CWS Market Review – June 21, 2019

“Many FOMC participants now see that the case for somewhat more accommodative policy has strengthened.” – Federal Reserve Chairman Jerome Powell

That little statement above sparked a party on Wall Street. What it means, basically, is that the Fed is leaning towards cutting rates. Wall Street responded with a big rally. On Thursday, the S&P 500 closed at a brand-new all-time high.

Our Buy List also closed at an all-time high. We have a nice lead over the market as well. We’re now up over 21% on the year and 2019 isn’t even halfway done.

In this week’s CWS Market Review, we’ll take a closer look at what the Fed’s plans are. I’ll also preview next week’s earnings report from FactSet. This stock has been a rock star for us this year. It’s our #1 stock this year, with a 50% gain.

I also have some updates for our Buy Below prices. Thanks to the recent rally, our stocks keep busting past their Buy Belows. But first, let’s look at what the Fed had to say this week. Or more accurately, what they’re no longer saying.

The Fed Is Patient No More

The Federal Reserve met on Tuesday and Wednesday of this week. This was an important meeting because there’s been growing pressure on the Fed to help out the economy. The central bank decided against lowering interest rates.

Going into this meeting, there was some speculation that the Fed could surprise us with a rate cut. Alas, that didn’t happen, but the Fed appears to be more open to cutting rates in the future. In fact, one member, St. Louis Fed President James Bullard, voted to cut rates immediately.

In their policy statement, the Fed noted the overall strength in the economy. Importantly, the Fed removed a key sentence. The words “In light of global economic and financial developments and muted inflation pressures, the Committee will be patient as it determines what future adjustments to the target range for the federal-funds rate may be appropriate to support these outcomes” were absent from this statement. Previously, the “patience” referred to the need to raise interest rates.

The statement contained this sentence: “The Committee continues to view sustained expansion of economic activity, strong labor-market conditions and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes.” And it added: “but uncertainties about this outlook have increased.”

That’s telling. The FOMC debates these words carefully. There are clearly Fed members in addition to Bullard who want to see rates go down soon.

The Fed also released its economic projections for the coming few years. Here’s where things get interesting. Despite the market’s desire for rate cuts, a slim majority at the Fed sees no need to cut rates this year. After that, they only see one rate cut coming next year.

Wall Street is far from this view. Very far. According to the latest futures prices, a cut at next month’s meeting is a foregone conclusion. I’m not exaggerating. The futures market has the odds of a cut priced at 100%. You can’t get much more certain that that! One month ago, the odds were at 20%.

On top of that, they see the odds of a cut at the following meeting, in September, at 87%. I’m puzzled by this level of certainty. In fact, futures traders see a third rate cut coming before the end of the year.

While it’s true that the Fed appears to have shifted its stance towards being more open to rate cuts, I think the market is greatly overestimating the Fed’s willingness to cut rates once, or even a few times. Whenever there’s a disagreement between market prices and a committee of economists, it’s usually a good idea to take the market’s opinion with greater weight. This time, I’m not so sure. It’s one thing to take back a wrongheaded rate hike in December. It’s quite another to cut rates by 1% over the coming year.

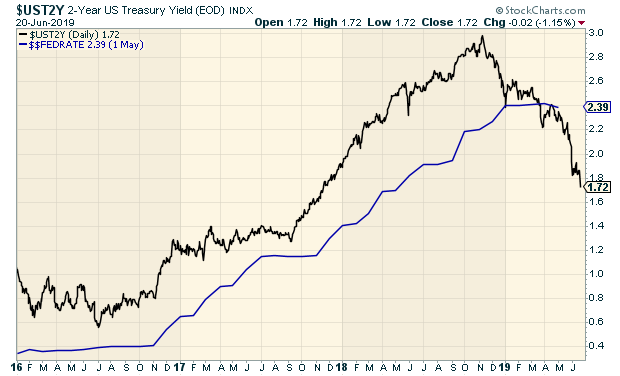

For their part, the bond market is all on board for rate cuts. This week, the yield on the 10-year Treasury dipped below 2%. The yield is now back to where it was before President Trump was elected more than two-and-a-half years ago. In the last seven months, the yield has dropped 120 basis points.

What this means is that the financial markets are very concerned about the sustainability of the economy. The most interesting part of the yield curve is the area around two to three years ago. Yields here have plunged very low in anticipation of Fed rate cuts. But it appears that investors aren’t expecting a prolonged cycle of lower rates. The yield curve starts to rise again after three years out.

On Thursday, the price of gold had its best day in three years. Gold is now at a six-year high.

Wall Street seems convinced on three points: we need three or four rate cuts, the Fed will oblige us and these cuts will be successful. Frankly, I’m a doubter on all three.

What to do now? The Fed’s policy change has been very good for share prices. So far, this has been the best June for the S&P 500 since 1955. Despite my skepticism regarding the Fed’s willingness to help us out, we’ve been doing very well.

There’s been a shift in the rally. Starting in June, the low-vol sectors started to lag. This comes after a few weeks of trouncing the market. In June, tech has done well, while areas like financials have lagged. This makes sense as banks like higher interest rates.

Investors should continue to focus on high-quality stocks like those we have on our Buy List. Pay particular attention to stocks that pay nice dividends. This includes stocks like Hershey (HSY), Hormel Foods (HRL) and AFLAC (AFL). Now let’s look at a Buy List stock that recently raised its dividend for the 14th year in a row.

Look for Good Earnings Next Tuesday from FactSet

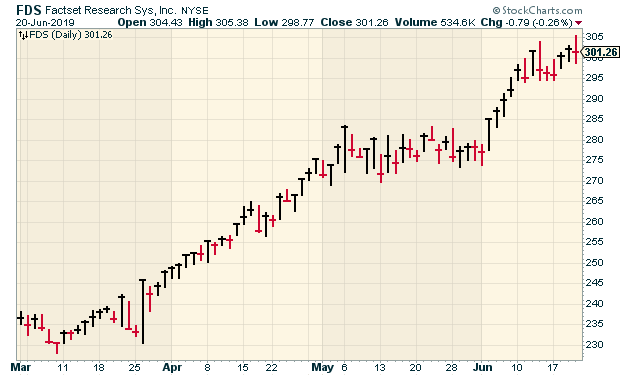

We’re now in the slow period for Buy List earnings reports. On Tuesday, June 25, FactSet (FDS) is due to report. After that, we won’t see our next earnings report until mid-July when the Q2 earnings season starts.

FactSet has been on a tear for us this year. It’s our top-performing stock, with a YTD gain of more than 50.3%. On a side note, FactSet is one of our off-cycle stocks. Their last quarter ended in May. We have one other stock on the same fiscal cycle, RPM International (RPM), but they won’t report for another month.

Business is going very well for FactSet. Three months ago, FDS reported fiscal Q2 earnings of $2.42 per share. That was nine cents better than Wall Street’s consensus. Quarterly revenue rose 5.9% to $354.9 million, and organic revenue rose 5.7%.

The key stat for FactSet is Annual Subscription Value, or ASV. In Q2, ASV rose to $1.44 billion. I was also pleased to see FactSet increase its adjusted operating margin to 33.2% from 31.4% a year ago. That’s a good sign.

As of the end of Q2, FactSet has a client count of 5,405. That’s an increase of 108. The user count increased by 6,854 to 122,063. Annual client retention is greater than 95% of ASV.

In March, FactSet also updated its financial guidance. The company expects revenue to range between $1.41 billion and $1.45 billion. They see adjusted operating margin between 31.5% and 33.5%. They see full-year earnings between $9.50 and $9.65 per share. That was an increase of five cents to the low end.

More good news came last month when FactSet raised its dividend by 12.5%. The quarterly payout increased from 64 to 72 cents per share. The stock keeps churning higher. Last week, FDS broke above $300.

The consensus on Wall Street for next week’s earnings report is $2.36 per share. Look for another beat. I’ll probably increase our Buy Below on FDS, but I want to see the earnings report first.

Buy List Updates

I have some comments on a few other stocks. This week, the Verge ran an expose on the content monitors at Facebook. It’s a disturbing story about how they have to watch graphic content on the Internet for hours on end. While the employees work at Facebook, they work for Cognizant Technology Solutions (CTSH).

I want to be clear that there are no specific allegations of wrongdoing, but it’s not a flattering story. Cognizant is wisely staying ahead of the news. The company released a statement reiterating their support for workplace safety.

This shouldn’t have any impact on the company’s financial health, but I wanted to make you aware of the latest news.

There’s not much to add after the fallout from the Raytheon (RTN)/United Technologies (UTX) deal. In Barron’s, Andrew Bary said that the deal has pulled off a rare feat: it’s upset both sets of shareholders. He’s right. If someone pulled the plug on the deal, both stocks would rally.

If there’s a silver lining, it’s that the recent dip in share price has made RTN a good value here. According to Bill Ackman, UTX is using their undervalued shares to buy us out. I don’t see a way that the merger can be called off. We’re stuck with it.

With the market’s recent surge, I want to adjust a few of our Buy Below prices. Hershey (HSY), for example, has been rallying steadily for a few weeks. Since April 24, shares of HSY are up more than 18%. The chocolatier is a good example of a defensive stock. It does best when people are scared. I’m raising our Buy Below to $145 per share.

Stryker (SYK) is now a 30% winner for us this year. This is one of the most consistent long-term winners you’ll find. The stock got up to a new 52-week high on Thursday. More good earnings news should come next month. I’m raising our Buy Below to $208 per share.

Danaher (DHR) will report its Q2 earnings in July 18. The company expects earnings to range between $1.13 and $1.16 per share. Earlier, Danaher lowered its full-year guidance from $4.75 – $4.85 per share to $4.72 – $4.80 per share. This reflects the share dilution to buy GE Biopharma. The deal should close sometime in Q4. This week, I’m raising my Buy Below on Danaher to $150 per share.

That’s all for now. Next week is the final trading week of the first half of the year. We’ll get a few important economic reports. On Tuesday, the new-home sales report comes out along with consumer confidence. On Wednesday, we’ll get the latest report on durable goods. On Thursday, the government will update the Q1 GDP numbers. The last report showed that the U.S. economy grew, in real terms, at a 3.1% clip in the first quarter. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on June 21st, 2019 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His