-

It Could Be Worse

Posted by Eddy Elfenbein on March 12th, 2009 at 10:39 pmNovember 24, 2008

Russian analyst predicts decline and breakup of U.S.

March 12, 2009

Chuck Norris: “I May Run For President of Texas” -

Bernie Goes Down, Market Goes Up

Posted by Eddy Elfenbein on March 12th, 2009 at 11:47 amSo we’re rallying on Bernie’s plea? Or maybe it’s one of those correlation/causation things I’ve read about.

I guess Bernie should have pleaded guilty several thousand points ago. If only someone had informed the Feds.

Esquire gives us a preview of Bernie’s new digs. -

So Long Risk Premium

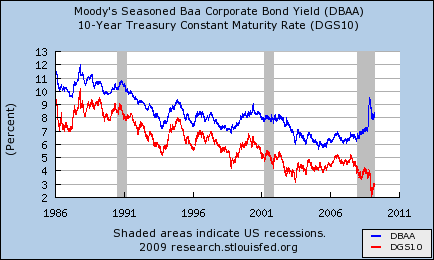

Posted by Eddy Elfenbein on March 12th, 2009 at 11:33 amBloomberg reports that long-term government bonds have outperformed the stock market over the last 30 years. The article quotes Douglas Cliggott, “Over the last 30 years there’s been no risk premium.”

Technically, the most common reference to the risk premium is stocks versus short-term T-bills. The problem is that the market isn’t that cheap when looking at long-term corporate yields (it’s not expensive either). What’s happened is that the spread between government and corporate debt has widened pretty dramatically.

The graph above shows the 10-year yield versus BAA debt. Clearly, folks have moved strongly away from risky assets. It’s not so much that the risk premium is gone, it’s that we’re in a T-bond bubble. -

Good Retail News

Posted by Eddy Elfenbein on March 12th, 2009 at 10:58 amThere was actually good news in retail sales. Good, not great. Retail sales for February dropped by 0.1% last month which was slightly better than what analysts were expecting. The best news came from the revisions for January. That number was revised higher to 1.8% from the original 1.0%. It’s not great but let’s hope this trend lasts.

Interestingly, if you exclude car sales from the February numbers, then retail sales rose by 0.7% -

Bernie Goes Down

Posted by Eddy Elfenbein on March 12th, 2009 at 9:49 amDisgraced financier Bernard Madoff entered federal court in lower Manhattan this morning and pleaded guilty to all 11 felony charges lodged against him in involving one of the largest Wall Street Ponzi schemes ever.

He will now face the wrath of many of the investors who say he ripped them off to the tune of $50 billion dollars, as they will speak in court. The 70-year-old Madoff now faces a maximum prison term of 150 years.

Victims of the one-time Nasdaq chairman and one of Wall Street’s elite had been gathering at the courthouse as early as 8 a.m. Those alleged to be cheated by Madoff lost their life’s fortunes, charities lost their investments, school trusts were blown and at least two investors took their own lives.

The question now is whether Madoff will go right to jail or will he remain out on bail under house arrest in his $7 million Manhattan penthouse to await sentencing. Most victims, as expected, prefer the former.See ya in 2159, Bernie.

-

Past Marchs and the Market

Posted by Eddy Elfenbein on March 10th, 2009 at 12:44 pmIt was six years ago tomorrow that the S&P 500 closed at its then low point of 800.73. Five months earlier there was an even lower low on October 9. The market’s high in 2007 also came on October 9.

It was on March 10, 2000 that the NASDAQ reached its highest close of 5,048.62. -

Picking a Bottom

Posted by Eddy Elfenbein on March 10th, 2009 at 11:25 amS&P recently said that the S&P 500 will have a slight earnings loss for the fourth quarter of 2008. This is the first loss ever for the index. However, AIG’s gigantic $62 billion loss knocks out $5.13 on operating earnings, so the other 499 made a small gain.

I’ve seen a lot of folks throw out numbers for a bottom in the S&P. Nouriel Roubini, for example, sees earnings for the index coming in at $50 for 2009. Using a multiple of 12, he places a target of 600 for the S&P. I agree on the $50 a share for earnings, but I’m inclined to see a higher multiple simply because that level of earnings would (hopefully) mark a trough. -

Gasparino Interviews Cayne

Posted by Eddy Elfenbein on March 9th, 2009 at 2:12 pmThe G-Man lands an interview with Jimmy Cayne. If there’s a line on swear words, I’m taking the over:

I have to admit I’ve always liked Jimmy Cayne. I’ve always found him informed, charming, and really funny—he reminded me recently of the time he and I were in the Four Seasons restaurant at a party for the GOP convention and he spotted Al Franken and told him that Bill O’Reilly crushed him when the two debated face-to-face. “Remember me saying to Franken, ‘Hey you laid down. He made you look like an asshole.’”

It’s a good interview. I’m looking forward to Charlie’s book, The Sellout.

-

A Rise In Used Car Prices

Posted by Eddy Elfenbein on March 8th, 2009 at 10:42 pmJohn Hempton eyes one tiny spec of good news in the Fed’s Beige Book:

…the used car business is holding up surprisingly well. This was mentioned in the Federal Reserve’s Beige Book – but also in the Manheim index of used car prices at auction. This index spiked up last month!

The biggest single determinant of losses in a subprime auto finance book is not loss rate – it is severity – the loss after the car is auctioned. I am not about to buy non distressed auto securitisations or anything – but if you want to play in the distressed stuff this is clearly good news.Hopefully, this is good news for companies like Nicholas Financial (NICK). That stock got knocked around hard last week. On successive days, the shares ranged from $1.80 to $2.71.

-

Satuday Night Live Takes a Look at the Banking Crisis

Posted by Eddy Elfenbein on March 8th, 2009 at 10:37 pm

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His