Author Archive

-

“Credit Losses Were Down 27% Sequentially”

Eddy Elfenbein, April 13th, 2011 at 10:53 am -

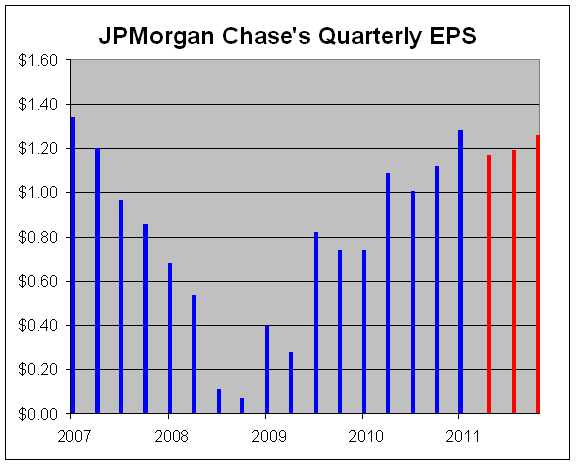

JPMorgan Chase Earns $1.28 Per Share

Eddy Elfenbein, April 13th, 2011 at 7:33 amJPMorgan Chase ($JPM) just reported Q1 earnings of $1.28 per share. Wall Street was expecting $1.16 per share. I said I was expecting $1.24 per share.

I have to explain something about bank earnings. When a bank calculates its profits, it has to estimate how many of its loans will turn out to be bad. That’s not so easy. If they over-estimate, then they need more loan loss reserves and that will decrease their current profit.

What we’ve been seeing from JPM is that they’ve been decreasing their loan loss reserves thanks to improvements in their assets. This is often criticized as somehow manipulating their bottom line. It’s not. This is how banking works. Unless you’re able to predict with perfect accuracy, you’re going to have to add or delete loan loss reserves.

J.P. Morgan Chase & Co.’s first-quarter profit jumped 67% as it set aside less for potential loan losses and revenue fell less than expected.

The first big bank reporting results, J.P. Morgan has seen earnings surge in recent quarters, largely because improving asset quality has led it to set aside less to cover loan losses. It has said loans are growing, and in the fourth quarter the bank saw revenue climb from year-earlier levels at operations tied to both Wall Street and Main Street.

In the latest period, the investment-banking arm’s profit slid 4.1% as net revenue dipped 1%. The retail financial-services business’ loss widened as revenue dropped 19%.

The company’s bottom line again benefited from it setting aside sharply less to cover potential loan losses. Many banks have seen lower reserves boost earnings amid signs of credit improvement. Credit-loss provisions were $1.17 billion, down from $7.01 billion a year earlier and $3.04 billion in the prior quarter.

J.P. Morgan reported a profit of $5.56 billion, or $1.28 a share, up from $3.33 billion, or 74 cents a share, a year earlier. The latest period included a net three cents in gains as a benefit from reduced credit-card loan loss reserves more than offset the impact of mortgage servicing rights asset adjustment and estimated expense of foreclosure-related matters.

Revenue on a managed basis, which excludes the impact of credit-card securitizations and is on a tax-equivalent basis, slid 8.5% to $25.79 billion.

Analysts polled by Thomson Reuters had most recently predicted earnings of $1.16 on $25.27 billion in revenue.

“The firm’s results reflected a strong quarter across the investment bank and solid performance from card services, commercial banking, treasury & securities services, and asset management,” Chief Executive James Dimon said.

-

Morning News: April 13, 2011

Eddy Elfenbein, April 13th, 2011 at 7:28 amStocks, Commodities Fall on Japan Nuclear Crisis; Bonds, Swiss Franc Gain

Japan Diminishes Its Economic Outlook

Deutsche Bank Said to Change U.S. Unit Ahead of Capital Rules

BRICS Push Resource-Hungry China to Buy Finished Goods

Banks Face Sovereign Debt Scrutiny in EU Stress Tests

Here’s Why France’s Wealth Tax Is Awesome

China’s Record Bank Lending May Spur Fitch Rating Downgrade

Gold Slumps As Equities, Commodities Retreat

In F.D.I.C.’s Proposal, Incentive for Excessive Risk Remains

Impatience Over Recovery at Morgan Stanley

Unilever and P&G Fined $456 Million for Price Fixing

Cisco Shutters Flip, Two Years After Acquisition

Dilbert’s Scott Adams: How to Get a Real Education

Joshua Brown: The False Hope of Higher Prices

Paul Kedrosky: S&P 500 vs. English: No “T’s” Please. We’re Public.

-

A Summary of Calendar Effects

Eddy Elfenbein, April 12th, 2011 at 2:54 pmEric Falkenstein writes today on the end-of-the-month anomaly. I’ve always been suspicious of these calendar effects.

Some do exist, but they’re often hard to exploit. Or, they have existed but are no longer important.

Perhaps the most dramatic is the days-of-week effect. I looked at the data and found that Monday has been the worst day of the week for stocks by far. Over the last twenty years, however, Monday has done much better. Historically, all of the market’s capital gain has come on Wednedays and Fridays. The rest of the time, the market is net down.

I also looked at the turn-of-the-month effect, but instead of the period Eric discussed, I looked at the last four days of the month followed by the first three days on the following month. That adds up to less than one-third of the total trading days in a year, yet the market has performed at an annualized rate of over 28%. The rest of the time, the market is down.

I recently looked at the First Day of the Month and found that it’s beaten the market since 1996.

Although it’s not a calendar effect, I’ve always been impressed by the market’s correlation to the previous day’s performance. For the time period I looked at (1950 to 2008), the S&P 500’s entire gain had come on days following up moves of 0.64% or more. Half the market’s gain came on day’s following 3.2% up moves which happens less than once a year.

-

Colorado Springs House Listing

Eddy Elfenbein, April 12th, 2011 at 1:55 pmI just stumbled across this house listing in Colorado Springs. This is a crazy cool house.

For the same price, you could get a very nice cardboard box in NW Washington, DC.

-

Ford Warns Quake Could Hurt Profit

Eddy Elfenbein, April 12th, 2011 at 11:30 amFord said the problem isn’t their facilities but that of their suppliers:

Supply disruptions stemming from the earthquake in Japan could hurt Ford Motor Co’s earnings, the automaker said in a securities filing with U.S. regulators on Monday.

The U.S. automaker, which has no auto plants in Japan but uses suppliers based there, said it was looking for alternate sources of auto parts as necessary.

The filing was another indication to investors from a U.S. automaker that missed shipments of parts from Japan could have far-reaching effects on financial performance.

“Because the situation in Japan continues to develop, supply interruptions related to other materials and components from Japan could manifest themselves in the weeks ahead,” the company said in the filing.

Ford said its operations in Asia, including joint ventures, could be affected by parts shortages from late April through May. The company said it did not expect the disruptions to have a “material impact” on results, but said if a replacement could not be found for a particular auto part, it could cut or cease vehicle production.

A loss of output could hurt Ford’s financial condition as well as that of its financing arm, Ford Motor Credit, the company said in a filing.

Here’s the SEC filing.

-

S&P 500 = 1,310

Eddy Elfenbein, April 12th, 2011 at 11:25 amSo far today, it’s a soggy day on Wall Street. The S&P 500 is off by a little over 1%. Once again, the cyclicals are leading the market lower. A few weeks ago, I talked about how the leadership of the cyclicals was coming to an end. Since then, the Morgan Stanley Cyclical Index ($CYC) largely kept pace with the market, but it started to break down yesterday. As I’ve said before, the cyclicals tend to move in…well, cycles. Once a trend gets started, it often lasts for a long time.

The good news is that although the Buy List is down today, it’s still running ahead of the market. This is because we don’t have as many cyclical stocks as the broader market. That really helped us yesterday. The S&P 500 dropped by 0.28% while our Buy List rose by 0.41%.

Let me say a few words about trading Nicholas Financial ($NICK). The stock traded as high as $12.99 yesterday but I think it was simply due to the internal mechanics of trading. The stock then traded at $12.32 before closing at $12.70. Today, it went back to $12.31 and is now at $12.50. Don’t be fooled into thinking there’s something more going on. The stock is absorbing more volume and is hence showing more volatility. I expect more good news from NICK when it reports earnings again in a few weeks.

-

Morning News: April 12, 2011

Eddy Elfenbein, April 12th, 2011 at 7:24 amThe Global Losing Streak Is Continuing, After An Ugly Night In Japan

U.K. Inflation Unexpectedly Slows as Stores Cut Food Prices

Bank of Japan Minutes Show Concern on Quake Impact

Allied Irish Banks’ Loss Soars to $15 Billion, Axes 2,000 Jobs

Yuan Forwards Decline After IMF Highlights Global Recovery Risk

IEA Says Oil Price Hurting Economy, Maintains Demand Outlook

Oil Advances a Fourth Day in New York on Libyan Conflict, Mideast Unrest

Gas Prices Rise, and Economists Seek Tipping Point

Building a Takeover Bid Over Takeout

The One Thing You Must Realize About PIMCO’s Big Bet Against Treasuries

Futures Slip as Alcoa Disappoints

Glencore Said to Plan $9 Billion to $11 Billion Initial Offering

Level 3 To Acquire Global Crossing In $1.9B All-Stock Deal

Google Goes Green, Invests $168 Million in Ivanpah Solar Power

-

NICK = $12.99

Eddy Elfenbein, April 11th, 2011 at 12:20 pmSomething’s up with Nicholas Financial ($NICK). The stock gapped up to $12.99 just now. The all-time high is $13.18 (split-adjusted) from five years ago.

I’m not sure why there’s a surge. It could just be due to an order imbalance. About 13,000 shares have been traded which is high but far from unprecedented.

-

3M Close to All-Time High

Eddy Elfenbein, April 11th, 2011 at 11:41 amShares of 3M ($MMM) have been as high as $94.64 today which is a fresh 52-week high. That’s actually a three-and-a-half year high.

This recent rally brings MMM very close to its all-time high price of $97 reached in October 10, 2007.

I highlight MMM because it’s a very diversified manufacturing firm. If it’s near an all-time high, it suggests that much of the non-financial economy is recovering.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His