-

Barron’s Calls Shares of Medtronic “Cheap”

Posted by Eddy Elfenbein on May 16th, 2009 at 8:12 pmIn this weekend’s Barron’s, Neil Martin makes the case for Medtronic (MDT):

Good news or bad, Medtronic’s stock is cheap. The shares are trading for 11.4 times fiscal ’09 estimates, and 10.5 times fiscal ’10 projections of $3.20 a share. That’s well below the 13 price/earnings multiple on the Standard & Poor’s 500 Health Care Equipment and Services index, and a P/E of 15 on the broader S&P. Medtronic itself hasn’t had such a low P/E in at least 10 years.

Analyst Rick Wise at Leerink Swann rates the stock Market Perform, but hails the ability of management, led by Chief Executive Officer William Hawkins, to set “achievable growth targets” resulting in 5% to 7% organic top-line growth. “Longer term, for investors who have the patience to watch this scenario unfold, Medtronic is one of the least expensive stocks in the health-care universe,” he says.

Earnings are coming out on Tuesday. -

The Market Punishes Greed

Posted by Eddy Elfenbein on May 16th, 2009 at 6:25 pmFrom George Will’s column:

Studying the Internet site Stubhub, which is owned by eBay, Harrington monitored the secondary market in Ohio State University football tickets for the Oct. 25, 2008, game against Penn State that was attended by a stadium record crowd of 105,711. Stubhub acts as a broker, charging 15 percent from buyers and 10 percent from sellers, who can charge whatever they choose. Generally, a ticket’s value depends on the seat’s location — the lower in the stadium and the closer to the 50-yard line the better.

Harrington collected two sets of information, one on Oct. 13, 12 days before the game, the other on Oct. 21, four days before. On Oct. 13 there were 346 sellers offering 682 tickets. Eight days later, 411 sellers were offering 845 tickets. In the interval, Ohio State beat Michigan State and undefeated Penn State beat Michigan, intensifying fans’ interest in the game.

Yet the average price of the tickets offered declined from $359 to $304. This was partly because the quality (seat location) of the remaining tickets declined. Also the number of selling days was becoming smaller. Seats at entertainment events are, like airline seats, a perishable inventory: When the plane takes off, or the game begins, the value of an unsold ticket becomes zero.

A greedy seller — one who priced his tickets too high — was less likely than other sellers were to sell them two weeks before the game. Hence he had to resort to much deeper discounts than others did as game day, and the potential worthlessness of his assets, drew near. The larger the number of seats available in the secondary market, and the more transparent that market is, thanks to the Internet, the more likely it is that greed will be punished. -

Steven Pinker on The Cognitive Niche

Posted by Eddy Elfenbein on May 16th, 2009 at 12:18 amHere’s Part 1 of the always fascinating Steven Pinker discussing the Cognitive Niche:

Part 2

Part 3

Part 4

Part 5

Part 6 -

Stock Returns and Employment

Posted by Eddy Elfenbein on May 15th, 2009 at 1:32 pmFrom 1947 through 2007, the nations’ unemployment rate was under 6% about two-thirds of the time, and over 6% the other one-third of the time.

For the time the rate was under 6%, the stock showed an annualized real return of 3.7%. When the rate was over 6%, the real return jumped to 17.3%.

The moral of the story is one I’m sure you already knew: Rotten times are great times to invest. -

Depressing Stockton!

Posted by Eddy Elfenbein on May 15th, 2009 at 10:33 amClusterstock has an uplifting slide show of the most-depressing places in America. If you were thinking of moving to East St. Louis, this may cause you to think again.

(Warning: It’s depressing) -

Friday Rallies

Posted by Eddy Elfenbein on May 14th, 2009 at 4:23 pmThe S&P 500 has rallied for the last five straight Fridays. That’s pretty impressive that there are buyers going into the weekend, and I think it signals some important confidence in the market.

So what’s the record for consecutive “up” Fridays? It turns out, we’re not even close. This is one of those Dimaggio-like records that may never be topped. From April to September 1955, the S&P 500 rose for an astounding 22 straight Fridays!

In the 1950s, Friday was almost a guaranteed money maker. During the decade, the market rose on 63% of the Fridays. The cumulative return was 138% over effectively two years (one-fifth of a decade).

For many years, the stock exchange had a brief Saturday session but that was eventually ditched in the early 50s. -

Not Regina!

Posted by Eddy Elfenbein on May 14th, 2009 at 2:24 pmZero Hedge has this ultra-cool map of Chrysler dealership closures.

States that are big losers are:

* Pennsylvania: 53

* Ohio: 47

* Texas: 45

* Illinois: 43

* Michigan: 40

* California: 31

* New Jersey: 30

* Florida: 29

* New York: 26 -

8 Bedroom/7 Bathroom House for $675,000

Posted by Eddy Elfenbein on May 14th, 2009 at 1:00 pmHere’s a great deal on an 8 bedroom/7bathroom Tudor home. It has a three-car garage and a koi pond.

About the location…. -

Merrll Lynch Goes After Zero Hedge

Posted by Eddy Elfenbein on May 14th, 2009 at 10:18 amNow that Merrill Lynch has upgraded every single REIT and has a price target of +/- infinity, (conveniently pocketing over $100 million in the process), the company can focus on more pressing issues at hand (and no, not redecorating Thain’s legacy office in the neo-uber-criminal style). Instead, the bank has sent not one, not two, but a whopping six cease and desist orders to Zero Hedge. As the recently acquired bank can finally afford to pay lawyers again compliments of its REIT analysts, it has decided to pursue the source of all evil: all those David Rosenberg posts Zero Hedge has published, that seek to educate and provide some color to otherwise confused and CNBC abused readers and investors.

If it is any consolation, now that David is literally out of the building, ML can sleep soundly that ZH will only focus on the bank’s daily REIT upgrades (no, we have not forgotten about those) as it is alas the only source amusement coming out of doomed mother Merrill.

So, dear readers, please be aware that the following six posts will be removed at some point tonight as Zero Hedge is unable to underwrite and collect on average $10 million per REIT dilution events and thus afford any lawyers (except potentially for White & Case’s Tom Lauria).

http://zerohedge.blogspot.com/2009/05/parting-thoughts-from-rosenberg-ver-10.html

http://zerohedge.blogspot.com/2009/05/shooting-shoots.html

http://zerohedge.blogspot.com/2009/05/look-back-at-week.html

http://zerohedge.blogspot.com/2009/04/are-fed-and-markets-on-same-page.html

http://zerohedge.blogspot.com/2009/04/spin-on-6-gdp.html

http://zerohedge.blogspot.com/2009/04/busy-day-for-reit-analysts.html

As for the 500 or so websites that fervently and automatically repost and redistribute ZH content, well, those we have no control over. -

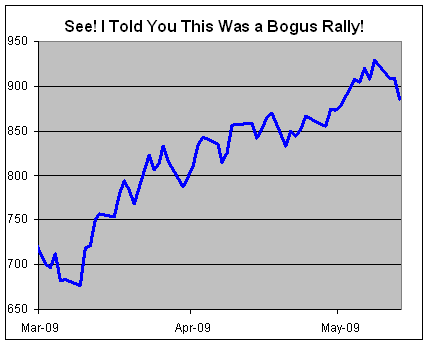

See! I Told You This Was a Bigus Rally!

Posted by Eddy Elfenbein on May 13th, 2009 at 4:02 pm

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His