-

Deep Truths about the Markets and Investing

Posted by Eddy Elfenbein on April 13th, 2010 at 4:04 pmIn his 1988 Baseball Abstract, Bill James listed a number of lessons had had learned so far through his study of baseball statistics. In that vein, I’ll list some observations that I’ve learned over the years:

The Federal Reserve isn’t nearly as powerful as is commonly believed.

There isn’t a person or group of people in charge of the market.

There’s no such thing as a “healthy correction.”

Good stocks can go down for no reason.

Bad stocks can go up for no reason.

A trend can last much longer than you thought possible.

Stocks don’t know you own them.

The market doesn’t care about politics.

The most important variable to the stock market, by far, is the direction of long-term interest rates.

Mega-mergers rarely work.

Investment bubbles aren’t due to the moral failings of the market participants.

Ignore anyone who tells you that the Federal Reserve is a private bank.

Commodities are almost always terrible investments.

The stock market hates inflation. The only thing it hates more is deflation.

The best environment for stocks is a low stable inflation rate.

As an investment tool, P/E Ratios work much better for individual stocks than for the market as a whole.

The best three fundamental metrics are (in order) ROE, Debt Ratios and Cash Flow.

Wherever possible, seek out stocks with expanding margins.

Dividends are underrated by investors, especially companies that consistently raise them.

Portfolio diversity is overrated.

As a general rule, IPOs are a bad deal.

Boring but profitable always beats exciting and unprofitable.

CAPM and MPT are nonsense.

No one can consistently time the market. No one.

The Equity Risk Premium (over long-term debt) is probably much smaller than commonly believed.

The data showing a return premium for small-cap stocks is probably wrong.

The media never questions the bond market. Only stock investors are “greedy.”

Perma-bears are never held to account for being wrong so if you want to sound smart, be very bearish and very vague.

The market really does “climb a wall of worry.”

Follow unfollowed stocks.

The market is self-aware. Scary but true.

It’s far easier to rationalize selling than buying.

The market isn’t efficient—it can be beaten.

But it’s very, very, very, very hard.

Most technical analysis is complete garbage.

A high P/E Ratio is much better sign of a stock to sell than a low P/E Ratio is a sign to buy.

It’s pointless to measure the stock market relative to gold or in euros or pork bellies or whatever else people can come up with.

Ignore any chart that has seemingly similar lines trying to show how this market is “just like’ the one in 1831.

Except at very low levels, volatility is neutral.

Many gold bugs are quite simply fanatics.

Whatever the issue, your typical finance professor will blame the investing public and urge more self-denial as the solution. Bank on it.

Never base an investment decision of demographics.

The worst investor in the world is the guy holding on to a small loss waiting for the rally because “they don’t want to take the loss.” Again, the stock doesn’t know you own it.

Very, very few serious companies are traded on the pink sheets.

Never stress out about what a stock does after you sell it.

-

Twittering Away

Posted by Eddy Elfenbein on April 13th, 2010 at 1:15 pmBy way, you can follow me on twitter at http://twitter.com/EddyElfenbein.

-

Intel’s Earnings

Posted by Eddy Elfenbein on April 13th, 2010 at 1:06 pmIntel (INTC) is due to report its earning after the close. A nature show could do entire episode on song-and-ritual between a powerful company and Wall Street analysts.

The current consensus is for Intel to earn 38 cents a share. This is a huge disfavor for individual investors because no one in the world expects Intel to earn 38 cents a share. If they did, the Street would freak.

Oh…watch the mighty red-bellied rough-winged swallow do its mighty beat-and-raise dance!!

My guess, and it’s just a guess, is that Intel will earn between 45 and 50 cents a share. Last earnings season, Intel report earnings of 40 cents a share, ten cents more than estimates. Even that didn’t impress the Street. The stock initially bounced but eventually gave it back and more.

With the last earnings report, Intel gave Q1 revenue guidance of $9.7 billion, plus or minus $400 million. That sounds fair. The real news will be what kind of guidance the company gives for the rest of the year.

I think they’re playing for the beat-and-guide-higher crowd. Count me a member. -

Markets and Politics

Posted by Eddy Elfenbein on April 13th, 2010 at 10:27 amOne of the big mistakes market watchers make is to assume that the stock market is political. This is what I call Dan Gross’ Disease. Otherwise bright people assume every bounce and tick in the market is a political pronouncement that, as it turns out, proves their side right. Larry Kudlow has the acute form of DGD.

Richard Nixon was once asked what he would do if he wasn’t president. Nixon said that he’d probably be on Wall Street buying stocks. This led one old-time Wall Streeter to say that he’d also be buying stocks if Nixon weren’t president.

The market is of course influenced by public policy. Don’t get me wrong on that. But politics isn’t about policy. Usually, the most damage is done by a public policy that’s hardly controversial at the time. Lots of people like to blame Greenspan’s low rates for the housing bubble, but those moves weren’t broadly criticized at the time. Gold was still tame and bonds yield fell. The government fully applauded lower lending standards.

Paul Krugman posts a nice jab at an old quote from Larry Kudlow saying that the stock market is a validation of the president’s (Bush) policy so the recent rally must approve of Obama. I’m not sure if Krugman believes that or is simply poking at Kudlow. With much of today’s political commentary, the snark is the point.

The assumption is that the politicians are like players on a football field and the stock market is a scoreboard. It’s really the other way around. What the politicians say and do is a better measurement of how well the market has performed. -

New All-Time High for the Buy List

Posted by Eddy Elfenbein on April 12th, 2010 at 6:47 pmThanks to new 52-week highs from several of our stocks like Fiserv (FISV), Joe Banks (JOSB), Leucadia National (LUK) and SEI Investments (SEIC), the Buy List reached another new high today.

For the year, the Buy List is up 11.73%. Including dividends, we’re up 12.19% compared with 7.89% for the S&P 500.

Combining all the Buy Lists going back to 2006, we’re 28.94% to the S&P 500’s 5.00%. -

VIX Hits 33-Month Low

Posted by Eddy Elfenbein on April 12th, 2010 at 1:03 pmThe Volatility Index (^VIX) dropped down to 15.32 today which is the lowest it has been since July 2007.

There seems to be a widespread assumption that lower volatility is good and higher volatility is bad. I’m not so sure. When the financial crises started to get serious, the VIX was only in the teens. It soared during the fall of 2008, and it was still very high one year ago when stocks were a great bargain.

I looked at the numbers last year and found that a lower VIX isn’t strongly correlated with better returns, although there was some out-performance when the index is very low (i.e., less than 13). -

Bove Meets Hegel, Nietzsche, Rousseau and Leibniz.

Posted by Eddy Elfenbein on April 12th, 2010 at 12:46 pmCrain’s New York features the only article you’ll read today where banking analyst Dick Bove cites Hegel, Nietzsche, Rousseau and Leibniz.

Renowned banking analyst Dick Bove is calling on Bank of America to break itself up. In a Friday report, he dutifully backed up this idea with the sorts of numbers Wall Street types often use to show the bank’s different components are worth more separate than together.

Much more interestingly, he also cited BofA’s failure in living up to the teachings of 19th century German philosopher Georg Wilhelm Friedrich Hegel.

Mr. Hegel is best known for his work on dialectics, which says that an event, for instance the Protestant Reformation, triggers an forceful opposing event (the Counter-Reformation), and eventually the phenomena combine, or synthesize, to produce an improved state of being. (In fact, Catholic and Protestant Europe did learn to live together, more or less agreeably). By the way, this school of thought was an important foundation for Karl Marx.

Mr. Bove, a Rochdale Securities analyst who clearly has read up on Idealist philosophers, says that BofA fails to meet the Hegelian test.

“In a Hegelian cycle, events keep returning to the same place. However, that position is always higher and somewhat better than in the prior cycle due to the accumulated wisdom gained from prior cycles,” he wrote. “However, [BofA] shows no evidence of having learned anything from the past cycles….It gets back to the same position but at a lower point in the cycle.”

Although he didn’t cite Nietzsche’s concept of the eternal recurrence, Mr. Bove may well have had that in mind when pointed out that last year BofA’s stock was trading for the same price it fetched in 1982 and its dividend payout appears to be the same.

In a best of all possible worlds—a phrase coined by 18th century philosopher Gottfried Leibniz—Mr. Bove argues that BofA’s different businesses would be spun off as independent entities. These newly independent companies, surely stocked with the sort of Ubermenschen in management that Friedrich Nietzsche would appreciate, would lead shareholders to greater heights than BofA could. Mr. Bove pegged BofA’s break-up value at $53 a share.

An analyst for some 40 years, Mr. Bove is known for his forthright views that distinguish him from many other analysts, though sometimes his work resembles Jean-Jacques Rousseau’s Reveries of a Solitary Walker.

A BofA spokesman had no comment.Clearly, the spokesman is a Stoic.

-

Calling the Recession Over

Posted by Eddy Elfenbein on April 12th, 2010 at 11:00 amThe NYT has a good article on the issue of NBER officially declaring the recession over. I hear lots of people talking about the possibility of a double-dip. Even if that happens, I would have to view that as a separate cycle.

There is no formula for defining a recession, even though it is often casually described as two consecutive quarters of economic contraction. The committee relies on interpretation to determine the beginning or end of one.

The last time it made such a cautious statement was in December 1990, when it said that a recession had most likely begun between June and September but that it could not make a determination until the contraction was sufficiently long and deep; the committee announced four months later that the recession had started in July 1990.

It seems nearly certain that the present recession will end up lasting longer than the 16-month recessions of 1973-75 and 1981-82. They had been the longest downturns since the 43-month period from 1929 to 1933 that was the first phase of the Great Depression.

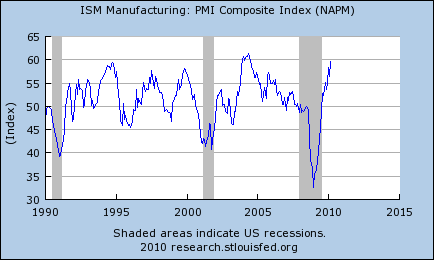

The committee, created in 1978, has assigned the start and end dates of economic contractions for every business cycle since 1854. It has long emphasized that it looks only backward, and does not make forecasts or predictions.I recently looked at the data and found that the ISM is the among the best predictors of what the committee will do. Once the ISM Composite Index crosses 44, the odds that we’re still in a recession drop dramatically. We’ve now been above that every month since June 2009.

Note that the last shaded area isn’t official. NBER has said the recession began in December 2007, but we haven’t heard on its ending just yet. -

2011 S&P 500 Earnings Estimate

Posted by Eddy Elfenbein on April 12th, 2010 at 10:41 amHoward Silverblatt, the top numbers guy at Standard & Poor’s, has pegged 2011 consensus earnings estimates for the S&P 500 at $93.55. Some have the consensus even higher. If that’s correct, then this market is still on the inexpensive side.

One major caveat is that we shouldn’t a great deal of faith in an earnings projection so far away. In March of 2009, Goldman said that the S&P 500 would earn just $40 for the entire year. Instead, it was $57. -

Upcoming Earnings Dates

Posted by Eddy Elfenbein on April 12th, 2010 at 10:28 amHere are some upcoming earnings dates and EPS estimates for stocks on the Buy List:

Intel INTC 13-Apr $0.38 Eli Lilly LLY 19-Apr $1.10 Gilead GILD 20-Apr $0.95 Johnson & Johnson JNJ 20-Apr $1.28 Stryker SYK 20-Apr $0.78 Baxter BAX 22-Apr $0.93 Reynolds American RAI 22-Apr $1.06 Aflac AFL 27-Apr $1.32 Becton Dickinson BDX 29-Apr $1.23 Fiserv FISV 29-Apr $0.97

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His