Posts Tagged ‘bbby’

-

A Housing Boom?

Eddy Elfenbein, August 14th, 2012 at 10:51 amIs there a housing boom afoot? Well, the simple answer is no. But there has been some modestly good news, and combined with some very cheap prices in housing-related stocks, that’s added up to a nice rally in the sector.

Check out this chart:

Lennar ($LEN, red line) has added some impressive gains. Our Bed Bath & Beyond ($BBBY, orange line) has also been a strong performer. I also included Lowe’s ($LOW, black line) in order to contrast it with Home Depot ($HD, blue line). Just because two companies appear similar doesn’t mean the stocks will perform the same way.

-

A Housing Boom?

Eddy Elfenbein, August 14th, 2012 at 10:51 amIs there a housing boom afoot? Well, the simple answer is no. But there has been some modestly good news, and combined with some very cheap prices in housing-related stocks, that’s added up to a nice rally in the sector.

Check out this chart:

Lennar ($LEN, red line) has added some impressive gains. Our Bed Bath & Beyond ($BBBY, orange line) has also been a strong performer. I also included Lowe’s ($LOW, black line) in order to contrast it with Home Depot ($HD, blue line). Just because two companies appear similar doesn’t mean the stocks will perform the same way.

-

A Housing Boom?

Eddy Elfenbein, August 14th, 2012 at 10:51 amIs there a housing boom afoot? Well, the simple answer is no. But there has been some modestly good news, and combined with some very cheap prices in housing-related stocks, that’s added up to a nice rally in the sector.

Check out this chart:

Lennar ($LEN, red line) has added some impressive gains. Our Bed Bath & Beyond ($BBBY, orange line) has also been a strong performer. I also included Lowe’s ($LOW, black line) in order to contrast it with Home Depot ($HD, blue line). Just because two companies appear similar doesn’t mean the stocks will perform the same way.

-

BBBY Completes Cost Plus Deal

Eddy Elfenbein, June 29th, 2012 at 9:14 amBed Bath & Beyond ($BBBY) just announced that they completed the Cost Plus deal. Now that the deal is done, the company said that it will subtract “several cents” off the Q2 guidance of 97 cents to $1.03 per share. BBBY also said the deal will be “slightly accretive” to earnings for the second half of the year. They reiterated their full-year guidance for earnings growth in a range of “high single to a low double digit percentage.”

-

Bloodbath & Beyond

Eddy Elfenbein, June 21st, 2012 at 10:04 amShares of Bed Bath & Beyond ($BBBY) are getting crushed today. The stock has been as low as $62.23 this morning.

I think this is an absurd overreaction. Combined with yesterday’s drop, the shares are down 16.72% since Tuesday’s close.

Just to be clear, the midpoint of BBBY’s guidance was eight cents below Wall Street’s consensus. The market is translating that into a loss of over $12.

-

Bed Bath & Beyond’s Earnings Call

Eddy Elfenbein, June 20th, 2012 at 11:45 pmFrom Seeking Alpha, here are some highlights from Bed Bath & Beyond’s ($BBBY) earnings call:

Based on these and other planning assumptions, we are modeling net earnings per diluted share to be approximately $0.97 to $1.03 for the fiscal second quarter of 2012. For all of fiscal 2012, including the benefit of the 53rd week and the incremental operating cost from the previously discussed major initiatives, we continue to model net earnings per diluted share to increase by a high single-digit to a low double-digit percentage range over fiscal 2011.

(…)

Our balance sheet and cash flows remains strong. We ended the fiscal first quarter with cash and cash equivalents and investment securities of approximately $1.8 billion. Assuming the completion of the Cost Plus transaction in our fiscal second quarter, we would expect the cash used in our fiscal second quarter for both the Linen Holdings and Cost Plus acquisitions to be approximately $650 million.

As of May 26, 2012, inventories at cost were approximately $2.2 billion or $60.63 per square foot, an increase of approximately 2.4% on a per square foot basis over the end of last year’s first quarter. Inventories continue to be tailored by store to meet the anticipated demands of our customers and are in good condition.

Consolidated shareholders equity at May 26, 2012, was approximately $3.9 billion, which is net of share repurchases, including the approximately $306 million, representing approximately 4.6 million shares repurchased during the fiscal first quarter of 2012. As of May 26, 2012, the remaining balance of the share — of the current share repurchase program authorized in December 2010 was approximately $613 million.

The company repurchased 2% of its outstanding stock last quarter.

-

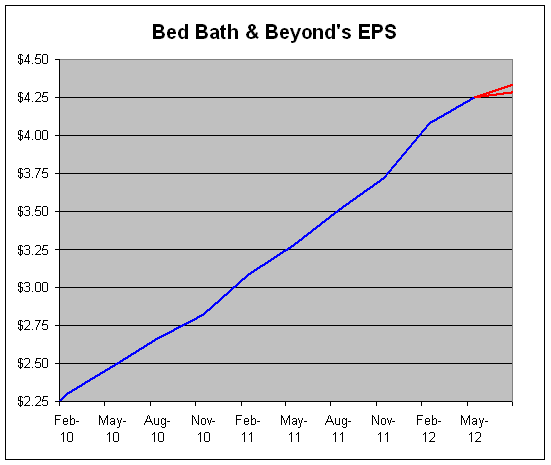

Bed Bath & Beyond Plunges After Hours

Eddy Elfenbein, June 20th, 2012 at 5:40 pmIn last week’s CWS Market Review, I made a bold prediction: I said that I thought Bed & Bath & Beyond ($BBBY) could report earnings of 88 cents per share for its May quarter. This was well above what most others thought. The company had given guidance of 79 to 83 cents per share. Wall Street’s consensus was for 84 cents per share.

As it turns out, I wasn’t optimistic enough. For its fiscal first quarter, Bed Bath & Beyond earned 89 cents per share.

This was a big improvement over the May quarter from last year when BBBY earned 72 cents per share. For the May quarter, gross margins slightly contracted from 40.6% to 40.0%. Sales rose by 5.1% to $2.218 billion, and same-store sales rose by 3%.

But the big news was BBBY’s weak guidance for the fiscal second quarter which ends in August. BBBY said to expect earnings to range between 97 cents and $1.03 per share. Wall Street had been expecting $1.08. The shares dropped 11% in after-hours trading.

For this year, the company sees earnings growth in the high single digits to low double digits. Let’s say that’s 8% to 12%. For the last fiscal year, BBBY earned $4.06 per share. The guidance translates to earnings between $4.38 and $4.55 per share. The Street had been expecting $4.63 which represents growth of 14%. In other words, looking past next quarter, this was below Wall Street’s view but not by much. Certainly not worth an 11% haircut.

Let’s see what happens tomorrow, but I suspect BBBY won’t be down by so much once trading starts.

Here are the sales and earnings for the past few quarters:

Quarter Sales Gross Profit Operating Profit Net Profit EPS May-99 $356,633 $146,214 $28,015 $17,883 $0.06 Aug-99 $451,715 $185,570 $53,580 $33,247 $0.12 Nov-00 $480,145 $196,784 $50,607 $31,707 $0.11 Feb-00 $569,012 $238,233 $77,138 $48,392 $0.17 May-00 $459,163 $187,293 $36,339 $23,364 $0.08 Aug-00 $589,381 $241,284 $70,009 $43,578 $0.15 Nov-01 $602,004 $246,080 $64,592 $40,665 $0.14 Feb-01 $746,107 $311,802 $101,898 $64,315 $0.22 May-01 $575,833 $234,959 $45,602 $30,007 $0.10 Aug-01 $713,636 $291,342 $84,672 $53,954 $0.18 Nov-02 $759,438 $311,030 $83,749 $52,964 $0.18 Feb-02 $879,055 $370,235 $132,077 $82,674 $0.28 May-02 $776,798 $318,362 $72,701 $46,299 $0.15 Aug-02 $903,044 $370,335 $119,687 $75,459 $0.25 Nov-03 $936,030 $386,224 $119,228 $75,112 $0.25 Feb-03 $1,049,292 $443,626 $168,441 $105,309 $0.35 May-03 $893,868 $367,180 $90,450 $57,508 $0.19 Aug-03 $1,111,445 $459,145 $155,867 $97,208 $0.32 Nov-04 $1,174,740 $486,987 $161,459 $100,506 $0.33 Feb-04 $1,297,928 $563,352 $231,567 $144,248 $0.47 May-04 $1,100,917 $456,774 $128,707 $82,049 $0.27 Aug-04 $1,273,960 $530,829 $189,108 $120,008 $0.39 Nov-05 $1,305,155 $548,152 $190,978 $121,927 $0.40 Feb-05 $1,467,646 $650,546 $283,621 $180,980 $0.59 May-05 $1,244,421 $520,781 $150,884 $98,903 $0.33 Aug-05 $1,431,182 $601,784 $217,877 $141,402 $0.47 Nov-06 $1,448,680 $615,363 $205,493 $134,620 $0.45 Feb-06 $1,685,279 $747,820 $304,917 $197,922 $0.67 May-06 $1,395,963 $590,098 $148,750 $100,431 $0.35 Aug-06 $1,607,239 $678,249 $219,622 $145,535 $0.51 Nov-07 $1,619,240 $704,073 $211,134 $142,436 $0.50 Feb-07 $1,994,987 $862,982 $309,895 $205,842 $0.72 May-07 $1,553,293 $646,109 $154,391 $104,647 $0.38 Aug-07 $1,767,716 $732,158 $211,037 $147,008 $0.55 Nov-08 $1,794,747 $747,866 $203,152 $138,232 $0.52 Feb-08 $1,933,186 $799,098 $259,442 $172,921 $0.66 May-08 $1,648,491 $656,000 $118,819 $76,777 $0.30 Aug-08 $1,853,892 $739,321 $187,421 $119,268 $0.46 Nov-08 $1,782,683 $692,857 $136,374 $87,700 $0.34 Feb-09 $1,923,274 $785,058 $231,282 $141,378 $0.55 May-09 $1,694,340 $666,818 $142,304 $87,172 $0.34 Aug-09 $1,914,909 $773,393 $222,031 $135,531 $0.52 Nov-09 $1,975,465 $812,412 $245,611 $151,288 $0.58 Feb-10 $2,244,079 $955,496 $370,741 $226,042 $0.86 May-10 $1,923,051 $775,036 $225,394 $137,553 $0.52 Aug-10 $2,136,730 $874,918 $296,902 $181,755 $0.70 Nov-10 $2,193,755 $896,508 $305,110 $188,574 $0.74 Feb-11 $2,504,967 $1,076,467 $461,052 $283,451 $1.12 May-11 $2,109,951 $857,572 $288,948 $180,578 $0.72 Aug-11 $2,314,064 $950,999 $371,636 $229,372 $0.93 Nov-11 $2,343,561 $958,693 $357,020 $228,544 $0.95 Feb-12 $2,732,314 $1,163,669 $550,765 $351,043 $1.48 May-12 $2,218,292 $887,199 $313,398 $206,836 $0.89 -

Today is Fed Day

Eddy Elfenbein, June 20th, 2012 at 11:09 amToday is Fed day. At 12:30, the Federal Reserve will release its latest policy statement. I don’t expect any major change, but traders will closely scrutinize today’s statement for any hint of more quantitative easing. I’m not holding my breath.

Our Buy List continues to do well. Reynolds American ($RAI) is at another new high. After the close, Bed Bath & Beyond ($BBBY) will report its earnings. I’m expecting good news.

The market has an odd wait-and-see attitude today. Stocks aren’t doing much of anything.

-

Some Retail Stocks Are Heating Up

Eddy Elfenbein, June 11th, 2012 at 2:50 pmEven though the stock market hasn’t been doing well lately, a number of retail stocks have bucked the trend. Target ($TGT), for example, just hit a new 52-week high today, and it’s not far from an all-time high. I expect Tar-Zhay to announce its 45th-straight dividend increase any day now. Last month, the company said it’s aiming to have its dividend at $3 per share by 2017. That’s pretty optimistic, but I like to see folks who have big plans.

Walmart ($WMT) has also been doing well. On Friday, the Behemoth of Bentonville broke $68 per share for the first time since January 2000.

Ross Stores ($ROST) hit a new all-time high today. The stock has practically been in a nonstop bull market for 18 years. In January 1994, shares of ROST were going for 74 cents. Now they’re at $64. That’s an annualized gain of over 27% a year, and it doesn’t include the dividend.

On our Buy List, Bed Bath & Beyond ($BBBY) has pulled back from its all-time high of $74.67 (reached on May 29th). The company had an outstanding earnings report in early April. They beat Wall Street’s consensus by 15 cents per share. What’s interesting, though, is that the stock market took a while to react. After a small bump up after the earnings report, it was almost all gone three weeks later. Then the stock started to rally.

BBBY will report earnings again on June 20th. The company sees fiscal Q1 earnings ranging between 79 cents and 83 cents per share.

-

CWS Market Review – June 1, 2012

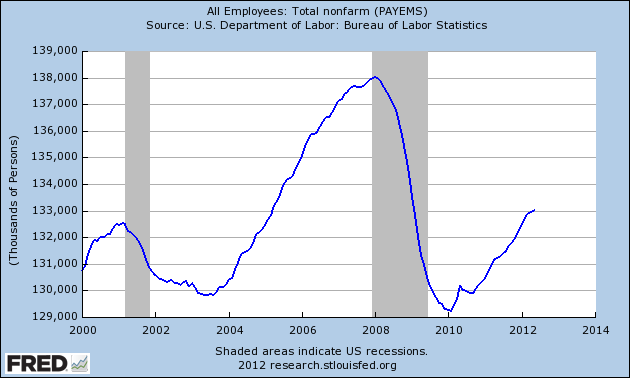

Eddy Elfenbein, June 1st, 2012 at 9:18 amThis morning, the government reported that the U.S. economy created just 69,000 jobs in May. This was well below expectations, and last month’s numbers were revised downward as well. The national employment rate ticked up from 8.1% to 8.2%. That’s just lousy, and it’s yet more data in a run of below-average economic news.

Before anyone gets too worked up over the jobs numbers, let me remind you that these are very imprecise estimates. The media breathlessly reports these figures as if they were handed down from Mount Sinai, but as Jeff Miller notes, the margin of error for these reports is exceedingly wide. The numbers are also subject to large revisions in the coming months.

Still, we have to adjust ourselves to the reality that the economy isn’t doing as well as most folks believed a few weeks ago. The jobs gains simply aren’t there. The other negative economic news this week included a sharp drop in consumer confidence, a rise in first-time claims for unemployment insurance and a negative revision to first-quarter GDP. The last one is old news since we’re already into the back-end of the second quarter.

Treasury Yields Hit an All-Time Low

I can’t say that I find the sluggish economic news surprising. In the CWS Market Review from two weeks ago, I wrote that economically sensitive cyclical stocks had been badly lagging the market. This is an important lesson for investors because by following the relative strength of different market sectors, we can almost see coded messages the market is sending us. In this case, investors were bailing out of cyclical stocks while the overall market wasn’t harmed nearly as much. Now we see why.

Since February 3rd, the S&P 500 is down by 2.6%, but the Morgan Stanley Cyclical Index (^CYC) is off by more than 11%. Looking at the numbers more closely, we can see that the Energy and Materials sectors have been sustaining the most damage. ExxonMobil ($XOM), for example, lost over $30 billion in market cap in May. The price for oil slid 17% for the month thanks to weak demand from Europe. Interestingly, the Industrials had been getting pummeled, but they’ve started to stabilize a bit in the past few weeks.

Tied to the downturn in cyclical stocks is the amazing strength of Treasury bonds. On Thursday, the yield on the 10-year Treasury bond got as low as 1.54% which is the lowest yield in the history of the United States. The previous low came in November 1945, and that’s when the government worked to keep interest rates artificially low. A little over one year ago, the 10-year yield was over 3.5%. Some analysts are now saying the yield could soon fall under 1%.

Don’t blame the Federal Reserve for the current plunge in yields. While the Fed is currently engaged in its Operation Twist where it sells short-term notes and buys long-term bonds, that program is far too small to have such a large impact on Treasury rates. The current Treasury rally is due to concerns about our economy and the desire from investors in Europe to find a safe haven for their cash. I strongly urge investors to stay away from U.S. Treasuries. There’s simply no reward for you there. Consider that the real return is negative for TIPs that come due 15 years from now. Meanwhile, the S&P 500 is going for 11 times next year’s earnings estimate. That translates to an earnings yield of 9%.

The latest swing in opinion seems to believe that Greece will give staying in the euro another shot. It’s hard to say what will happen since we have new elections in two weeks. Still, I think the country will at least try to keep the euro. The reason is that Greece’s economy is very small compared to the rest of Europe. If it leaves the euro, the headaches involved will be too much to bother with.

The real issue confronting Europe is Spain’s trouble which can’t so easily be swept under the rug. Their banking system is a mess. Think of us as reliving 2008 with Greece being Lehman Brothers and Spain being AIG. The major difference with this analogy is that Europe may not be able to bail out Spain even if it wanted to. So far, the Spanish government is putting up a brave front and is strongly resisting any form of a bailout. The politicians there obviously see how well that played out with public opinion in Greece.

In Germany, the two-year yield just turned negative (ours is still positive by 27 basis points). While much of Europe is in recession (unemployment in the eurozone is currently 11%), and China’s juggernaut is slowing down (this year may be the slowest growth rate since 1999), there’s still little evidence that the U.S. economy is close to receding. We’re just growing very, very slowly.

The stock market performed terribly in May. The Dow only rose five times for the month which is the fewest up days in a month since January 1968. The S&P 500 had its worst month since last April. But we need to remember that the U.S. dollar was very strong last month. It’s probably more correct to say that the dollar is less weak than everybody else, but that still translates to high prices for dollars. So in terms of other currencies, the U.S. equity market didn’t do so poorly.

Jos. A. Bank Clothiers Disappoints

We had one Buy List earnings report this past week: Jos. A. Bank Clothiers ($JOSB). The company had already told us that the quarter was running slow, so that muted my expectations. For their fiscal Q1, Joey Bank earned 53 cents per share which missed Wall Street’s consensus by nine cents per share. Quarterly revenue rose by 4.2% to $208.91 million. But the important metric to watch is comparable stores sales, and that fell by 1%. That’s not good.

Shares of JOSB dropped on Wednesday and stabilized some on Thursday. I’m not happy with how this company is performing and it’s near the top of my list for names to purge from the Buy List for next year. Still, I won’t act rashly. The company has said that this quarter is off to a good start: “So far the second quarter has started out much better than the first quarter. For May, both our comparable store sales and Direct Marketing sales are up compared to the same period last year, continuing the positive trend established in the last five weeks of the first quarter. However, Father’s Day, the most important selling period of the quarter, is still ahead of us.” I’m lowering my buy price from $52 to $48 per share.

Shares of Bed Bath & Beyond ($BBBY) broke out to a new all-time high this past week. On Tuesday, the stock got as high as $74.67. It’s our #1 performer for year and is up nearly 25% YTD. The stock is an excellent buy below $75 per share, but I won’t move the buy price until I see the next earnings report which is due out on June 20th.

Two other Buy List stocks I like right now are Ford ($F) and Oracle ($ORCL). Ford has been doing so well that it’s actually having a hard time keeping up with demand. I’m expecting a strong earnings report from Oracle later this month. The May quarter, which is their fiscal fourth, is traditionally their strong quarter. Oracle is an excellent buy under $30 per share.

Before I go, let me say a quick word about Facebook ($FB). In last week’s CWS Market Review, I told you to stay away from the stock, and I was right as the shares have continued to fall. The stock got as low as $26.83 on Thursday. I don’t think Facebook is an attractive stock to own until it reaches $17 to $20 per share. Until then, keep your distance!

That’s all for now. Be sure to keep checking the blog for daily updates. I’ll have more market analysis for you in the next issue of CWS Market Review!

– Eddy

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His