-

81% of Earnings Reports Are Beating Expectations

Posted by Eddy Elfenbein on October 28th, 2010 at 9:04 amThe market seems poised to rise today after staging a nice afternoon rally yesterday. For a while there it looked like it was going to be an ugly day. Around 1:15 pm, the S&P 500 was at 1,172, but we added more than 10 points from there. In the end, the S&P 500 only lost 0.27% yesterday.

The good news today is that the unemployment claims report came in below expectations. Normally this is among the least-important economic reports, but I think traders want to latch on to something positive. The number of jobless claims fell by 21,000 to 434,000, which is the lowest total since July. The total number of people receiving unemployment insurance dropped to a two-year low.

The big news today will be earnings from Nicholas Financial (NICK). After that, the big event will be tomorrow’s GDP report. I’m not sure what to expect, probably something between 1.5% and 2.2%. Anything below 3% isn’t good enough. The fourth quarter, however, may be better.

Then next Tuesday we have the election and after that, the Fed will meet and announce QE2. I think the Fed will say that it plans to buy somewhere between $300 billion and $500 billion worth of Treasuries between, say, five years and twenty years. What the Fed will say is still up in the air, but I guarantee you that whatever they say, it won’t be enough for some people.

The Fed is reportedly asking bond dealers, “Suppose we said we’re going to buy tons of Treasuries—and we’re not saying we are—but say we said we might say we are, how might that affect yields, if that event did in fact occur?” I’m paraphrasing, but that’s the idea.

Here’s something interesting I spotted at MarketWatch:

In all, with roughly half of the S&P 500 reporting by Wednesday, 81% had exceeded expectations, with just 13% coming up short, according to data compiled by Thomson Reuters.

If that percentage holds, it would be the highest level of companies beating estimates in a quarter ever — or a least since Thomson Reuters began tracking them 16 years ago. It would top even the 79% mark hit in the third quarter of 2009, when the economy came off the absolute rock bottom of late 2008.

-

Morning News: October 28, 2010

Posted by Eddy Elfenbein on October 28th, 2010 at 7:32 amEasing Uncertainty Pushes Dollar Lower

Shell Says Repercussions of U.S. Drilling Moratorium Could Last Into 2012

Bank of Japan Holds Steady, Cuts Growth Outlook

IPOs in Asia Grab Record Share of Funds as U.S. Offers Dry Up

China Promises Action on Trade Surplus, Emissions

Foreclosure Activity up Across Most US Metro Areas

Banks `Want to Sit Down’ With States to Discuss Foreclosures

Dow Chemical Tops Estimates, Net Declines

Sanofi’s Viehbacher Rules Out $80-a-Share Offer for Genzyme

-

Stocks Up, Bonds Down

Posted by Eddy Elfenbein on October 27th, 2010 at 3:03 pmHere’s an interesting chart of the past few years. This shows the S&P 500 (in black), along with two long-term T-bond funds (blue and gold):

The key is to see when the two asset classes diverge. Two years ago, investors dumped stocks for the safety of Treasuries. Slightly after the top in the bond market in late 2008, stocks started to rebound in March 2009.

During much of this year, bonds did well while stocks started to languish. Recently, however, bonds have started to swoon while stocks have continued to climb. Generally, the bond market precedes the stock market by a few months.

-

According to Intrade, It’s a GOP Landslide

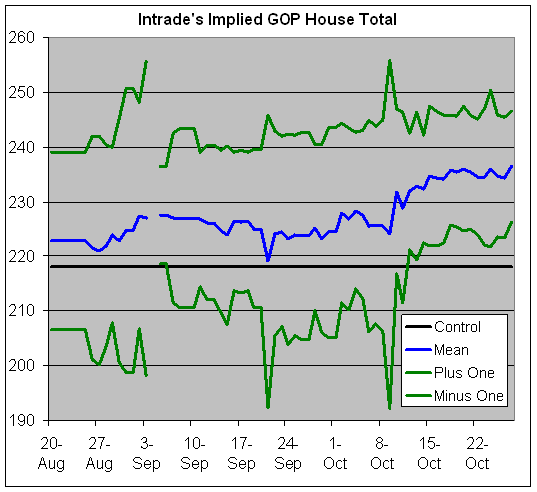

Posted by Eddy Elfenbein on October 27th, 2010 at 11:59 amHere’s the latest look at the implied House gains for the GOP in next week’s election according to Intrade. (For a complete explanation, see this earlier post.)

The normal caveats apply — these are very illiquid markets. I based the mean and standard deviation on the 50+ gain and 60+ gain contracts.

The last trade on the 60+ seat gain contract was 53.5. Pairing that with the latest trade on the 50+ seat gain (80) translates to the GOP gaining a mean of 61.2 seats with a standard deviation of 13.3 seats.

(Note: I deleted the September 4 data point due to bad data.)

-

AFLAC Hits Two-Year High

Posted by Eddy Elfenbein on October 27th, 2010 at 11:22 amThe good news is that AFLAC (AFL) is doing well thanks to its strong earnings report. The stock finally took out its high from last April ($56.56) and has been as high as $56.80 this morning. AFLAC hasn’t been this high in two years.

The bad news is that not much else is doing well. The Dow is currently down 133 points and the S&P 500 is off by 12. The 30-year T-bond ticked above 4% today, which is still pretty low, but it had been below 3.5% just a few weeks ago.

Fiserv (FISV) is down with the rest of the market, which I find a bit of a surprise, although I know better than to be surprised by one-day moves. Still, Fiserv is only back to where it was a few days ago.

-

CommScope Bought Out for Half Off

Posted by Eddy Elfenbein on October 27th, 2010 at 10:40 amShares of CommScope are much higher today on the news that it’s being bought out by Carlyle Group for $3.9 billion. The price tag comes to $31.50 per share which is a 36% premium to yesterday’s close.

CommScope is working to revive sales after the global recession hurt demand last year. Carlyle is banking on an increase in demand for fiber-optic networks as phone- and Internet-service providers update their systems to accommodate increasing amounts of video and data.

CommScope, which sells its products worldwide, said revenue this quarter will be $730 million to $780 million, missing the $805.9 million predicted by analysts in a Bloomberg survey. The company has raised prices as its costs have increased, cutting into sales, Chief Financial Officer Jearld Leonhardt said in a separate statement. Sales a year earlier were $748.5 million.

The buyout is the good news. The bad news is that even after a 36% premium, CommScope is still going for half its 2007 high. It’s even well below where it was in 1999 and 2000.

Sure, many stocks are in the same boat, but I think it’s important to put a 36% premium into some context.

-

Earnings Calendar

Posted by Eddy Elfenbein on October 27th, 2010 at 9:30 amHere’s our updated earnings calendar for the stocks on the Buy List:

Company Ticker Symbol Earnings Date Estimated EPS Reported EPS Intel INTC 12-Oct $0.50 $0.52 Gilead GILD 19-Oct $0.87 $0.90 Johnson & Johnson JNJ 19-Oct $1.15 $1.23 Stryker SYK 19-Oct $0.77 $0.80 SEI Investments SEIC 20-Oct $0.26 $0.30 Baxter BAX 21-Oct $0.97 $1.01 Eli Lilly LLY 21-Oct $1.15 $1.21 Reynolds American RAI 21-Oct $1.34 $1.35 Fiserv FISV 26-Oct $1.00 $1.04 AFLAC AFL 26-Oct $1.39 $1.45 Nicholas Financial NICK 28-Oct $0.30 Moog MOG-A 4-Nov $0.70 Wright Express WXS 4-Nov $0.68 Becton Dickinson BDX 4-Nov $1.25 Sysco SYY 8-Nov $0.51 Note that this only covers the stocks on the March/June/September/December reporting cycle. Also, the $0.30 cent estimate for Nicholas Financial isn’t the Street’s view, but it’s my view.

-

Morning News: October 27, 2010

Posted by Eddy Elfenbein on October 27th, 2010 at 7:58 amCanadian Men are Confident about Stock Market

Oil Is Steady as Consumer Confidence Climbs, Dollar Rebounds

Orders for U.S. Durable Goods Likely Climbed, Boosting Growth

Stock Futures Dip as Investors Rethink Stimulus Views

India’s Currency Attracts Investors, but Damages Exports

Mortgage Applications in U.S. Increase, Spurred by Lower Borrowing Costs

Comcast 3Q Profit Falls 8.2%; Adjusted Results Beat Street Views

P&G First-Quarter Profit Falls 6.8%, Tops Analysts’ Estimates

Sprint Posts Wider Loss Than Estimated on Handset Upgrade Costs

-

Malcolm Gladwell on General Motors

Posted by Eddy Elfenbein on October 26th, 2010 at 10:51 pmHere’s a sample from the latest New Yorker:

Next up was General Motors. Team Auto’s idea was to bypass the traditional bankruptcy procedure, in which the entire company would be restructured through a protracted process of negotiation with creditors. Instead, the company would be divided into two. “Old G.M.” would contain the unwanted factories and debts and unused assets—all of which would be wound down and sold over time. The best parts of the automaker would be transferred to “New G.M.,” an entity funded and owned by the American taxpayer. The task of carving out the new entity was enormously complex, and involved rewriting countless contracts with unions, suppliers, and creditors. To minimize disruption to the company’s operations, Team Auto worked with lightning speed. Rattner would rise at five-thirty, be on the treadmill at the gym by six, and in the office by seven. Lunch was a tuna-fish sandwich at his desk. He wouldn’t be back at his rented condo in Foggy Bottom until eight or nine, catching up on the day’s e-mails before heading to bed. One of Rattner’s team members spent his first month on a friend’s couch in Virginia. Another worked around the clock during the week, and then made the five-hour drive every weekend to see his family, in Pittsburgh. None had any time for ceremony. At one point, two members of Team Auto, Brian Osias and Clay Calhoon, called for a sitdown with senior Chrysler executives at eleven on a Saturday morning. “The executives were almost all middle-aged industry veterans,” Rattner recounts. “Osias was thirty-two years old and Calhoon was twenty-six, and both looked younger than their years.” Calhoon announced to the room, “We’re going to sit at this table until we’re done.” They were there until 2 A.M. on Sunday. On another occasion, the Team Auto member Harry Wilson had a meeting with senior G.M. officials, who arrived with a hundred-and-fifty-page document. Rattner writes, “ ‘What’s this?’ Harry asked. ‘The agenda,’ came back the reply. Harry, almost laughing, said, ‘You can’t run a meeting with a 150-page agenda!’ ” He substituted his own. Rattner took the job as Auto Czar in February. He was back home in New York, mission accomplished, by July.

Rattner has since run into some trouble. Recently, an S.E.C. investigation into a “pay to play” scandal involving the New York state pension fund led to sanctions against Rattner, who has reportedly accepted a two-year ban from the securities business. But there is no question that the auto bailout represents one of the signature accomplishments both of his career and of the Obama Administration. In August, G.M. posted its second quarterly profit in a row, its best result in three years. Chrysler, for its part, is now safely in the hands of Fiat, at least for the time being. Two years ago, when the heads of G.M., Ford, and Chrysler came to the Senate in the hope of gaining relief, no one could have imagined such a favorable outcome. At the time, the Center for Automotive Research estimated that the collapse of the Big Three would result in as many as three million lost jobs. So soon after the Wall Street rescue, there seemed little public or political appetite for another taxpayer bailout. The reaction of Richard Shelby, the ranking Republican on the Senate finance committee, was typical. “I don’t believe they’ve got good management,” he said of G.M. “They don’t innovate. They are a dinosaur. . . . I don’t believe the twenty-five billion dollars they’re talking about will make them survive. It’s just postponing the inevitable.” The reason to bring in a private-equity expert is that he would never be so defeatist. To someone like Rattner, there is nothing wrong with giving a dinosaur money if you think you can fix the dinosaur. One might even say that the private-equity investor prefers the dinosaur, because dinosaurs are cheap, which increases the potential profit at the end. And then the world will look at him with awe and say, “Wow, you turned around a dinosaur”—even if, on closer examination, that wasn’t what happened at all.

-

AFLAC Earns $1.45 Per Share

Posted by Eddy Elfenbein on October 26th, 2010 at 4:58 pmAFLAC (AFL) just reported Q3 operating earnings today of $1.45 per share. (I have to apologize because this was a surprise. For some reason, I was expecting AFL’s earnings tomorrow.)

For insurance companies, we always want to look at the operating number. The company said to expect $1.35 to $1.38 per share. Wall Street was expecting $1.39 per share.

These are great results. I can’t believe this stock is going for 38 times quarterly earnings.

The average exchange rate of the yen in the quarter was 85.74 to the dollar, stronger than 93.56 a year earlier. The yen hit 15-year highs against the dollar in the quarter.

For the year, Aflac expects operating earnings of $5.52 to $5.57 per share, assuming the yen averages somewhere between 80 and 85 to the dollar in the fourth quarter.

Aflac also warned that, if interest rates stay at historically low levels, operating earnings growth in 2011 would likely be at the low end of its forecast range — 8 percent to 12 percent before currency impacts.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His