Author Archive

-

Morning News: October 7, 2014

Eddy Elfenbein, October 7th, 2014 at 6:57 amGerman Recession Fears Grow as Output Drops 4%

Following Apple And Starbucks, Amazon Now Faces European Commission Tax Probe

HP’s Split Frees Up Units to Chase Deals

Paulson Says AIG Harsh Loan Terms Meant to Send Message

California’s Brown Returns PG&E Money as Probe Surfaces

Bitcoin Volatility Highlights Need for Advanced Investing Facilities

What Snapchat Wants From Yahoo

Chinese Investor to Pay $1.95 Billion for New York’s Waldorf Astoria

Glencore Has Work To Do If It Wants to Grab Rio

These Funds Are Benefiting From Bill Gross’s Pimco Exit

Samsung’s Not Done — Tech Giant Looks to New Phones, Materials to Rally

Banker Admits Libor Fraud Conspiracy

Oh My GTAT…$1.5 Billion Goes Poof Over the Weekend!

Jeff Carter: To Understand Crony Capitalism, Understand George Stigler

Be sure to follow me on Twitter.

-

Watch the Reporting Date

Eddy Elfenbein, October 6th, 2014 at 9:07 pmHow will you know if a stock beats earnings? Consider this novel indicator:

The indicator you should watch: Whether or not a company changes its earnings reporting date, and whether than change moves the date forwards or backwards.

Not surprisingly, if the date moves up, the news is usually good. If it moves back? Probably not good. Professor So, who is the Sarofim Family Career Development Professor and an assistant professor at the MIT Sloan School of Management. says the simple rule is human nature. People rush home to tell their families good news, and tend to keep quiet about bad news.

Professor So looked at eight years’ of earnings announcements — 19,000 firms between 2006 and 2013. Firms that move up their announcements earn 2.6% more than the firms that delay announcements over the month following earnings calendar revisions. “The magnitude of this mispricing is massive,” So said in a statement.

This is interesting and it makes sense. Fourth-quarter earnings season begins on Wednesday.

-

Janet Who?

Eddy Elfenbein, October 6th, 2014 at 8:42 pmBinyamin Appelbaum highlights a poll done by the Pew Center which found that no one has any idea who runs the Fed.

Presented with a list of four names, just 24 percent of respondents to a new Pew Research Center poll correctly identified Janet L. Yellen as the Fed’s chairwoman. The runner-up, with 17 percent, was Alan Greenspan, who retired from the job almost a decade ago.

All things being equal, I’d prefer to live in a world where the head of the central bank is barely known. Still, it’s a little shocking how many Americans are so clueless about monetary policy.

-

Prime Working-Age Pop Growing Again

Eddy Elfenbein, October 6th, 2014 at 3:29 pmHere’s an important chart that says a lot about the economy. After 25 years of deceleration, the growth rate of the prime working-age population is once again accelerating.

The segment of the population that’s between 25 and 54 and not in jail or the military had actually been shrinking for a few years. The growth rate peaked in 1986, and it gradually declined for many years. Now it’s growing again. The segment that’s between 20 and 24 is now the largest.

-

Hewlett-Packard to Split in Two

Eddy Elfenbein, October 6th, 2014 at 10:36 amLate yesterday we got remarkable news that Hewlett-Packard (HPQ) is splitting itself in two new companies.

Meg Whitman will lead one new company, which will be Hewlett-Packard Enterprise. They’ll focus on hardware and services. The other new company will focus on PCs and printers and they’ll be known as HP Inc. (I’m fairly confident that neither new company will have those names within five years.)

This is big news, especially for those of us who study business history. Hewlett-Packard was one of the great American business legends. It was famously started in a garage by Bill Hewlett and Dave Packard. They used a coin toss to decide if it would be Hewlett-Packard or Packard-Hewlett. The company was a spectacular success for several decades.

Frankly, Hewlett-Packard never fully recovered from the bursting of the tech bubble in 2000. They ran through a few mediocre CEOs (except for Mark Hurd), and they took on several poorly considered acquisitions. In 2001, they bought Compaq (which was fought by Walter Hewlett, Bill Hewlett’s son).

I don’t have an opinion of which of the new companies will be better, but I applaud this move. There should be more breakups in Corporate America. It’s better for shareholders and better for the companies. Also today, Hewlett-Packard said that earnings-per-share, for this fiscal year (ending October 2015) will range between $3.23 and $3.43.

-

Morning News: October 6, 2014

Eddy Elfenbein, October 6th, 2014 at 7:10 amWorld Bank Forecasts Southward Asia Growth Shift

German Industrial Orders Fell Sharply in August

Greece Sees 2015 Budget Surplus Close To Bailout Target

Gold Sinks on Robust U.S. Data, Platinum at Multi-Year Lows

Oil Steadies above $92 as Equity Markets Rally

No Charity as Iron Ore Giants Rio and BHP Grind Rivals

HP to Separate Into Two New Industry-Leading Public Companies

Credit Swap Indexes Trade After $17 Trillion Market Overhaul

Chevron Sells Stake in Canadian Shale Area

Samsung Electronics makes $14.7 Billion Bet With New Chip Plant

Becton Dickinson to Buy CareFusion for $12 Billion in Cash, Stock

Euro Disney Shares Tumble 15% on Debt Financing Plans

Bernanke, Paulson and Geithner Face Grilling Over AIG Bailout

Joshua Brown: Meanwhile, a Rolling Debacle For Stock Mutual Funds

Jeff Miller: Will Global Weakness Drag Down the US Economy?

Be sure to follow me on Twitter.

-

Apco Bought Out for $14.50 Per Share

Eddy Elfenbein, October 3rd, 2014 at 4:39 pmToday, Apco Oil & Gas International ($APAGF) agreed to be bought out for $14.50 per share.

Never heard of Apco? Don’t worry, you’re not alone.

The reason I bring up Apco is due to their interesting history. Two years ago, the stock got slammed. It fell from around $90 to $10 in just a few months. Up until then, Apco had been one of the most successful stocks over the long-term. I believe it was the top-performing stock over a 30-year period.

According to Yahoo Finance, Apco was going for 1/8th of a dollar in 1985. It split 4-for-1 since then, so in today’s terms, the price was about thee cents per share. Apco reached a high of $93.29 in May 2011. That’s a gain of 186-fold in 26 years. Annualized, that’s more than 22%.

Not bad — assuming you sold at the right time. Today’s buyout price is an 84% haircut from the high.

-

Medtronic to Rework Deal

Eddy Elfenbein, October 3rd, 2014 at 2:26 pmShares of Medtronic ($MDT) dropped recently due to proposed changes for tax inversions. The company has responded by reworking its deal with Covidien.

The Obama administration’s crackdown on inversions is already shaking up some multibillion-dollar deals.

On Friday, the medical device maker Medtronic said it was restructuring the financing for its $43 billion acquisition of Covidien, a deal that will allow the American company to reincorporate in Ireland and lower its tax bill.

The announcement was the most direct sign yet that new rules from the Treasury Department, announced last week, were having an impact on pending deal plans. It also suggested that the Treasury Department had found a way to hit inverting companies where it hurt.

Until Friday, Medtronic had planned to used overseas cash held by it and Covidien to help pay for the deal. That plan would have been tax efficient: Medtronic had intended to use so-called hopscotch loans to get around paying the Internal Revenue Service to repatriate billions in cash.

But the Treasury Department put an end to hopscotch loans for inverted companies last week, forcing Medtronic to rethink its financing for Covidien. Now, instead of using existing cash being held abroad, Medtronic will draw on $16 billion in external financing to complete the deal. The terms of the deal remain unchanged.

The stock has been up as much at 4.8% today.

-

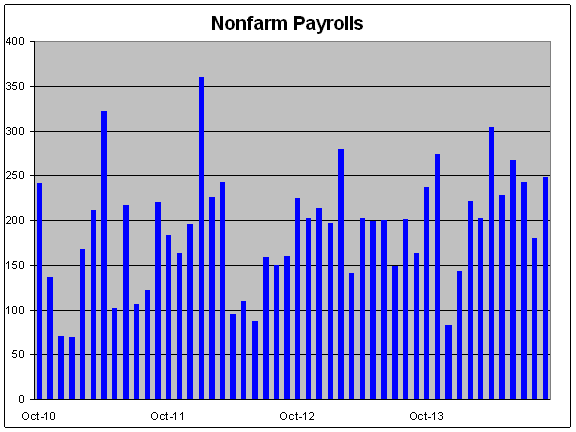

September NFP = +248,000

Eddy Elfenbein, October 3rd, 2014 at 8:30 amThe jobs report is out and the numbers are good. The U.S. economy created 248,000 jobs last month. We also had revisions. July’s NFP was revised from 212,000 to 243,000. August was revised from 142,000 to 180,000.

The unemployment rate fell to 5.9%. This the first time since July 2008 that the unemployment rate is under 6%.

-

CWS Market Review – October 3, 2014

Eddy Elfenbein, October 3rd, 2014 at 7:09 am“Every generation laughs at the old fashions, but

follows religiously the new.” – Henry David ThoreauThe last two weeks have been rough for the stock market. Over the last ten sessions, the S&P 500 has lost 3.24%. The index recently fell below its 50-day moving average, which is a cautious sign, and the 200-DMA is closing in on us. The small-cap Russell 2000 has already lost more than 10% from its high, which is the traditional definition of a correction.

What’s the reason for the slip? That’s always hard to say. It’s probably a mix of bad news: ISIS, Ebola, Hong Kong and some disappointing economic news. I recently predicted such a minor pullback, and I suspect we have a bit more to go. But the big story for investors is the surging U.S. dollar. The greenback is flattening every currency out there.

In this week’s CWS Market Review, we’ll take a look at how investors should go about investing in a strong-dollar world. I’ll also discuss the lower guidance we got this week from Ford Motor. The shares took a nasty slide this week, but I’m not backing away. On the bright side of our Buy List, eBay wisely decided to spin off PayPal. The shares jumped 7.5% on the news. Later on, I’ll take a look at an important but overlooked part of this rally, which is the tremendous growth of dividends. But first, let’s look at how the strong dollar continues to impact our portfolios.

Investing in a Strong-Dollar World

There’s been a recent rash of worse-than-expected economic data. This week’s ISM report came in a bit light. Personal income missed expectations. Construction spending was unexpectedly negative, and the ADP employment report was below expectations.

I’m writing this to you early on Friday, ahead of the big September jobs report. The last jobs report was a bit weak, but nothing too terrible. I doubt that a larger trend has started, but we always want to focus on the facts, not what we hope.

Despite some troubling economic data, the investing climate is still dominated by the strong dollar. Actually, I understated that. Everybody and everything is massively fixated on the surging greenback. It’s impacting nearly every market. Of course, it’s not so much that the dollar is strong as it is that everything else is weak, so the dollar looks good by comparison.

Just look at Japan. The yen is getting steamrolled. This week, for the first time since 2008, the yen hit 110 to the dollar. The Japanese stock market just took its biggest plunge in seven months.

The same thing’s happening in Europe. Stock markets there have been sliding downward. It’s as if they’re in a time machine and living through our experiences of three years ago. This week, there was a terrible report on German manufacturing which threw cold water in the face of a lot of traders. Now folks are realizing that the euro-economy is in worse shape than people thought. That’s why the dollar’s been rising and Mario Draghi, the head of the ECB, is going ahead with their bond-buying program. The yield on German 10-year bonds has slipped below 1%. That’s just crazy.

The strong dollar is also squeezing the price of several commodities. I talked about gold recently. This week, the price of oil dropped below $90 per barrel for the first time in more than a year. Production is soaring, and we’re not importing as much of the black gold as we used to. All that oil has to go somewhere, so the big producers have to cut prices. OPEC may try to cut back on production, but I can’t say how much of an impact that will have. As a result, energy stocks have been badly lagging the market.

Investing in a strong dollar world is tricky. Most of the rise in the dollar has probably passed us. Investors should continue to focus on high-quality stocks like the ones you can find on our Buy List. I especially encourage investors to make sure they own stocks with strong and secure dividends. In particular, I like Ross Stores ($ROST), Microsoft ($MSFT), Wells Fargo ($WFC) and Qualcomm ($QCOM). Cognizant Technology Solutions ($CTSH) also looks very attractive here, although it doesn’t pay a dividend. Now let’s take a closer look at our problem child for this week, Ford Motor.

Ford Motor Drops on Lower Guidance

Shares of Ford Motor ($F) got slammed this week when the automaker lowered its profit guidance for this year. By the end of the day on Thursday, Ford closed at $14.56 per share. Only a few weeks ago, Ford was threatening to break through $18 per share.

Before, Ford had said that its pre-profit for this year would range between $7 billion and $8 billion. Now they’re saying it will be $6 billion. There are a few culprits for the bad news. One is Europe—and Russia in particular. The sanctions there are starting to weigh heavily, and the European economy as a whole is still in rough shape. Ford said they expect to lose $1.2 billion in Europe this year. But that will improve to a loss of “only” $250 million next year.

On top of that, Ford said it had to recall 850,000 vehicles to fix an airbag problem. The total cost will be $500 million. Ford also said it projects to lose $1 billion in South America this year. One bright spot is Asia, where Ford projects a profit of $700 million.

In the U.S., Ford sees margins ranging between 8% and 9%, which is at the low end. The recalls are clearly taking a toll. To its credit, Ford remains optimistic for next year. It sees 2015 profits ranging between $8.5 billion to $9.5 billion. That’s about $2.20 to $2.45 per share in pre-tax earnings.

Here’s my take: I’m disappointed by this lower guidance. Ford has been recovering well, but there are clearly more hurdles to overcome. I’m not so concerned about the geopolitical issues; Ford can’t control those. I am, however, concerned by the recalls. They’re not a good sign.

In the longer run, Ford’s core business is still truck sales in North America. The big issue for the next 12 months is how well the new aluminum-bodied car will be received. The company has a lot at stake on this. I apologize for the rough ride in this stock, but I’m still a believer in Ford’s long-term outlook. The stock currently yields 3.43%, which is a very good yield. If Ford’s forecast for next year is right, then Ford is going for a very attractive price here. To reflect this week’s sell-off, I’m lowering my Buy Below on Ford to $17 per share.

Icahn Wins! eBay Will Spinoff PayPal

Earlier this year, Carl Icahn got into a war of words with the board of eBay ($EBAY). Icahn is an “activist investor,” which means he buys big blocks of shares in a company, then demands changes to boost the share price. Corporate boards hate him, and that’s not because he’s unsuccessful. When he takes a position, Carl’s usually right.

Icahn’s beef with eBay was that they should spin off their PayPal unit. The eBay board said no, and the public feud got nasty. Icahn eventually backed down, and the issue seemed to be settled, but then Apple ($AAPL) announced the introduction of Apple Pay. Well, that changed things. Three weeks ago, one shockingly underpriced newsletter wrote:

PayPal is a big money-maker for eBay, and there’s been a lot of pressure on the company to sell the division. As I noted a few weeks ago, just a rumor of that news sent shares of eBay higher. Even though eBay has said they’re not interested in selling PayPal, I think the market’s evident interest will prevail. It usually does. I can’t say whether Apple Pay will crush PayPal, but I think it will add more pressure on eBay to move. The board also has “cover” to make an about-face.

Sure enough, eBay announced this week that it will spin off PayPal sometime next year. Traders loved the news: shares of eBay jumped 7.5% on Tuesday. In 2002, eBay bought PayPal for $1.5 billion. I’m pretty sure the spin-off will be for more than that. A lot more.

By the way, spin-offs are often great investments. Research has shown that once the divisions are freed from the mother ship, they often do well. Perhaps it’s the reverse dynamic at work, which has hampered so many mega-mergers. I wouldn’t be surprised if PayPal were bought out not long after its spin-off.

Icahn wrote on his blog, “We are happy that eBay’s board and management have acted responsibly concerning the separation—perhaps a little later than they should have, but earlier than we expected.” I have to agree with Carl. This is good news. Look for another solid earnings report from eBay on Wednesday, October 15. eBay remains a buy up to $55 per share.

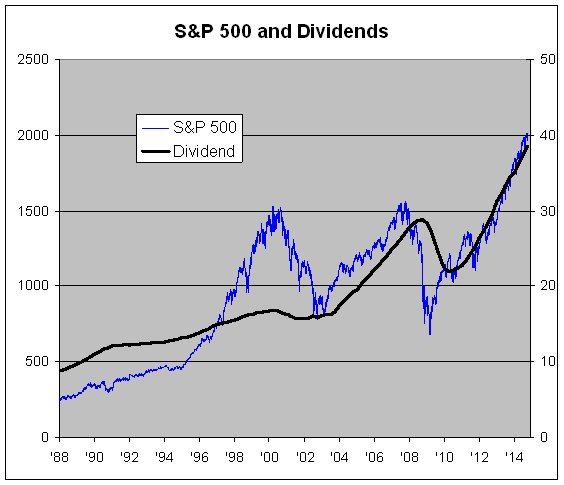

Dividends Continue to Rise

Now that three quarters of 2014 are under our belt, I wanted to look at the continuing trend of growing dividends. This has been one of the overlooked parts of the stock market’s rally. The numbers are in, and last quarter was another strong quarter for dividends. For the first time ever, the S&P 500 paid out more than $10 per share in dividends. (That’s the dividend-adjusted number; every $1 on the index is worth about $8.88 billion.)

Dividends for Q3 were $10.02 per share, which is an increase of 12.50% over last year’s Q3. Note that over the same time, the index has increased its price by 17.29%. So in terms of dividend yield, the S&P 500 has a slightly higher valuation, but both dividends and stock prices are growing roughly in line with each other. That’s why I think much of this “bubble” talk is very premature.

Dividends have grown by more than 10% for 14 of the last 15 quarters. The only exception was the fourth quarter of last year, and that’s because the fourth quarter of 2012 had been unusually strong (+22.77%) so investors could take advantage of the new tax laws. Dividends for Q3 are up more than 77% from the third quarter of 2010, while the index is up by 73%. Yes, the dividend yield is slightly higher than what it was four years ago. Some bubble.

I’m a big fan of dividends. There are so many ways a company can play around with corporate earnings, but when you get a dividend, you know it’s something real. Over the last four quarters, the S&P 500 has paid out $38.49 in dividends. Going by the index’s close on Tuesday (1,972.29), that comes to a trailing dividend yield of 1.95%.

Here’s a chart showing the S&P 500 (in blue, left scale) along with dividends (in black, right scale). The two lines are scaled at a ratio of 50-to-1, which means that whenever the lines cross, the trailing yield is exactly 2%. For the last three years, both lines have stuck by each other pretty closely. You can also see how cheap the market was in early 2009.

In addition to Ford, I’m also lowering my Buy Below prices on a few more Buy List stocks. None of these are sells; I’m merely adjusting our Buy Belows to reflect the current market. I’m lowering AFLAC’s ($AFL) Buy Below to $63. The problem isn’t the company; it’s the lousy yen/dollar exchange rate. I’m dropping CA Technologies ($CA) to make it a buy up to $30 per share. The stock currently yields 3.68%. I wasn’t thrilled with Oracle’s ($ORCL) last earnings report. I’m lowering our Buy Below on Oracle to $42 per share. Lastly, I’m dropping Express Scripts ($ESRX) by $2 to $77 per share. The stock was our big winner last earnings season, but it’s slid back over the last few days. I still like ESRX a lot.

Shares of DirecTV ($DTV) got a nice bump on Thursday after the satellite-TV company extended its Sunday Ticket package with the NFL. This is a ginormous money maker for both DTV and the NFL, so I knew they’d come together. The new deal is for eight years. It’s such a big part of DTV’s business that AT&T had the option of walking away from their merger deal if DTV lost the Sunday Ticket. This is another sign that the merger deal is progressing. DirecTV remains a buy up to $95 per share.

That’s all for now. Third-quarter earnings season officially kicks off next week, but things won’t start heating up until the following week. On Tuesday, October 14, Wells Fargo ($WFC) will be our first Buy List stock to report Q3 earnings; eBay ($EBAY) follows the next day. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His