CWS Market Review – October 12, 2018

“I think the Fed is making a mistake. It’s so tight, I think the Fed has gone crazy.”

– President Donald Trump

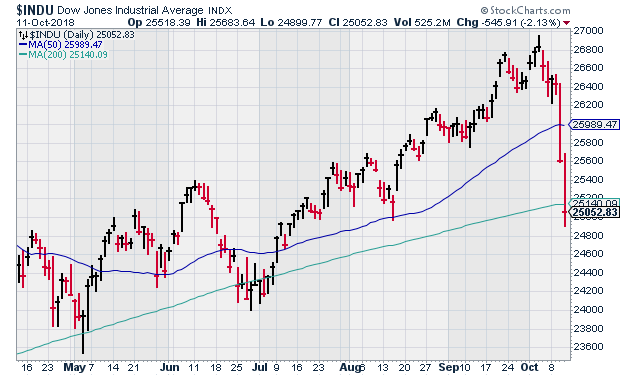

In last week’s CWS Market Review, I told you that the bears would strike again—and they did. On Wednesday, the Dow Jones Industrial Average shed 831 points for its worst loss in eight months. The market then followed that up with a further drop of 546 points on Thursday. That’s a staggering loss of 1,377 points in just 48 hours.

Suddenly, Wall Street is nervous. In the last six days, the Volatility Index is up 160%. The first thing I should tell you is don’t panic. While all this sounds bad, from a historical perspective, this week’s loss isn’t that unusual. In fact, this isn’t even our worst two-day drop of this year. The one from February still has this one beaten.

I am, however, cautious, and in this issue, I want to explain why. On Thursday, the S&P 500 closed below its 200-day moving average (see the green line in the above chart). This is a quick-and-dirty gauge of the stock market’s momentum. Historically, stocks have done better when they’re above their 200-DMA rather than below it. The S&P 500 had not closed below its 200-DMA in more than two months. In fact, if we go back further to March 2016, the S&P 500 has closed every day but two above its 200-DMA.

In this week’s CWS Market Review, we’ll discuss what has the market so spooked. Fortunately, our Buy List has done much better than the market this week (meaning, less badly). We’re also starting third-quarter earnings season soon. I’ll preview the first four earnings reports coming our way next week. But first, let’s look at the market’s October swoon.

Risk Returns to Wall Street

So what caused Wall Street’s ruction this week? That’s not so easy to say. Since something happened, we assume it has an identifiable cause, but that’s not the way it works with financial markets. Instead, a lot of different things happen all at once, in real time, and markets react.

Having said that, let’s round up some of the usual suspects. For one, the stock market has done so well for so long that it’s inevitable that we’re due for some sort of backlash. Not only have markets been happy, but they’ve also been calm. The S&P 500 went 74-straight sessions without a single one closing up or down by more than 1%. Many of those days, the index moved less than 0.5%. That’s not normal. Markets are dynamic things, and that demands action. This week, we got some.

There’s also the issue of interest rates. The Federal Reserve recently hiked interest rates. We all knew this was coming. The Fed has been pretty consistent about its intentions, so no one can claim they were caught off guard by the last rate hike.

What’s happened this time is that long-term interest rates have started to rise. Last Friday, the 10-year Treasury yield got to 3.23%. That’s up 90 basis points in the last year. The rise is because the economy has been getting better. The current climb in yields isn’t solely due to inflation, which continues to behave. Lenders are demanding more money for their money, and they’re getting it. For example, if we look at the inflation-protected bonds, we see yields rising. Last week, the yield on the five-year TIPs topped 1%. That’s stronger competition for stocks, so some reaction from stocks is expected.

Here’s the S&P 500 minute-by-minute over the last two weeks.

Rising rates also take some energy out of the economy, particularly in the housing market. Mortgage yields are now at a seven-year high, and the housing market is beginning to show some cracks. If rates go from 4% to 5%, that adds $150 per month to a $250,000 mortgage. That prices a lot of homebuyers out of the market. Existing home sales have fallen for six months in a row. There are cracks appearing in an otherwise solid foundation. For example, unsold high-end homes in New York City are piling up.

The Homebuilder ETF (XHB) fell for 13 days in a row. It rose slightly and then fell sharply for three more days. We can see the impact on our Buy List with stocks like Sherwin-Williams (SHW) and Continental Building Products (CBPX).

I should add that our Buy List has held up well during the recent selloff. On Wednesday, the Buy List beat the S&P 500 by 84 basis points. Interestingly, the selloffs on Wednesday and Thursday had very different profiles. Wednesday’s drop was heavily concentrated on tech stocks. The FAANG stocks lost $175 billion in market value. But on Thursday, defensive and value stocks fell more than riskier stocks did.

That’s the opposite of what you’d usually expect. If I were told that the Nasdaq beat the Dow by 1%, as it did on Thursday, then I’d naturally assume it was a strong up day for Wall Street. Instead, we lost over 2%.

Let’s remember that Wednesday’s fall doesn’t even crack the Top 50 of worst days of the last 20 years. There was a nine-week period in 2008 when we had five days twice as bad as Wednesday. This Wednesday was also the tenth anniversary of the greatest intra-day reversals in history. The Dow dropped 8.12%, then rallied to +3.75%, and closed for a measly loss of 1.49%. If you’re historically-minded, two bear markets ended on October 10th: one in 1990 when the Dow was at 2,365, and the other in 2002 when the Dow was at 7,181. The latter one ended at 10:10 am on 10/10.

There’s also the issue of trade. The Trump Administration has ratcheted up the rhetoric in its approach toward China. Trade is still a small part of our overall economy, but this is having an impact. Consider that 85% of toys sold in the United States are made in China. As I pointed out in this week’s epigraph, President Trump lays the blame for the recent turbulence on the Fed. Meanwhile, the Chinese stock market has been in a tailspin. High-profile Chinese stocks like Alibaba (BABA) and Tencent (TCEHY) have been getting smacked down.

It’s not good for us if the Chinese economy goes off the rails. They’re a key trading partner, plus they own a good share of our treasury debt. I think this is clearly a factor in this week’s drop. Hopefully, the Trade War talk and retaliations will subside before serious damage is done.

The bears are easily startled, but they’ll soon be back, and in greater numbers. For us, we need to focus on high-quality Buy List stocks. Here’s our game plan. In order.

1. Don’t panic

2. Expect more drops

3. Be patient

4. Wait for bargains

Let the other guys panic. The Buy List has outstanding stocks, and we’ll see more proof of that over the next few weeks as earnings season dominates the news.

Four Buy List Earnings Reports Next Week

Over the next three weeks, 20 of our 25 Buy List stocks are due to report Q3 earnings. Here’s a preliminary earnings calendar with each stock, the earnings data and Wall Street’s estimate. I don’t have all the dates just yet (some companies are better at that than others). Four of our stocks are due to report next Thursday.

| Company | Ticker | Date | Estimate |

| Alliance Data Systems | ADS | 18-Oct | $6.24 |

| Danaher | DHR | 18-Oct | $1.08 |

| Signature Bank | SBNY | 18-Oct | $2.83 |

| Snap-On | SNA | 18-Oct | $2.86 |

| AFLAC | AFL | 24-Oct | $0.99 |

| Check Point Software | CHKP | 24-Oct | $1.36 |

| Sherwin-Williams | SHW | 25-Oct | $5.78 |

| Stryker | SYK | 25-Oct | $1.68 |

| Cerner | CERN | 25-Oct | $0.63 |

| Moody’s | MCO | 26-Oct | $1.80 |

| Cognizant Technology Solutions | CTSH | 30-Oct | $1.13 |

| Fiserv | FISV | 31-Oct | $0.77 |

| Intercontinental Exchange | ICE | 31-Oct | $0.80 |

| Church & Dwight | CHD | 1-Nov | $0.54 |

| Ingredion | INGR | 1-Nov | $1.97 |

| Becton, Dickinson | BDX | 6-Nov | $2.93 |

| Wabtec | WAB | TBA | $0.95 |

| Torchmark | TMK | TBA | $1.53 |

| Carriage Services | CSV | TBA | $0.22 |

| Continental Building Products | CPBX | TBA | $0.49 |

Alliance Data Systems (ADS), the loyalty rewards company, started off the year terribly By May, ADS was down more than 20% for us. But it turned around and regained a lot of lost ground. That rally hit the rocks a few weeks ago, and ADS has been trending lower again. This past week didn’t help matters.

I’ll credit ADS for consistently standing by its full-year earnings forecast of $22.50 to $23 per share. That means the stock is currently going for less than 10 times this year’s earnings. The consensus on Wall Street is for Q3 earnings of $6.24 per share. Recently, an analyst at Bank of America Merrill Lynch started coverage of ADS with a buy and gave it a $290 price target. I’ll be curious to hear any guidance for 2019.

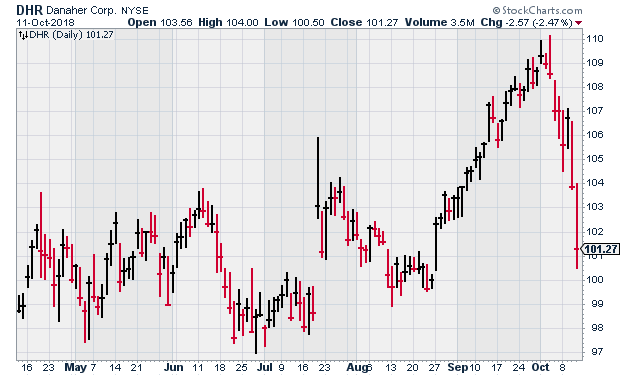

Three months ago, Danaher (DHR) gave us another nice earnings beat, but that wasn’t the big news. The company also announced that it will spin off its dental business next year. That business currently accounts for about 20% of Danaher’s revenues. For Q2, Danaher made $1.15 per share. The company had told us to expect Q2 earnings between $1.07 and $1.10 per share. Danaher also raised its full-year earnings range to $4.43 to $4.50 per share. For Q3, Danaher expects earnings to range between $1.05 and $1.08 per share.

The company has been in the news lately because its former CEO, Larry Culp, has been selected as GE’s new CEO. Going by his performance at Danaher, that’s a very wise choice.

Snap-on (SNA) was our big winner last earnings season. The company said that Q2 earnings rose 20% to $3.11 per share. That beat the Street by 16 cents per share. The stock responded by jumping 9.5%. This could be a trend for Snap-on. The stock jumped more than 6% after the Q1 earnings came out in April.

For Thursday, Wall Street expects Q3 earnings of $2.86 per share. That’s an increase of 16% over last year. Thanks to the recent downdraft, SNA is going for 13 times next year’s earnings. I also expect to see another dividend increase from Snap-on in early November. In the last five years, SNA’s dividend has more than doubled.

I’m also going to include Signature Bank (SBNY). Although the bank hasn’t formerly announced its earnings date, going by its regular schedule, I’m guessing it will be on Thursday. This has been a frustrating stock to own. The shares are currently less than 3% above their 52-week low. The narrowing yield curve is taking its toll on Signature’s valuation.

Despite the drop, I think SBNY looks very good. The shares are going for about 10 times next year’s earnings estimate. The bank also initiated its first dividend of 56 cents per share. Going by Thursday’s close, that works out to a yield of 2%.

Total deposits now stand at $34 billion. That’s an increase of 5.5% in the last year. Loans are up 12.4% to $34.15 billion. Net interest margin, which is the key metric for banks, came in at 2.94% for Q2. Those are decent numbers. For Q3, the consensus on Wall Street is for earnings of $2.83 per share.

That’s all for now. Earnings season will start to ramp up next week. We’ll also get a few key economic reports. On Monday, the retail-sales report for September comes out. Then on Tuesday, we’ll get our latest look at industrial production. Wednesday is housing starts plus the minutes to the last Fed meeting. The exiting-home sales report comes out on Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Syndication Partners

I’ve teamed up with Investors Alley to feature some of their content. I think they have really good stuff. Check it out!

Two Stocks to Buy in Japan’s Quiet Bull Market

It’s the bull market that almost no U.S. investor has heard about. But it is a very real and vibrant bull market. What am I talking about?

The Japanese stock market, which last week hit a 27-year high!

After Japan’s “bubble economy” collapsed in the early 1990s, its entered a long period of recession and stagnation. In the late 1990s, conditions got even worse as a financial crisis hit some of its leading financial companies, such as Yamaichi Securities and the Long-Term Credit Bank of Japan. The Nikkei index continued drifting downward after that, hitting the 7,054.98 mark on March 10, 2009 as the global financial crisis took its toll.

But then, the second Abe government began in December 2012, and its so-called Abenomics economic strategy, including an ultra-easy monetary policy from the Bank of Japan, took both Japan’s economy and stock market into a long upward trend, which has continued to this day.

If you are looking to invest into Japan’s bull market, please do NOT use ETFs. If you do, your performance will be held back by the banks and other similar companies in the index that offer little growth.

Instead, stick with individual stocks as I have with the Growth Stock Confidential portfolio that currently holds three Japanese stocks with great growth potential.

Posted by Eddy Elfenbein on October 12th, 2018 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His