-

Michael Moore’s Curious Economics

Posted by Eddy Elfenbein on December 4th, 2008 at 12:34 pmAt the Huffington Post, Michael Moore writes:

Of course, the auto magnates used be the Masters who ruled the world. They were the pulsating hub that all other industries — steel, oil, cement contractors — served. Fifty-five years ago, the president of GM sat on that same Capitol Hill and bluntly told Congress, what’s good for General Motors is good for the country. Because, you see, in their minds, GM WAS the country.

This is the myth that refuses to die. Charles Wilson was the head of General Motors in the 1950s when President Eisenhower selected him to be the Secretary of Defense. During his confirmation hearings, Wilson was asked if he could make a decision against of the interest of General Motors. He said he could but he could think of such a situation “because for years I thought what was good for the country was good for General Motors and vice versa.”

Ever since, this humble statement of dedication to public service has been twisted into sounding like some statement of Nietzschean corporatism. Moore even has to add “bluntly” to his description.

So what’s Mike’s plan. Nationalize the car companies. I’m serious; he wants the government to buy all the outstanding stock, but he’s quick to add “None of us want government officials running a car company, but there are some very smart transportation geniuses who could be hired to do this.”

I’m a little lost of the logic here. Does he think the problem is simply poor management? If so, why is it dragging down all of the companies at once? His complaint is that the companies’ restructuring plan involves cutting jobs. Although that seems perfectly obvious to me, Moore finds it idiotic.

His plan is took nationalize the companies, turn them over to “very smart transportation geniuses,” force them to build environmentally friend cars and not lay anyone off.

Though I do agree with one part of Moore’s take: “Let me just state the obvious: Every single dollar Congress gives these three companies will be flushed right down the toilet.” -

Buy List Updates

Posted by Eddy Elfenbein on December 4th, 2008 at 10:37 amHere’s some recent news on our stocks.

Amphenol (APH) cuts fourth-quarter guidance.

Stryker (SYK) increases dividend by 21%.

Joseph A. Bank’s (JOSB) quarterly profits rise 31% and beat expectations.

Bed Bath & Beyond (BBBY) lowers Q3 outlook.

Medtronic (MDT) is sued over bone product. Here’s the company’s response.

UnitedHealth (UNH) affirms guidance. Plus their new product: Insurance that covers your insurance! -

A Healthy Democracy

Posted by Eddy Elfenbein on December 3rd, 2008 at 11:45 pmThis is stunning.

Total Democratic Presidential Votes Since 1932: 745,407,082

Total Republican Presidential Votes Since 1932: 745,297,123

Total Third-Party Presidential Votes Since 1932: 66,061,486

How’s that for parity? That’s a difference of 109,959 votes out of over 1.5 billion cast.

Here’s a spreadsheet.

Source: uselectionatlas.org -

Questions about the Wal-Mart Death

Posted by Eddy Elfenbein on December 3rd, 2008 at 4:12 pmWal-Mart is now being sued by the family of the worker who was trampled to death on Long Island. I truly hate these kinds of lawsuits but I can’t say I’m surprised.

I would like to raise an uncomfortable question. The City of New York went out of its way to block every attempt by Wal-Mart to open a store in the city which included one in Queens.

According to the Census Bureau, the village of Valley Stream is 7.5% black, while the pictures show that the crowd was heavily black. Would a store located in the neighborhood of its customers have been better able to handle a crowd? Please note: I’m not talking about race but geography.

I don’t know what the answer is, but I think it’s worth asking. I’m not convinced the anti-Wal-Mart activists helped anyone. -

100-Year Bonds

Posted by Eddy Elfenbein on December 3rd, 2008 at 12:46 pmDavid Merkel has advocated the U.S. Treasury issue longer-dated bond, as far as 100 years. It makes sense. We can be pretty sure the government will still be around in 2108. The general idea is that the more in debt you are, the longer you want your term structure to be. Fifteen years ago, Disney issued 100 year bonds, and later Ford did. Of course, I don’t know if Ford will be around in 100 years. Perhaps as a minor division of Toyota.

Now, Peter Fisher, who used to be Treasury undersecretary, has also come out in favor of a 100-year bond. Fisher was the same guy who ditched the 30-year bond a few years ago. Of course, Uncle Sam’s finances looked a lot better then. Fisher was also the guy who got calls from Bob Rubin to help out Enron when it was going under. Fisher told Rubin (correctly) that the economy would survive an Enron bankruptcy.

I could go one step further and say we need perpetuities—bonds that never mature. The Brits call these consol bonds. Mathematically, there’s something I like about perpetuities. You can ditch the complex YTM formula and simply divide the coupon by the current price of the bond. -

Big Three Seek $34 Billion Aid

Posted by Eddy Elfenbein on December 3rd, 2008 at 10:44 amDetroit’s plan for survival includes a lot of our money:

Detroit’s Big Three auto makers presented turnaround plans to Congress on Tuesday that indicate both General Motors Corp. and Chrysler LLC could collapse by the end of the month unless they get billions of dollars in emergency government loans.

As part of a renewed bid for a bailout, GM said it needs an immediate injection of $4 billion to stay afloat until the end of the year, a fact it hadn’t before disclosed. In total, the company said it needs $18 billion in loans — $6 billion more than it said it would need just two weeks ago.

Chrysler’s 14-page summary of its presentation to Congress requests $7 billion, and it said it needs the funds by Dec. 31. Chrysler also wants $6 billion from a Department of Energy program aimed at promoting fuel-efficient vehicles.

Ford Motor Co. seeks a $9 billion line of credit from the government, though it adds it may not need to tap it. In addition, Ford wants $5 billion from the Energy Department program.

All three makers said they will consolidate operations and accelerate production of higher-mileage vehicles. In addition, GM and Ford plan to trim their brands.I’m not political strategist, but I don’t see how a bailout could pass. The financial bailout was a special situation. But here, the car companies are just going broke.

-

Time to Ditch the Extra-Point?

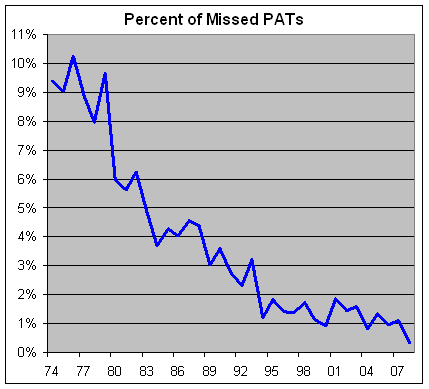

Posted by Eddy Elfenbein on December 2nd, 2008 at 10:23 pmExtra-points are getting out of hand this year. The PAT success rate is normally very high, but this year it’s reaching absurd levels. Through week 13, only 3 extra-point attempts failed out of 884 tries. That’s a success rate of 99.66%. Sheesh, that’s even higher than Ivory Soap.

Sorry, but anything that consistent isn’t a game anymore. To put it in context, the number of missed PATs is down by about 90% from 20 years ago. Remember, football is a game. That means it’s supposed to be, you know, fun to watch. Well, 99.66% ain’t fun to watch. It’s a mockery of sports. The PAT has become a useless play that could only cause injuries.

So should we just get rid of it? Nah, it’s been around forever, so let’s try modifying it.

How about moving the extra-point line back? Well, let’s look at the data. In the 20 to 29-yard range, kickers have made 203 of 206 attempts this year for a 98.54% success rate. I’m assuming that’s a median attempt of 24.5 yards, meaning the line of scrimmage is about the 7 or 8. Remarkably, that lower success rate is still higher than the league’s extra-point success rate until 15 years ago.

One idea would be to move the PAT line back to, say, the 10-yard line. Of course, that would make a two-point conversion much harder. The problem is that the 2-point conversion already can’t compete from the 2-yard line. The success rate runs at 44% which makes it inefficient compared to the 1-point try. The 2 is only used when it has to be. (Do the one- and two-point attempts have to take place at the same place? Hmmm. For simplicity’s sake, I’d say yes).

Here’s a look at the percent of missed PATs going back to 1974 when the NFL moved the goalposts to the back of the endzone. I should note that there have been some rule changes. For example, running “leaps” by the defense were banned in 1984. Cool to watch but probably a bit dangerous.

The rule change I’d support wouldn’t be to move the extra-point line back, but moving it in a little bit. Perhaps to the one-yard line, or maybe the four- or five-foot line. That would make the 2-point try more competitive while having no impact on the 1-point try. Just like in economics, it’s all about incentives.

Update: Brian Burke has more. He says to narrow the goal posts.

-

Hoofy and Boo Win an Emmy

Posted by Eddy Elfenbein on December 2nd, 2008 at 10:10 pmCongratulations to everyone at Minyanville:

Minyanville Media, the fast growing financial information and entertainment company, today won a Business and Financial Reporting Emmy for its animated news show “Minyanville’s World in Review with Hoofy and Boo.”

The show was honored by The National Academy of Television Arts and Sciences, in the New Approaches to Financial Reporting category for its groundbreaking weekly show starring the animated icons of finance, Hoofy the Bull and Boo the Bear.

“It is a humbling honor for us, to be recognized as a leader of business news reporting,” said Minyanville Founder and CEO Todd Harrison. “We continue to do our part in helping narrow the gap between what people know about managing their money and what they need to know,” he added. -

Victoria Secret Model Gets all Pottymouth on CNBC

Posted by Eddy Elfenbein on December 2nd, 2008 at 3:35 pmSorry for the commercial intro. The clip starts at 16 seconds.

Here’s the clip with Victoria Secret’s CEO. Later, Michelle Caruso Cabrera asks who “did the lovely tease for us.” -

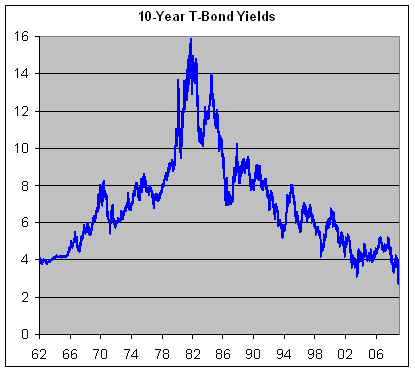

10-Year Yield Drops to 50-Year Low

Posted by Eddy Elfenbein on December 2nd, 2008 at 12:49 pmThe yield on the 10-year Treasury fell below 2.7%. That’s lowest on the daily records which go back to 1962. The monthly records go back further so it’s the lowest since 1955.

With the S&P 500 currently around 845, this means that index only needs to get to 1073 over the next ten years to beat the Treasury bond. That doesn’t include dividends and the yield on stocks may be higher than 2.7%. (Some in the media have said that the S&P’s yield is already above long-term Treasuries, but I’d rather see how dividend payouts fare in the coming months before I’d say it’s true.)

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His