-

More on Our Gold Model

Posted by Eddy Elfenbein on November 1st, 2010 at 8:41 amMichael Stokes at MarketSci has a great post where he takes a closer look at our Gold Model. He found that using 2.4% as the break-even point produces a slightly better fit. (Here’s my original post.)

Michaels sums it up with three points; the good, the bad and the geeky:

The GOOD: there’s clearly something good about the CWS model. The analysis is made a little difficult by the fact that we have so little data to look at (the price of gold didn’t float prior to the late-1960’s), but the model definitely makes sense conceptually and fits the macro trends in gold over the last 40+ years.

The BAD: during both of those periods (in grey) when the model and gold diverged, long-term real rates were behaving very different than short-term real rates (and better matched the changes in gold). I’m wondering if the model could be improved by incorporating both short and long-term rates. Food for thought for future analysis.

The GEEKY: the model “works” by trying to predict month-to-month changes in gold, but has only done well modeling the absolute price level of gold. That’s awkward. A model that predicts monthly changes, but is only effective in terms of absolute price, is especially prone to curve-fitting because each monthly prediction impacts all future data points. Just something to roll around in the noggin’.

-

Expect a Pullback this Week

Posted by Eddy Elfenbein on November 1st, 2010 at 8:23 amLast Thursday, I noted that the S&P 500 has barely budged over the past few trading days. Well, we can add Friday’s market to the list as well. The S&P 500 lost 0.52 points on Friday, or 0.04%.

This week, however, I think it’s very likely that we’ll see a sell-off following the Fed’s QE2 announcement. Don’t worry: I don’t think it will be a major sell-off. Bear in mind that with the recent rally that began on August 30th, the market has rallied on 27 sessions and fallen on just 16. The largest pullback based on closing numbers is 1.6%.

The catalyst for any sell-off will most likely be that the Fed’s QE2 total won’t be as much as Wall Street expects. The number that’s most frequently tossed around is $500 billion in Treasury purchases over the next six months. That’s been estimated to be equivalent to a 0.50% rate cut.

I’m still expecting a number closer to $250 billion, but no one from the Fed has contacted me for my views. In any event, we’ll know more on Wednesday. Also, the ECB and Bank of England meet on Thursday, so it’s a big week for central bankers.

The good news that no one wants to hear is that this has been an excellent earnings season. It’s odd how there’s always someone to attack any good news that comes along. According to the last figures, 71% of companies have beaten earnings expectations so far. That’s very, very high.

I will add with false modesty that all the stocks on our Buy List have beaten earnings this season. We’re not done just yet. There are three more earnings report for the Buy List this week; Moog (MOG-A), Wright Express (WXS) and Becton Dickinson (BDX).

We’re also heading into what has historically been the best six-month stretch of the year for the market. Bespoke notes that since 1960, the S&P 500 has averaged a 6.4% gain for the November through April period. For May through October, the market has only averaged 0.8%. I should add that the market has also done well for the last three “third years” of a presidential term.

I’ll be very curious what the ISM Index will say for October. I don’t expect much of a change, but even a little movement should put the Double Dip nonsense to rest. It won’t, of course, but it should.

Finally, we’ll get the October jobs report on Friday and it will not be pretty.

-

Morning News: November 1, 2010

Posted by Eddy Elfenbein on November 1st, 2010 at 7:01 amU.S. Stock-Index Futures Climb as Chinese Manufacturing Expands

U.K. Manufacturing Growth Unexpectedly Accelerates as Exports Strengthen

Wall St. Futures Point to Higher Open; Data Eyed

Oil Rises as Dollar Weakens on Speculation of Fed Credit-Easing Measures

China Manufacturing Posts Biggest Gain in Six Months

Awaiting Fed’s Plans, Markets Are in Limbo

U.S. Economy Grew 2% as Consumer Spending Rises

Humana Tops Estimates, Lifts Guidance

Pontiac, 84, Dies of Indifference

Oracle Seeks $2.3 Billion in SAP Download `Humiliation’ Trial

-

Buy List Update

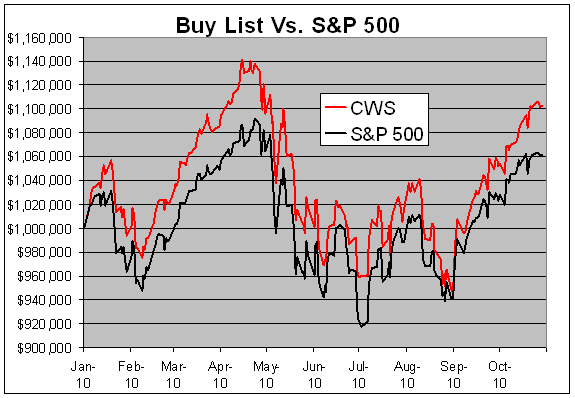

Posted by Eddy Elfenbein on October 31st, 2010 at 9:58 pmNow that October is on the books, let’s take a look at the YTD performance of the Buy List.

Through October, the Buy List is up 10.25% compared with 6.11% for the S&P 500 (dividends not included).

Here’s a look at the chart for 2010:

-

You STILL Haven’t Sign up for CWS Review!

Posted by Eddy Elfenbein on October 29th, 2010 at 3:01 pmWell, what are you waiting for? It’s free!

-

“Yes you did. You invaded Poland.”

Posted by Eddy Elfenbein on October 29th, 2010 at 2:42 pmThat’s enough market talk for one week. Have a great weekend everyone, and enjoy this classic John Cleese (who turned 71 this week) clip as Basil Fawlty:

-

Time to Raise Rates?

Posted by Eddy Elfenbein on October 29th, 2010 at 2:05 pmLast week, Josh Brown brought up the issue of the Federal Reserve raising interest rates. With QE2 around the corner, it doesn’t look like the Fed will, but I think Josh has a good case.

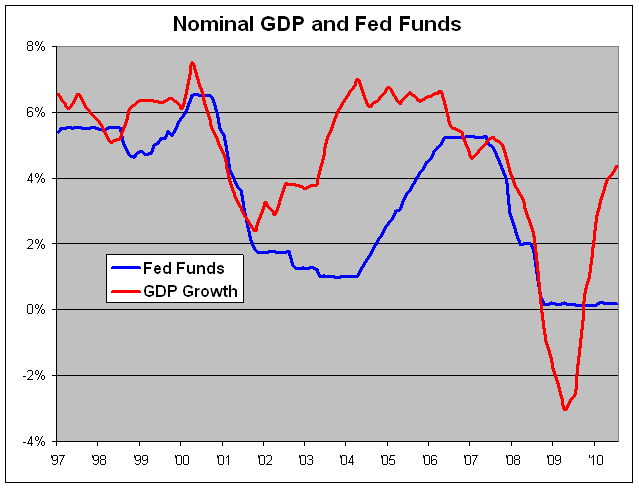

Here’s a look at the Fed Funds rate against trailing four-quarter nominal GDP:

The two lines tack each other well. The hotly debated point is the middle of last decade when nominal GDP indicted that rates were too low. Other commentators said this as well, and more sophisticated measures like the Taylor Rule agreed.

Lately, however, nominal GDP growth has climbed to over 4% while interest rates are still stuck at 0%. Should this be discounted since it’s only making up for the slack caused by negative growth? Or is the Fed again behind the curve?

-

The Double Dip Is Dead

Posted by Eddy Elfenbein on October 29th, 2010 at 12:50 pmContinuing with what I said before, the Economic Cycle Research Institute also calls the end of the Double Dip:

The good news is that the much-feared double-dip recession is not going to happen.

That is the message from leading business cycle indicators, which are unmistakably veering away from the recession track, following the patterns seen in post-World War II slowdowns that didn’t lead to recession.

For 25 years, we’ve personally spent every working day studying recessions and recoveries. Based on our work and that of our colleagues at ECRI, we’ve called the last three recessions and recoveries without any false alarms, including an accurate forecast of the end of the most recent recession in the summer of 2009.

After completing an exhaustive review of key drivers of the business cycle, ranging from credit to inventories and measures of labor market conditions, we can forecast with confidence that the economy will avoid a double dip.

But the bad news is that a revival in economic growth is not yet in sight. The slowing of economic growth that began in mid-2010 will continue through early 2011. Thus, private sector job growth, which is already easing, will slow further, keeping the double-dip debate alive.

Of course, it is the renewed job market weakness, combined with deflation fears, that is behind the Fed’s promise to implement a second round of quantitative easing, or QE2.

-

QE2 Will Spur Demand for More Risk

Posted by Eddy Elfenbein on October 29th, 2010 at 10:19 amNext week, the Federal Reserve is expected to announce another round of Quantitative Easing, or as the cool kids are calling it, QE2. All investors need to understand that QE2 will have a major impact on their investments. The most important aspect is that Quantitative Easing will help fuel a demand for riskier asset classes.

More specifically, Quantitative Easing will aid a shift toward growth stocks at the expense of bonds and value stocks. QE2 won’t affect the direction of stock market—that will remain strong—as much as it will alter the market’s internal leadership.

Now let me back up and explain this in more detail. Over the last several weeks, the Federal Reserve has made its QE intentions crystal clear. I’m surprised that they haven’t taken out a full-page ad in the Wall Street Journal.

The Fed’s main problem is that the economy is still grinding its wheels, as today’s GDP report shows, and interest rates are already at 0%. As a result, the central bank now plans to inject money into the economy by buying enormous amounts of U.S. Treasuries.

The only question now is “how much?” The general consensus on the Street is that QE2 will clock in around $500 billion, although some say it could be as much as $1 trillion. We’re really in unchartered territory here.

Personally, I think the plan will be less than the Street expects. Remember, the C in FOMC is for “committee” and that means compromises. We can expect uber-hawk Thomas Hoenig, the president of the Kansas City Fed, to be a “nay” vote, and he may be joined by one or two others. I expect an announcement of around $250 billion give or take, which may even cause a near-term pullback. Much like a pampered Hollywood starlet, Wall Street just loves to be disappointed when it receives favors.

So where will Bernanke and his buddies get all this cash? That’s easy. They have a magical super power where they can write checks out of thin air. Or, at least, they can create currency out of thin air. The U.S. dollar has already gotten smacked around in the currency pits lately, although it’s not nearly as bad as the dollar’s haters make it sound.

My thesis that the Fed’s purchasing of debt will lead an exodus out of Treasuries and into riskier assets may sound counterintuitive. The important point is that the market is already heavily tilted toward low-risk assets. Currently, there’s a lot of money—too much money—sitting on the sidelines. Moody’s Investors Service reports that U.S. companies are sitting on $943 billion in cash. Three companies; Cisco (CSCO), Microsoft (MSFT) and Google (GOOG) account for the largest portion. Hey, who needs the Fed? They could do a QE all by themselves!

The simple fact is, to paraphrase Jimmy McMillan, bonds are too damn high. In fact, the move out of bonds has already started. Yesterday, the yield on the 30-year Treasury closed at its highest level in nearly three months and it’s now over 50 basis points from its low point in late August. Not by coincidence, that was right when the stock market bottomed. In short, the stock rally has been at the expense of bonds.

What this means is that at long last, investors are finally choosing sanity over liquidity. Let’s look at some numbers: Since August 31, the S&P 500 is up 12.8%. That’s a nice run, but the growth side of the index as measured by the S&P 500 Growth Stock Index is up 19.3%. That’s nearly double the 10.4% gain for the S&P Value Index.

Here’s the key to understanding QE2’s impact: Don’t think of it as a stock movement. Instead, think of it as a risk movement with a seal of approval from the Federal Reserve.

-

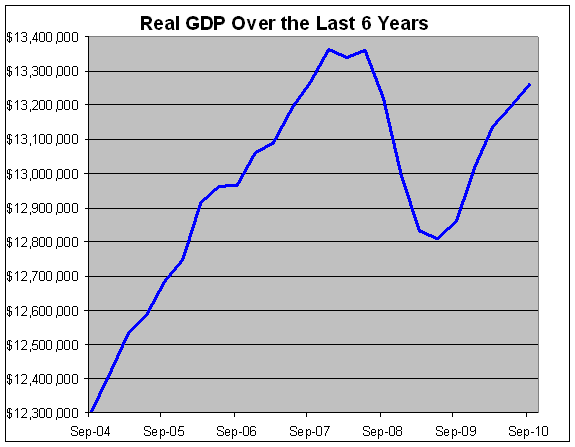

Third-Quarter GDP Grew By 2%

Posted by Eddy Elfenbein on October 29th, 2010 at 8:31 amThe official numbers are in and the third-quarter GDP grew by just 2%.

That estimate matched the consensus forecasts for the gross domestic product, and is a slight uptick from the second quarter.

Though the recovery officially began in June 2009, growth since then has been tepid, at best. The economy expanded at a 1.7 percent pace in the second quarter, down sharply from a 3.7 percent rate in the first.

In recent weeks, the economy has presented two faces, which is reflected in the latest G.D.P. numbers. There have been fledgling signs of growth: home sales and chain store sales are up bit, a swelling stock market has raised consumer confidence a few notches, and jobless claims fell noticeably last week, albeit to a still quite high and painful level. At the same time, the steroidal effect of the stimulus spending is fading. City and state governments have shed tens of thousands of employees, and states face a sea of red ink as they look at next year’s budgets.

Sigh. This is yet another quarter of subpar growth. For the economy to truly recover, we need to see several quarters of GDP growth over 3%. Over 4% would be even better.

This report is the government’s first attempt at an estimate. The report will be revised two more times, at the end of November and at the end of December, and it will probably be revised a few more times after that.

The trouble is that the government tries to estimate the trade numbers for the last month of the quarter. They give it a good effort, but we never know exactly. For the third quarter, it turns out that trade knocked off 2% from the final number. Excluding trade, the economy grew by 4%.

Here are the GDP numbers for the past few quarters:

Quarter GDP Growth Dec-07 2.90% Mar-08 -0.73% Jun-08 0.60% Sep-08 -4.00% Dec-08 -6.77% Mar-09 -4.87% Jun-09 -0.70% Sep-09 1.60% Dec-09 5.01% Mar-10 3.73% Jun-10 1.72% Sep-10 1.99% The good news, if there is any, is that the economy is no longer decelerating, meaning the rate of growth isn’t slowing.

That’s basically what all the Double Dip hype amounted to: it was all in the second derivative. We never dipped. We grew, but the rate of growth dipped. This report has shown a very, very slight acceleration. Very, very, very slight.

Over the last 10 years, real GDP has grown by 17.68% which is just 1.64% on an annualized basis. The economy has grown at a slower pace over the last 10 years than over the three-year period of 1963, 1964 and 1965.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His