-

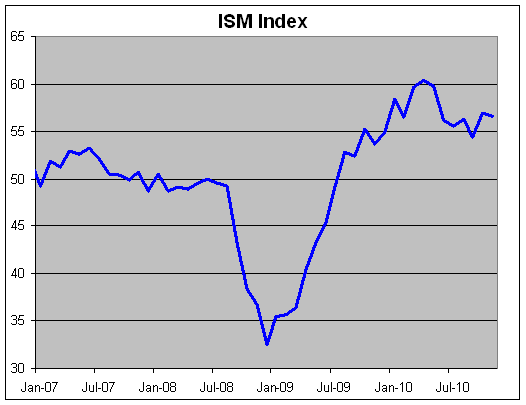

November ISM = 56.6

Posted by Eddy Elfenbein on December 1st, 2010 at 10:07 amThe ISM for November came out at 56.6 which beat Wall Street’s view by 0.1. The ISM has now been above 52.4 for 16 months in a row.

Two other items to pass along this morning: First, the dollar was the top-performing asset last month. The greenback beat stocks, bonds and commodities. This news will completely baffle the legions who have predicted the dollar’s imminent demise.

Second, Q3 productivity was revised higher to 2.3%.

-

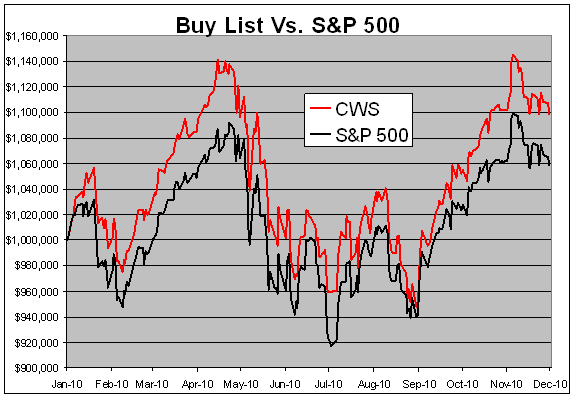

Buy List Performance YTD

Posted by Eddy Elfenbein on December 1st, 2010 at 9:07 amWith 11 months now under our belt, let’s take a look at the Buy List‘s year-to-date performance.

Through yesterday, the 20 stocks on our Buy List are up 9.83% compared with 5.87% for the S&P 500.

Including dividends, we’re up 11.39% while the S&P 500 is up 7.86%.

If beta still means anything to you, ours is 0.9458.

-

JoS. A. Bank Earns 42 Cents Per Share

Posted by Eddy Elfenbein on December 1st, 2010 at 8:37 amJoS. A. Bank Clothiers (JOSB) reported earnings today of 42 cents per share. Wall Street was expecting 50 cents per share and I was expecting even more.

While business is still going well for JOSB, this is a big disappointment:

JoS. A. Bank Clothiers, Inc. (Nasdaq Global Select Market: JOSB) announces that net income for the third quarter of fiscal year 2010 increased 7.1% to $12.6 million, as compared to $11.7 million for the third quarter of fiscal year 2009. Earnings per share for the third quarter of fiscal year 2010 increased 7.1% to $0.45 per share, as compared to $0.42 per share for the third quarter of fiscal year 2009. The third quarter of fiscal year 2010 ended October 30, 2010; the third quarter of fiscal year 2009 ended October 31, 2009.

Total sales for the third quarter of fiscal year 2010 increased 7.4% to $173.3 million from $161.3 million in the third quarter of fiscal year 2009, while comparable store sales increased 3.0% and Direct Marketing sales increased 14.9%.

Comparing the first nine months of fiscal year 2010 with the first nine months of fiscal year 2009, net income increased 25.6% to $44.9 million, as compared to $35.7 million and earnings per share increased 24.8% to $1.61 per share, as compared to $1.29 per share. Total sales for the first nine months of fiscal year 2010 increased 9.9% to $539.8 million from $491.0 million for the first nine months of fiscal year 2009, while comparable store sales increased 7.6% and Direct Marketing sales increased 8.4%.

“Sales for the quarter were positive but started out below plan in August and then picked up in September and October with each month getting progressively better, and then were even stronger in November and early December,” commented R. Neal Black, President and CEO of JoS. A. Bank Clothiers, Inc. “The hot weather in August was hard on us and it was tough to stage a big rebound after that due to the election; however, with these third quarter results, we have achieved record earnings growth in 36 of the past 37 quarters when compared to the respective prior year periods, including 18 quarters in a row. Right now, to date, the fourth quarter has started out strong. November suit sales and total sales were up substantially compared to last year and were ahead of our plans. Our fourth quarter results last year were very strong. Therefore we remain cautious, but our merchandising and marketing plans are in place for the most important selling period of the quarter and the year and we have confidence in those plans,” continued Mr. Black.

-

Morning News: December 1, 2010

Posted by Eddy Elfenbein on December 1st, 2010 at 7:30 amEuro Gets Respite as Yield Spreads Tighten

U.K. Manufacturing Surges in November

Oil Rises After Biggest Drop in Two Weeks on U.S. Supply Outlook

Fed to Name Recipients of $3.3 Trillion in Aid During Crisis

Contagion May Force EU to Expand Arsenal to Fight Debt Crisis

Dollar Proves Best-Returning Asset in November, Defies Skeptics

Output Climbs Led by Asia, Despite Euro Crisis

Spain Banks Face Funding Hurdle Amid Bailout Threat

Google Gambit for Groupon Raises Concern

-

RBC Sees Gilead Climbing 31% in 12 Months

Posted by Eddy Elfenbein on November 30th, 2010 at 6:54 pmBarron’s gives Gilead Sciences (GILD) some love:

Gilead, however, may yet prove its critics wrong.

It dominates a $13 billion global market for AIDS drugs, generates huge amounts of cash and has a promising pipeline that could produce new blockbuster AIDS medications in the next two years.

And at just over nine times earnings, the stock offers investors a compelling bargain.

“The stock’s fall from grace has been too significant, and I see it grinding its way higher,” says Kris Jenner, manager of the T. Rowe Price Health Sciences Fund.

How high?

RBC Capital Markets sees the stock climbing 31% in the next 12 months. Meanwhile, UBS Securities analyst Matt Roden launched a Buy rating on the stock on Nov. 16 and a $44 target price.

“It trades at a multiple that’s in-line with Big Pharma, but Gilead’s growth prospects are comparatively better,” says Roden.

-

California Is Voted Off the Island

Posted by Eddy Elfenbein on November 30th, 2010 at 3:38 pmHere are the results of the poll I ran a few days ago asking which state would you most like to see kicked out of the union:

State PCT Votes California 40.47% 225 Texas 14.21% 79 Mississippi 5.04% 28 Massachusetts 3.42% 19 New York 3.06% 17 Alaska 2.52% 14 Utah 2.52% 14 Arizona 2.34% 13 Alabama 2.16% 12 South Carolina 1.80% 10 Louisiana 1.62% 9 West Virginia 1.62% 9 Hawaii 1.44% 8 Illinois 1.44% 8 Arkansas 1.26% 7 Kansas 1.26% 7 New Jersey 1.26% 7 Ohio 1.26% 7 Florida 1.08% 6 Michigan 1.08% 6 Wyoming 0.90% 5 New Mexico 0.72% 4 Washington 0.72% 4 Connecticut 0.54% 3 Delaware 0.54% 3 Georgia 0.54% 3 Maine 0.54% 3 Nevada 0.54% 3 Oklahoma 0.54% 3 Vermont 0.54% 3 Kentucky 0.36% 2 Maryland 0.36% 2 Missouri 0.36% 2 Oregon 0.36% 2 South Dakota 0.36% 2 Colorado 0.18% 1 Iowa 0.18% 1 Montana 0.18% 1 Nebraska 0.18% 1 New Hampshire 0.18% 1 North Carolina 0.18% 1 Pennsylvania 0.18% 1 Idaho 0% 0 Indiana 0% 0 Minnesota 0% 0 North Dakota 0% 0 Rhode Island 0% 0 Tennessee 0% 0 Virginia 0% 0 Wisconsin 0% 0 With 556 votes in, California was the big winner with just over 40% of the vote. Texas came in a distant second with 14%. Mississippi was third with just over 5%. After that, no other state could get more than 3.5%.

I’m not surprised that California won, but I was a little shocked that states like New York and Florida got so few votes.

If the results were adjusted for each state’s population, then Alaska would be the winner. Our northernmost state had a rate twice as much as #2 Mississippi. Then came Wyoming, Hawaii and California. (Who wants Hawaii out??)

-

Bank of America Drops on 13-Month-Old News

Posted by Eddy Elfenbein on November 30th, 2010 at 2:52 pmShares of Bank of America (BAC) are down today.

Why? It’s because Julian Assange of Wikileaks fame said yesterday that early next year he will release information that could take down “one or two banks.”

So, what banks?

Raw Story found that last October he told Computer World that he had 5GB from Bank of America.

In other words, the stock is down today on news that was first reported 13 months ago.

-

Exxon Mobil’s Taxes

Posted by Eddy Elfenbein on November 30th, 2010 at 1:46 pmSenator Bernie Sanders of Vermont has tweeted:

Last year Exxon made $19 BILLION in profit. Guess what? They paid zero in taxes & got $156 mill. refund from the IRS.

This is technically accurate but very misleading. Exxon Mobil (XOM) paid zero federal taxes but they indeed had a massive tax bill last year.

Before taxes, XOM recorded a profit of $34.8 billion. They paid $15.1 billion in taxes to foreign countries. The U.S. tax code allows them to deduct that tax bill from what’s due to the IRS.

CNN/Money explains:

Exxon paid the most taxes last year of any U.S. company, by far — but not a cent went to the IRS for income taxes. That’s because the oil giant does business in some of the mostly highly taxed countries in the world. Want to extract petroleum in Nigeria? Be prepared to fork over up to 85% of your profit in tax payments.

Exxon doled out more than $15 billion in income tax payments to foreign countries last year. U.S. tax codes allow companies to take massive deductions in light of those international charges, which knocked Exxon’s federal income-tax bill down into negative territory.

That said, Uncle Sam gets his money in other ways. Including sales taxes and duties, Exxon recorded $7.7 billion in U.S. tax costs last year, and paid even more overseas.

Its grand total in global taxes for the year? A whopping $78.6 billion. The company’s effective income tax rate was a hefty 47%, its highest in three years.

-

Investor Quiz

Posted by Eddy Elfenbein on November 30th, 2010 at 10:44 amAccording to the BIS, how large is the swaps market?

I’ll give you a hint: $583 trillion.

To put that into proper perspective, think of it this way: If you took that sum in the form of $100 bills, then stacked those bills on the floor of the Grand Canyon, that’s a shitload of money.

-

Right at the 50-DMA

Posted by Eddy Elfenbein on November 30th, 2010 at 10:26 amThe S&P 500 is currently battling with its 50-day moving average. For a brief period yesterday, the index fell below the 50-DMA, and we’re fighting it again today.

The current reading for the 50-DMA is 1177.31.

I’m not a big fan of technical analysis but I make an exception for the 50-DMA. It’s one of those dumb ideas that works for a really smart reason. The key is that the stock market is a momentum-driven data series. What happens yesterday impacts what happens today. Each day’s move is not independent of the day before.

What this means for investors is that once the market gets moving in one direction, the odds are very likely that it will continue in that direction. The turning point is just about impossible to know. Historically, however, once the market breaks its average close for the past 50 trading sessions, that is often a decent indicator. It’s not good, but it’s good enough.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His