Author Archive

-

Trade and PPI Weigh on Market

Eddy Elfenbein, October 14th, 2010 at 10:11 amWall Street continues to take the David Arquette/Courteney Cox news in stride. The Dow is currently off 20 points. Our Buy List is modestly higher.

Reynolds American (RAI) came within one penny of making a new 52-week high this morning. The stock is up over 13% for the year for us — and that doesn’t include the big dividend.Other news impacting finance this morning is that the report on the U.S. trade gap for last month climbed higher than expected. The gap grew by 8.8% to $46.3 billion compared with Wall Street’s estimate of $44 billion. Imports rose by 2.1%, while exports increased 0.2%. Here’s a stunning fact: Trade knocked off 3.5 percentage points from Q2 GDP growth. That’s the most since 1947 and imports grew at the fastest pace since 1984.

The Labor Department said that wholesale prices rose by 0.4% last month. However, the “core rate,” which doesn’t include food and energy prices, rose by just 0.1%. As it turns out, the core reading explains a lot since food prices rose by 1.2% in September and since energy prices rose by 0.5%.

Overall, this news will give Bernanke & Co more room to operate. I think the Fed will go ahead with QE2 at their meeting in early November. I expect that the Fed will announce a program to buy, say, $300 billion to $500 billion worth of Treasuries in an attempt to get the economy moving again.

-

Morning News: October 14, 2010

Eddy Elfenbein, October 14th, 2010 at 7:43 amWorld Stocks Hit Two-year High, Led by Emerging Markets

Franc Strengthens to Record Versus Dollar on Fed Easing Concerns

Goldman No. 1 at Rating Financial Companies With 38% Right

Bankers Ignored Signs of Trouble on Foreclosures

Yahoo Surges on Reports of Buyout by AOL

Oil Climbs a Second Day on Speculation of Renewed Fed Action

Dollar Pummeled after Singapore Widens FX Band

Pimco Sells Treasuries on Prospect Fed Easing Round to Have Limited Impact

-

Bernanke Warns

Eddy Elfenbein, October 13th, 2010 at 8:48 pmNotice a pattern?

Bernanke Warns of High Budget Deficits

Bernanke Warns of Devastating Economic Collapse

Bernanke Warns of Threat from Deficit

Ben Bernanke Warns of Looming Economic Crisis

Fed Chairman Ben Bernanke Warns Against Hasty Action on the US Deficit

Bernanke Warns U.S. of ‘Unsustainable’ Debt Level

Bernanke Warns About Creating New Bubbles

Bernanke Warns Against Narrowing Fed Focus

Bernanke Warns of Small-Bank RisksBernanke Warns Economic Outlook ‘Uncertain’

Bernanke Warns of Tax Hikes or Benefit Cuts to Deal With Deficit

Bernanke Warns of Need for Monetary Tightening

Bernanke Warns Mortgage Rates Could Rise on Debt Worries

-

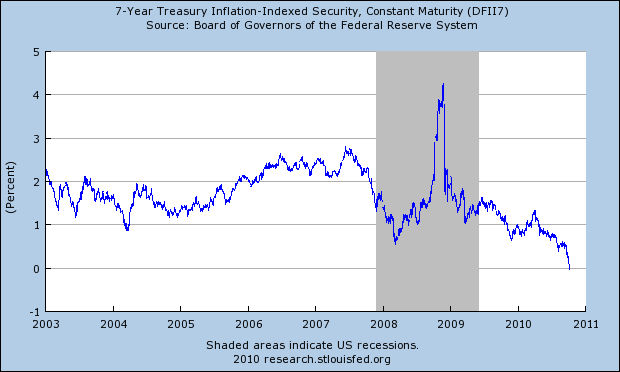

The 7-Year TIPs Yield Is Now Negative

Eddy Elfenbein, October 13th, 2010 at 4:16 pmAmazing! Bond 36,000 continues.

-

Holding on to Nice Gains Today

Eddy Elfenbein, October 13th, 2010 at 3:23 pmThe market is holding on to decent gains as we head into the closing bell. The S&P 500 has been as high as 1,184.38. Interestingly, that’s near the close of 1,186.75 on July 17, 1998 which was the closing high before the market plunged later that year. The subsequent rally was so strong it nearly makes us forget how nasty that downturn was.

Despite having decent earnings, shares of Intel (INTC) have sold off today. However, the stock is merely giving back its run-up going into earnings. As I said before, this is a good buy under $20.

JPMorgan Chase (JPM) has also pulled back some after a good earnings report. This isn’t a major sell-off but I think JPM looks good under $40. As I said this morning, it’s possible that JPM could restore its 38-cent quarterly dividend. I doubt they’ll do that, but they could if they wanted to.

Apple (AAPL) also made news today by busting through $300 per share. I was happy to see AFLAC (AFL) get as high as $55.55 today. This is still an excellent stock to own. Wright Express (WXS) is one of the quieter stocks on our Buy List, but don’t let that fool you. The stock hit a fresh 52-week high today. It’s up 18% on the year for us. Jos. A Bank Clothiers (JOSB) also made a new high today. The stock is up 67% year-to-date.

Tomorrow we’ll get the report on wholesale inflation, and on Friday, we’ll get the report on consumer inflation. On the earnings front, Google (GOOG) reports tomorrow as does AMD (AMD). On Friday, GE (GE) reports. The good thing about the GE report is that the company is so diversified that it’s almost like a private sector GDP report.

-

50 Years Ago Today

Eddy Elfenbein, October 13th, 2010 at 1:45 pmA few quick notes. The #21 you see in the crowd at home plate is Roberto Clemente. Also, the left fielder who watches the ball sail over him is Yogi Berra. He occasionally played in the outfield. As a player, Berra played in 14 World Series and won ten of them. As a manager, he appeared in two more but lost both in the seventh game.

-

24 Scary Facts About the U.S. Economy

Eddy Elfenbein, October 13th, 2010 at 12:38 pmHere are 24 scary facts about the U.S. economy:

#1 Ten years ago, the United States was ranked number one in average wealth per adult. In 2010, the United States has fallen to seventh.

#2 The United States once had the highest proportion of young adults with post-secondary degrees in the world. Today, the U.S. has fallen to 12th.

#3 In the 2009 “prosperity index” published by the Legatum Institute, the United States was ranked as just the ninth most prosperous country in the world. That was down five places from 2008.

#4 In 2001, the United States ranked fourth in the world in per capita broadband Internet use. Today it ranks 15th.

#5 The economy of India is projected to become larger than the U.S. economy by the year 2050.

#6 One prominent economist now says that the Chinese economy will be three times larger than the U.S. economy by the year 2040.

#7 According to a new study conducted by Thompson Reuters, China could become the global leader in patent filings by next year.

#8 The United States has lost approximately 42,400 factories since 2001. Approximately 75 percent of those factories employed at least 500 workers while they were still in operation.

#9 The United States has lost a staggering 32 percent of its manufacturing jobs since the year 2000.

#10 Manufacturing employment in the U.S. computer industry is actually lower in 2010 than it was in 1975.

#11 In 1959, manufacturing represented 28 percent of all U.S. economic output. In 2008, it represented only 11.5 percent.

#12 The television manufacturing industry began in the United States. So how many televisions are manufactured in the United States today? According to Princeton University economist Alan S. Blinder, the grand total is zero.

#13 As of the end of 2009, less than 12 million Americans worked in manufacturing. The last time that less than 12 million Americans were employed in manufacturing was in 1941.

#14 Back in 1980, the United States imported approximately 37 percent of the oil that we use. Now we import nearly 60 percent of the oil that we use.

#15 The U.S. trade deficit is running about 40 or 50 billion dollars a month in 2010. That means that by the end of the year approximately half a trillion dollars (or more) will have left the United States for good.

#16 Between 2000 and 2009, America’s trade deficit with China increased nearly 300 percent.

#17 Today, the United States spends approximately $3.90 on Chinese goods for every $1 that China spends on goods from the United States.

#18 According to a new study conducted by the Economic Policy Institute, if the U.S. trade deficit with China continues to increase at its current rate, the U.S. economy will lose over half a million jobs this year alone.

#19 American 15-year-olds do not even rank in the top half of all advanced nations when it comes to math or science literacy.

#20 Median household income in the U.S. declined from $51,726 in 2008 to $50,221 in 2009. That was the second yearly decline in a row.

#21 The United States has the third worst poverty rate among the advanced nations tracked by the Organization for Economic Cooperation and Development.

#22 Since the Federal Reserve was created in 1913, the U.S. dollar has lost over 95 percent of its purchasing power.

#23 U.S. government spending as a percentage of GDP is now up to approximately 36 percent.

#24 The Congressional Budget Office is projecting that U.S. government public debt will hit 716 percent of GDP by the year 2080.

(Via: The Economic Collapse Blog)

-

Maxine Waters on Foreclosures

Eddy Elfenbein, October 13th, 2010 at 11:59 amJoe picks up on some off-camera laughter at around the 1:43 mark.

-

Apple Breaks $300

Eddy Elfenbein, October 13th, 2010 at 9:45 amI’m beginning to think that Apple (AAPL) at $6.36 was a good buy in April 2003.

-

JPMorgan Chase Earns $1.01 Per Share

Eddy Elfenbein, October 13th, 2010 at 9:01 amMy earnings-dar has been fairly well-adjusted this week. For Intel, I said “I expect 50 or 51 cents, maybe 52 cents.” Intel earned 52 cents per share.

I also wrote, “The stock that I think is a good candidate for an earnings beat is JPMorgan Chase (JPM).” This morning, JPM reported Q3 earnings of $1.01 per share. Wall Street was expecting 90 cents per share.

I have to explain something about how banks report their earnings because it’s a tricky topic. When a bank reports its earnings, it needs to estimate now how many of its loans will turn out to be bum loans down the road.

Obviously, a bank hopes all of its loans will be repaid, but we know that a small amount will disappear into the ether. But how many? That’s not so easy to say. If the bank thought the loan would go bust, they never would have made it in the first place. But for sake of accounting, they need to set aside some money for their bum loans.

This means that the bank’s estimate of its future bad loans has a major impact in the here and now in the form of its current earnings. The whole thing is based on a guess, really. It can be a good guess or it can be a bad guess, but it’s only a guess.

So whenever a bank releases its earnings report, there’s always a debate about the quality of its earnings versus the quantity of its earnings. “Sure,” the bears grumble, “that’s what they tell us they earned, but the bank is living in La-La Land if they think those forecasts will hold.” Sometimes they’re right (see ZeroHedge for a critical look at JPM’s earnings). However, banks have no incentive to lie or mislead investors about their bad loans. It will only come back to bite them in the end.

Our own Nicholas Financial (NICK) is a good example of the opposite. They overestimated their bad loans and for the past few quarters had to play catch up with their loan reserves. This made it appear that earnings were improving more rapidly then they were. (This was a very small effect though.) Your guess is never going to be 100% spot-on so you always need to make adjustments.

Now back to JPMorgan Chase. Here’s the WSJ:

The nation’s second largest bank by assets reported $300 billion in new and renewed credit and capital raises in the quarter, and it said consumers spent more on their credit cards. But consumers and businesses continue to pay off loans faster than the bank makes new ones, and Wall Street’s wobble over the summer reduced revenue and profits from the securities business.

Still, J.P. Morgan’s $4.4 billion in third-quarter profits, $1.01 per share, topped analysts’ estimates, as the amount of money it set aside for loans that might go bad continued to tumbled. The bank also continued to report a declining defaults across most of its loan books.

Revenue on a managed basis, which excludes the impact of credit-card securitizations and is on a tax-equivalent basis, dropped 15% to $24.34 billion.

The bank did expand; assets increased 5% from a year ago to $2.1 trillion, mainly because it added securities to its investment portfolio.

J.P. Morgan’s shares rose 1% to $40.80 premarket amid broad market strength, pulling along rising shares of its main big bank rivals Bank of America Corp. and Wells Fargo & Co. As of Tuesday’s close, the stock had fallen 12% the past year.

The profit “was the result of the good underlying performance of our businesses,” Chairman and Chief Executive James Dimon said in a press release.

He noted that the investment banking’s results were “solid” and its Main Street operations saw “strong” mortgage loan production.

Still, the investment-banking arm saw profit drop by one-third as revenue slid 29%. Profit soared to $907 million from $7 million a year earlier on sharply lower credit-loss provisions at its retail financial-services segment as revenue declined 7%.

The first big bank reporting results, J.P. Morgan’s bottom-line had been solidly tied to its Wall Street-related operations recently, but growth shifted toward the giant bank’s Main Street operations in the second quarter as the economy continued healing. Investment-banking results have turned sour in recent quarters amid a steep decline in trading activity.

The bank also has benefited recently from a sharp cut in its loan-loss reserves. Managed credit-loss provisions were $3.22 billion, down from $9.8 billion a year earlier and $3.36 billion in the prior quarter.

Analysts polled by Thomson Reuters had forecast earnings of 90 cents a share on $24.64 billion in revenue.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His