-

Guess Who’s on Twitter?

Posted by Eddy Elfenbein on March 18th, 2009 at 1:59 pmBernie Madoff! Well, not really but it is funny.

(Via: Barry.) -

FOMC Announcement

Posted by Eddy Elfenbein on March 18th, 2009 at 1:58 pmWhat do you do at the top of a Treasury bubble? Buy!

Information received since the Federal Open Market Committee met in January indicates that the economy continues to contract. Job losses, declining equity and housing wealth, and tight credit conditions have weighed on consumer sentiment and spending. Weaker sales prospects and difficulties in obtaining credit have led businesses to cut back on inventories and fixed investment. U.S. exports have slumped as a number of major trading partners have also fallen into recession. Although the near-term economic outlook is weak, the Committee anticipates that policy actions to stabilize financial markets and institutions, together with fiscal and monetary stimulus, will contribute to a gradual resumption of sustainable economic growth.

In light of increasing economic slack here and abroad, the Committee expects that inflation will remain subdued. Moreover, the Committee sees some risk that inflation could persist for a time below rates that best foster economic growth and price stability in the longer term.

In these circumstances, the Federal Reserve will employ all available tools to promote economic recovery and to preserve price stability. The Committee will maintain the target range for the federal funds rate at 0 to 1/4 percent and anticipates that economic conditions are likely to warrant exceptionally low levels of the federal funds rate for an extended period. To provide greater support to mortgage lending and housing markets, the Committee decided today to increase the size of the Federal Reserve’s balance sheet further by purchasing up to an additional $750 billion of agency mortgage-backed securities, bringing its total purchases of these securities to up to $1.25 trillion this year, and to increase its purchases of agency debt this year by up to $100 billion to a total of up to $200 billion. Moreover, to help improve conditions in private credit markets, the Committee decided to purchase up to $300 billion of longer-term Treasury securities over the next six months. The Federal Reserve has launched the Term Asset-Backed Securities Loan Facility to facilitate the extension of credit to households and small businesses and anticipates that the range of eligible collateral for this facility is likely to be expanded to include other financial assets. The Committee will continue to carefully monitor the size and composition of the Federal Reserve’s balance sheet in light of evolving financial and economic developments.

Voting for the FOMC monetary policy action were: Ben S. Bernanke, Chairman; William C. Dudley, Vice Chairman; Elizabeth A. Duke; Charles L. Evans; Donald L. Kohn; Jeffrey M. Lacker; Dennis P. Lockhart; Daniel K. Tarullo; Kevin M. Warsh; and Janet L. Yellen. -

The Prime of Mr. Nouriel Roubini

Posted by Eddy Elfenbein on March 18th, 2009 at 11:48 amPortfolio profiles Nouriel Roubini:

Not only has Roubini been a professional downer for years, his reasoning has frequently been off. He first predicted, incorrectly, that there would be a bust as a result of Hurricane Katrina, and later, again incorrectly, that the economy would tank as a result of trade imbalances. The collapse was initially triggered by subprime-credit problems, and he initially underestimated how devastating they would be. More than a few economists are convinced that Roubini’s call was less a matter of his genius and more about the simple fact that if you forecast a recession often enough, sooner or later you’ll be vindicated. “Nouriel Roubini has been singing the doom-and-gloom story for 10 years,” says Nariman Behravesh, chief economist for IHS Global Insight. “Eventually something was going to be right.”

To pick up on my earlier criticism of fixcnbc.com, the manifesto that wants CNBC to hire “people who have a track record of being right about the economic crisis.”

Not only is that wrong, it’s the opposite of what CNBC ought to do. Their assumption is that economic forecasting is similar to shooting foul shots—just get someone who’s good and don’t use someone who’s bad. Easy.

Forecasting, if it has any merits, doesn’t work that way. The type of person who’s more likely to be correct on something like the current economic mess will probably have been totally off on their previous 20 predictions. That’s both a reflection on their nature and the nature of the credit mess.

Mainstream economists are very good at relaying the conventional wisdom. But when a crisis occurs, those well-known patterns and trends often break down, and those marginal voices are more open to seeing different outcomes. Their benefit is that they’re misaligned with the rest of the crowd.

What CNBC ought to do is have a variety of commentators reflecting a broad spectrum of views. If you’re looking to purge those who were incorrect, you’ll soon run out of economists. -

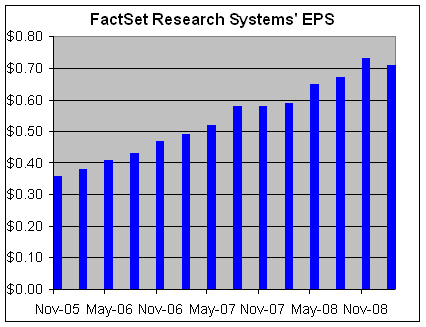

FactSet Research Systems Reports 20% EPS Growth

Posted by Eddy Elfenbein on March 18th, 2009 at 10:06 amYesterday, FactSet Research Systems (FDS) delivered solid earnings for its fiscal second-quarter. EPS came in at 71 cents, two cents more than estimates. That’s a 20% jump over the 59 cents in made in last year’s Q2. Revenue rose 11.6% to $156.5 million.

For the current quarter, FDS sees EPS coming in between 72 and 74 cents which is higher than the Street’s current consensus of 70 cents.

For the last three months, FactSet saw a net decline of just 12 clients to give them a total of 2,067 clients. The company has 38,700 users after a quarterly decline of 1,500 users.

-

The Onion: U.S. Economy Gunned Down In Gas Station Robbery

Posted by Eddy Elfenbein on March 17th, 2009 at 11:48 pm -

Why Do People Make Market Forecasts?

Posted by Eddy Elfenbein on March 17th, 2009 at 11:58 amYesterday, Joe Wiesenthal criticized the idea of Nouriel Roubini making stock market forecasts. Felix Salmon jumped to his old boss’ defense by saying that forecasts are indeed worthless, but the reasoning behind the forecasts can be very interesting.

Then why did Roubini make a forecast in the first place? His audience just expected it? Hmmm. I think I have an answer and it’s not a complicated one.

The dirty secret is that stock market forecasts are fun.

It’s odd that people ignore this basic insight. Markets are a lot of fun. Sure, every serious person is seriously concerned over market forecasts because they’re not serious. Still, people do it anyway. Why? It’s damn fun.

The worst moment of Stewart V Cramer was Stewart saying that finance isn’t a “game.” Oh please! Cramer may deliver his advice in a clownish way, but the advice is serious (in his mind). The thing I hate about Jon Stewart is that he combines too much self-righteousness while being too little informed. The two reinforce each other. Stewartism is really an invitation to ignorance. As long as you have that smug, knowing attitude, who needs to actually understand the issues?

Finance is and has always been a game. I’ve noticed that over the past few years the look of ESPN and CNBC has become steadily similar. That’s not an accident. They’re both graphics heavy, fast-moving, male-oriented and a datanaut’s dream. Heck, the indexes are nothing but a scoreboard. All that’s missing is Gary Glitter blasting away.

Picking stocks and seeing which way the markets go every day is one of the best things about investing. You get to pick a thesis and see if you’re right in real time, and you can make money while doing so. Look, we’re not allowed to do anything anymore. The country has been reduced to be a bunch trans-fat-less, non-smoking, Happy Holidays ninnies walking through airports in our socks. Don’t take this one simple pleasure from us.

I always enjoyed telling a client that the stock they bought last week at $20 is now at $28. That’s an amazing feeling. You made money with your money. I often hear people, professors especially, say that indexing is the only way to invest. Dear lord, these people can take the sex out of anything. They tell us that it’s impossible to beat the market consistently (curiously, they leave out the other side of the argument which is it should be impossible to lose to the market as well).

Put aside the arguments for or against EMT, people will still try to beat the market because it’s a frickin’ blast. I would even argue that the amount that would be lost versus the market is more than made up for by the participant’s enjoyment factor. There’s also no reason to buy a luxury car. That’s a complete waste of money yet people do it. I won’t judge them. If they enjoy it, good for them. The amount of money wasted on a luxury car probably exceeds what many folks would suffer by not indexing, assuming it would cost them anything.

Have you ever shorted some worthless stock and had it pay off? Man, that’s a great feeling. Who needs heroin when you have Advanced Micro?

In his book, An American Hedge Fund, Tim Sykes talks about how exciting he found the stock market while he was in college. Soon, his investing activities overwhelmed his college activities. Of course it’s addictive because it’s fun. Trading or forecasts aren’t harming people. Investing and risk-taking is good for a society. Obviously people should know what they’re getting into, but that’s why I started this blog.

I’ll leave it to the professional worriers to grand-stand over the rollicking style of finance. But I’m having a blast. -

Happy St. Patrick’s Day

Posted by Eddy Elfenbein on March 17th, 2009 at 6:42 am -

Just Say No to College

Posted by Eddy Elfenbein on March 16th, 2009 at 5:07 pmThis past weekend’s episode of This American Life had an interesting vignette (Act One). One of the NPR guys was upset that his cousin DJ had dropped out of college. He was trying to change DJ’s mind so he called one of his friends, a labor economist at Georgetown, to speak with DJ.

After talking with him, the professor did something very refreshing. She took DJ’s side.

For many Americans, college is a raw deal. I find it amazing that so many young people are forced to take on huge amounts of debt and get so little in return. -

FixCNBC.com

Posted by Eddy Elfenbein on March 16th, 2009 at 4:52 pmThe liberal group Media Matters for America has a new website up, fixcnbc.com, which is demanding changes at CNBC.

You screwed up badly. Don’t apologize – fix it!

CNBC should publicly declare that its new overriding mission will be responsible journalism that holds Wall Street accountable. As a down payment, we ask you to hire some new economic voices – people who have a track record of being right about the economic crisis and holding Wall Street executives’ feet to the fire.Oh boy. Neither CNBC nor Jim Cramer are responsible for the credit crisis. If you think they are, then you don’t understand the crisis.

The idea that they need to hire “people who have a track record of being right about the economic crisis” is laughable. No economist predicted what happened because no economist could have predicted it. Some people got parts of it right, but were way off on many, many other aspects. And being right on one prediction doesn’t mean much about your next prediction.

One more thing. You can only ask for a down payment if you own something and someone else wants to buy it. Ironically, it was people who didn’t understand the concept of a down payment that Media Matters should be upset with. They can blame themselves. -

Guess How Many Building Permits Massachusetts Issued in January?

Posted by Eddy Elfenbein on March 16th, 2009 at 4:28 pmOne.

The sharp downturn has ended a prolonged building boom that was fueled by easy credit and a strong housing market. Now, constraints on lending are preventing developers from getting money to start work. In January, one building permit was issued in Massachusetts for a residential complex with five or more units, according government housing data. Homeowners are also feeling the pinch, delaying renovations and other odd jobs that have helped sustain construction workers during previous downturns.

Something tells me that despite less work, the government agency wasn’t downsized.

(Via: Blodget).

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His