-

December CPI Report

Posted by Eddy Elfenbein on January 12th, 2022 at 8:47 amThe December CPI report is out. For the last month of 2021, headline inflation increased by 0.47% and the core rate increase by 0.55%.

Over the course of 2021, the headline CPI rose by 7.12%. The core rate rose by 5.49%.

That’s the highest 12-month headline rate since June 1982. It’s the highest 12-month core rate since February 1991.

Shelter costs, which make up about one-third of the total rose 0.4% for the month and 4.1% for the year. That was the fastest pace since February 2007.

Used vehicle prices, which have been a major component of the inflation increase during the pandemic due to supply chain constraints that have limited new vehicle production, rose another 3.5% in December, bringing the increase from a year ago to 37.3%.

Conversely, energy prices mostly declined for the month, falling 0.4% as fuel oil was down 2.4% and gasoline fell 0.5%. Still, the complex as a whole rose 29.3% in the 12-month period, including a gain of 49.6% for gasoline.

Here’s a look at the seasonally-adjusted monthly headline rate of inflation. Of the last 10 months, December had the eighth-highest inflation rate.

-

Morning News: January 12, 2022

Posted by Eddy Elfenbein on January 12th, 2022 at 7:03 amTurks Pile Into Bitcoin and Tether to Escape Plunging Lira

China’s Guangxi Region Reopens Border for Trade With Vietnam Province

World’s Worst-Performing Bank Lent Billions to China Evergrande

A People’s Fed? It’s Starting to at Least Look That Way

Central Banks’ Inflation Bets Come Due in 2022

Price Inflation Is Expected to Pop Again as Policymakers Await an Elusive Peak

The Psychology of 7% Is Hiding Other Inflation Data

The Market Is Too Serene About Inflation

Is Government Money Creation Actually Enabling Deficit Spending?

Goldman Sachs Clients Favor European Stocks as U.S. Risks Grow

Cathie Wood Is Expecting a ‘Bloodbath’ in This Segment of the Market

Time to Buy: Retail Investors Swoop In When Stocks Falter

Why Grocery Store Shelves Are Bare. Again.

DirecTV and Dish in Merger Talks Once Again Despite Past Antitrust Concerns

Delta Air Lines and A Union Spar Over Isolation Periods for Sick Workers

Travel Is ‘Roaring Back’ — But the Industry Might Not Be Ready for a Boom

Be sure to follow me on Twitter.

-

CWS Market Review – January 11, 2022

Posted by Eddy Elfenbein on January 11th, 2022 at 7:12 pm(This is the free version of CWS Market Review. If you like what you see, then please sign up for the premium newsletter for $20 per month or $200 for the whole year. If you sign up today, you can see our two reports, “Your Handy Guide to Stock Orders” and “How Not to Get Screwed on Your Mortgage.”)

The Great Resignation

On Friday, the government released the jobs report for December. According to the Bureau of Labor Statistics, the U.S. economy created 199,000 net new jobs last month.

In normal times, that’s a pretty good number, but in the post-lockdown era, that’s not so good. It was less than half of Wall Street’s expectation of 422,000.

This was especially disappointing because two days earlier, the ADP jobs report doubled expectations. Also, the weekly jobless claims have continued to be near 52-year lows. I should mention that ADP uses real-time info. The government’s numbers will be revised in the months ahead. Sometimes these revisions can be quite large.

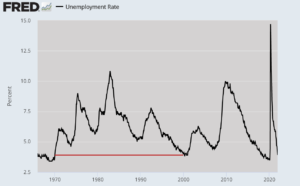

Despite the poor jobs figure, the unemployment rate fell to 3.894%. That’s lower than the unemployment rate for every single month during the entire 1970s, 1980s and 1990s.

(Your humble editor tweeted out that fact and it was retweeted by White House Chief of Staff Ronald Klain. Naturally, this demonstrates my immense power and influence.)

For December, average hourly earnings rose by 0.6%. In the last year, average hourly earnings are up 4.7%. Again, that sounds impressive until you realize that it’s less than the rate of inflation. The sad reality is that many workers are seeing a decrease in their standard of living.

Among business sectors, leisure and hospitality added 53,000 jobs, professional and business services added 43,000 and manufacturing added 26,000. One encouraging sign is that the broader U-6 unemployment rate fell 0.4% to 7.3%.

The labor force participation rate increased slightly to 61.91%. That’s the highest since March 2020. While more folks are gradually returning to the labor market, the U.S. continues to experience the Great Resignation.

What’s happening is that many folks near retirement age have decided to go ahead and retire right now. I’m sure many near-retirees have done well with the stock market, so retiring now may make sense for them. Who needs to deal with the daily rat race especially with Covid? During November, 4.5 million Americans quit their jobs. That’s an all-time record.

The labor force participation rate among prime-working-age adults (age 25 to 54) is holding up fairly well but the real decrease has come among people 55 and over. I suspect that we will see the labor force continue to expand. As my friend Gary Alexander wrote, “Covid and its consequences brought us a record level of savings, government benefits, and stimulus checks, which have now run dry and so work income is once again necessary.”

The Market Is Nervous about Tomorrow’s Inflation Report

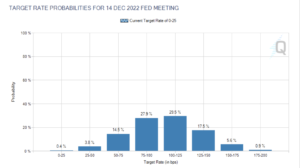

The bond market wasn’t exactly placated by the jobs report. In fact, the futures market now believes that the Federal Reserve will hike interest rates four times in 2022. Futures traders now put a 21% chance on a fifth hike this year. I can’t say I’m surprised. The first rate hike could come as soon as March.

Nerves on Wall Street were soothed today during Federal Reserve Chairman Jerome Powell’s confirmation testimony. There weren’t any surprises. Powell said that the economy is ready for tighter monetary policy. He also said that the economy will only have “short-lived” impacts from Covid.

The markets liked what they heard. Actually, this was the second day in a row the market saw some big reversals. Yesterday, the Nasdaq dropped 2.7% before rallying 2.8% off its low. The index closed slightly in the black yesterday. Today we saw much the same. The Nasdaq initially fell by 0.7% but rallied by more than 2.1% off its low.

What we’re seeing is some pushback from the trend that I’ve talked so much about. During much of November and December, low volatility stocks strongly outperformed high beta. Lately, high beta is getting its revenge. Today, the S&P 500 High Beta index rose by 1.96% while the S&P 500 Low Vol Index fell 0.20%. I don’t expect this to last. The risky stocks still need to lag some more before they’re anywhere close to being reasonably priced.

The market may soon get a lot more interesting. This Friday is the unofficial start of the Q4 earnings season. Citigroup, Wells Fargo and BlackRock are due to report earnings. The stock market will be closed on Monday in honor of Dr. Martin Luther King’s birthday. Then on Tuesday, Goldman Sachs is scheduled to report. I suspect we’ll see very good results.

Tomorrow, the government will release the December CPI report. I think a lot of folks will be on pins and needles for this report. The inflation numbers last time were not good. For November, headline inflation rose by 0.78% while core inflation increased by 0.54%. Over the prior 12 months, headline inflation increased by 6.88% and core inflation rose by 4.96%.

These are some of the highest numbers we’ve seen in decades, and they’ve completely discredited the Fed’s line that it will be transitory. I wouldn’t be surprised if headline inflation for 2021 was close to 7.5%.

For tomorrow, Wall Street expects to see December headline inflation of 0.4% and core inflation of 0.5%. So far, the Fed has only hinted of rate hikes, but inflation may turn out to be a difficult dragon to slay in 2022.

The Fed has come under additional scrutiny lately due to Vice-Chairman Richard Clarida’s stock trades. In February 2020, Clarida sold some mutual funds that he bought back shortly thereafter at the same time the Fed was preparing its response to Covid. Clarida announced that he’s going to resign from the Fed at the end of this week. His term expires at the end of January.

Now let’s look at some good news from one of my favorite Buy List stocks.

Danaher Guides Above Expectations

We had some good news today from Danaher (DHR), one of our Buy List stocks. This is particularly welcome news because the shares had been a little weak lately. In any event, CEO Rainer M. Blair said that Q4 core revenue growth will be above the company’s previous guidance.

Let’s take a step back. In October, Danaher said it expected Q4 core revenue growth “in the low-to-mid teens percent range.” Now the company expects core revenue in the high teens. For Q4 non-core revenue growth, Danaher now expects “high-teens to low-twenties.”

Mr. Blair stated, “Our team delivered an outstanding finish to 2021, with better-than-expected results across all three reporting segments led by Life Sciences and Diagnostics. We were particularly pleased with the strength of our base business across the portfolio, which was up approximately 10% in the quarter. We also saw better than expected revenue growth in Cepheid’s molecular diagnostics business driven by both respiratory and non-respiratory testing demand.”

Blair continued, “Our performance is a testament to the power of our portfolio and our team’s commitment to the Danaher Business System, and we are excited about the opportunities ahead to continue building long-term, sustainable value for our shareholders.”

Danaher does so many things so well that it’s easy to overlook them. Danaher has beaten earnings for the last 26 quarters in a row. For the last six quarters, it’s beaten expectations by more than 10%.

We first added Danaher to our Buy List in 2017. Since then, DHR has gained more than 292% for us. Including dividends, it’s up 302%. That makes it a four-bagger for us.

Danaher will report its Q4 earnings on Thursday, January 27. Wall Street currently expects earnings of $2.48 per share.

That’s all for now. I’ll have more for you in the next issue of CWS Market Review.

– Eddy

P.S. Don’t forget to sign up for our premium newsletter.

-

Morning News: January 11, 2022

Posted by Eddy Elfenbein on January 11th, 2022 at 7:05 amWary Global Bond Markets Brace for the Supply Floodgates to Open

The Clashing Forces That Will Drive U.S. Inflation in 2022

Is SEC’s Gary Gensler the Skunk at the Fintech Party or the Adult in the Room?

Fed’s Bostic Says Three Hikes, Fast Balance Sheet Runoff Needed for Inflation Fight

The Fed’s Vice Chair Resigns As Questions Mount About His Early-Pandemic Trades

The I.R.S. Is Warning of A Messy Tax Season

Economists Pin More Blame on Tech for Rising Inequality

50 Company Stocks to Watch in 2022

Flush With Cash, California Has Problems That Are No Quick Fix

Workers Sick With Omicron Add to Manufacturing Woes. ‘The Hope Was That 2022 Would Get Better.’

UBS Targets Less-Wealthy Customers With Advice by Device

How Amazon’s Battle with Reliance for India Retail Supremacy Became A Legal Jungle

Take-Two Pays Hefty Premium for Mobile Experiment

Smart Guns Finally Arriving In U.S., Seeking to Shake Up Firearms Market

Crocs Estimates Its Revenue Surged 67 Percent Last Year

Be sure to follow me on Twitter.

-

Four Rate Hikes in 2022

Posted by Eddy Elfenbein on January 10th, 2022 at 3:30 pmThe futures market now sees four rate hikes coming from the Federal Reserve this year:

-

RIP Louis Simpson

Posted by Eddy Elfenbein on January 10th, 2022 at 3:24 pmLouis Simpson, who helped pick stocks for Warren Buffett, has died at age 85.

Simpson spent more than three decades selecting equities for Geico, the auto insurer owned by Omaha, Nebraska-based Berkshire Hathaway Inc. Buffett, Berkshire’s billionaire chief executive officer whose stock-picking prowess earned him a worldwide following, was a longtime stakeholder in Geico and helped choose Simpson to be its chief investment officer in 1979. When Berkshire acquired full ownership of Geico in 1996, Buffett asked Simpson to continue managing its stock portfolio.

Simpson was a “Hall of Famer” as an investor and “the best investment manager in the property-casualty business,” Buffett wrote in annual letters to Berkshire shareholders. In his 2004 letter, Buffett included a section called “Portrait of a Disciplined Investor,” saying Simpson’s picks had produced an annual average return of 20 percent since 1980, compared with 14 percent for the S&P 500 Index.

(…)

One of Simpson’s successes came with the breakup of American Telephone & Telegraph Co. in the 1980s. He invested about 40 percent of Geico’s capital in three of the regional “Baby Bell” operating companies formed by the dismantling. The stake doubled over two years and added $400 million to the insurer’s $1 billion net worth, according to Jack Byrne, the former chairman of Geico. His other notable investments included Nike Inc., an athletic apparel maker, and CarMax Inc., which sells used autos.

“He just knocked the cover off the ball year after year after year,” Byrne said in a 2011 interview. “I have been asking Lou for 20 years whether he would take a separate account with me.”

-

Anything Risky Is Down

Posted by Eddy Elfenbein on January 10th, 2022 at 1:42 pmThe stock market is having a rough day so far today. The S&P 500 has been as low as 4,582.24. Right now, the index is hanging around 4,600 which is a loss of 1.65%.

The Nasdaq is down even more. That index is currently off by about 2.3%. In fact, the Nasdaq is basically flat over the last six months. The S&P 500 Tech sector is down about 2.4%.

Anything risky, folks are running from. Bitcoin briefly dipped below $40,000. GameStop has been down as much as 15%.

This is a good time to revisit my favorite comparison of late which is the S&P 500 Low Vol vs. the S&P 500 High Beta index. The High Beta index is currently off by 2.43% while the Low Vol index is down 0.89%.

Despite all the selling, on our Buy List, AFLAC (AFL), Church & Dwight (CHD) and Reynolds Consumer Products (REYN) all got to new 52-week highs today.

-

Morning News: January 10, 2021

Posted by Eddy Elfenbein on January 10th, 2022 at 7:08 amMark Mobius Sees ‘Much Much Higher’ U.S. Yields on Inflation Risks

Goldman Now Expects Four Fed Hikes, Sees Faster Runoff in 2022

The Federal Reserve Can Neither Shrink You, Nor Elevate You

Big U.S. Banks Expected to Post Uptick In Core Q4 Revenues on Economic Rebound

Robert Birnbaum, Architect of Modern-Day Financial Markets, Dies at 94

Forget Shareholder Resolutions, Fund Manager Says: Hire Better Directors

Even Companies in Workaholic Japan Are Introducting Four-Day Workweek

Shimao Puts Residential Projects on Sale As China Property Woes Deepen

Intel Erases Reference to China’s Xinjiang After Social-Media Backlash

Intel Is About to Relinquish Its Chipmaking Crown to Samsung

Why Tesla Soared as Other Automakers Struggled to Make Cars

World’s Biggest Crypto Fortune Began With a Friendly Poker Game

Quiet Awards Season Has Hollywood Uneasy

Elizabeth Holmes’s Mixed Verdict Could Handicap an Appeal, Lawyers Say

U.S. Sues Shop Owner Who Dumped 91,500 Pennies on Ex-Worker’s Driveway

Be sure to follow me on Twitter.

-

December Jobs Report: +199,000

Posted by Eddy Elfenbein on January 7th, 2022 at 11:58 amThe December jobs report is out, and the U.S. economy created 199,000 net new jobs last month. That was well below expectations of 422,000.

The unemployment rate fell to 3.9%. That’s lower than where it was during every single month of the 1970s, 80s and 90s.

Average hourly earnings were up 0.6% last month and 4.7% for the whole year.

The broader U-6 employment rate fell 0.4% to 7.3%.

Job creation was highest in leisure and hospitality, a key recovery sector, which added 53,000. Professional and business services contributed 43,000, while manufacturing added 26,000.

The unemployment rate was a fresh pandemic-era low and near the 50-year low of 3.5% in February 2020. That decline came even though the labor force participation rate was unchanged at 61.9% amid an ongoing labor shortage in the U.S.

A more encompassing measure of unemployment that includes discouraged workers and those holding part-time jobs for economic reasons slid to 7.3%, down 0.4 percentage point. Though the overall jobless rates fell, unemployment for Blacks spiked during the month, rising to 7.1% from 6.5%. The rate for white women 20 years and older fell sharply, to 3.1% from 3.7%.

“The new year is off to a rocky start,” wrote Nick Bunker, economic research director at job placement site Indeed. “These less than stellar numbers were recorded before the omicron variant started to spread significantly in the United States. Hopefully the current wave of the pandemic will lead to limited labor market damage. The labor market is still recovering, but a more sustainable comeback is only possible in a post-pandemic environment.”

-

Morning News: January 7, 2022

Posted by Eddy Elfenbein on January 7th, 2022 at 7:02 amBOE Push to Green Quantitative Easing Isn’t Working, Study Shows

China’s Shocking Start to 2022 Pressures Beijing to Calm Markets

Kazakhstan’s Huge Bitcoin Mining Industry Is Upended By Unrest

December Jobs Report Is Expected to Show Record Annual Gain

Fed’s ‘Maximum Employment’ Is Here; Not Everyone Has Benefited

U.S. Treasuries Off to Worst-Ever Start of the Year

Look Ahead to 2032, at the Very Least

‘I Know What the End of the World Looks Like’

Meme Stocks Meet Crypto Mania With GameStop Pursuing NFTs

Wall Street Is Using Tech Firms Like Zillow to Eat Up Starter Homes

At CES, Tech Alliances Firm Up in the Self-Driving Car Wars

Mortgage Rates Surge. It’s Just the Beginning

After Two Weeks of Flight Cancellations, Airlines Assess What Went Wrong

That $1,000 Bourbon You Bought May Be a Phony

Coca-Cola’s Fresca to Join Crowd of Canned Cocktails

Apple CEO Tim Cook Received Nearly $100 Million in Compensation in 2021

Be sure to follow me on Twitter.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His