Author Archive

-

Becton, Dickinson Beats and Guides Higher

Eddy Elfenbein, April 26th, 2011 at 4:20 pmBecton, Dickinson ($BDX) just reported fiscal Q2 earnings of $1.38 per share which was eight cents more than expectations.

The company also raised its full-year EPS guidance from the earlier range of $5.45 to $5.55 to a new range of $5.55 to $5.65.

This revised guidance reflects the anticipated effects of favorable currency and operating efficiencies, partially offset by higher resin costs and the negative impact of the Japan earthquake and tsunami. Diluted earnings per share from continuing operations for fiscal year 2011 are expected to increase 12 to 14 percent over adjusted diluted earnings per share from continuing operations of $4.94, excluding the specified item, for fiscal year 2010. The specified item represents the aforementioned 2010 non-cash charge of $0.04 per share related to healthcare reform. On a currency-neutral basis, the Company expects diluted earnings per share from continuing operations to increase about 10 percent over adjusted diluted earnings per share in the prior-year period.

If I’m reading the earnings report right, the revised guidance includes a loss of five cents per share due to the impact of the earthquake and tsunami.

This is a very good report. The stock is up about $1 in the after-hours market.

-

Volume Surge at NICK

Eddy Elfenbein, April 26th, 2011 at 3:06 pmSo far, 105,000 shares have traded today. That’s about 10 times normal and it’s happening on no news. Another 53,700 shares traded yesterday.

Today looks to be the highest volume day in nearly two years. Twice in the last month, the stock didn’t trade a single share all day.

-

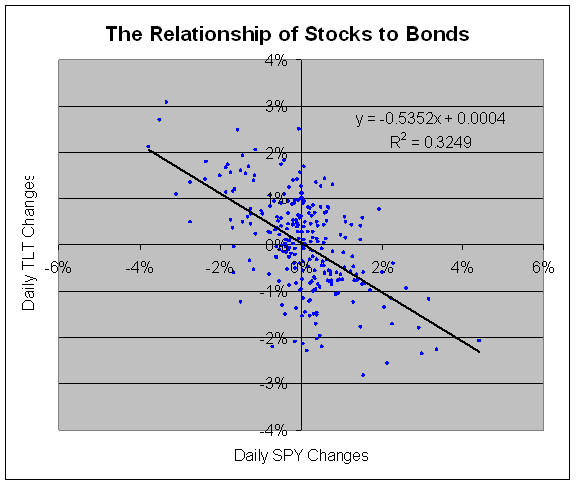

Stocks and Bonds Are Both Up Today

Eddy Elfenbein, April 26th, 2011 at 2:11 pmNot only is today a good day for the stock market (the S&P 500 even got into Black Death territory of 1348-49), but the bond market is also doing well. This has been fairly rare recently to have both markets rally on the same day.

Below I have a chart of the daily changes for the past year of the S&P 500 ETF ($SPY) on the X-axis and the Long Treasury Bond ETF ($TLT) on the Y-axis. As you can see, the returns have been negatively correlated.

What does a re-convergence mean? It’s hard to say because both can be correlated on the up or down side. I should add that the TLT is the iShares Barclays 20+ Year Treas Bond ETF and that maturity hasn’t been the prime focus of the Federal Reserve’s QE2 policy.

So what happens when paper assets are doing well on the same day? Hard assets like gold and silver are down.

-

Buy List Breaks 10% for the Year

Eddy Elfenbein, April 26th, 2011 at 11:54 amIt’s still early but our Buy List is doing very well today. Right now, we’re up 1.10% which gives us a gain of 10.64% for the year.

Ford had been the big gainer today but it’s given some back. Fiserv ($FISV), Joey Banks ($JOSB) and Oracle ($ORCL) are all at new 52-week highs.

I shouldn’t speak too loudly since we’re still in the middle of earnings season. I’m very curious what Becton, Dickinson ($BDX) will have to say after the close. I also think Deluxe ($DLX) is ready for a nice earnings beat on Thursday.

Today’s report on consumer confidence beat expectations. The index rose to 65.4 which was 0.9 more than consensus. This is important because consumers make up about two-thirds of the economy.

-

Market Hits 34-Month High

Eddy Elfenbein, April 26th, 2011 at 11:15 amThanks to strong earnings from 3M ($MMM) and Ford ($F), the S&P 500 has broken out to a 34-month high today. The index has gotten as high as 1,345.97 this morning. This is the highest the S&P 500 has been since June 19, 2008.

-

Ford Earns 61 Cents Per Share

Eddy Elfenbein, April 26th, 2011 at 8:31 amExcellent quarter for Ford ($F). The company made 61 cents per share which was 11 cents more than Wall Street’s consensus. This was Ford’s best profit in 13 years. The stock looks to open close to $16 per share this morning.

Ford earned $2.6 billion in the first three months of 2011, a 22.4% improvement over a year earlier, as U.S. sales increased on the strength of small and midsize cars and cost-cutting in Europe resulted in a modest operating profit.

The Dearborn automaker’s net income of 61 cents per share beat the 50 cents per share consensus forecast of about 20 Wall Street analysts and marked Ford’s most profitable first-quarter in 13 years. In 2010’s first quarter Ford made $2.1 billion, or 46 cents per share.

Revenue increased 18% to $33.1 billion from $28.1 billion a year earlier.

“Our team delivered a great quarter, with solid growth and improvements in all regions,” said Alan Mulally, Ford president and CEO. “We continue to accelerate our One Ford plan around the world.”

Other good news is that the earthquake in Japan will have a very minor impact on Ford’s finances.

-

Morning News: April 26, 2011

Eddy Elfenbein, April 26th, 2011 at 7:33 amCanadian Banks Aren’t Cracking China

Greek 2010 Budget Deficit Revised Higher

Most European Stocks Climb as UBS Surges; U.S. Futures Advance

Dollar Falls on Speculation Fed May Keep Supporting Economy After QE Ends

US Stock Futures Post Modest Gains Ahead Of Ford Earnings, FOMC

Gold Dips; Silver Partly Recovers From Asia Swoon

Oil Drops From 31-Month High as Saudi Arabia Signals Discomfort With Price

ICE, Nasdaq: Explain Rival Deal’s New Synergies

Biggest Banks Beating Estimates Can’t Hide 13% Drop in Revenue

Smaller Cars Lift Ford’s Profit to $2.55 Billion

UBS Attracts Highest Inflows Since 2007 as Profit Tops Estimates

Netflix 1Q Net Soars But 2Q Outlook Disappoints

Minmetals Drops Equinox Bid After Being Trumped by Barrick’s $7.68 Billion

APPARENTLY QE2 IS “DISAPPOINTING”…

-

Department of Awesome Ticker Symbols

Eddy Elfenbein, April 25th, 2011 at 9:56 pmThe new iPath Pure Beta Precious Metal ticker symbol = BLNG.

(HT: StockJockey)

-

Shiller Vs. Seigel

Eddy Elfenbein, April 25th, 2011 at 7:02 pm

I find this discussion frustrating because I disagree with both parties on major points. Having said that, I think that Professor Seigel has the better argument.I’ve often criticized Professor Shiller’s attachment to the 10-year P/E Ratio, which he calls the Cyclically Adjusted P/E Ratio (or CAPE). The problem is that both stock prices and earnings are cyclical so it makes sense that their valuation metrics should be cyclical as well.

The other problem with looking so far back into the past is that the CAPE begins to tell you less about current valuations and more about the past earnings trend. Professor Seigel makes this point and he’s correct: the elevated CAPE highlights how poor earnings have been since 2001. I don’t know how that portends a poor-performing stock market.

The other issue is that many people don’t see what Professor Shiller is doing. He makes it clear that he’s not trying to predict market tops or bottoms. He’s trying to assess a very long-term market outlook. This is something he makes very clear yet he’s earned a reputation for making accurate market calls which he never has.

If you followed CAPE you would have missed out on much of the greatest buying opportunity of the last 70 years. Shiller was bullish during part of the run but he turned cautious very early. In fact, Shiller is routinely credited for being accurate when he’s really being consistently cautious.

Don’t get me wrong — I think Shiller’s goal of making long-term assessments of the market is important. But I’m far more concerned with the question of where the stock market (and individual stocks) should be priced right now.

Personally, I think the yield curve does a better job than the P/E Ratio does.

More: Megan McArdle takes Shiller’s side.

-

Supply of New Homes Is Lowest Since August 1967

Eddy Elfenbein, April 25th, 2011 at 10:45 amCheck out today’s housing report. The supply of homes on the market is at its lowest since since August 1967. Yet prices are still down from a year ago!

The Commerce Department said on Monday sales rose 11.1 percent to a seasonally adjusted 300,000 unit annual rate, after an upwardly revised 270,000 unit pace in February.

Economists polled by Reuters had forecast new home sales climbing to a 280,000-unit pace last month from a previously reported record low 250,000 unit rate.

Compared to March last year sales were down 21.9 percent.

The market for new homes is being squeezed by competition from previously owned homes and a deluge of foreclosed properties, even though inventories of new houses are at a 43-1/2 year low.

A report last week showed there were 3.55 million previously owned homes on the market in March, well above the economy’s natural rate of between 2 million and 2.5 million.

When foreclosed homes and those that are highly delinquent are taken into account, economists say supply is anywhere in the range of 8 million to 9 million.

The median sales price for a new home rose 2.9 percent last month to $213,800 from February. Compared with March last year, the median price fell 4.9 percent.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His