Archive for July, 2019

-

Bloomberg Appearance

Eddy Elfenbein, July 22nd, 2019 at 10:00 amHere’s my appearance on Bloomberg from Friday. I’m introduced at 1:30:45.

-

RPM International Earns $1.24 per Share

Eddy Elfenbein, July 22nd, 2019 at 9:11 amGood news for RPM International (RPM). The company made $1.24 per share for its fiscal Q4. That was 10 cents more than estimates.

“We are very pleased with our significant earnings leverage for the quarter, which was bolstered by our 2020 MAP to Growth operating improvement plan, the benefits of which are beginning to be realized. Also contributing to the bottom line were recently implemented price increases and stabilizing raw material cost inflation. These gains were partially offset by continuing increases in costs for distribution and labor,” stated RPM chairman and CEO Frank C. Sullivan.

“Sales grew organically by 3.5%, while acquisitions contributed 1.9%. This sales growth was offset by unfavorable foreign exchange of 2.6%. Sales in North America, our largest market, were slowed by some of the wettest spring months on record, which caused delays in painting and construction projects. In addition, conditions in Europe, our second largest market, remained soft. Despite these challenges, our operating units were able to drive top-line growth and gain market share,” stated Sullivan.

This was a very good quarter for RPM. Net sales rose by 2.8% to $1.6 billion. The company also sees 2020 earnings of $3.30 to $3.42 per share.

-

Morning News: July 22, 2019

Eddy Elfenbein, July 22nd, 2019 at 7:26 amSawdust Might Be One Answer to the World’s Plastic Problem

Millions of Barrels of Iranian Oil Are Piled Up in China’s Ports

Brexit May Have Already Triggered U.K. Recession, Niesr Says

Chinese Buyers Seek Tariff Exemptions for U.S. Farm Goods

Chinese Money in the U.S. Dries Up as Trade War Drags On

Batman and AT&T: A New Dynamic Duo?

How to Prepare for Retirement If You’re Worried About Social Security

Hyundai Motor Lays out U.S. Recovery Plan, Places Hope on New SUV Models

Fire Forces Philadelphia Energy Solutions to File for Bankruptcy Again

Halliburton Profit Beats on International Demand for Oilfield Services

‘Lion King’ Remake Becomes Disney’s Latest Box-Office Smash

Equifax Settlement in Data Breach Will Cost at Least $650 Million

Joshua Brown: Elizabeth Warren’s Banking Sector Napalm

Ben Carlson: The Work Required to Behave in the Markets

Howard Lindzon: Momentum Monday – It’s Always Something….

Be sure to follow me on Twitter.

-

RIP: @Nonrelatedsense

Eddy Elfenbein, July 19th, 2019 at 4:54 pmI didn’t know the Tweeter known as @Nonrelatedsense, but I interacted with him many times. I’m deeply saddened to learn of his passing. He was a great addition to the sometimes-raucous arena we call Finance Twitter.

Jason Zweig added in the WSJ:

That’s never been clearer than it was a few days ago, when the person behind the @Nonrelatedsense account died, prompting an outpouring of love and grief in the financial quadrant of Twitter known as FinTwit. (Although I know who he was and where he worked, I’m honoring the wishes of his family and friends to preserve his anonymity.)

Those who followed him, even without meeting him in real life, felt as if we had lost one of our smartest friends.

NRS tweeted more than 117,000 times—an inimitable mix of investing insights, snarky quips, nature photographs and cocktail recipes. He exchanged what had to be thousands of direct messages with dozens, perhaps hundreds, of people who sought his opinions. (I was among them.)

NRS was blunt, cynical, often profane, but seldom cruel—even though he saw clearly that the business model of many financial companies is to pile up mountains of fees from a blizzard of flim-flam and gibberish. A financial adviser obsessed with mutual funds and income-oriented investments, he could smell baloney in a single sniff—and as soon as he detected it, he mocked it.

At the same time, his tweets and messages were infused with skeptical wisdom and profound uncertainty about how much anyone can ever know (“your confidence in this thesis is far too high to be credible”).

“I only knew him through his Twitter identity,” Cliff Asness, co-founder of AQR Capital Management in Greenwich, Conn., which manages $194 billion in assets, told me this week. “But it was very clear he was very knowledgeable about finance, a great wit and committed to the truth.”

Jason was kind enough to add me to his list of Tweeters who provide “witty but informative market takes.”

-

CWS Market Review – July 19, 2019

Eddy Elfenbein, July 19th, 2019 at 7:08 am“Sometimes the hardest thing to do is to do nothing.” – David Tepper

Second-quarter earnings season has arrived. There’s been a blizzard of earnings reports this week, and even more are coming next week.

This week, three of our Buy List stocks reported Q2 earnings. We had good news from Signature Bank and Danaher, and we had very bad news from Eagle Bank. (Actually, I think the market dramatically over-reacted on Eagle. I’ll explain it all in a bit.)

We also have ten Buy List earnings reports coming next week. That may be a record. In this week’s issue, I’ll preview them all. There’s a lot to get to, so let’s jump into this week’s earnings.

Three Buy List Earnings Reports this Week

Let’s start with the bad news. On Thursday, Eagle Bancorp (EGBN) had a terrible, horrible, no good, very bad day. For the June quarter, the bank earned $1.08 per share. That was four cents below expectations.

However, the big news was the news that Eagle said that its legal bill jumped in the second quarter due to “investigations and related document requests and subpoenas from government agencies.” What’s this all about?

In their SEC report, Eagle specified “the Company’s identification, classification and disclosure of related party transactions; the retirement of certain former officers and directors; and the relationship of the Company and certain of its former officers and directors with a local public official.”

All this sounds fishy but the bank made it clear that this will not materially impact its results. Also, the bank isn’t under any regulatory restrictions. One problem is that due to the nature of the legal issues, Eagle can’t say very much. I suspect this is connected to local Washington, DC political scandals. The problem is that it’s combined with an earnings miss. Also, there were flimsy (in my opinion) allegations of impropriety a few years ago.

On Thursday, the stock got nailed for a 26.75% loss. Still, digging through the numbers, Eagle didn’t do that bad, especially considering the tough environment for interest rates.

Let’s run through some numbers. Eagle now has assets of $8.7 billion which is a 10% increase over last year. Average total loans grew by 11% and average deposits grew by 10%. For the quarter, net interest margin was 3.91%. That’s down 24 basis points from a year ago. I was pleased to see Eagle’s efficiency ratio improved to 38.04% compared with 38.55% a year ago.

This was a difficult quarter for Eagle but I’m not nearly as upset by this news as Wall Street is. What happened is that a four-cent earnings miss translated to a 1,430-cent share price reduction. This is a giant over-reaction.

Thanks to the selloff, shares of Eagle are now going for just over eight times next year’s earnings. That’s a good deal. The dividend yield is up to 2.25%. I’m not giving up on Eagle. This week, I’m lowering our Buy Below price on Eagle to $43 per share.

Now let’s look at some good news. On Thursday, Danaher (DHR) reported adjusted earnings of $1.19 per share. That’s an increase of 3.5% over last year. It was also above Danaher’s own range. The company told us to expect Q2 earnings of $1.13 to $1.16 per share. Quarterly revenues rose by 3.5% and non-GAAP core revenues rose by 5.5%. For the quarter, operating cash flow came in at $1.2 billion and non-GAAP free cash flow was $1.0 billion.

Let’s look at guidance. For Q3, Danaher sees earnings ranging between $1.12 and $1.15 per share. For the full year, the company now sees earnings between $4.75 and $4.80 per share. That’s an increase of three cents to the lower end.

Thomas P. Joyce, Jr., President and Chief Executive Officer, stated, “We are very pleased by our strong start to 2019, with our team’s execution driving another quarter of 5.5% core revenue growth. We believe that recent investments in innovation and commercial initiatives contributed to share gains in many of our businesses. Combined with solid operating margin expansion and cash flow generation, the strength of our results is a testament to our team and the power of the Danaher Business System.”

Joyce added, “We continue to make progress on our anticipated acquisition of GE Biopharma and the planned initial public offering of our Dental business, which will be called Envista. Both transactions remain on track relative to our previously indicated expectations. We are excited about the opportunities ahead, and we believe the combination of our differentiated portfolio and our team’s DBS-driven execution positions us well to continue our strong performance through 2019 and beyond.”

Three months ago, Danaher lowered its full-year range down from $4.75 to $4.85 per share. That was due to share dilution for the GE Biopharma deal. That deal should close sometime in Q4. This revised guidance nearly brings us back to the original forecast.

Sometime in the second half of this year, Danaher will IPO Envista Holdings, their dental business. The ticker symbol will be NVST. Shares of DHR hit a new 52-week high on Thursday. Danaher remains a buy up to $150 per share.

Also on Thursday, Signature Bank (SBNY) reported Q2 earnings of $2.72 per share. That was one penny more than expectations.

Signature seems to have a nasty habit of plunging after each earnings report so it’s nice to see the shares gain some ground after this report.

The details are pretty good. Total assets rose 8.1% to $48.88 billion. For the quarter, average assets are up 9.4% from a year ago. Deposits rose 7.3% to $37.54 billion. Net interest margin came in at 2.75%. That’s down 20 basis points from a year ago. That’s not great, but it’s certainly respectable for this environment.

I’m happy to say that Signature is almost done with its taxi medallion mess. The bank went into this in a big way, but then thanks to ride-sharing apps, the medallions plunged in price. That left the bank holding a bunch of bum loans. Last quarter, Signature sold off $46.4 million in medallion loans. That leaves them with $18.8 million in non-performing medallion loans plus $43.8 million in repo-ed medallions. It was a costly mistake, but the issue is basically behind them.

This week, I’m raising my Buy Below on Signature Bank to $130 per share. Now let’s look at all the earnings reports coming next week.

Ten Buy List Stocks Due to Report Next Week

Here’s the updated Earnings Calendar:

Company Ticker Date Estimate Result Eagle Bancorp EGBN 17-Jul $1.12 $1.08 Danaher DHR 18-Jul $1.16 $1.19 Signature Bank SBNY 18-Jul $2.71 $2.72 RPM International RPM 22-Jul $1.14 Sherwin-Williams SHW 23-Jul $6.37 Torchmark TMK 24-Jul $1.65 Check Point Software CHKP 24-Jul $1.37 Cerner CERN 24-Jul $0.64 Stryker SYK 25-Jul $1.94 AFLAC AFL 25-Jul $1.07 Hershey HSY 25-Jul $1.17 Raytheon RTN 25-Jul $2.64 Fiserv FISV 25-Jul $0.81 Moody’s MCO 31-Jul $2.01 Church & Dwight CHD 31-Jul $0.52 Cognizant Technology Solutions CTSH 31-Jul $0.92 Continental Building Products CBPX 1-Aug $0.52 Intercontinental Exchange ICE 1-Aug $0.93 Disney DIS 6-Aug $1.76 Becton, Dickinson BDX 6-Aug $3.06 Broadridge Financial BR TBA $1.71 RPM International (RPM) will report its fiscal Q4 results before the market opens Monday, July 22. The company’s fourth quarter ended in May. The company owns a broad selection of well-known brands like Rust-Oleum.

RPM got off to a rough start for us this year, but things have improved lately. The April earnings report was very encouraging. (Incidentally, this is why we hold our positions for the entire year. Our strategy gives good stocks a chance to rebound.)

I am concerned about the currency issue. That’s a big one for RPM. For fiscal Q4, RPM sees earnings ranging between $1.12 and $1.16 per share. That sounds about right. RPM has increased its dividend every year for the last 45 years. I’m expecting #46 in October.

Earlier I mentioned the big drop in shares of Eagle Bank. That’s nothing compared to what happened to Sherwin-Williams (SHW) last fall. Shares of the paint company dropped 26% in just a few weeks. That was scary but we held on and the stock has rallied back impressively.

Sherwin’s last earnings report was a bit light but the key is that they didn’t alter their full-year forecast. The company still sees 2019 earnings ranging between $20.40 and $21.40 per share. For Q2, Wall Street expects $6.37 per share.

Sherwin also settled a 19-year legal battle over lead paint. I can’t speak to the merits of the claim, but the settlement was in Sherwin’s favor.

We have three earnings reports on Wednesday.

First up is Cerner (CERN) which is having an outstanding year for us. For Q2, Cerner expects earnings of 63 to 65 cents per share on revenue of $1.41 to $1.46 billion.

For all of 2019, Cerner sees earnings of $2.64 to $2.72 per share. That’s up from the previous guidance of $2.57 to $2.67 per share. Earlier this year, Cerner reached an agreement with Starboard Value to start paying a dividend and increase its buyback authorization by $1.5 billion.

For Q1, Check Point Software (CHKP) had a decent earnings report. The cyber-security firm earned $1.32 per share. That beat estimates by one penny per share. CEO Gil Shwed said, “We had good results in the first quarter with 13 percent growth in our security subscriptions including advanced solutions for Cloud and Mobile as well as SandBlast Zero day threat prevention.”

The problem was that guidance was light. Check Point said it sees Q2 revenues coming in between $474 million and $500 million. For earnings, CHKP sees EPS ranging between $1.32 and $1.40. Frankly, I had expected more. The stock has pulled back since the spring. I’ll be curious to hear what CHKP has to say.

Torchmark (TMK) is probably the most boring stock on our Buy List, and it’s having a very good year for us. The last earnings report was quite good. Net income as an ROE was 12.9%. Net operating income as an ROE, excluding net unrealized gains on fixed maturities, was 14.7%. For Q2, Wall Street expects $1.65 per share.

Thursday will be a very busy day for us. Five of our Buy List stocks are due to report.

Let’s start with AFLAC (AFL). The duck stock has been rallying well for us lately. For Q1, AFLAC earned $1.13 per share. That beat the Street by seven cents per share.

The supplemental insurer expects to buy back between $1.3 billion and $1.7 billion in shares this year. AFLAC recently raised its dividend for the 36th year in a row. For 2019, AFLAC is standing by its previous guidance for earnings of $4.10 to $4.30 per share. That assumes the yen trades at ¥110.39 to the dollar. For Q2, Wall Street expects $1.07 per share.

Last year was Fiserv’s (FISV) 33rd year in a row of double-digit earnings growth. I think they have a good shot at #34. The company made $3.10 per share last year so they need to hit $3.41 per share this year. For 2019, Fiserv has given us a range of $3.39 to $3.52 per share. I’ll be curious to see if they raise guidance next week.

Of course, the big news for Fiserv is the planned merger with First Data. This is a massive deal. Fiserv expects it to be completed later this year.

Jeffery Yabuki, Fiserv’s CEO, warned that Q2 “will be the low watermark for both internal revenue and adjusted EPS growth.” Wall Street expects earnings of 81 cents per share. The stock gapped up to a new high on Thursday.

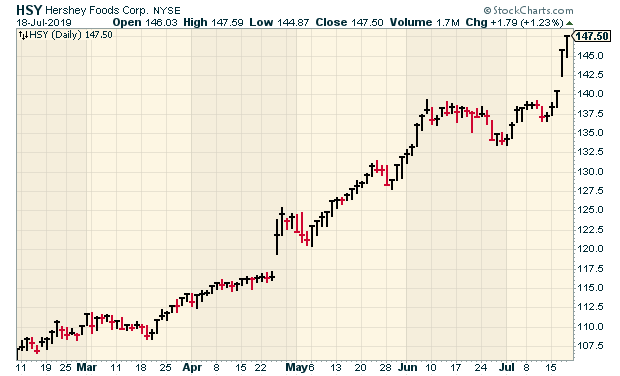

Hershey (HSY) has been another strong stock for us lately. The Q4 earnings weren’t that good, but Q1 was a big improvement. For all of 2019, Hershey expects EPS of $5.63 to $5.74. The chocolate stock is up 37.6% for us this year. For Q2, Wall Street expects $1.17 per share.

In April, Raytheon (RTN) crushed estimates. The Tomahawk-maker earned $2.77 per share for Q1 which beat the Street by 30 cents per share.

Raytheon is doing especially well with cyber-security and its intelligence and information unit. For 2019, RTN sees earnings between $11.40 and $11.60 per share and sales of $28.6 billion to $29.1 billion. Earlier this year, Raytheon hiked its dividend by 8.6%. That was its 15th annual dividend increase in a row. For Q2, the consensus is for $2.64 per share.

For Q2, Stryker (SYK) expects earnings between $1.90 and $1.95 per share. For the full year, Stryker sees earnings between $8.05 and $8.20 per share. The shares are up 34.3% for us this year.

That’s all for now. There will be lots more reports next week. On Tuesday, the report on sales of existing homes will be released. Then on Wednesday, the report on sales of new homes comes out. Thursday is durable goods and jobless claims. Then on Friday, we’ll get our first look at Q2 GDP. The economy grew by 3.1% during the first three months of the year. It may have grown at half that rate for the second quarter. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Morning News: July 19, 2019

Eddy Elfenbein, July 19th, 2019 at 7:04 amFed Officials Shake Markets With Rate Cut Comments

Wall Street Trading Costs to Surge as New Rules Hit Derivatives

Central Banks’ Gold-Buying Spree Is Far From Over

Trump to Nominate Eugene Scalia for Labor Secretary Job

As ‘Superstar’ Cities Keep Winning, Worrisome U.S. Divide Widens

Amazon Prime Day Inks Another Record, But That’s Not The Big Takeaway

Microsoft Earnings: Sales Jump 12 Percent, Fueled by Cloud

Boeing Takes $4.9 Billion Charge for Prolonged Grounding of 737 MAX Planes

PepsiCo to Buy South Africa’s Pioneer Food for $1.7 Billion

Netflix’s Indian Ambitions Face a Wall of Cheaper Rivals

The Corvette Gets Radical Makeover as Stick Shift Makes Way for Touchscreen

When Corporate Lobbies Started to Look Like Museum Galleries

Ben Carlson: Why History Gets Stuff Wrong All the Time

Michael Batnick: Come Do A Podcast

Jeff Miller: You Can’t Have All the Answers

Be sure to follow me on Twitter.

Earnings from Signature Bank and Danaher

Eddy Elfenbein, July 18th, 2019 at 7:21 amPress release from Signature Bank:

Net Income for the 2019 Second Quarter Was $147.9 Million, or $2.72 Diluted Earnings Per Share, Versus $154.6 Million, or $2.83 Diluted Earnings Per Share, Reported in the 2018 Second Quarter

The Bank Declared a Cash Dividend of $0.56 Per Share, Payable on or After August 15, 2019 to Common Stockholders of Record at the Close of Business on August 1, 2019

During the 2019 Second Quarter, the Bank Repurchased 412,977 Shares of Common Stock For a Total of $50.0 Million. Thus Far, the Bank Has Repurchased $114.7 Million of Common Stock From Its $500 Million Authorization

Total Deposits in the Second Quarter Grew $917.9 Million to $37.54 Billion; Total Deposits Have Grown $2.55 Billion, or 7.3 Percent, Since the End of the 2018 Second Quarter. Average Deposits Increased $456.0 Million in the 2019 Second Quarter

For the 2019 Second Quarter, Loans Increased $466.5 Million, or 1.2 Percent, to $37.93 Billion. Since the End of the 2018 Second Quarter, Loans Have Increased 11.1 Percent, or $3.78 Billion. During the 2019 Second Quarter, the Bank Sold $46.4 Million of Taxi Medallion Loans and Sold a $91.8 Million Portfolio of Signature Financial Equipment Loans. Excluding These Sales, Loans Would Have Increased $604.7 Million

Non-Accrual Loans Were $41.3 Million, or 0.11 Percent of Total Loans, at June 30, 2019, Versus $94.7 Million, or 0.25 Percent, at the End of the 2019 First Quarter and $158.1 Million, or 0.46 Percent, at the End of the 2018 Second Quarter. Excluding Taxi Medallion Loans, Non-Accrual Loans Were $22.5 Million, or Six Basis Points of Total Loans

Net Interest Margin on a Tax-Equivalent Basis was 2.74 Percent, Compared with 2.75 Percent for the 2019 First Quarter and 2.94 Percent for the 2018 Second Quarter. Core Net Interest Margin on a Tax-Equivalent Basis Excluding Loan Prepayment Penalty Income Decreased Two Basis Points to 2.71 Percent, Compared with 2.73 Percent for the 2019 First Quarter

Tier 1 Leverage, Common Equity Tier 1 Risk-Based, Tier 1 Risk-Based, and Total Risk-Based Capital Ratios were 9.70 Percent, 11.59 Percent, 11.59 Percent, and 12.82 Percent, Respectively, at June 30, 2019. Signature Bank Remains Significantly Above FDIC “Well Capitalized” Standards. Tangible Common Equity Ratio was 9.46 Percent

In the 2019 Second Quarter, the Bank Appointed Two Private Client Banking Teams. Thus Far in 2019, Four Teams have Joined the Bank, Including the 28 Person Venture Banking Group and the Eight Person Kanno-Wood Team Which Specializes in Banking to Mortgage Servicing Clients

Signature Bank (SBNY), a New York-based full service commercial bank, today announced results for its second quarter ended June 30, 2019.

Net income for the 2019 second quarter was $147.9 million, or $2.72 diluted earnings per share, versus $154.6 million, or $2.83 diluted earnings per share, for the 2018 second quarter. The decrease in net income for the 2019 second quarter, versus the comparable quarter last year, is due to an increase of $19.3 million in non-interest expenses mostly due to the significant hiring of private client banking teams, including nearly 50 employees added for the Fund Banking Division, Venture Banking Group and the Kanno-Wood Team.

Net interest income for the 2019 second quarter reached $326.3 million, up $5.3 million, or 1.6 percent, when compared with the 2018 second quarter. This increase is primarily due to growth in average interest-earning assets. Total assets reached $48.88 billion at June 30, 2019, an increase of $3.66 billion, or 8.1 percent, from $45.22 billion at June 30, 2018. Average assets for the 2019 second quarter reached $48.78 billion, an increase of $4.20 billion, or 9.4 percent, compared with the 2018 second quarter.

Deposits for the 2019 second quarter rose $917.9 million to $37.54 billion at June 30, 2019. When compared with deposits at June 30, 2018, overall deposit growth for the last twelve months was 7.3 percent, or $2.55 billion. Average deposits for the 2019 second quarter reached $36.93 billion, an increase of $456.0 million.

“During the past several years, and particularly over the last twelve months, Signature Bank has been focused on expanding our franchise and securing a larger presence throughout the national banking landscape. To reflect, we began diversifying our revenue streams with the launch of Signature Financial, our specialty finance subsidiary. We continued the diversification and expansion of the Bank with the addition of the Digital Banking Team and the Fund Banking Division, which have both already made meaningful contributions. Moreover, we recently added the Venture Banking Group as well as the Kanno-Wood team, which will provide treasury management products and services to residential and commercial mortgage servicers. We also launched Signet, our 24/7 payments platform, which today continues to be the only such platform offered by an FDIC-insured institution. All these banking teams, which are national in scope, have raised Signature Bank’s profile and offerings and are contributing to a more diversified credit and asset liability position over the short and long term,” explained Joseph J. DePaolo, President and Chief Executive Officer.

“Signature Bank is establishing a banking presence across the country. We have always grown this institution prudently and methodically, utilizing our strong reputation and solid capital position to attract the best bankers available in their industry and keeping the needs of our clients and their depositor safety at the forefront of all we do,” DePaolo concluded.

“In spite of a challenging deposit environment, we once again delivered solid deposit and loan growth leading to strong earnings. Also, we further reduced our risk in the Taxi Medallion portfolio with the sale of $46.4 million in NYC taxi loans on 375 medallions. Additionally, we have put in place several major new initiatives, which will provide significant benefit to our institution over the coming years. Personally, I have never been more positive on our future growth prospects. Our model of doing business remains robust, and we will continue to build value for our long-term investors,” explained Scott A. Shay, Chairman of the Board.

Danaher Corporation today announced results for the second quarter 2019. For the quarter ended June 28, 2019, net earnings were $731.3 million, or $0.97 per diluted share which represents a 2.0% year-over-year increase from the comparable 2018 period.

Non-GAAP adjusted diluted net earnings per share were $1.19 which represents a 3.5% increase over the comparable 2018 period. For the second quarter 2019, revenues increased 3.5% year-over-year to $5.2 billion, with non-GAAP core revenue growth of 5.5%.

Operating cash flow for the second quarter 2019 was $1.2 billion and non-GAAP free cash flow was $1.0 billion.

For the third quarter 2019, the Company anticipates that diluted net earnings per share will be in the range of $0.86 to $0.89 and non-GAAP adjusted diluted net earnings per share will be in the range of $1.12 to $1.15.

For the full year 2019, the Company now anticipates that diluted net earnings per share will be in the range of $3.38 to $3.43 versus previous guidance of $3.34 to $3.42. The Company is raising its 2019 non-GAAP adjusted diluted net earnings per share guidance to $4.75 to $4.80 versus previous guidance of $4.72 to $4.80.

Thomas P. Joyce, Jr., President and Chief Executive Officer, stated, “We are very pleased by our strong start to 2019, with our team’s execution driving another quarter of 5.5% core revenue growth. We believe that recent investments in innovation and commercial initiatives contributed to share gains in many of our businesses. Combined with solid operating margin expansion and cash flow generation, the strength of our results is a testament to our team and the power of the Danaher Business System.”

Joyce added, “We continue to make progress on our anticipated acquisition of GE Biopharma and the planned initial public offering of our Dental business, which will be called Envista. Both transactions remain on track relative to our previously indicated expectations. We are excited about the opportunities ahead, and we believe the combination of our differentiated portfolio and our team’s DBS-driven execution positions us well to continue our strong performance through 2019 and beyond.”

Morning News: July 18, 2019

Eddy Elfenbein, July 18th, 2019 at 7:05 amSanctions on Russia and North Korea Put Tiny Latvia in U.S. Cross Hairs

U.S. Targeting of Chinese Scientists Fuels a Brain Drain

Big Banks Are Earning Billions of Dollars. Trump’s Tax Cuts Are a Big Reason.

Bond Markets Once Felled Governments. Now Negative Yields Rule

Netflix Plunges After Biggest Stumble in Streaming Era

Verizon Resurrects Media Business as Safe Haven on the Internet

Trump’s Tariffs Trip Up the All-American RV Industry

Amazon’s Most Ambitious Research Project Is a Convenience Store

The S.U.V.s That Conquered Suburbia

Amazon Prime Day was Bigger than its Black Friday and Cyber Monday — Combined

Mellody Hobson of Ariel Investments: ‘Capitalism Needs to Work for Everyone’

Roger Nusbaum: Avoiding Dogma Part Gajillion

Jeff Carter: You Can’t Have All the Answers

Michael Batnick: Opposite of Conventional Wisdom & Animal Spirits: Shielded Alpha

Be sure to follow me on Twitter.

Eagle Bancorp Earned $1.08 per Share for Q2

Eddy Elfenbein, July 17th, 2019 at 4:20 pmEagle Bancorp (EGBN), the parent company of EagleBank, today announced quarterly net income of $37.2 million for the three months ended June 30, 2019, as compared to $37.3 million net income for the three months ended June 30, 2018.

Net income per basic common share for the three months ended June 30, 2019 was $1.08 compared to $1.09 for the same period in 2018. Net income per diluted common share was $1.08 for both the three months ended June 30, 2019 and June 30, 2018.

For the six months ended June 30, 2019, the Company’s net income was $71.0 million, a 3% decrease from the $73.0 million of net income for the same period in 2018.

Net income per basic common share for the six months ended June 30, 2019 was $2.06 compared to $2.13 for the same period in 2018, a 3% decrease.

Net income per diluted common share for the six months ended June 30, 2019 was $2.05 compared to $2.12 for the same period in 2018, a 3% decrease.

“While we experienced a challenging interest rate environment in the second quarter of 2019, we are pleased to report another quarter of overall favorable earnings, supported by continued loan and balance sheet growth, solid asset quality and favorable operating leverage,” noted Susan G. Riel, President and Chief Executive Officer of Eagle Bancorp, Inc. Ms. Riel continued, “The Company’s assets ended the quarter at $8.7 billion, representing 10% growth over the second quarter of 2018. Second quarter 2019 earnings resulted in a return on average assets (“ROAA”) of 1.74%, return on average common equity (“ROACE”) of 12.81%, and a return on average tangible common equity (“ROATCE”) of 14.08%.”

The Company’s performance in the second quarter of 2019 as compared to the second quarter of 2018 was highlighted by growth in average total loans of 11%, growth in average total deposits of 10%, a net interest margin of 3.91%, 5% growth in total revenue to $87.7 million, and a 3% increase in noninterest expenses, further improving our operating leverage and resulting in an improved efficiency ratio of 38.04% versus 38.55% for the second quarter of 2018. Additionally, annualized net charge-offs to average loans was 0.08%.

Ms. Riel noted, “The Company continues to focus more on growth of average balances year over year and quarter over quarter since that measure more directly impacts income statement results.”

Comparing average balances in the second quarter of 2019 versus the first quarter of 2019, average loan growth was 3% while average deposits declined by 1%. As average U.S. Treasury rates in the two to five year area declined by about 35 basis points in the second quarter 2019 and the average yield curve remained fairly flat, we experienced 11 basis points of net interest margin compression as compared to the first quarter of 2019, as our cost of funds increased 11 basis points while the yield on earning assets was unchanged. The yield on our substantial level of variable rate assets was negatively impacted by the lower interest rate environment in the second quarter of 2019, including a decline in the average one month LIBOR rate, while our cost of funds was impacted by our goal of funding solid new loan opportunities. In spite of the margin compression, we continue to believe that our net interest margin remains superior to other banking companies.

Ms. Riel added, “In the second quarter of 2019, period end total loan growth was 3.1% over March 31, 2019, while total deposits increased 4.0% over March 31, 2019. New loans settled in the second quarter of 2019 were substantially greater than those closed in the first quarter of 2019, which had a 2.6% growth rate. The total of unfunded loan commitments has remained stable over the last six quarters at approximately $2.4 billion. The Company continues to emphasize achieving core deposit growth. The mix of noninterest deposits to total deposits averaged 31% in the second quarter of 2019 as compared to 33% in both the second quarter of 2018 and the first quarter of 2019.

The net interest margin was 3.91% for the second quarter of 2019, down 24 basis points from the second quarter of 2018. Ms. Riel noted, “There has been a lesser focus on higher risk and higher yielding construction lending and more attention towards strong commercial real estate credits secured by stabilized income producing properties. The yield on the loan portfolio was 5.61% for the second quarter of 2019 as compared to 5.53% for the second quarter of 2018 and 5.62% for the first quarter of 2019. The cost of funds was 1.30% for the second quarter of 2019 as compared to 0.96% for the second quarter of 2018 and 1.19% for the first quarter of 2019. We continue to see well structured new loan opportunities and are having to pay higher rates to fund that growth. Even considering the decline in the net interest margin, the Company’s net interest income increased 4% in the second quarter of 2019 over 2018 as the Company has continued its emphasis on disciplined pricing for both new loans and funding sources in the face of competitive pressures.”

Transports on a Roller-Coaster

Eddy Elfenbein, July 17th, 2019 at 10:45 amI like to watch the relative strength of transportation stocks. Yesterday, the transports had one of their best days versus the broader market in years. Today, they’re giving back all that gain.

Here’s the chart:

Transports are a classic cyclical play. If the sector is strong, that’s probably a good sign for the economy. I would be concerned if we saw the transports start to lag the market significantly.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His