CWS Market Review – July 3, 2020

“We hold these truths to be self-evident, that all men are created equal.” – Thomas Jefferson

The first half of 2020 is on the books, and it was certainly an eventful six months.

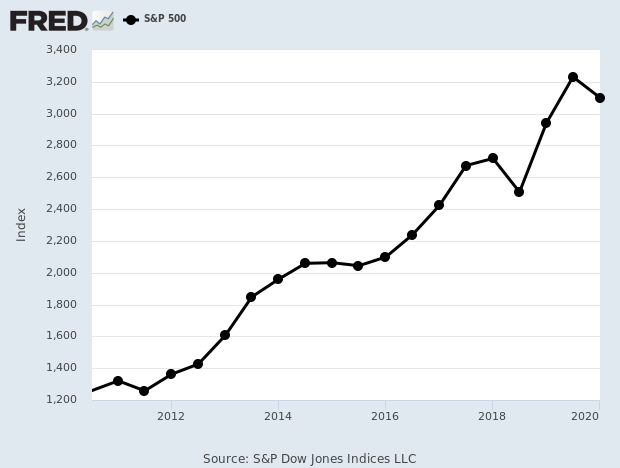

How’s this for serendipity? For the first quarter of the year, the S&P 500 fell by 20%, almost on the nose (-20.001%). For the second quarter, the index rallied by 20%. Again, almost on the nose (-19.953%).

So, -20% followed by +20%. Perhaps that’s fitting for the year 2020.

Unfortunately, a 20% loss followed by a 20% rebound doesn’t bring us back to 0%. It’s still a 4% loss, but that’s well within the bounds of “normal” for the stock market. If you’d checked the stock market once every six months (not a bad idea, btw), then you’d hardly think anything happened from January to June 2020.

This is an oddly quiet time for our Buy List. Earnings season doesn’t get going for another few weeks. There hasn’t been much stock-specific news for us lately. Since we’re at the midpoint of the year, in this issue, I want to take the opportunity to summarize the Buy List’s performance so far. I’ll also discuss some stocks that might be candidates for next year’s Buy List.

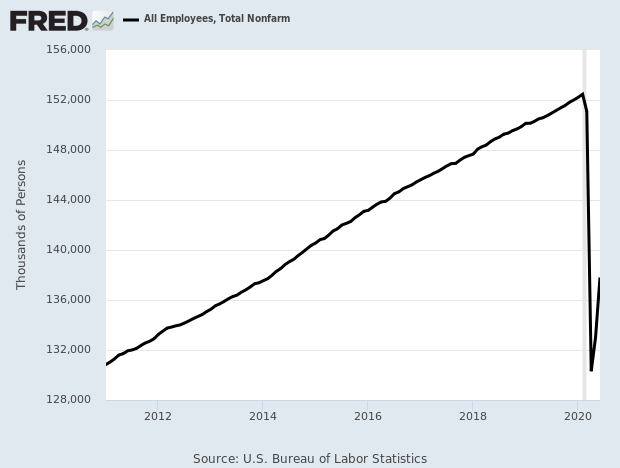

But first, let’s look at the latest economic news. According to the government’s figures, the economy created 4.8 million net new jobs last month. That’s a massive gain. That’s the good news. The bad news is that we have a long, long way to go.

The U.S. Economy Created 4.8 Million Jobs in June

The stock market is closed on Friday, July 3, so we get the full three-day weekend for Independence Day. Because of that, the June jobs report came out on Thursday instead of its normal time on Friday.

Most months, the jobs report comes out after I send you the weekly newsletter. Thanks to the holiday, I got to see the report this month before our deadline.

The government said that the U.S. economy created 4.8 million jobs last month. That’s an amazing figure. It blows past any record, but it’s still only a fraction of the jobs that were lost. Economists had been expecting a gain of 2.9 million. The report said that 10 million Americans have permanently lost their job.

The unemployment rate fell 2.2% to 11.1%. That’s an encouraging drop, but to add context, the jobless rate is still higher than the peak rates of unemployment rate in 1982, 1992 or 2009. In other words, we’re down to levels that are still higher than some pretty rough times for the economy. Things are better, but there’s a long way to go.

Here’s a look at nonfarm payrolls.

Thanks to the strong jobs report, the S&P 500 closed higher on Thursday. In fact, the index closed higher each day this week.

Also on Friday, the jobless-claims report came in at 1.427 million. That’s the 15th week in a row that jobless claims have topped one million. Wall Street had been expecting 1.38 million.

On Wednesday, ADP said that private payrolls increased by 2.360 million in June. I don’t place a great deal of faith in some of these numbers. It’s not that I think anyone’s lying. Instead, the circumstances are so unusual that it’s hard to get an accurate picture of what’s really happening.

To give you an example, ADP revised the May number from a loss of 2.76 million jobs to a gain of 3.065 million. A big revision like that doesn’t exactly instill confidence. The lockdown seems to have screwed with so much economic data.

Also on Wednesday, the ISM Manufacturing Index for June came in at 52.6%. That’s up from 43.1% in May. Bear in mind that the ISM is always in relative terms. It’s only concerned with things improving or worsening, not with the overall standing. Wall Street had been expecting 49.0.

The bottom line is that the fortunes of the economy are tied to that of the coronavirus. It really is that simple. As long as states and localities can reopen, then the economy will improve. Lately, the coronavirus has been making its presence felt in regions that it had largely bypassed. The good news is that some of the early data suggests that the coronavirus is less lethal than previously believed.

My fear is that the economy will bounce back but will still be below the level it was at in February 2020. In fact, it may take years for some sectors of the economy to fully recover. After all, the U.S. didn’t fully shake off the Great Depression until World War II. The Dow didn’t take out its 1929 peak for 25 years. I’m not predicting that, but I am pointing out that the economy often grows unevenly and inconsistently.

First-Half Buy List Summary

Through Thursday, our Buy List is down 4.04% for the year. That’s not too bad, but it trails the S&P 500, which is down 3.12% for the year. (These figures don’t include dividends, but my final year-end numbers will.)

It’s frustrating to be losing to the S&P 500 because as recently as June 1, we were beating the market by nearly 2%. June was tough for our relative performance due to the big shift towards cyclical stocks.

Our big weakness is technology stocks. The tech sector is crushing the market this year, especially big tech. Amazon (AMZN), for example, is up 56% this year. When trillion-dollar companies move like that, it distorts the rest of the market.

I shouldn’t be too disappointed by trailing the index by less than 1%, but I’m very competitive by nature. Still, the 15-year track record is very much in our favor.

Now for some more details:

Trex (TREX) is our top-performing stock with a YTD gain of 41.1%. This was a great addition to the portfolio. FactSet (FDS) comes in at #2 with a gain of 25.2%. Interestingly, most of our stocks are beating the market this year (13 of 25). It’s just that the losers are weighing us down.

Eagle Bancorp (EGBN) is our biggest loser with a loss of 37.3% this year. Middleby (MIDD) is perhaps our most dramatic stock this year. At one point, MIDD was down 60% for us, but it’s rallied back 80% from its low. That’s still a big loss, but not as steep as it was. Of our four biggest losers this year, three are financial stocks (AFLAC, Eagle and Globe Life).

Per Buy List rules, at the end of each year, I add five new stocks and delete five current ones. Here are ten stocks I’m looking at for next year:

Paycom Software (PAYC)

The Trade Desk (TTD)

Colgate-Palmolive (CL)

Masimo (MASI)

Waters (WAT)

Tyler Technologies (TYL)

CAE Inc. (CAE)

Simulations Plus (SLP)

Cooper Companies (COO)

HEICO (HEI)

Next year is still six months away, so I haven’t made up my mind, but those are ones I’m seriously looking at.

That’s all for now. On Monday, the ISM Non-Manufacturing Index is due out. The job-openings report comes out on Tuesday followed by the consumer-credit report on Wednesday. Thursday means another jobless-claims report. Lastly, the wholesale-inflation report comes out next Friday. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

Posted by Eddy Elfenbein on July 3rd, 2020 at 7:08 am

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His