CWS Market Review – January 17, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The stock market is slowly getting back on its feet. This comes after a very sluggish performance for the market in December. Although the S&P 500 closed lower today (-0.20%), this comes after the index reached its highest intra-day level in a month. Today also snapped a four-day winning streak.

On Friday, the S&P 500 closed above its 50- and 200-day moving averages. Also on Friday, the S&P 500 briefly went above 4,000. That’s something it hadn’t done since December 14.

We’re now getting into the thick of earnings season. So far, the results look promising. According to FactSet, 7% of the companies in the S&P 500 have reported results. Of those, 70% have topped expectations. That’s quite good.

The problem is that those expectations were cut back dramatically as earnings season approached. This is an old Wall Street trick: manage earnings so low that it’s easy to say you beat expectations. The paring this season has been more than usual. During Q4, analysts cut their estimates by 6.5%. Over the last five years, the average cut has been 2.5%.

Goldman Bombs Its Earnings Report

Typically, many of the major banks are the first to report their earnings. The big surprise today was that Goldman Sachs (GS) badly missed expectations. Wall Street had been expecting Goldman to report earnings of $5.48 per share. Instead, Goldman only made $3.32 per share. This was Goldman’s worst earnings miss in more than a decade. The stock fell more than 6.4% today.

Interestingly, the earnings from Goldman Sachs had an unusually large impact on today’s market. Namely, the Dow Jones Industrial Average did significantly worse than the S&P 500 (-1.14% to 0.20%). That’s because the Dow is a price-weighted index. In other words, the Dow is calculated by adding up the prices of all 30 stocks and multiplying by some factor.

Since Goldman was down by so much and because it has a high nominal share price, a bad day for Goldman has distorted the entire index. Goldman has the second-highest share price in the Dow.

In my opinion, using price-weighted indexes is a bad idea. All indexes should be weighted by market cap. Price-weighted indexes can cause too many problems. I’ll give you an example. Going back to November 2021, the Dow is down by 3.49% while the S&P 500 is off by more than 14.27%.

The gap should never be that large. The advantage for the Dow is that it’s been around for a long time, but the S&P 500 is the better index.

Last year was a tough year for Goldman and other Wall Street investment houses. Rising inflation and interest rates and also the war in Ukraine weighed on investors. That held back a lot of potential deals.

For Q4, Goldman made $1.33 billion. That’s down 66% from Q4 of 2021. The bank said it was hurt by a slowdown in deal making. Quarterly revenue was $10.59 billion, down 16% from a year ago. That missed the roughly $10.76 billion expected by analysts. For Q4, Goldman made $1.76 billion in fees. That’s down 48% from Q4 2021.

Goldman has been trying to focus more of its attention on consumer banking. The problem with a business set on high finance is that it can follow a boom-or-bust cycle. Goldman would rather have a business that generates consistent fees no matter what the environment is. So far, Goldman’s venture into consumer finance is not working out well.

One bright spot is that Wall Street traders have been keeping Goldman’s trading desks busy. Last quarter, trading revenue jumped 18% to $4.76 billion.

In terms of American business giants, Goldman Sachs really isn’t that big. By market cap, Goldman is about the 70th-largest stock in the index. However, Goldman punches far above its weight in terms of influence on Wall Street and the larger economy. Goldman sits at the innermost core of finance. That’s why its quarterly reports are carefully watched.

Earlier today, Morgan Stanley said that its profits fell 40% in Q4. Despite the big drop, Morgan earned $1.26 per share which beat by one penny per share. On Friday, JPMorgan Chase and Bank of America both reported big earnings declines. As a general rule, Goldman’s business is more Wall Street-centered while the other big banks are geared more toward banking for consumers.

Michael Hsu, the Comptroller of the Currency, said today that the major banks might soon break themselves up. He wasn’t making a specific prediction about the stock market or regulations. He merely stressed that at some point, it may be too difficult for a large bank to navigate government restrictions. Hsu said, “Effective management is not infinitely scalable.” He’s right. In fact, some banks, like Citigroup, could do very well by spinning off certain business units.

While today was slow on Wall Street, we’re going to have some important news coming soon and many of these reports will highlight the recent weakness in the economy. Tomorrow, for example, we’ll get the retail sales report for December. This is obviously the biggie as it covers the all-important holiday shopping season.

I’m also curious to see the retail sales report because the last few reports haven’t been very strong. Consumers are clearly feeling stretched. The report for November showed a drop of 0.6%, and Wall Street expects to see a drop of 1% for December. This is connected to the weak wage growth we’ve seen in the recent jobs reports.

Also tomorrow, we’ll get the report on industrial production. Much like retail sales, industrial production hasn’t been so great lately. The last report showed a drop of 0.2%. For tomorrow, Wall Street expects a drop of 0.1%. These aren’t awful numbers, but they underscore that the economy is not in top shape.

We’ll also get the key housing reports. That sector has been struggling lately. On Thursday, the report on housing starts is due out. Then on Friday we’ll get the report on existing-home sales. I’m not expecting good news here.

The non-bank earnings will also start to come in. On Thursday, we’re going to get earnings reports from Procter & Gamble, Fastenal and Netflix.

One year ago, Netflix made $1.33 per share for Q4 of 2021. This time, Wall Street expects earnings of 44 cents per share. Three months ago, Wall Street had been expecting $1.12 per share for Q4. Slash, slash, beat.

We won’t see the first of our Buy List earnings reports until next week. I’m expecting very good results for our stocks. Now let’s take at look at one of the surprising winners of the last 20 years.

Stock Focus: Old Dominion Freight Line

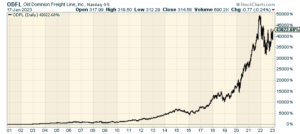

If someone had told me that one of the top-performing stocks of this century is the trucking stock, Old Dominion Freight Line (ODFL), I’m not sure I would have believed them. But it’s true. Since October 2000, shares of ODFL are up 43,000%.

Looking at a chart like the one above can be a little misleading. Some of those dips you can see were brutal at the time. The pullback in 2015 or the one in late 2018 appear minor in a chart from today. But they weren’t. In fact, the drop ODFL had last year was small potatoes going by recent history.

Old Dominion describes itself as “one of the largest North American less-than-truckload (‘LTL’) motor carriers and provides regional, inter-regional and national LTL services through a single integrated, union-free organization.”

Their services include “expedited transportation, which are provided through an expansive network of service centers located throughout the continental United States.”

It’s a lot more than just driving a truck. Old Dominion offers a range of value-added services including container drayage, truckload brokerage and supply chain consulting.

The company is due to report earnings again on February 1. Wall Street expects $2.68 per share, and I think Old Dominion can beat that. That’s really not a surprise. The company has beaten earnings for the last 10 quarters in a row. I should add that, unlike so many companies, the $2.68 figure has only been lowered by a few cents this season.

Once we get the final numbers, Old Dominion will have earned about $11.90 per share, give or take. That’s a big increase over the $8.89 per share it made last year and the $5.68 per share it made in 2020.

I’ll caution you that ODFL isn’t cheap. The stock closed today at $314.58 per share. That’s more than 26 times next year’s estimate.

My point in highlighting ODFL isn’t to show off a great value. Instead, I want to show you that great stocks can come from the unlikeliest sectors. Investors spend too much time thinking about what sector they invest in. Instead, we want to concentrate on how well they do whatever it is they do. Think of the old country song, “Do What You Do Do Well.”

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on January 17th, 2023 at 7:34 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His