-

Was Belichick Right to Go for it?

Posted by Eddy Elfenbein on November 17th, 2009 at 11:06 amBrian Burke says yes:

A punt from the 28 typically nets 38 yards, starting the Colts at their own 34. Teams historically get the TD 30% of the time in that situation. So the punt gives the Pats about a 0.70 WP.

Statistically, the better decision would be to go for it, and by a good amount. However, these numbers are baselines for the league as a whole. You’d have to expect the Colts had a better than a 30% chance of scoring from their 34, and an accordingly higher chance to score from the Pats’ 28. But any adjustment in their likelihood of scoring from either field position increases the advantage of going for it. You can play with the numbers any way you like, but it’s pretty hard to come up with a realistic combination of numbers that make punting the better option. At best, you could make it a wash.Greg Mankiw adds: “Randomness is a fact of life, even if Patriots’ fans do not fully appreciate it.”

-

What Do You Think?

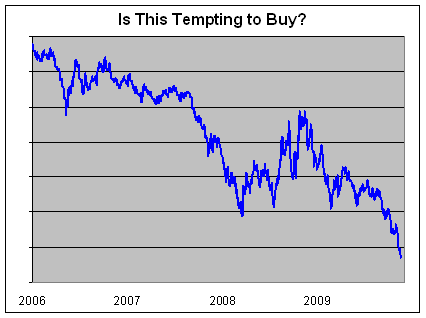

Posted by Eddy Elfenbein on November 16th, 2009 at 6:14 pmCheck out this chart. Do you think it’s forming a bottom?

Could be. I honestly can’t say. So what’s the stock? -

Buy List +42% YTD

Posted by Eddy Elfenbein on November 16th, 2009 at 5:03 pmThanks to big gains from stocks like Joe Banks (JOSB) and Nicholas Financial (NICK), our Buy List made a new high for the year (up 42%) and a new relative strength high (19.19% more than the S&P 500). I think the big surprise was NICK breaking out today without any warning.

Not only is this blog completely free, but it makes you money. If you started with $1 billion at the start of the year, I made you $420 million!

You’re welcome. -

Guess How Much Money GM Lost…

Posted by Eddy Elfenbein on November 16th, 2009 at 11:20 amBetween January 2005 and its Chapter 11 filing on June 1?

Answer = $88 billion. -

S&P 500 = 1,100

Posted by Eddy Elfenbein on November 16th, 2009 at 10:59 amThe Suckers Rally continues to be very kind to our Buy List. We’re now up over 40% for the year. FactSet (FDS), Donaldson (DCI), Danaher (DHR) and Cognizant (CTSH) are all at new 52-week highs today. Plus, Stryker (SYK), Medtronic (MDT) and Amphenol (APH) aren’t too far away.

The S&P 500 is up to 1,110 which is its highest level in 13 months. -

Your Handy Guide to Wall Street Conspiracies

Posted by Eddy Elfenbein on November 16th, 2009 at 10:19 amGary Weiss provides a nice overview of the various conspiracy theories floating around Wall Street. The Giant Vampire Squid won’t be pleased.

-

Atlas Yawned

Posted by Eddy Elfenbein on November 16th, 2009 at 9:50 amBarry Ritholtz notes the reemergence of Ayn Rand. This is one of those phenomena, like orange soda, that I will never understand.

Barry rightly calls Rand’s prose “a giant pedantic bore,” and also zeros in on the cult-like behavior of Randians. I just don’t get it. My theory is that Rand’s appeal is mainly to make college sophomores feel superior to freshmen.

Michael Shermer (via Oliver Kamm) addressed the Randians a few years ago when writing “The Unlikeliest Cult in History.”One of the closest to Rand was Nathaniel Branden, a young philosophy student who joined the Collective in the early days before Atlas Shrugged was published. In his autobiographical memoirs entitled Judgment Day (1989), Branden recalled: “There were implicit premises in our world to which everyone in our circle subscribed, and which we transmitted to our students at NBI.” Incredibly, and here is where the philosophical movement became a cult, they came to believe that (pp. 255-256):

• Ayn Rand is the greatest human being who has ever lived.

• Atlas Shrugged is the greatest human achievement in the history of the world.

• Ayn Rand, by virtue of her philosophical genius, is the supreme arbiter in any issue pertaining to what is rational, moral, or appropriate to man’s life on earth.

• Once one is acquainted with Ayn Rand and/or her work, the measure of one’s virtue is intrinsically tied to the position one takes regarding her and/or it.

• No one can be a good Objectivist who does not admire what Ayn Rand admires and condemn what Ayn Rand condemns.

• No one can be a fully consistent individualist who disagrees with Ayn Rand on any fundamental issue.

• Since Ayn Rand has designated Nathaniel Branden as her “intellectual heir,” and has repeatedly proclaimed him to be an ideal exponent of her philosophy, he is to be accorded only marginally less reverence than Ayn Rand herself.

• But it is best not to say most of these things explicitly (excepting, perhaps, the first two items). One must always maintain that one arrives at one’s beliefs solely by reason.By the way, here’s a letter to the editor of the New York Times from November 3, 1957:

To the Editor:

Atlas Shrugged is a celebration of life and happiness. Justice is unrelenting. Creative individuals and undeviating purpose and rationality achieve joy and fulfillment. Parasites who persistently avoid either purpose or reason perish as they should. Mr. Hicks suspiciously wonders “about a person who sustains such a mood through the writing of 1,168 pages and some fourteen years of work.” This reader wonders about a person who finds unrelenting justice personally disturbing.

Alan Greenspan, NY -

The Gladwell Bubble Bursts

Posted by Eddy Elfenbein on November 16th, 2009 at 9:27 amOver the weekend, Harvard psychology professor, Steven Pinker, reviewed Malcolm Gladwell’s latest, What the Dog Saw, for the New York Times. Pinker writes:

An eclectic essayist is necessarily a dilettante, which is not in itself a bad thing. But Gladwell frequently holds forth about statistics and psychology, and his lack of technical grounding in these subjects can be jarring. He provides misleading definitions of “homology,” “saggital plane” and “power law” and quotes an expert speaking about an “igon value” (that’s eigenvalue, a basic concept in linear algebra). In the spirit of Gladwell, who likes to give portentous names to his aperçus, I will call this the Igon Value Problem: when a writer’s education on a topic consists in interviewing an expert, he is apt to offer generalizations that are banal, obtuse or flat wrong.

Ouch! Steve Sailer notes that Gladwell assertion that quarterback performance isn’t correlated to draft choice is incorrect. Finally, Vanity Fair chimes in with a Gladwellian parody on Christmas:

He is grotesquely overweight. He is childless. He lives in the chilly and undesirable North Pole. He insists on dressing in a bright-red jumpsuit with fur trimmings. He can only ever find employment on one day a year, and, even then, it is night work.

On every accepted level, Santa Claus is a total loser.

Yet this is a man who heads up a brand that commands 98 percent global recognition.

Furthermore, he is universally adored.

How does he do it?

In a controlled research investigation involving uninterrupted surveillance videotaping, a sustained loop of twinkly music, and state-of-the-art ¬merriness-determination equip¬ment, a Dutch santologist named Hans Bunquum discovered the secret to Claus’s phenomenal success.

“The conclusion is both remarkable and inescapable but also—most importantly—counter-intuitive,” Dr. Bunquum told me over a glass of organic lemonade in his stunn¬ing waterstulp, or waterside studio, near Rotterdam. “To become the object of universal love, one must first live with a red-nosed rein¬deer, and then gain a premier position as the sole registered employer of elves in the Northern Hemisphere. It’s as simple as that.” -

Don’t Tell Dennis Kneale

Posted by Eddy Elfenbein on November 15th, 2009 at 12:58 amCNBC Cameraman Can’t Believe He’s Filming Another Blog Off A Computer Monitor

-

A Great Earnings Season

Posted by Eddy Elfenbein on November 12th, 2009 at 3:54 pmAt Zacks, Dirk Van Dijk notes what a good earnings season it’s been:

It’s almost time to close the books on a fantastic earnings season. With almost 90% of reports in, there have been 339 that have exceeded expectations while only 62 have fallen short — a ratio of 5.47. While it is true that most companies will normally try to under-promise and over-deliver, this quarter the beats are beating the misses by about twice the normal margin of 3:1.

Nor have all the surprises only been by a penny or two, but there have been lots of companies that simply crushed their earnings estimates. The median surprise is a very high 7.11%. Over the last five years, a median surprise of about 3.0% has been normal. Part of the reason is that expectations were set very low going into the earnings season.

For most companies, their earnings are still below year ago levels, just not as far down as people thought they would be. Only 193 firms have posted positive year-over-year growth, versus 251 that have fallen short of year-ago levels — a ratio of 0.77.

The disparity between firms beating estimates but having negative year-over-year earnings growth is particularly noticeable in Tech, where the earnings surprise ratio is an awesome 9.25. However, the growth ratio (# of firms with positive growth/# of firms with negative growth) is just 0.49. A similar situation, but not quite as extreme, is true for Materials. Staples and Medical have been both growing earnings and beating expectations.

On the top line, it has also been a successful season so far (relative to expectations), but in terms of actual year-over-year growth it has been downright ugly The total revenues of the 444 firms that have already reported are 13.4% below year-ago levels. A total of 241 firms have reported higher-than-expected revenues, versus 176 that have disappointed, for a ratio of 1.37. On the other hand, only 127 actually had higher sales than a year ago, versus 314 with lower revenues, a ratio of 0.40. Put another way, only 28.6% of all firms reporting so far have had higher sales than a year ago.

In other words, cost-cutting has been the major force driving earnings and earnings surprises. However, the costs to one company are either the revenues of another company or someone’s paycheck, which is then spent to create revenues for firms. The bottom-up data coming out of all these individual firms seems to confirm what we have been getting from the government’s macro statistics. The economy is growing due to increases in productivity. Higher GDP with fewer workers.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His