign is that Wells’s lending margin fell below 3% for the first time in more than 20 years. Their efficiency ratio was 58.8%, which isn’t bad. Wells surprised me by increasing their mortgage-banking revenue by 2.5%.

The shares sold off after the earnings report. At one point on Tuesday, WFC hit $53.57 per share. Frankly, there wasn’t a single piece of information in this report that should have scared a long out of his or her position. Sure enough, WFC quietly rallied back and broke above $55 on Thursday.

My outlook on Wells remains the same. This is an excellent bank. The new dividend will yield investors 2.74% at the current price. Wells Fargo is a good buy up to $57 per share.

Next Week’s Earnings Blizzard

Our Buy List has been fairly tame over the past few weeks, but things will soon get a lot more interesting. We have eight Buy List earnings reports coming our way. Let’s run down the scorecard.

On Tuesday, Stryker and Signature Bank are due to report. In January, Stryker (SYK) told us to expect Q1 earnings to range between $1.05 and $1.10 per share. That disappointed the Street, as analysts had been expecting $1.17 per share. As you might have guessed, they blamed the dollar. The orthopedics company also said they see full-year earnings ranging between $4.90 and $5.10 per share. Last year, they made $4.73 per share.

I think the company is being conservative with this guidance, which makes sense in this environment. I expect a modest earnings beat. The stock has been stuck in a trading range between $90 and $95 per share for nearly the entire time since Thanksgiving. Last month, Stryker’s board approved a $2 billion buyback.

Signature Bank (SBNY) doesn’t make a lot of news, and that’s exactly how they want it. The financial news loves to cover every minor creak or moan from Apple and Google. Meanwhile, Signature has quietly amassed an amazing track record. In Q4, the bank had their 21st record earnings season in a row.

Analysts currently expect Q1 earnings of $1.59 per share. That’s a 16% jump over last year’s Q1. That’s a high number, but I think Signature can do it. The stock is going for 16.6 times next year’s earnings. Look for more good news from SBNY.

On Wednesday, three Buy List stocks are due to report: eBay, Qualcomm and Wabtec. Shares of eBay (EBAY) have been weak recently, and I think they’re a good value here. The online auction house gave weak guidance for Q1: 66 to 71 cents per share. I think that’s too low, and I expect a solid earnings beat. Of course, the PayPal spinoff is in the works, and the company also hinted that it might sell off its enterprise division. That makes sense, since that division doesn’t fit into either eBay or PayPal. I hope they do it.

Speaking of spinoffs, Jana Partners made news this week when they said that Qualcomm should break itself up. They want QCOM to spin off its chip business from its patent-licensing biz. Again, that makes a lot of sense, and I’d like to see QCOM do that.

There’s often a familiar script to these demands from activist investors. The activists make a big splash by revealing a list of demands. The company ignores or denounces it. Then it quietly does much of what the activists wanted. Obviously, no one wants to be told how to do their job. But we like Qualcomm because the stock has sagged, and that puts more pressure than anything on a corporate board. Remember that QCOM recently announced a 14% dividend increase and a major buyback plan. I think Jana is exactly right.

I like Wabtec (WAB) because it’s one of those dull businesses that’s actually quite profitable. WAB makes locomotives, brakes and other systems for the freight- and passenger-rail sectors. Hey, somebody’s got to do it. It’s already our second-best performer this year (see chart below). Earlier this year, the company said they expect full-year earnings of $4.05 per share. That’s up from $3.62 per share last year, and $3.01 in 2013. A lot of companies would love earnings growth like that. The stock came very close to making a new 52-week high on Thursday. A strong earnings report could push WAB over $100 per share.

Next Thursday, three more Buy List stocks report: CR Bard, Microsoft and Snap-on. CR Bard (BCR) has been a great stock for us. Last year was a standout year for the medical-devices firm. Two years ago, the company changed direction to focus on emerging markets and faster-growing areas. That was a brilliant move. Bard expects earnings this year between $8.95 and $9.05 per share. That includes 25 cents per share due to the dollar. For Q1, they see earnings coming in between $2.04 and $2.08 per share. Don’t let the high share price scare you away, BCR is hardly overpriced.

Lately I’ve been hyping Microsoft (MSFT) as one of the cheapest stocks on our Buy List, and I want to reiterate that now. The shares yield just under 3%, which is a good deal in this market. In January, Microsoft got smacked around after the last earnings report. The problem was a weak outlook for PC sales. That’s not really Microsoft’s fault but a macro issue. Next week’s earnings, which is their fiscal Q3, will be a weak one from Microsoft, but the question now is, how weak? Wall Street currently expects 51 cents per share, which is down from 68 cents per share for last year’s Q1. Microsoft faces some issues, but I like what Nadella is doing. I expect to see an earnings beat here.

Snap-on (SNA) crushed earnings last time. The diversified manufacturer earned $1.97 per share, which was 16 cents more than estimates. Last year, Snap-on earned $7.14 per share, which was a 20% increase over 2013. Wall Street expects Q1 earnings of $1.82 per share. I currently rate Snap-on a buy up to $151 per share.

In addition to those eight, we may have a ninth Buy List earnings report next week, which would be Moog (MOG-A). The company usually reports Q1 earnings on the last Friday of April, but I couldn’t get that date confirmed before I wrote this, so this is a just a guess. Either way, I’ll have full details on the blog. Like many others, Moog has felt the squeeze of the richer greenback. Wall Street expects earnings of 92 cents per share. Moog is a good, conservative stock.

Before I go, I wanted to draw your attention to this IBD feature on Ross Stores (ROST). You can see why I like this retailer so much. Remember it will be splitting 2 for 1 in June. Ross Stores is a buy up to $107 per share.

That’s all for now. Lots more earnings reports next week. You can see our Buy List earnings calendar here. We’ll also get important updates on the housing market; existing homes sales on Wednesday and new home sales on Thursday. Plus, durable goods comes out on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: April 17, 2015

Eddy Elfenbein, April 17th, 2015 at 7:01 amIMF’s Lagarde To Greece; Pay Us Or Else

‘Beijing Put’ May Be Driving China’s Stock-Market Fever

For Reeling Turkish Investors, Politics Are Nothing But Trouble

Deals Postponed After Bloomberg Terminals Go Down Globally

Big-Bank Profit Engines Accelerate

GE Power-Unit Sales Boost Profit Past Estimates Amid Oil Slump

GE’s Exit From Finance Merely Shifts Systemic Risk to Others

Emirates Signs Rolls for A380 Engines in $9.2 Billion Deal

UnitedHealth’s Premium Valuation Could Lose Insurance

AmEx Revenue Misses on Strong Dollar, Loss of Co-Branded Tie-Ups

Seattle CEO Who Cut His Pay Sees a ‘Moral Imperative’ to Bridge Income Gap

Mattel Posts Smaller-Than-Expected Loss as Barbie Woes Abate

Honeywell Profit Beats Estimates While 2015 Sales Forecast Cut

Jeff Carter: Never Look A Gift Horse In the Mouth

Howard Lindzon: Peak Goldman or Peak Google…Who do you Anti-Trust

Be sure to follow me on Twitter.

-

IBD on Ross Stores

Eddy Elfenbein, April 16th, 2015 at 3:17 pmInvestor’s Business Daily has a nice feature on Ross Stores (ROST). Here’s a sample:

Ross’ appeal is based on its motto, “Dress for Less.” Ross stores offer what the company calls “first-quality, in-season, name-brand and designer” apparel, accessories, footwear and home fashions at prices 20% to 60% below regular prices at department and specialty stores.

With an average price of $10 on clothing purchases, “Ross ends up as the low-price leader in apparel,” said Greenberger. “There are few retailers out there that consistently price below Ross in apparel.”

The average apparel price at TJX’s (NYSE:TJX) T.J. Maxx is $15, and for affiliated chain Marshalls it’s $14, she says, adding: “We love T.J. Maxx, but not everybody can afford to shop there.”

Ross’ low price point is one of the main ingredients of its “secret sauce,” Greenberger says. “Almost anyone” can afford to shop there.

But shoppers who can afford more like to go there, too. Take the tourist in Florida from Manhattan’s Upper West Side, who recently bragged to friends that she bought three designer dresses at a Ross store near West Palm Beach for $36 each.

That kind of “thrill” of finding a bargain on a “fabulous brand” keeps shoppers coming back, Greenberger says.

-

Morning News: April 16, 2015

Eddy Elfenbein, April 16th, 2015 at 7:03 amChina March FDI Robust at $12.4 Billion, Outbound Flows Up 29.6% in First-Quarter

Saudi Arabia Adds Half a Bakken to Global Oil Market in a Month

Yellen and Bernanke Go Separate Ways on Exit Strategy

The Slow Global Spread of Savings Accounts

Goldman Sachs Gains Focusing on Less-Volatile Businesses, Cutting Costs

McDonald’s Japan Sees Wider Losses This Year After Food Scandals

Here Comes Marissa Mayer’s First Home Grown Consumer Product for Yahoo

Unilever Sees Tailwinds Boosting Sales Hopes

Nokia Takeover Fulfills Alcatel Chairman’s Vision of Telecom Airbus

Netflix: Street Applauds Disastrous Financial Results

Bank of America Results Highlight Challenges

3 Big I.P.O.s Could End Slow Start for ’15 Debuts

Microsoft, Once an Antitrust Target, Is Now Google’s Regulatory Scold

Roger Nusbaum: The Active/Passive Debate: Others Weigh In

Joshua Brown: Effervescence Extrapolated

Be sure to follow me on Twitter.

-

High Beta Takes the Lead

Eddy Elfenbein, April 15th, 2015 at 10:35 amSince January 15, the High Beta ETF (SPHB) has been beating the market soundly:

This could be a result of investor frustration with finding bargains. The market is forced to reward riskier stocks, not because of a change in view of risk, but because there’s not much left out there.

-

The Nasdaq Plunge 15 Years On

Eddy Elfenbein, April 15th, 2015 at 10:07 amLast month we celebrated the 15th anniversary of the great Nasdaq top. On March 10, 2000, the Nasdaq Composite closed at 5,048.62. It’s never closed that high since.

Yesterday was the 15th anniversary of the Nasdaq’s biggest one-day plunge. On April 14, 2000, the index fell 9.67% in one session.

The Nasdaq had started drifting downward after March 10, but it wasn’t until April 14 that the selling really started. It wouldn’t let up. The index lost 33% in just 10 sessions.

(Note the numbers on the vertical axis; these are big moves.)

After May, the Nasdaq recovered a bit and many investors thought the storm was over. It was just beginning. There was another selling fury that fall. After 9/11, the Nasdaq was 72% below its 2000 high. It went on to make even lower lows in 2002.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His