-

Citigroup Is About to Break the Buck

Posted by Eddy Elfenbein on March 5th, 2009 at 10:27 amThe stock got down to as low as $1.02 today. Not too long ago, the company used to earn about that amount each quarter.

-

Cowboys Cut Terrell Owens

Posted by Eddy Elfenbein on March 5th, 2009 at 7:57 am

The Dallas Cowboys have cut wide receiver Terrell Owens. I mention this because I believe I’m the first person to document TO-related events to the stock market:December 7, 1973: Owens born in Alabama. Dow rises 3% to 838.05.

October 14, 2002: Sharpie Incident. Dow rises 27 points to 7,877.40.

November 15, 2004: Desperate Housewives Incident. Dow rises 11 to 10,550.24.

September 27, 2006: Owens denies suicide attempt. Dow rises 20 points to 34 points shy of an all-time high.I’m guessing being cut is a bullish event but I’m honestly not sure.

-

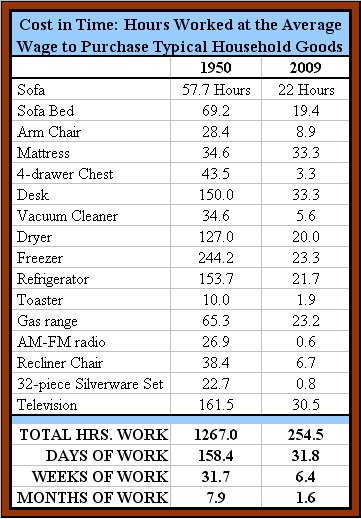

The True Measure of Inflation

Posted by Eddy Elfenbein on March 4th, 2009 at 11:37 pmMark J. Perry, a professor at Michigan, has a fascinating chart I’ve added below. It shows the truest measure of inflation—how much time it takes to buy certain items. By this measurement, most consumer goods are dramatically cheaper than they were 60 years ago.

I would add that this as dramatic as this chart is, it probably understates the case of deflation because it doesn’t adjust for the dramatic rise in quality. -

Jimmy Cayne on Geithner

Posted by Eddy Elfenbein on March 4th, 2009 at 11:16 pmThe former CEO of Bear Stearns opines on Tim Geithner:

The audacity of that p—k in front of the American people announcing he was deciding whether or not a firm of this stature and this whatever was good enough to get a loan,” he said. “Like he was the determining factor, and it’s like a flea on his back, floating down underneath the Golden Gate Bridge, getting a h–d-on, saying, ‘Raise the bridge.’ This guy thinks he’s got a big d–k. He’s got nothing, except maybe a boyfriend. I’m not a good enemy. I’m a very bad enemy. But certain things really—that bothered me plenty. It’s just that for some clerk to make a decision based on what, your own personal feeling about whether or not they’re a good credit? Who the f–k asked you? You’re not an elected officer. You’re a clerk. Believe me, you’re a clerk. I want to open up on this f—-r, that’s all I can tell you.

This vaguely reminds me something but I can’t quite place it.

Willard: They told me that you had gone totally insane, and that your methods were unsound.

Kurtz: Are my methods unsound?

Willard: I don’t see any method at all, sir.

Kurtz: I expected someone like you. What did you expect? Are you an assassin?

Willard: I’m a soldier.

Kurtz: You’re neither. You’re an errand boy, sent by grocery clerks, to collect a bill. -

Dennis Kneale as Dexter?

Posted by Eddy Elfenbein on March 4th, 2009 at 7:34 pmThe Reformed Broker gives us CNBC Separated at Birth?

BTW, Ron Insana is the best. -

Obama Says Buy!

Posted by Eddy Elfenbein on March 3rd, 2009 at 7:47 pm“What you’re now seeing is profit and earning ratios are starting to get to the point where buying stocks is a potentially good deal if you’ve got a long-term perspective on it.”

The president later failed to mention what business school he didn’t attend.

-

Investor Quiz: Guess What’s Down for 11 of the Past 12 Sessions?

Posted by Eddy Elfenbein on March 3rd, 2009 at 7:00 pmI’ll give you a hint: It begins with S&P and ends with 500.

Give up?

The last time this happened was May 8 to 24, 1984.

The mega-bear market that ended in 1982 finished with 14 down days in 15 sessions. -

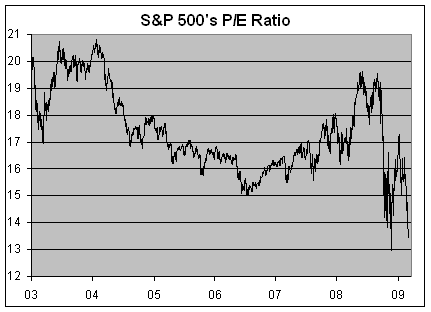

The P/E Sits Just Above November’s Low

Posted by Eddy Elfenbein on March 3rd, 2009 at 2:58 pmDespite yesterday’s unpleasantness, the market’s P/E Ratio remains a hair above the low from November. What this means is that stock prices have fallen a tiny bit less than earnings. Of course, there won’t be much of any earnings soon.

-

Ugh!

Posted by Eddy Elfenbein on March 2nd, 2009 at 6:11 pmToday was a wipeout. The S&P 500 dropped below 700 for the first time since October 28, 1996, just days before the 1996 Presidential Election. To add some perspective, Barack Obama was just 35 years old at the time. Neither of his children was even born.

The Dow dropped to 6763.29. Obviously, traders were glued to this site since the Dow closed within inches of the Fibonacci number 6765. -

Since September the Dow Utilities are Up 118%!

Posted by Eddy Elfenbein on March 2nd, 2009 at 2:40 pmBy September, I meant the one in 1929.

-

-

Archives

- June 2025

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His