Archive for August, 2019

-

Morning News: August 22, 2019

Eddy Elfenbein, August 22nd, 2019 at 7:11 amGerman Companies Signal Looming Recession After Demand Plunges

Inside India’s Messy Electric Vehicle Revolution

Jackson Hole’s Greatest Hits Justify Obsessing Over Fed Meeting

Fed Was Divided About Interest Rate Cut

Job Gains Were Weaker Than Reported, by Half a Million

Hedge Funds Have Already Bled $55.9 Billion This Year

This Nobel Prize-Winning Idea Is Instead Piling Debt on Millions

Apple Readies Camera-Focused Pro iPhones, New iPads, Larger MacBook Pro

Target Shares Surge on Same-Day Delivery Boost

Wal-Mart Suit Against Tesla May Prove Buying SolarCity Was a Mistake

A Popeyes Chicken Sandwich and a Tactic to Set Off a Twitter Roar

What Are the Obstacles to Bayer Settling Roundup Lawsuits?

Ben Carlson: Is The United States Turning Japanese? & Animal Spirits: Paycheck to Paycheck

Roger Nusbaum: Is The 60/40 Portfolio Really Dead?

Jeff Miller: Stock Exchange: Are You Paying Attention To Market Conditions?

Be sure to follow me on Twitter.

-

From the Fed Minutes

Eddy Elfenbein, August 21st, 2019 at 2:03 pmThe Federal Reserve just released the minutes from their last meeting. This is when they decided to cut interest rates:

Participants’ Views on Current Conditions and the Economic Outlook

Participants agreed that the labor market had remained strong over the intermeeting period and that economic activity had risen at a moderate rate. Job gains had been solid, on average, in recent months, and the unemployment rate had remained low. Although growth of household spending had picked up from earlier in the year, growth of business fixed investment had been soft. On a 12-month basis, overall inflation and inflation for items other than food and energy were running below 2 percent. Market-based measures of inflation compensation remained low; survey-based measures of longer-term inflation expectations were little changed.

Participants continued to view a sustained expansion of economic activity, strong labor market conditions, and inflation near the Committee’s symmetric 2 percent objective as the most likely outcomes. This outlook was predicated on financial conditions that were more accommodative than earlier this year. More accommodative financial conditions, in turn, partly reflected market reaction to the downward adjustment through the course of the year in the Committee’s assessment of the appropriate path for the target range of the federal funds rate in light of weak global economic growth, trade policy uncertainty, and muted inflation pressures.

Participants generally noted that incoming data over the intermeeting period had been largely positive and that the economy had been resilient in the face of ongoing global developments. The economy continued to expand at a moderate pace, and participants generally expected GDP growth to slow a bit to around its estimated potential rate in the second half of the year. However, participants also observed that global economic growth had been disappointing, especially in China and the euro area, and that trade policy uncertainty, although waning some over the intermeeting period, remained elevated and looked likely to persist. Furthermore, inflation pressures continued to be muted, notwithstanding the firming in the overall and core PCE price indexes in the three months ending in June relative to earlier in the year.

In their discussion of the business sector, participants generally saw uncertainty surrounding trade policy and concerns about global growth as continuing to weigh on business confidence and firms’ capital expenditure plans. Participants generally judged that the risks associated with trade uncertainty would remain a persistent headwind for the outlook, with a number of participants reporting that their business contacts were making decisions based on their view that uncertainties around trade were not likely to dissipate anytime soon. Some participants observed that trade uncertainties had receded somewhat, especially with the easing of trade tensions with Mexico and China. Several participants noted that, over the intermeeting period, business sentiment seemed to improve a bit and commented that the data for new capital goods orders had improved. Some participants expressed the view that the effects of trade uncertainty had so far been modest and referenced reports from business contacts in their Districts that investment plans were continuing, though with a more cautious posture.

Participants also discussed developments across the manufacturing, agriculture, and energy sectors of the U.S. economy. Manufacturing production had declined so far this year, dragged down in part by weak real exports, the ongoing global slowdown, and trade uncertainties. Several participants noted ongoing challenges in the agricultural sector, including those associated with increased trade uncertainty, weak export demand, and the effects of wet weather and severe flooding. A couple of participants commented on the decline in energy prices since last fall and the associated reduction in economic activity in the energy sector.

Participants commented on the robust pace of consumer spending. Noting the important role that household spending was currently playing in supporting the expansion, participants judged that household spending would likely continue to be supported by strong labor market conditions, rising incomes, and upbeat consumer sentiment. A few participants noted that the continued softness in residential investment was a concern, and that the expected boost to housing activity from the decline in mortgage rates since last fall had not yet materialized. In contrast, a couple of participants reported that some recent indicators of housing activity in their Districts had been somewhat more positive of late.

In their discussion of the labor market, participants judged that conditions remained strong, with the unemployment rate near historical lows and continued solid job gains, on average, in recent months. Job gains in June were stronger than expected, following a weak reading in May. Looking ahead, participants expected the labor market to remain strong, with the pace of job gains slower than last year but above what is estimated to be necessary to hold labor utilization steady. Reports from business contacts pointed to continued strong labor demand, with many firms reporting difficulty finding workers to meet current demand. Several participants reported seeing notable wage pressures for lower-wage workers. However, participants viewed overall wage growth as broadly consistent with the modest average rates of labor productivity growth in recent years and, consequently, as not exerting much upward pressure on inflation. Several participants remarked that there seemed to be little sign of overheating in labor markets, citing the combination of muted inflation pressures and moderate wage growth.

Regarding inflation developments, some participants stressed that, even with the firming of readings for consumer prices in recent months, both overall and core PCE price inflation rates continued to run below the Committee’s symmetric 2 percent objective; the latest reading on the 12-month change in the core PCE price index was 1.6 percent. Furthermore, continued weakness in global economic growth and ongoing trade tensions had the potential to slow U.S. economic activity and thus further delay a sustained return of inflation to the 2 percent objective. Many other participants, however, saw the recent inflation data as consistent with the view that the lower readings earlier this year were largely transitory, and noted that the trimmed mean measure of PCE price inflation constructed by the Federal Reserve Bank of Dallas was running around 2 percent. A few participants noted differences in the behavior of measures of cyclical and acyclical components of inflation. By some estimates, the cyclical component of inflation continued to firm; the acyclical component, which appeared to be influenced by sectoral and technological changes, was largely responsible for the low level of inflation and not likely to respond much to monetary policy actions.

In their discussion of the outlook for inflation, participants generally anticipated that with appropriate policy, inflation would move up to the Committee’s 2 percent objective over the medium term. However, market-based measures of inflation compensation and some survey measures of consumers’ inflation expectations remained low, although they had moved up some of late. A few participants remarked that inflation expectations appeared to be reasonably well anchored at levels consistent with the Committee’s 2 percent inflation objective. However, some participants stressed that the prolonged shortfall in inflation from the long-run goal could cause inflation expectations to drift down—a development that might make it more difficult to achieve the Committee’s mandated goals on a sustained basis, especially in the current environment of global disinflationary pressures. A couple of participants observed that, although some indicators of longer-term inflation expectations, like TIPS-based inflation compensation and the Michigan survey measure, had not changed substantially this year, on net, they were notably lower than their levels several years ago.

Participants generally judged that downside risks to the outlook for economic activity had diminished somewhat since their June meeting. The strong June employment report suggested that the weak May payroll figures were not a precursor to a more material slowdown in job growth. The agreement between the United States and China to resume negotiations appeared to ease trade tensions somewhat. In addition, many participants noted that the recent agreement on the federal debt ceiling and budget appropriations substantially reduced near-term fiscal policy uncertainty. Moreover, the possibility of favorable outcomes of trade negotiations could be a factor that would provide a boost to economic activity in the future. Still, important downside risks persisted. In particular, participants were mindful that trade tensions were far from settled and that trade uncertainties could intensify again. Continued weakness in global economic growth remained a significant downside risk, and some participants noted that the likelihood of a no-deal Brexit had increased.

In their discussion of financial market developments, participants observed that financial conditions remained supportive of economic growth, with borrowing rates low and stock prices near all-time highs. Participants observed that current financial conditions appeared to be premised importantly on expectations that the Federal Reserve would ease policy to help offset the drag on economic growth stemming from the weaker global outlook and uncertainties associated with international trade as well as to provide some insurance to address various downside risks. Participants also discussed the decline in yields on longer-term nominal Treasury securities in recent months. A few participants expressed the concern that the inversion of the Treasury yield curve, as evidenced by the 10-year yield falling below the 3-month yield, had persisted for about two months, which could indicate that market participants anticipated weaker economic conditions in the future and that the Federal Reserve would soon need to lower the federal funds rate substantially in response. The longer-horizon real forward rate implied by TIPS had also declined, suggesting that the longer-run normal level of the real federal funds rate implicit in market prices was lower.

Among those participants who commented on financial stability, most highlighted recent credit market developments, the elevated valuations in some asset markets, and the high level of nonfinancial corporate indebtedness. Several participants noted that high levels of corporate debt and leveraged lending posed some risks to the outlook. A few participants discussed the fast growth of private credit markets—a sector not subject to the same degree of regulatory scrutiny and requirements that applies in the banking sector—and commented that it was important to monitor this market. Several participants observed that valuations in equity and corporate bond markets were near all-time highs and that CRE valuations were also elevated. A couple of participants noted that the low level of Treasury yields—a factor seen as supporting asset prices across a range of markets—was a potential source of risk if yields moved sharply higher. However, these participants judged that in the near term, such risks were small in light of the monetary policy outlooks in the United States and abroad and generally subdued inflation. A few participants expressed the concern that capital ratios at the largest banks had continued to fall at a time when they should ideally be rising and that capital ratios were expected to decline further. Another view was that financial stability risks at present are moderate and that the largest banks would continue to maintain very substantial capital cushions in light of a range of regulatory requirements, including rigorous stress tests.

In their discussion of monetary policy decisions at this meeting, those participants who favored a reduction in the target range for the federal funds rate pointed to three broad categories of reasons for supporting that action.

First, while the overall outlook remained favorable, there had been signs of deceleration in economic activity in recent quarters, particularly in business fixed investment and manufacturing. A pronounced slowing in economic growth in overseas economies—perhaps related in part to developments in, and uncertainties surrounding, international trade—appeared to be an important factor in this deceleration. More generally, such developments were among those that had led most participants over recent quarters to revise down their estimates of the policy rate path that would be appropriate to promote maximum employment and stable prices.

Second, a policy easing at this meeting would be a prudent step from a risk-management perspective. Despite some encouraging signs over the intermeeting period, many of the risks and uncertainties surrounding the economic outlook that had been a source of concern in June had remained elevated, particularly those associated with the global economic outlook and international trade. On this point, a number of participants observed that policy authorities in many foreign countries had only limited policy space to support aggregate demand should the downside risks to global economic growth be realized.

Third, there were concerns about the outlook for inflation. A number of participants observed that overall inflation had continued to run below the Committee’s 2 percent objective, as had inflation for items other than food and energy. Several of these participants commented that the fact that wage pressures had remained only moderate despite the low unemployment rate could be a sign that the longer-run normal level of the unemployment rate is appreciably lower than often assumed. Participants discussed indicators for longer-term inflation expectations and inflation compensation. A number of them concluded that the modest increase in market-based measures of inflation compensation over the intermeeting period likely reflected market participants’ expectation of more accommodative monetary policy in the near future; others observed that, while survey measures of inflation expectations were little changed from June, the level of expectations by at least some measures was low. Most participants judged that long-term inflation expectations either were already below the Committee’s 2 percent goal or could decline below the level consistent with that goal should there be a continuation of the pattern of inflation coming in persistently below 2 percent.

A couple of participants indicated that they would have preferred a 50 basis point cut in the federal funds rate at this meeting rather than a 25 basis point reduction. They favored a stronger action to better address the stubbornly low inflation rates of the past several years, recognizing that the apparent low sensitivity of inflation to levels of resource utilization meant that a notably stronger real economy might be required to speed the return of inflation to the Committee’s inflation objective.

Several participants favored maintaining the same target range at this meeting, judging that the real economy continued to be in a good place, bolstered by confident consumers, a strong job market, and a low rate of unemployment. These participants acknowledged that there were lingering risks and uncertainties about the global economy in general, and about international trade in particular, but they viewed those risks as having diminished over the intermeeting period. In addition, they viewed the news on inflation over the intermeeting period as consistent with their forecasts that inflation would move up to the Committee’s 2 percent objective at an acceptable pace without an adjustment in policy at this meeting. Finally, a few participants expressed concerns that further monetary accommodation presented a risk to financial stability in certain sectors of the economy or that a reduction in the target range for the federal funds rate at this meeting could be misinterpreted as a negative signal about the state of the economy.

Participants also discussed the timing of ending the reduction in the Committee’s aggregate securities holdings in the SOMA. Ending the reduction of securities holdings in August had the advantage of avoiding the appearance of inconsistency in continuing to allow the balance sheet to run off while simultaneously lowering the target range for the federal funds rate. But ending balance sheet reduction earlier than under its previous plan posed some risk of fostering the erroneous impression that the Committee viewed the balance sheet as an active tool of policy. Because the proposed change would end the reduction of its aggregate securities holdings only two months earlier than previously indicated, policymakers concluded that there were only small differences between the two options in their implications for the balance sheet and thus also in their economic effects.

In their discussion of the outlook for monetary policy beyond this meeting, participants generally favored an approach in which policy would be guided by incoming information and its implications for the economic outlook and that avoided any appearance of following a preset course. Most participants viewed a proposed quarter-point policy easing at this meeting as part of a recalibration of the stance of policy, or mid-cycle adjustment, in response to the evolution of the economic outlook over recent months. A number of participants suggested that the nature of many of the risks they judged to be weighing on the economy, and the absence of clarity regarding when those risks might be resolved, highlighted the need for policymakers to remain flexible and focused on the implications of incoming data for the outlook.

-

AFLAC: Allegation and Response

Eddy Elfenbein, August 21st, 2019 at 11:56 amToday it’s AFLAC’s turn.

The Japan Times revealed that Japan Post “improperly sold around 104,000 insurance policies issued by U.S. partner Aflac Inc.”

The actions of Japan Post, which sells Aflac policies at post offices nationwide, resulted in customers becoming temporarily uninsured and or being double charged for a one-year period that ended in May this year, the sources said.

Japan Post halted sales of its own and third-party life insurance products after admitting in July to conducting inappropriate sales of around 183,000 policies and leaving customers at a disadvantage over the past five years.

It continues to sell Aflac’s cancer insurance products, however, treating them as an exception.

Aflac has long been a leader in cancer insurance in Japan. It signed a business partnership with Japan Post Holdings in 2013 and agreed last December to receive direct investment from Japan Post to expand their cooperation.

Under an arrangement with Aflac, a new customer cannot be insured for three months after he or she purchases the insurance to prevent a person who has already developed cancer from receiving a payout.

The rule caused people switching to a new Aflac insurance policy from an old one to pay for both contracts or be left without coverage for three months.

Since 2014, Aflac eliminated the duplication of premium payments in a contract renewal, but Japan Post did not make the necessary upgrade to its computer system to reflect that change, the sources said.

Shares of AFL are down over 4% today. The company responded:

Contrary to a certain media report, during the formal meeting of the Strategic Alliance Committee on July 17, 2019, Japan Post Holdings Co., Ltd. confirmed to Aflac Life Insurance Japan, Ltd. (Aflac Japan) that the Japan Post Group does not plan to halt the sales of Aflac Japan’s cancer insurance through the Japan Post Group system. Furthermore, consistent with comments on Aflac Incorporated’s July 26th earnings call, on July 26th Japan Post Holdings Co. Ltd. reconfirmed to Aflac Japan that there is no plan to halt the sales of Aflac Japan’s cancer insurance policies.

I’m not sure of the long-term impact of this but my first guess is that this will soon blow over.

-

Morning News: August 21, 2019

Eddy Elfenbein, August 21st, 2019 at 7:02 amJapan, U.S. Ministers Meet for Trade Talks as Hopes for Early Deal Fade

How Central Banks, Governments Are Fighting Global Slowdown

The Upside-Down Economy: Some Banks Want the Rich to Pay to Deposit Money

Muni-Bond Buyers Are Desperate. Risky Borrowers Are Cashing In

Trump Says He Had to ‘Take China On,’ Regardless of Short-Term Impact on U.S. Economy

Trump Says He’s Exploring ‘Various Tax Reductions,’ and the Economic Data He Loves Shows Why

The Big Business of Scavenging in Postindustrial America

Amazon Opens Its Largest Campus Yet

Goldman Moves to Take Majority Control of China Joint Venture

Welcome to McDonald’s. Would You Like a Podcast With Those Fries?

The Collective Memory of American Shoppers

Citigroup, BNP Caught Up in U.S. Case Against Huawei CFO

Nick Maggiulli: The Red Queen of Investing

Howard Lindzon: The Business of Sleep

Be sure to follow me on Twitter.

-

Morning News: August 20, 2019

Eddy Elfenbein, August 20th, 2019 at 7:27 amWall Street Poised to Get Long-Sought Changes to Volcker Limits

Huawei Founder Sees ‘Live or Die Moment’ From U.S. Uncertainty

How Shareholder Democracy Failed the People

Banks Want Efficiency. Critics Warn of Backsliding.

Facebook and Twitter Say China Is Spreading Disinformation in Hong Kong

Humbled Deutsche Bank Faces Battle in Its Own Backyard

Climate Change Could Rain on Saudi Aramco’s IPO Parade

Apple’s Highly Profitable Meal

U.S. Yield Curve: Invert, Steepen, Repeat

Elanco to Become No.2 in Animal Health with $7.6 Billion Bayer Deal

The Sports News Site Haters Love to Dunk on Keeps Signing Up Subscribers

Why Luxury Fashion Is Walking the Runway in Recycled-Plastic Heels

Michael Batnick: “Make It Stop”

Ben Carlson: Talk Your Book: Invest Like a Hedge Fund With Titan

Roger Nusbaum: The Greatest Thing I Have Ever Seen!

Be sure to follow me on Twitter.

-

Was Disney Inflating Revenue?

Eddy Elfenbein, August 19th, 2019 at 4:16 pmI don’t know the details, but this story just broke (from MarketWatch):

Disney whistleblower told SEC the company inflated revenue for years

The whistleblower was fired as a Walt Disney Co. accountant in 2017

A former Walt Disney Co. accountant says she has filed a series of whistleblower tips with the Securities and Exchange Commission alleging the company has materially overstated revenue for years.

Sandra Kuba, formerly a senior financial analyst in Disney’s revenue-operations department who worked for the company for 18 years, alleges that employees working in the parks-and-resorts business segment systematically overstated revenue by billions of dollars by exploiting weaknesses in the company’s accounting software.

Kuba said she has met with officials from the SEC on several occasions to discuss the allegations.

A spokeswoman for the SEC declined to comment.

A Disney spokesperson said the company had reviewed the whistleblower’s claims and found that they were “utterly without merit.”

Kuba’s whistleblower filings, which have been reviewed by MarketWatch, outline several ways employees allegedly boosted revenue, including recording fictitious revenue for complimentary golf rounds or for free guest promotions. Another alleged action Kuba described in her SEC filing involved recording revenue for $500 gift cards at their face value even when guests paid a discounted rate of $395.

Kuba has also alleged that employees sometimes recorded revenue twice for gift cards, both when guests bought the gift card and when it was used at a resort. Sometimes, revenue was recorded even though a gift card was given to a guest for free following a customer complaint, for instance, according to the whistleblower’s allegations.

Kuba’s filing alleges that flaws in the accounting software made the manipulation difficult to trace, though the consequences could be significant. In just one financial year, 2008-09, Disney’s annual revenue could have been overstated by as much as $6 billion, Kuba’s whistleblower filing alleges. The parks-and-resorts business segment reported total revenue of $10.6 billion in 2009, according to its annual report filed with the SEC.

Kuba told MarketWatch she first reported the alleged revenue-recognition issues to management in 2013. She said that no one responded to her at that time. She said that she escalated her concerns to a more senior executive in 2016 and that Disney’s corporate audit group contacted her once in November 2016 but never followed up.

Kuba said she brought her concerns to the SEC in August 2017. She was fired from Disney about a month later.

In October 2017, Kuba filed a whistleblower-retaliation complaint with the Department of Labor’s Occupational Safety and Health Administration. Disney’s response to the department’s whistleblower office investigator’s inquiry said that Kuba’s employment was terminated because “she displayed a pattern of workplace complaints against co-workers without a reasonable basis for doing so, in a manner that was inappropriate, disruptive and in bad faith.”

Kuba has made two additional whistleblower filings since leaving the firm, including one this past June. The most recent tip alleges some Disney employees reclassified guest revenue from high-sales-tax items such as hotel rooms to lower-taxed items such as food and beverages with the purpose of significantly reducing sales tax liabilities in Florida, California and Hawaii. MarketWatch has reviewed the three filings and supporting documentation that was sent to the SEC.

The Disney spokesperson said: “The claims presented to us by this former employee — who was terminated for cause in 2017 — have been thoroughly reviewed by the company and found to be utterly without merit; in fact, in 2018 she withdrew the claim she had filed challenging her termination. We’re not going to dignify her unsubstantiated assertions with further comment.”

Kuba said she has withdrawn her claim challenging her termination but reserves the right to resubmit it and continues to dispute Disney’s decision to fire her.

The whistleblower said she has talked with officials from the SEC by phone and met with them in person on more than one occasion, including as recently as last week, to discuss the allegations in her filings. The SEC has also requested additional documentation related to the allegations, based on correspondence reviewed by MarketWatch.

The pattern of interaction with the SEC suggests the regulator is taking the allegations seriously, said Jordan A. Thomas, a former attorney in the SEC’s enforcement division and chairman of Labaton Sucharow’s whistleblower-representation practice. As Thomas told MarketWatch: “The SEC receives more than 25,000 tips, complaints and referrals each year, and the vast majority do not make it this far. The fact that the SEC has asked for more information more than once and conducted interviews suggests an inquiry is underway.”

These charges should be taken seriously but there seems to be reason for doubt.

-

Morning News: August 19, 2019

Eddy Elfenbein, August 19th, 2019 at 7:13 amChina Pressures Business Over Hong Kong. Workers Get Caught in the Middle.

Trump Says U.S. Is Talking With China But Not Ready for a Deal

Apple CEO Warns Trump About China Tariffs, Samsung Competition

A Year of Stock Market Fury, Signifying Nearly Nothing

How the Recession of 2020 Could Happen

Powell Likely to Use Jackson Hole to Suggest Fed Ready to Cut

Stimulus Optimism Boosts Stocks, Eases Pressure on Bonds

Business Roundtable’s New Philosophy: It’s Not All About Shareholders

Fearing Data Privacy Issues, Google Cuts Some Android Phone Data for Wireless Carriers

Novartis CEO Battles Fallout From Data Manipulation

How Aggressively Cute Toys for Adults Became a $686 Million Business

Jeff Miller: Is the Yield Curve Inversion on the Jackson Hole Agenda?

Ben Carlson: Who Has the Most Impressive Investment Track Record?

Jeff Carter: Growth Vs Maintenance & If You Are Drowning And Someone Throws You A Life Line-Take It

Be sure to follow me on Twitter.

-

CWS Market Review – August 16, 2019

Eddy Elfenbein, August 16th, 2019 at 7:08 am“Don’t gamble; take all your savings and buy some good stock and hold it till it goes up, then sell it. If it don’t go up, don’t buy it.” – Will Rogers

What had been a fairly quiet summer on Wall Street has gotten rather more dramatic recently. On August 5, the Dow plunged 767 points. That was followed by a plunge of 800 points on August 14.

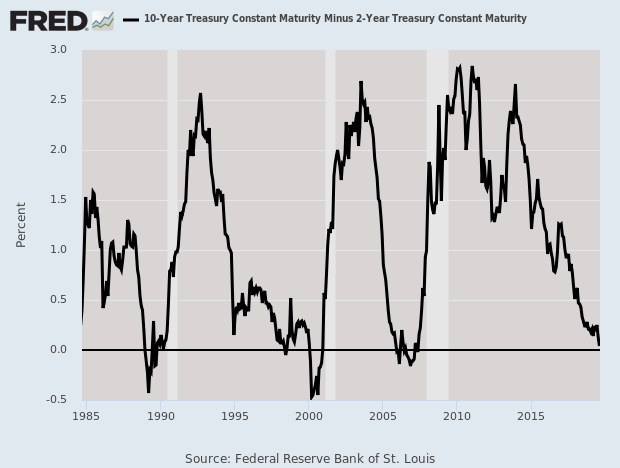

In percentage terms, of course, those drops are barely a scratch, but it’s jarring, especially when compared with the calm market we’ve had. We also had the news this week that the yield curve finally inverted. Specifically, the yield on two-year Treasuries exceeded that of ten-year Treasuries. This event caused a Category 1 freakout among market commenters. I’m surprised FEMA wasn’t called in. The yield curve even got a presidential tweet (in all caps).

This is an odd market. Investors have been gobbling up bonds at a frenetic pace. This week, the yield on the 30-year Treasury dropped to an all-time low, and the Federal Reserve looks to cut rates again. There’s renewed talk that a recession is just around the bend.

First let me say: don’t worry. In this week’s CWS Market Review, I’ll walk you through the mysterious territory of Wall Street and let you know what you should be doing. By the way, our Buy List has been zipping past the market nearly every day recently. We’re on our way to beating the market again this year. But first, let’s look at the great yield curve inversion of 2019.

What an Inverted Yield Curve Means for Us

On Wednesday, the yield curve finally inverted. What does that mean? In plain language, the yield on the two-year Treasury was above that of the ten-year Treasury.

Gotcha, but what does that mean?

In still plainer talk, investors aren’t being paid to take on more risk. Lending your money to Uncle Sam for two years pays you the same as lending for ten. You’re not getting anything for taking on the risk of eight more years. Well, if people aren’t being paid to take on risk, guess what: they won’t.

Not taking on risk is not a good thing for the economy. That’s the why the 2/10 Spread has a pretty good track record of predicting recessions. It’s not so much the inversion that’s bad; it’s what it means. By the way, there are lots of ways to measure the yield curve. The 2/10 is just one, but it’s the one in the news.

I want to stress a few notes of caution. Let’s look at the world of economic stats.

Lagging indicators: sure, we got plenty of those.

Coincident indicators: eh, a few.

Leading indicators: not much.

The 2/10 is one. As the saying goes, it’s hard to make predictions, especially about the future.

With the 2/10, we gain a rare example of a forward indicator with a decent track record, but it comes at the expense of timing. Simply put, the world doesn’t automatically explode once the 2/10 gets inverted. It’s more of a dimmer switch than a toggle.

The key is that the 2/10 isn’t bad news itself. The world of finance loves to fetishize numbers. Instead, we should focus on what those numbers represent. An inverted 2/10 spread is basically like all the fire trucks being down at Arby’s having lunch. When trouble does come—and it will—the response will be more difficult.

In December 1988, the 2/10 inverted more than 18 months ahead of the recession. In May 1998, the 2/10 briefly inverted. It fought that off, but it became inverted again in February 2000. The recession began a year later.

During the last recession, the 2/10 spread first inverted in December 2005, but the recession didn’t begin for another two years.

Still, that track record beats a lot of humans. Remember that all metrics have downsides. That’s not a reason to dismiss them. It means we have to be aware of the limitations of our analytical tools.

The bottom line is that the yield curve inversion is a big deal, but it’s no reason to run for the exits. The Federal Reserve will probably lower rates next month, and perhaps a few more times after that. That could revert the curve. In fact, a 0.5% cut isn’t out of the question.

The Two-Tiered U.S. Economy

I also have to mention that we’re at an interesting juncture for the economy. The U.S. economy is currently moving at two different speeds. The consumer part of the economy is doing well. Folks are out there buying stuff. The last retail-sales report was quite good, and Walmart had a very encouraging earnings report. (It’s funny, but the Walmart earnings report is de facto a report on American consumer spending.)

However, the industrial part of the economy is feeling winded. This week’s industrial-production report wasn’t so hot. A lot of cyclical stocks haven’t done much (like RPM or Continental Building Products). People ask me if the market is going to sag, but in reality, a lot of the stock market has been in correction mode for several months. Energy stocks in particular have been dead. There are four key cyclical sectors: Financials, Energy, Materials and Industrials. All four have been weak lately.

We may also be at the limits of what monetary policy can do for the economy. Granted, I’m being more speculative here. Jay Powell and his friends can lower rates. That’s not hard. But it doesn’t mean that banks will start making loans. The demand part is the problem. The situation is far more advanced in Europe where interest rates are negative. A bank in Denmark just launched the world’s first negative interest rate mortgage. The bank will pay borrowers 0.5% to buy a home. This is a new world.

It seems odd that the U.S. would want to follow Germany and Japan down the maze they’ve been trapped in. There’s $15 trillion worth of negative-rate bonds in the world at the moment. We could be in a vicious cycle of low rates not creating demand, which is creating still-lower rates.

One key bright spot for the economy is the housing market. It’s steadily expanding. As long as that’s happening, the odds of a recession are very low. Next week, we’ll get the latest reports on new- and existing-home sales. That’s probably as important as the yield curve.

For now, investors should continue to focus on high-quality stocks. You may have noticed that on days when the market gets nervous, our Buy List stocks tend to do much better. Our Buy List has beaten the S&P 500 14 times in the last 16 days. The only hitch is that it means we’ve lost less. Over that time, the S&P 500 has lost 5.69% while we’re down just 1.38%. For the year, we’re beating the S&P 500 19.87% to 13.59% (not including dividends).

I want to highlight a few Buy List stocks that look particularly good at the moment. I like where Raytheon (RTN) is right now. My Buy Below is currently $195 per share, but if you can get RTN below $180, that’s a good deal. Check Point Software (CHKP) also looks quite good. Any buy below $110 is a smart move. Lastly, there’s Eagle Bancorp (EGBN). I’ll warn you that EGBN is more speculative, but that’s how the game is played. Of course, the legal issues are a problem, but if all goes well, then this bank is going for a nice bargain.

Now let’s look at some upcoming earnings reports.

Earnings Preview for Ross Stores and Hormel Foods

Now that Q2 earnings season is behind us, we have the earnings reports for Buy List stocks with quarters that ended in July. There are only three stocks like that. Ross Stores and Hormel Foods are due to report earnings next Thursday, August 22. JM Smucker reports the following Tuesday, August 22. I’ll preview the jelly folks next week. Let’s now look at the first two.

Ross Stores (ROST) continues to be one of my favorite retailers, and they’re doing quite well in the Age of Amazon. Three months ago, the deep-discounter reported fiscal Q1 earnings of $1.15 per share. Those numbers were quite good. For context, Ross told us to expect earnings between $1.05 and $1.11 per share. As usual, Ross is pretty conservative with its guidance.

The CEO noted that ladies’ apparel has been somewhat weak. Ross is also facing higher transportation costs. All of that puts a squeeze on operating margins. For any business that caters to bargain-conscious shoppers, that can be a big problem. For now, Ross seems to be handling it well.

For Q2, Ross sees comparable-store sales growth of 1% to 2%. For EPS, the company sees the exact same as Q1: $1.05 to $1.11 per share. Ross now sees full-year earnings of $4.38 to $4.52 per share. That includes seven cents per share thanks to a favorable tax benefit. The old range was $4.30 to $4.52 per share. Adjusting for that, in effect, ROST’s guidance range narrowed thanks to a one-cent increase at the low end and a five-cent decrease at the high end.

Let’s remember that Ross took a swan dive late last year. The shares fell from $103 to $76 in just a few weeks. It was scary, but I’m glad we held on. The stock gradually made its way back. On Tuesday of this week, Ross got briefly got above $108 per share. Look for another good report from Ross Stores next Thursday.

Hormel Foods (HRL) has been one of our laggards this year. Through Thursday, shares of HRL are down 3% on the year. Despite the sluggish performance, I can’t say that HRL has been a big disappointment.

Three months ago, Hormel beat by a penny. The problem is that they lowered their full-year guidance. Hormel now sees sales of $9.5 billion to $10 billion. The previous guidance was $9.7 billion to $10.2 billion. They also lowered their EPS guidance to $1.71 – $1.85. The previous range was $1.77 to $1.91 per share.

Jim Snee, Hormel’s CEO, said that despite record sales, last quarter did not meet their expectations: “African swine fever in China started to impact global hog and pork markets this quarter, which led to rapidly increasing input costs. In response, we have announced pricing action across our branded value-added portfolio in the Grocery Products, Refrigerated Foods and International segments.”

Snee said that the lower guidance “is based on the input cost increases experienced in the second quarter and a forecast for volatile domestic pork prices in the second half of fiscal 2019.”Hormel’s outlook is troubling, but I’m still confident the company can manage its way through short-term issues. Wall Street is looking for earnings of 37 cents per share.

Before I go, there’s one more important item. Torchmark has changed its name to Globe Life (GL). The new ticker symbol is GL. Nothing else changes, and the share price and Buy Below are the exact same.

That’s all for now. There’s not a whole lot in the way of economic news next week, but I’ll be keeping an eye out for a few things. On Wednesday, the Federal Reserve will release the minutes of their last meeting. This is when they decided to cut interest rates. Also on Wednesday, we’ll get the report on sales of existing homes. Then on Friday, the report for sales of new homes comes out. For the most part, the housing sector is expanding. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

Morning News: August 16, 2019

Eddy Elfenbein, August 16th, 2019 at 7:04 amTrump Says China Talks ‘Productive’; Beijing Vows Tariff Retaliation

China Ramps Up Brazil Soybean Imports, Rebuffing U.S. Crops

Saudi Arabia is Dramatically Changing Its Oil Exports to China and the US

‘Crazy Inverted Yield Curve’ Vexes Fed, With No Clear Resolution

Businesses Flock to Baltimore Wasteland in Epic Turnaround Tale

Cathay CEO Quits After Airline Caught in Hong Kong Protests

GE Rout Ambushes Hedge Funds After Second-Quarter Buying Spree

Boeing Delays Launch Of Long-Haul Jet As 737 Max Crisis Remains The Focus

WeWork Stands Before Us in All Its Naked Glory

U.S. Surfboard Makers Not So Stoked About China Tariffs

Momofuku’s Secret Sauce: A 30-Year-Old C.E.O.

Wells Fargo Closed Their Accounts, but the Fees Continued to Mount

Cullen Roche: Let’s Get Inverted

Lawrence Hamtil: Compendium of Posts on Investing in Emerging Markets

Joshua Brown: Murdoch Has Seen Enough, ”Economic Buffoonery”, How Young Investors Should Think About Yield Curves and Recessions & Is the Yield Curve Coming to Kill You?

Be sure to follow me on Twitter.

-

Morning News: August 15, 2019

Eddy Elfenbein, August 15th, 2019 at 7:04 amMarkets Are Shaken by New Signs of Global Economic Trouble

Here’s Why the German Economy is Tanking and Most Likely Headed for Recession

China Signals Imminent Retaliation Against New U.S. Tariffs

Hong Kong Adds $2.4 Billion in Stimulus as Protests Hit Economy

India Shut Down Kashmir’s Internet Access. Now, ‘We Cannot Do Anything.’

U.S. Seeks to Block Release of Seized Oil Ship in Gibraltar

Trump Delays a Holiday Tax, but Toymakers Are Still Worried

Markets Register a Shock, But is Trump Right to Blame the Fed?

Boeing Delays Delivery of Ultra-Long-Range Version of 777X

WeWork IPO Shows It’s the Most Magical Unicorn

Macy’s Needs No Help to Fall Flat on Its Face

Facebook Just Gave 1.3 Billion Messenger Users A Reason To Delete Their Accounts

Michael Batnick: The Game Has Changed & It’s Hard to Think Long-Term

Animal Spirits: Business in a Box

Jeff MIller: Stock Exchange: The Beginning Or End Of The Sell Off?

Be sure to follow me on Twitter.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His