CWS Market Review – February 14, 2023

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

January Inflation Was Slightly Higher Than Expected

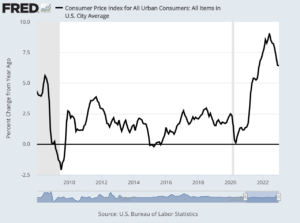

Today was the day of the big inflation report, and numbers came in slightly higher than expected. This morning, the government said that inflation rose by 0.5% in January. Economists had been expecting an increase of 0.4%. Over the last 12 months, inflation has increased by 6.4%. That was 0.2% above expectations.

The 12-month inflation rate ending in January was a teeny tiny bit lower than the 12-month rate for December. That means we can technically say that year-over-year inflation has declined for seven months in a row. Inflation peaked last June at 9.1%.

The core rate, which excludes food and energy prices, rose by 0.4% in January. That was 0.1% higher than expected. Over the last 12 months, core inflation is running at 5.6%. While the core rate has been lower than the headline inflation, it’s been tougher to bring down. The 12-month core rate peaked in September at 6.6% and has now declined for four months in a row.

Rising shelter costs accounted for about half the monthly increase, the Bureau of Labor Statistics said in the report. The component accounts for more than one-third of the index and rose 0.7% on the month and was up 7.9% from a year ago. The CPI had risen 0.1% in December.

Energy also was a significant contributor, up 2% and 8.7%, respectively, while food costs rose 0.5% and 10.1%, respectively.

Rising prices meant a loss in real pay for workers. Average hourly earnings fell 0.2% for the month and were down 1.8% from a year ago, according to a separate BLS report that adjusts wages for inflation.

The takeaway is that inflation continues to fade, but it’s taking its time. The battle to beat inflation won’t be a quick one.

Today’s inflation report didn’t have much of an impact on today’s trading. The S&P 500 fell by a minuscule amount. The real action was in the futures pits where traders bet on what the Fed will do. Traders think the Fed will now be more aggressive with its interest rate hikes.

We can look at the price for interest-rate contracts to find the implied probability of what the Fed will do. It doesn’t mean the market is right, but it gives us a sense of what the market is thinking. Until today, the market had been thinking that the Fed was all talk.

Right now, futures traders still think there’s a very high probability of another 0.25% rate hike next month, but traders also see another 0.25% rate hike coming in May. The odds of a May rate hike are now up to 85%.

After that, it starts to get interesting. Thanks to today’s inflation report, traders now expect an additional rate hike in June. One month ago, the implied odds of a 0.25% rate hike in June were 6%. Now those odds are 55%. That’s all due to today’s report. Going out a few months, traders think there will be a rate cut by December. Previously, the market had been expecting two rate cuts before the end of the year.

In plain English, today’s inflation report gives Jerome Powell and his friends at the Fed more cover to keep raising interest rates. The idea that the economy is about to tip over into a recession seems just a tad less likely. Or it may happen, but not quite so soon. A few months ago, Wall Street was expecting the Fed to pivot. Now, not so much.

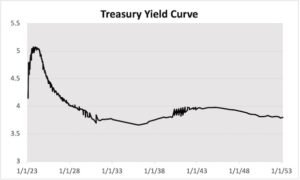

Here’s a look at the complete Treasury yield curve. I plotted every single outstanding U.S. Treasury which is over 300 securities. Note how after a short-term increase, interest rates are expected to fall rapidly.

The International Monetary Fund just raised its estimate for U.S. economic growth this year to 1.4%. That’s not a lot, but it’s better than a recession.

What’s interesting is that many stock markets around the world are outpacing the U.S. market. Some are doing it by a lot. From 2008 to last year, the American stock market was the place to be. That came to an end last October. Since then, stock markets in countries such as Poland and Hungary have soared. Even China is doing well amid its lockdowns.

This Has Been a Crummy Earnings Season

We’re now heading into the closing part of Q4 earnings season. Frankly, this has been a disappointing season. Jonathan Golub, who is the Chief U.S. Equity Strategist at Credit Suisse, said that excluding recessions, this has been the worst earnings season in 24 years.

So far, 69% of companies have reported results. Of those, 69% have beaten estimates. That’s below the five-year average of 77%. It’s weaker than that considering how much analysts lowered their estimates prior to earnings season.

Overall, 69% of the companies in the S&P 500 have reported actual results for Q4 2022 to date. Of these companies, 69% have reported actual EPS above estimates, which is below the percentage of 70% at the end of last week, below the 5-year average of 77%, and below the 10-year average of 73%.

Earnings are coming in at 1.1% higher than estimates. That’s not that good. The five-year average is 8.6%. Q4 earnings are tracking a decline of 4.9% compared with Q4 2021. If that holds up, it will be the first overall earnings decline since Q3 2020.

So far, 63% of the earnings reports have beaten their revenues estimates. That’s below the five-year rate of 69%. The S&P 500 is on track to report revenue growth of 4.6% compared with Q4 2020.

The overall picture is that revenues are slightly higher while earnings are slightly lower. That means that profit margins are under pressure. That often happens late in an economic cycle. Wall Street expects earnings to decline for Q1 and the entire year.

As we discussed before, on Wall Street, stocks are expected to beat expectations. Some companies are experts at guiding Wall Street analysts to believe that earnings will be a few pennies per share less than where they really are. This lets companies pretend that they beat expectations when that’s not really the case.

John Butters with FactSet noticed something interesting about this earnings season. Companies that have beaten expectations are getting a larger bump than normal while companies that miss expectations are getting a smaller ping than normal.

It’s as if Wall Street is onto the analysts this time. As a result, traders are taking the earnings misses in stride.

I should point out that our Buy List is having a much better performance. Of our 16 earnings reports so far, 14 beat estimates, one missed and one met expectations.

Stock Focus: Investors Title

I like to use this space to tell you about stocks that few people know about. I figure that it’s not hard to find someone to tell you what they think about Tesla or Facebook. Not many people will let you know about U.S. Lime and Minerals (USLM). Well, I’m happy to do that. (By the way, USLM hit another new 52-week high yesterday.)

This week, we’re going to look at Investors Title (ITIC). As you might guess, ITIC is a title insurance company based in Chapel Hill, NC. Title insurance protects homeowners against competing claims for their property. It’s not a very big outfit. ITIC only has about 500 employees and a market cap of $300 million. Over the last 33 years, ITIC has returned 4,800%. I suppose it’s a good business when homeowners are forced by law to buy it.

Would you like to guess how many analysts follow ITIC? If you’ve been around here, you probably know the answer. Zero. Not a single analyst bothers to follow this stock.

Another neat aspect of ITIC is that it occasionally pays out special dividends Sometimes these have been quite large. The current regular dividend is 46 cents per share. Last year, ITIC paid out a special dividend of $3 per share. In 2021, it was $18 per share. In the three years prior to that, ITIC paid out dividends of $15, $8 and $11 per share. This is on top of the regular dividend.

Here’s an interesting historical tidbit for you: Title insurance played an important role in the history of our two greatest presidents. In the 1750s, Lord Fairfax, the only peer living in North America, asked a young man named George Washington (a distant relative) to survey some of his land in the western part of Virginia. Fairfax owned some five million acres. Earlier, the Virginia House of Burgesses tried to do what governments like to do, claim some of his land for itself.

About 60 years later, and not that far away, a Virginia-born farmer named Thomas Lincoln bought a small farm in Kentucky. At this time, this was frontier country. He built a log cabin there and soon, he and his wife had a son. Then along came a man with a competing claim to the farm and the court ruled against the Lincoln family. They had to move and the legal costs were a great hardship to the young family. They were able to lease another farm and soon, the same things happened again.

Thomas Lincoln was fed up with Kentucky and moved to Indiana which had recently been surveyed by the Federal government, so land claims were more secure. Shortly after the family got in Indiana, Thomas’ wife Sarah died. The whole episode left a great impression on Abraham Lincoln, and it may have led him to study surveying and the law.

This morning, Investors Title reported Q4 earnings of $3.97 per share. That’s terrible compared with one year ago, but that’s due to the Fed and the housing market. Real estate is cyclical. Quarterly revenues were down 28%. For the year, ITIC made $12.59 per share.

ITIC is a tough stock to own when rates are rising, but once you sense the Fed will soon start cutting, ITIC could be a very attractive buy.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. If you want to learn more about the stocks on our Buy List, please sign up for our premium service. It’s $20 per month, or $200 per an entire year.

Posted by Eddy Elfenbein on February 14th, 2023 at 7:23 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His