-

Morning News: November 18, 2010

Posted by Eddy Elfenbein on November 18th, 2010 at 7:38 amGlobal Stocks Rise; Nikkei Gains 2.1%

China Behind Chilling Drop in Commodity Prices

London Stock Exchange Profit Gains 26%; to Offer Derivatives in 2011

Irish Central Banker Says Rescue Loan Is Likely

Beijing’s Focus on Food Prices Ignores Broader Inflation Risk

General Motors Returns to NYSE After Raising $20 Billion in IPO

Goldman Says to Buy Calls, Not Shares, in Intel, IBM

Sears Loss Widens on Tepid Sales

-

IPOs by the Numbers

Posted by Eddy Elfenbein on November 17th, 2010 at 12:50 pmTim Kildaze at the Globe and Mail lists the five largest global IPOs and the five largest U.S. IPOs:

Top 5 Largest Global IPOs

Agricultural Bank of China – China

Size: $22.1 billion (U.S.)

Date: July 2010

Sector: BanksIndustrial and Commercial Bank of China – China

Size: $22.0 billion (U.S.)

Date: October 2006

Sector: Credit institutionsAmerican International Assurance Group – Hong Kong

Size: $20.5 billion

Date: October 2010

Sector: InsuranceVisa Inc. – U.S.

Size: $19.7 billion

Date: March 2008

Sector: Other financialsNTT Mobile Communications Network Inc. – Japan

Size: $18.1 billion

Date: October 1998

Sector: Wireless technologiesTop 5 Biggest U.S. IPOs

Visa Inc.

Size: $19.7 billion

Date: March 2008

Sector: Other financialsAT&T Wireless Group

Size: $10.6 billion

Date: April 2000

Sector: Wireless TechnologiesKraft Foods Inc.

Size: $8.7 billion

Date: June 2001

Sector: Food and beverageUPS

Size: $5.5 billion

Date: November 1999

Sector: Transportation and InfrastructureKKR Private Equity Investors

Size: $5.0 billion

Date: May 2006

Sector: Alternative financial investmentsThe GM IPO has a shot of becoming #1. Here’s how it breaks down:

* Total IPO and preferred offerings before overallotments: $19.3 billion to $19.77 billion. The midpoint would be $19.54 billion.

* Total IPO and preferred offerings including all overallotments: $22.19 billion to $22.74 billion. The midpoint would be $22.47 billion.

* Treasury total take from IPO and preferred offering: Up to $15.7 billion from common stock sales including overallotments and $2.1 billion from selling its Series A preferred shares to GM when the IPO is completed.

* Common share price range: $32 to $33 per share

* Common shares offered: 478 million shares

* Optional underwriter overallotment: 71.7 million

* Total common shares with overallotments: 549.7 million

* Series B preferred shares price: $50 per share

* Preferred shares offered: raised to 80 million

* Optional underwriter overallotment: 12 million shares

* Total preferred shares with overallotments: 92 million

* Preferred shares proceeds: $4 billion

* Preferred proceeds with overallotment: $4.6 billion

-

The Market Is Not a Market

Posted by Eddy Elfenbein on November 17th, 2010 at 12:11 pm -

The Battle for GM 1910-1915

Posted by Eddy Elfenbein on November 17th, 2010 at 11:38 amThanks to heavy demand, the GM IPO has been increased by 31% to 478 million shares.

An overallotment and an offering of preferred shares may increase the total amount raised to about $22.7 billion. Agricultural Bank of China Ltd.’s $22.1 billion initial sale is the largest common-stock IPO in history.

The initial sale, scheduled for today, will bring Chief Executive Officer Dan Akerson closer to his goal of returning the $49.5 billion GM received in a taxpayer bailout last year. The Treasury, which is taking a loss on its portion of the sale, will break even only if the shares climb at least 60 percent, Bloomberg data shows.

One of the most exciting and rollicking periods in Wall Street history was the battle for control of GM between 1910 and 1915. Billy Durant had founded the company but was tossed out by the bankers in 1910. He then partnered up Louis Chevrolet to start Chevrolet. He soon bought him out, then bought a controlling interest in GM and by 1916 was president again. In 1914 shares of GM were going for as low as $37 each. Thanks to Durant’s raid and WW1, the stock got as high as $558 by 1915.

In his battle to regain control, Durant used DuPont as an ally. This tactic was to become common in the 1980s. The problem was that by 1920, DuPont had control.

Still, it’s a great story. Check out this NYT story from December 1915 when Durant finally gained control of GM.

-

Trading Volume in NICK

Posted by Eddy Elfenbein on November 17th, 2010 at 10:53 amTrading volume in Nicholas Financial (NICK) has been pretty slow. Make that very slow. As in zero volume yesterday and none so far today.

Yep, that’s real slow.

Update: Oh Em Gee! 200 shares at $9.99!

-

Buffett Says “Thank You”

Posted by Eddy Elfenbein on November 17th, 2010 at 10:47 amHere’s part of Warren Buffett’s “thank you” letter to Uncle Sam in today’s New York Times:

When the crisis struck, I felt you would understand the role you had to play. But you’ve never been known for speed, and in a meltdown minutes matter. I worried whether the barrage of shattering surprises would disorient you. You would have to improvise solutions on the run, stretch legal boundaries and avoid slowdowns, like Congressional hearings and studies. You would also need to get turf-conscious departments to work together in mounting your counterattack. The challenge was huge, and many people thought you were not up to it.

Well, Uncle Sam, you delivered. People will second-guess your specific decisions; you can always count on that. But just as there is a fog of war, there is a fog of panic — and, overall, your actions were remarkably effective.

I don’t know precisely how you orchestrated these. But I did have a pretty good seat as events unfolded, and I would like to commend a few of your troops. In the darkest of days, Ben Bernanke, Hank Paulson, Tim Geithner and Sheila Bair grasped the gravity of the situation and acted with courage and dispatch. And though I never voted for George W. Bush, I give him great credit for leading, even as Congress postured and squabbled.

You have been criticized, Uncle Sam, for some of the earlier decisions that got us in this mess — most prominently, for not battling the rot building up in the housing market. But then few of your critics saw matters clearly either. In truth, almost all of the country became possessed by the idea that home prices could never fall significantly.

That was a mass delusion, reinforced by rapidly rising prices that discredited the few skeptics who warned of trouble. Delusions, whether about tulips or Internet stocks, produce bubbles. And when bubbles pop, they can generate waves of trouble that hit shores far from their origin. This bubble was a doozy and its pop was felt around the world.

So, again, Uncle Sam, thanks to you and your aides. Often you are wasteful, and sometimes you are bullying. On occasion, you are downright maddening. But in this extraordinary emergency, you came through — and the world would look far different now if you had not.

Your grateful nephew,

Warren

-

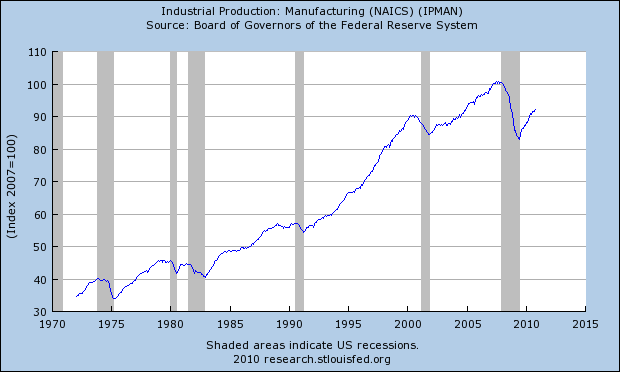

We Don’t “Make Anything” Anymore

Posted by Eddy Elfenbein on November 17th, 2010 at 9:24 amOne of the biggest myths about the U.S. economy is that we don’t “make anything” anymore. This simply is not true. The U.S. is a manufacturing powerhouse.

The difference is that fewer people are employed in manufacturing. Productivity and output have soared. Since 1983, manufacturing production has doubled.

-

Six Losses in Seven Sessions

Posted by Eddy Elfenbein on November 17th, 2010 at 8:42 amThe stock market has now fallen for six of the last seven sessions. Yesterday was particularly ugly as the S&P 500 dropped 19.41 points or 1.62%. The index is now 4.66% off the high reached the Friday before last.

I had thought the market might pull back in the wake of Quantitative Easing, but instead, the market rallied when QE2 was announced on November 3rd. I was either wrong or premature. In any event, I still believe the market is very inexpensive. Let me explain what’s been happening.

There’s been a slow exodus out of the long end of the Treasury yield. Yesterday, the yield on the 30-year Treasury got as high as 4.40%. That’s a 94-point jump from the recent low reached on August 25th.

Overall, this is a good thing. First, it shows that investors are turning against overpriced bonds and finding value in stocks. Just look at how many blue chip stocks have dividend yields that compare favorably with 10-year Treasuries.

Second, investors are now willing to take on riskier assets. During the recent unpleasantness, investors crammed themselves into anything and everything that appeared to be safe. As a result, all assets that were perceived as even slightly below “bulletproof” were tossed overboard. That’s starting to correct itself.

This is why growth has been leading value, why small-caps have been leading large, why cyclicals have been leading consumers and why stocks have been leading bonds. Very recently, we’ve seen a large shift away from mid-term bonds like the 5-year Treasury which is up 37 basis points over the last eight sessions.

I caution you not to be rattled by the past few days. The stocks on the Buy List are very strong. In particular, stocks like AFLAC (AFL) and Reynolds American (RAI) are fairly cheap. Wright Express (WXS) also looks good. Yesterday’s close was at $43.12 which is a very good price.

Interestingly, gold got hit hard yesterday. The contract for December delivery dropped over $30 per ounce which is 2.2%. This could mean that a Fed rate hike will come sooner than people think.

The good news today is that inflation continues to be tame. Headline inflation was up 0.2% last month and core inflation was flat. Wall Street has been expecting rises of 0.3% for headline and 0.1% for core. I just don’t get the nervousness over hyperinflation. It may come one day, but for now, the statistics say inflation isn’t a problem.

Here’s a very good clip of Tadas Viskanta on Stock Twits TV explaining that the stock market might have rallied over the past few weeks because things are really looking better.

(HT: Jeff Miller)

-

Morning News: November 17, 2010

Posted by Eddy Elfenbein on November 17th, 2010 at 7:45 amUS Stock Futures Up Before Housing, CPI Data

Fed May Hesitate on More Easing After Critics Question Mandate

Consumer Prices in U.S. Probably Rose in October on Gasoline

Currency Fight With China Divides U.S. Business

Ireland Prepares to Open Books as EU Weighs Help for Banks

China Acts to Slow Rise in Food Prices

GM Increases IPO Size as Treasury, UAW Sell More Shares

-

The Muni Meltdown

Posted by Eddy Elfenbein on November 16th, 2010 at 1:16 pmCheck out the drop-off in the Muni Bond ETF (MUB):

This chart is slightly deceptive. The ETF is normally very stable. We’re only talking about a drop of a few percentage points, but it appears more dramatic when compared with its normal stability.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His