-

Dow +103 on BOJ Move

Posted by Eddy Elfenbein on October 5th, 2010 at 10:06 amThe market is moving up this morning thanks to a decision by the Central Bank of Japan to weaken the yen. They’re using some of the same medicine we are: cutting rates to zero and buying back bonds. This will hopefully help Japanese exporters. Right now, all the major indexes are higher and 19 of the 20 stocks on our Buy List are up (NICK is unchanged).

Yesterday evening, Ben Bernanke gave more clues that the Fed is close to a second round of quantitative easing. The yield on the two-year note is still near a record low.

“The additional purchases — although we don’t have precise numbers for how big the effects are — I do think they have the ability to ease financial conditions,” Bernanke said yesterday at a forum with college students in Providence, Rhode Island. He said the first wave that ended in March was an “effective program.”

The Fed snapped up $300 billion of Treasuries last year, and said in August it would reinvest proceeds from maturing mortgage holdings into government debt. The central bank is scheduled today to buy Treasuries due from September 2016 to August 2020, and from March 2013 to August 2014 tomorrow.

Walgreen (WAG) had good news to report. The company said that same-store sales rose 0.4% and the stock was upgraded by Jefferies. There was also a report showing that office vacancies are now at 17.5% which is the highest level in 17 years.

-

Morning News: October, 5, 2010

Posted by Eddy Elfenbein on October 5th, 2010 at 7:58 amBank of Japan Cuts Rates to as Low as Zero Percent

Rogue Trader at Société Générale Gets Jail Term

China’s Snub of Yuan Pleas Fuels Doubts on Europe Growth

Europe Services, Manufacturing Cool as Retail Sales Decline

Stock Futures Rise on Bank of Japan Move, ISM Data Due

Bernanke Says More Fed Asset Purchases Could Help

Moody’s Warns it May Downgrade Ireland’s Debt

-

Citi Gave Back One-Third of Profits to Financial, Legal or Regulatory Costs

Posted by Eddy Elfenbein on October 4th, 2010 at 2:47 pmMike Mayo, an analyst at CLSA, raised his price target on Citigroup (C) from $3.50 to $4 and maintained his underperform rating. (Nope, I don’t get it either.) But this caught my eye.

For every $3 of profit the last decade, Citi gave back a dollar because of regulatory, legal, financial or accounting losses, observes Mayo. That means Citi’s main problem is how not to “mess up,” in Mayo’s view.

Sandler O’Neill notes that the Treasury’s stake in Citigroup — meaning the taxpayers — has fallen from 27% to 12%.

-

Abby Joseph Cohen: Stocks Are Still Atttractive

Posted by Eddy Elfenbein on October 4th, 2010 at 12:56 pm -

Beware Friday’s Jobs Report

Posted by Eddy Elfenbein on October 4th, 2010 at 11:14 amThis is the first full week of the fourth quarter. The big economic news will come on Friday with the September jobs report. This will also be the last jobs report before the election. The bad news is that the labor market is still in very rough shape. Wall Street expects that unemployment will tick up from 9.6% in August to 9.7% in September. This means that despite impressive growth in profits, it’s not trickling down to new jobs.

Fed Chairman Ben Bernanke will speak later today and Wall Street will be paying even closer attention than usual. The reason is that the Fed is expected to announce another round of “quantitative easing” which is a fancy name for a money dump. Bernanke, of course, won’t say this explicitly. Instead, he’ll imply his actions under a blizzard of econo-speak. Any clue we can find will be a big deal. Personally, I don’t think a QE announcement will come until after the election. Bear in mind that the two-year Treasury just hit an all-time low of 0.375%. Ouch!

The other big news for this week is the start of earnings season. Alcoa (AA) is set to report this Thursday. Wall Street expects to see Alcoa report earnings of six cents per share which is a big bust from the 28 cents per share they earned a year ago. Earnings season won’t kick into high gear for the rest of Wall Street until next week and the week after.

Interestingly, Wall Street analysts are beginning to pare back some of their earnings estimates. It’s not big but it’s noticeable because the analyst community hasn’t done this in a long time. Almost continuously since the world exploded, analysts have raised and raised their forecasts. More than 70% of S&P 500 companies have topped Wall Street’s forecast for four-straight quarters. That’s the longest streak since 1993.

Last month, Wall Street’s consensus earnings forecast for S&P 500 earnings for 2011 got as high as $96.16. Now it’s down to $95.17. Like I said, it’s not a major change but it’s the first move lower in a long time. I’d also point out that eight of the 22 worst days ever have come in October.

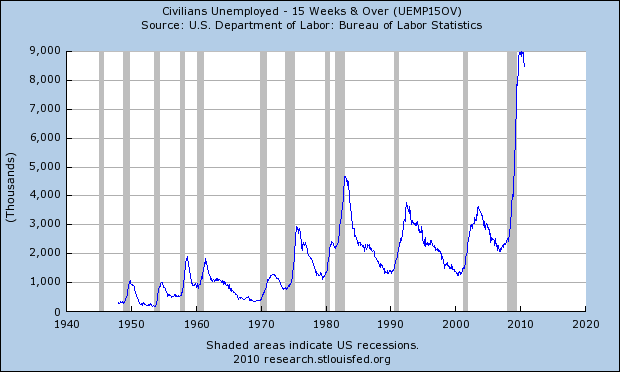

Finally, here’s a look at how many Americans have been unemployed for 15 weeks or longer. This shows you how different this (former??) recession is from previous ones.

-

Morning News: October 4, 2010

Posted by Eddy Elfenbein on October 4th, 2010 at 7:31 amUnconventional Wisdom: Stocks Do Beat Funds

6 Things You Think Add Value to Your Home — But Really Don’t

Cheap Debt for Corporations Fails to Spur Economy

Fed Bond Buying’s Unintended Consequences May Mean Higher Rates

Verizon Wireless to Pay Millions in Refunds

Sanofi Launches Hostile $18.5 Billion Bid for Genzyme

Kuwait Commits $1 Billion to AIA IPO

Flawed Paperwork Aggravates a Foreclosure Crisis

Structured Notes: The Retail Broker’s Own Little Synthetic CDO

-

About that Tiger Picture

Posted by Eddy Elfenbein on October 3rd, 2010 at 9:01 pmIf you haven’t seen it yet, this amazing picture of Tiger Woods at the Ryder Cup will soon reach iconic status.

-

Ichiro’s Hit Distribution

Posted by Eddy Elfenbein on October 1st, 2010 at 11:06 pmIchiro Suzuki is finishing up his tenth-straight season of collecting 200 hits. For his career, Ichiro has 2,240 hits out of 6,766 at bats. That’s remarkable for just ten years in the league.

Here’s a look at the distribution of his hits and at bats:

At Bats Hits # of Games 0 0 2 1 0 11 1 1 1 2 0 8 2 1 14 2 2 2 3 0 55 3 1 73 3 2 39 3 3 8 4 0 166 4 1 304 4 2 231 4 3 57 4 4 6 5 0 49 5 1 186 5 2 185 5 3 88 5 4 19 5 5 5 6 0 7 6 1 17 6 2 18 6 3 15 6 4 10 6 5 1 7 1 2 7 2 2 7 3 1 7 4 1 7 5 1 8 3 1 -

Homemade Spacecraft

Posted by Eddy Elfenbein on October 1st, 2010 at 10:19 pmHomemade Spacecraft (textless version) from Luke Geissbuhler on Vimeo.

-

Why Is Facebook Splitting Its Stock?

Posted by Eddy Elfenbein on October 1st, 2010 at 4:03 pmThe news today is that Facebook is splitting its (privately held) stock 5-to-1. Felix Salmon wonders why:

If Facebook stock was trading at thousands of dollars per share, the split might still make sense — if you’re handing out stock or stock options to relatively junior employees, for instance, a single extra share can make a substantial difference. But it’s not: the highest reported figure for Facebook stock is just $76 per share. A 5-for-1 split would bring that down to just $15 per share: there seems to be no particular reason to have a share price that low.

It’s possible that the $76 figure is wrong by an order of magnitude or so: that might explain the split. But absent that explanation, I can’t think of any good reason for this split, unless an IPO is much more imminent than anybody currently thinks. Can you?

I wouldn’t be so quick to dismiss pressure from junior employees about the share price. When you deal with investing at the retail level, price level is perhaps the strongest cognitive bias there is.

People just don’t like buying stocks over $70 per share no matter what the quality is. The average retail investor just loves to find stocks in the teens. I know it makes no sense, but I’ve seen it again and again.

One of the reasons Microsoft went public, and Bill Gates was in no hurry, was that junior-level employees were becoming rich on paper but there was no place for them to sell their shares. The point is that even non-public companies can come under pressure about their share price.

My advice is to never worry about the nominal price of a stock. Pay far more attention to the company’s business and financial ratios.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His