CWS Market Review – June 3, 2025

(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Best May Since 1990

On Friday, the S&P 500 closed out its best May in 35 years. It was also the second-best May since 1948.

The old Wall Street adage that we’re to “sell in May and go away” isn’t working this year. Not only was last month the best May, but it was also the best month since November 2023.

For the month, the S&P 500 gained 6.15%. If we include dividends, then the market was up 6.29%. For the year, the S&P 500 is up 0.51%, and with dividends, it is up 1.06%.

After suffering a major scare earlier this year, it’s amazing that we’re not far from new all-time highs. For the last two weeks, the S&P 500 mostly traded within a narrow range. In thirteen of the last 15 trading sessions, the S&P 500 has closed within 1% of 5,900.

We’ve had some disappointing economic news lately. On Monday, we got the ISM Manufacturing Index. I look forward to this report for a few reasons. For one, it’s usually reported on the first business day of the month. So many econ stats lag far behind what they’re supposed to be reflecting.

Also, the ISM is simple. They go to several companies and ask the purchasing managers if they’ve been buying more, buying less or buying the same. That’s it.

An ISM report above 50 means that the factory sector of the economy is growing, and below 50 means it’s shrinking. The ISM for May came in at 48.5. That’s down 0.2 from April. That’s negative but not by much. The ISM recently snapped a 26-month losing streak. The ISM doesn’t reach the worrying level until it drops down to 43 or 44.

Interestingly, the ISM Manufacturing report also showed that imports dropped to 39.9 last month. That’s the lowest since the financial crisis.

That’s not the only negative report on the economy. Also on Monday, the Census Bureau said that construction spending pulled back in April by 0.4%. So far this year, construction spending is running 1.4% of last year’s total.

On Tuesday, the Census Bureau said that factory orders fell by 3.7% in April. That comes after a 3.4% increase for March. Economists had been expecting a drop of 3.1%. Orders for commercial aircraft dropped by 51.5%. Motor vehicles, parts and trailers fell by 0.7%.

The OECD made waves on Tuesday when it cut its estimate for U.S. economic growth this year to 1.6%, and to 1.5% for next year. As key factors for the downgrade, the OECD cited tariffs and the policy uncertainty. The group also said that it expects inflation in the U.S. to increase.

To me, these are signs that the economy is expanding but at a slow pace. I don’t think we’re close to a recession, but that could change before the end of the year.

Growth Charges Ahead and Healthcare Lags

I’ve been surprised by the outperformance of growth stocks over value stocks over the past two months. Of course, some of this is to be expected as growth stocks love to outperform in bull markets. Still, I didn’t think it would be by this much.

Since the April 8 low, the S&P 500 Value Index has gained 13.3% while the S&P 500 Growth Index is up by 26.8%. That’s a hefty lead for such a short period of time.

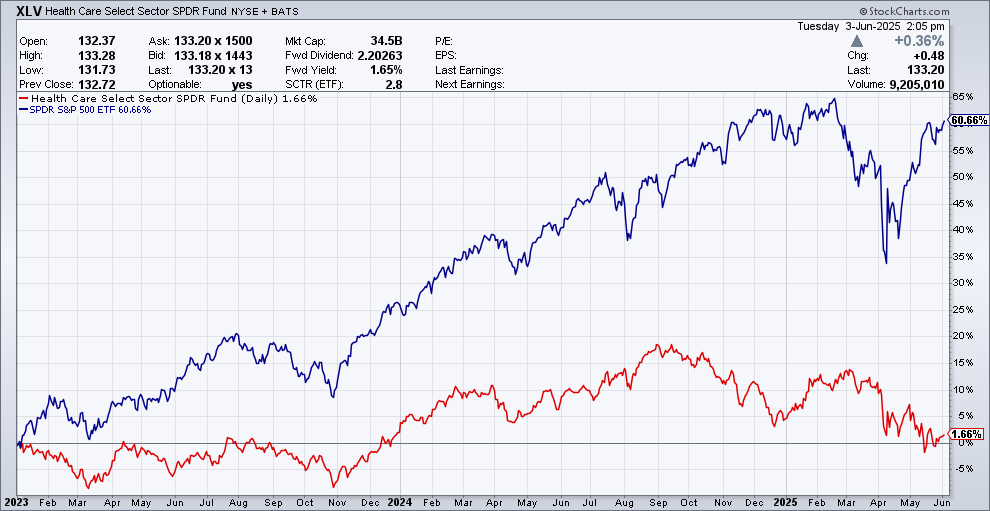

If we dig down a little, an interesting fact about the market in May is that every sector gained except for healthcare. In fact, healthcare has been lagging the rest of the market for the last 30 months.

In the chart below, the red line is the S&P 500 Healthcare ETF, and the blue is the S&P 500.

I notice this because healthcare has usually been a very good sector to invest in, and there have been many big winners over the years. So many trends are in its favor. You have technology and demographics working together, plus a very large amount of government support.

Stocks like Johnson & Johnson (JNJ) and AbbVie (ABBV) are going for less than 14 times forward earnings. Merck (MRK) and Pfizer (PFE) are both trading less than eight times forward earnings. Pfizer currently yields over 7.2%.

We’re fortunate to have some solid healthcare names on our Buy List. Abbott Labs (ABT) is up more than 17% this year. Stryker (SYK) has been a great stock for us for many years.

I won’t predict an imminent turnaround for healthcare, but I will note that historically, it lags the market occasionally but not for long. Healthcare crushed the market from 2011 to 2015. It had a very good year in 2022 as well. The relative strength of healthcare is at its lowest point in 25 years.

Healthcare is also a quintessential defensive stock. That means it does well when the economy is flat on its back. Healthcare’s (and Value’s) day will come, but it needs a recession first.

Costco Rallies on Earnings Beat

Last week, I highlighted Costco (COST) and talked about why I like the company so much, if not the stock. More proof came last Thursday when the retailer posted another solid earnings report.

For its fiscal Q3, Costco earned $4.28 per share. That beat Wall Street’s consensus by four cents per share, and it’s up from $3.78 per share one year ago. Quarterly revenue rose 8% to $63.21 billion. That was $20 million more than Wall Street had been expecting. (It says something about your company when a beat of $20 million is basically a rounding error.)

On the earnings call, the company conceded that tariffs have been difficult for them. Specifically, Costco had to adjust their supply chain and, in some cases, raise some prices which I know they hate to do. I can’t say how much the impact has been. Costco is one of the few retailers that does not provide earnings guidance.

Same store sales were up by 8%, and e-commerce sales were up by 16%. Costco could actually benefit from the tariff policies because consumers might be more willing to lock in long-term discounts by buying Costco memberships. Still, tariffs are an issue. About one-third of Costco’s sales in the United States are in goods from outside the country.

Costco isn’t alone in fighting higher prices. Walmart (WMT) also said it will have to pass on higher costs.

On the company’s earnings call, CEO Ron Vachris said Costco has looked for ways to reduce tariff costs while keeping prices low. He said its buyers rushed orders to get them to the U.S. ahead of tariffs. It has rerouted goods from countries with higher tariffs to non-U.S. markets. And it’s sourced more items for its private brand, Kirkland Signature, in the countries or regions where the items are sold.

Even with tariffs, he said, Costco has lowered the price of some items including eggs, butter and olive oil. He said it’s also trying to lean into reasons that customers might sign up for or renew membership, such as extending the hours of its gas stations that sell discounted fuel.

On Friday’s trading, the shares rallied a little over 3%. As I’ve said, Costco is a wonderful company that I’d love to buy, but I still think it’s simply too expensive. Costco is currently trading at more than 50 times next year’s earnings. I don’t think that’s reasonable.

That’s all for now. The May jobs report is due out on Friday. Wall Street is looking for a gain of 125,000 new new jobs. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

Posted by Eddy Elfenbein on June 3rd, 2025 at 4:55 pm

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.

-

Archives

- March 2026

- February 2026

- January 2026

- December 2025

- November 2025

- October 2025

- September 2025

- August 2025

- July 2025

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His