-

What If There Was a Recession and Nobody Came?

Posted by Eddy Elfenbein on August 29th, 2008 at 11:42 amFrom today’s IBD:

We keep looking for the much-anticipated recession, but it doesn’t seem to have gotten here yet. Could it be that many of those expecting a downturn were wrong, and the economy’s not going into the tank?

Going out on a limb to predict what the economy will do is a tricky business. It’s possible, though by no means likely, that the economy briefly lapsed into recession late last year or early this year, based on weak GDP data, falling home sales, rising oil prices and a jump in unemployment. We won’t know for sure until months — maybe years — after it ends.

Even so, we were struck by Thursday’s news that second-quarter GDP was revised up from 1.9% to 3.3%, more in line with boom than bust. The consensus estimate was for 2.7% growth.

As more than one economist has noted, nearly all of that growth — some 3.1% of it — came from stronger exports, a result of the weak dollar. The rest came from inventories. Take those away, and the economy crawled at a weak 0.2% pace for the quarter.

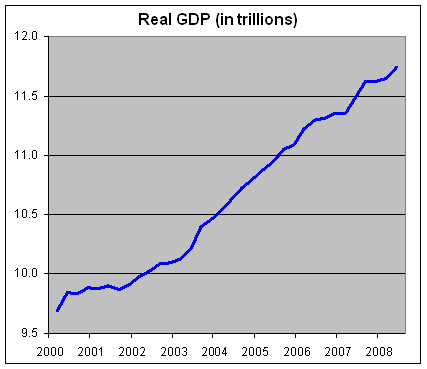

Fair enough. But we did our own calculations. The slowdown in the economy is mainly due to one thing: housing. We indexed overall GDP to housing GDP back to 2000.

As the chart shows, it’s a very stark picture. We crunched even more numbers. Since 2006, the economy minus the ailing housing sector has grown at an average 3.3% rate. Add housing back in, and GDP growth has averaged just 2.4%. So housing’s collapse has cost us roughly 1% of GDP.

Housing is still weak, with sales off 35% year over year and values depreciating at double-digit rates. Banks can’t boost lending much, since they’re writing off old loans and have to shrink capital. This will take time.

But listening to the media and the Democrats in Denver, you’d think the economy was in a depression. Well, it’s not. In fact, we’re modestly optimistic. By the end of this year, all the really bad year-to-year comparisons in growth will be over. Sales and prices will start to look more normal. And the panic will leave the market.

As noted, exports have supported the economy this year. To critics, a stronger dollar means export growth will slow. Maybe so. But falling oil prices mean our import tab will also drop.

Moreover, oil demand now is falling. The Energy Department recently reported a shocking statistic that got little attention: U.S. demand in June plummeted 1.17 million barrels a day from last year, and a spokesman said prices could fall below $100 a barrel due to rising output in the U.S., Brazil and Canada.

Other data also suggest grounds for optimism. Just this week, the Census Department reported median household income hit $50,233 in 2007, after inflation, a gain of 1.6% since 2001.

Despite the slowdown in growth, the number of people without health insurance fell one million last year, while the poverty rate was unchanged at 12.5% of the population. And believe it or not, the average unemployment and poverty rates under President Bush have been slightly lower than under President Clinton.

Sure, bad things can happen. But we don’t have to will them into existence. As it stands, the much anticipated recession — thanks to Bush’s tax cuts and timely Fed actions — might just be a no-show. -

My Boldest Prediction Yet

Posted by Eddy Elfenbein on August 28th, 2008 at 10:22 amWrite down this time and day, and note that I’m calling a bottom in Pakistan’s stock market.

In other news, Pakistan has barred stocks from trading below yesterday’s close.

One more prediction, this won’t end well.

(Via: Birthday Boy Joseph Weisenthal). -

Latest Phony Concern: Delistings “Pinching” Exchanges

Posted by Eddy Elfenbein on August 28th, 2008 at 10:08 amOne of things I enjoy about the financial media is finding stories that are negative no matter what the outcome is. For example, you’re read a story about “red lining” and how banks are shutting out lower-income borrowers. Then a few years later, you’ll read a story about “predatory lending,” and how banks are taking advantage of lower-income borrowers. The completely contradict each other, but end results is always bad news. Or worse, it “raises concerns.” One day I hope to write a book, ” How Media Alarmism is Killing Our Children.”

If you want to be taken seriously as an economic analyst or policy maker, you need to spend much of your day being “worried” and/or “concerned.” You don’t have to do anything. Just say that this latest development “raises troubling questions.” (See Bernanke Warns.)

Probably the classic example is the worry of corporate consolidation and mega-mergers seamlessly turns into a worry about junk IPOs. I would think you can worry about one of these, but not both. Apparently the latest concern is a wave of stock delistings:The combination of more delistings and fewer new listings has pinched the big U.S. exchange operators, as the financial meltdown topples some of their clients and spooks others.

Midway through this year, more companies than in previous years had been bumped from the Nasdaq Stock Market and, to a lesser extent, from the New York Stock Exchange because they failed to meet the minimum requirements.

Meanwhile, tumbling stock markets have brought the IPO market to a crawl, compounding the pain for Nasdaq OMX Group and NYSE Euronext, which derive up to 15 percent of their overall revenue from listing fees.

“It’s a negative” for the exchanges, said Ed Ditmire, analyst at Fox-Pitt Kelton. “But it ebbs and flows with the economic cycle.”

More Nasdaq-listed companies have been delisted for non-compliance so far this year than in either of the previous two years, according to Nasdaq data. Some 54 stocks were bumped as of Aug. 7, compared to 48 in all of last year and 52 in 2006.

At larger rival NYSE, data show 11 companies had been delisted due to non-compliance as of July 1. That compares to 21 delistings in all of last year and 14 in 2006.Let me get this right: A growing wave of delistings is 11 for the first half of this year compared with 21 for all of last year?

-

Q2 GDP Revised to 3.3%

Posted by Eddy Elfenbein on August 28th, 2008 at 9:30 amThe government just revised second-quarter GDP to 3.3% from the original 1.9%. That’s a pretty hefty increase.

Record exports and the temporary stimulus from the tax rebates prevented the economy from stalling as housing slumped and companies cut expenditures. Consumer spending is now waning and slower growth abroad dims the outlook for foreign sales, signaling last quarter will be the year’s highpoint.

“Outside of trade, the economy is considerably weaker,” said Carl Riccadonna, an economist at Deutsche Bank Securities Inc. in New York. “When you look at the spending, it looks terrible for the second half of the year.”I’m not too interested in the debate of, “are we or are we not in a recession.” Consider, however, a few facts.

Imports have now declined for three straight quarters, and four of the last five.

Fixed investment has declined for four straight quarters.

Residential investment has fallen for 10 straight quarters.

-

FDIC May Tap Treasury

Posted by Eddy Elfenbein on August 28th, 2008 at 8:37 amThe FDIC is designed to protect investors’ deposits up to $100,000. The FDIC’s fund currently has $45.2 billion which insures about $4.5 trillion.

Sooo…who protects the FDIC? If you said “the taxpayer,” congratulations, you can move to the head of the class.Federal Deposit Insurance Corp. Chairman Sheila Bair said Tuesday her agency might have to borrow money from the Treasury Department to see it through an expected wave of bank failures.

Ms. Bair said the borrowing could be needed to cover short-term cash-flow pressures caused by reimbursing depositors immediately after the failure of a bank. The borrowed money would be repaid once the assets of that failed bank are sold.

The last time the FDIC borrowed funds from Treasury came at the tail end of the savings-and-loan crisis in the early 1990s after thousands of banks were shuttered. That the agency is considering the option again, after the collapse of just nine banks this year, illustrates the concern among Washington regulators about the weakness of the U.S. banking system in the wake of the credit crisis.

“I would not rule out the possibility that at some point we may need to tap into [short-term] lines of credit with the Treasury for working capital, not to cover our losses, but just for short-term liquidity purposes,” Ms. Bair said in an interview. Ms. Bair said such a scenario was unlikely in the “near term.”

She said she did not expect the FDIC to take the more dramatic step of tapping a separate $30 billion credit line with Treasury, which has never been used.

The FDIC said Tuesday its “problem” list of banks at risk of failure had grown to 117 at the end of June, compared with 90 at the end of March.

The FDIC’s deposit insurance fund reimburses depositors who lost money in a bank failure, typically up to $100,000. The fund’s balance fell in the second quarter to $45.2 billion. That is just 1.01% of all insured deposits, low by historical standards.Here’s the key table in the FDIC’s report.

-

An Interest Rate What?

Posted by Eddy Elfenbein on August 27th, 2008 at 2:49 pm -

Citigroup to Cut Costs

Posted by Eddy Elfenbein on August 27th, 2008 at 1:20 pmFrom Bloomberg:

Citigroup Inc., the biggest U.S. bank by assets, banned off-site meetings among investment- banking employees and cut back on color photocopying to reduce expenses as revenue declines.

Just to be clear, according to their most recent 10-Q, Citi has assets of $2.1 trillion.

-

The Best Central Banker in the World Today

Posted by Eddy Elfenbein on August 27th, 2008 at 11:58 amImagine a country whose central bank responded to growing inflation by raising interest rates, strengthening the currency and trying to win investor confidence. This may be shocking to some U.S. investors, but proper monetary policy is still being practiced. Just not here in the United States. I’d give the award for Best Central Banker in the World Today to Mexico’s Guillermo Ortiz.

This is a story that truly ought to be better known. Mr. Ortiz has now been at the helm of the Mexican central bank for over ten years and despite many obstacles (consider that 70% of Mexicans don’t even use banks), he’s emerged as the anti-Greenspan. Mr. Ortiz previously served Finance Minister where he helped clean up the mess surrounding the peso devaluation in 1994.

What impresses me about Oritz, who earned has a Ph.D. from Stanford, is that he’s made it unequivocally clear that the Banco de Mexico (or Banxico) intends to fight inflation until its wins. In the last three months, the bank has raised rates three times. Interest rates now stand at 8.25%, an amazing 625 basis points higher than in the U.S. even though inflation rates are roughly similar.

Make no mistake; the Mexican economy has its share of problems. Growth is slowing and inflation is on the rise. Of course, much of this is understandable considering their raucous, hung-over neighbors to the north—nearly 80% of Mexico’s exports go to the U.S. Still, my money’s on Ortiz. He’s even had the chutzpah to criticize our monetary policy as being “very lax.” Don’t expect to hear anything like that from Senators McCain or Obama.

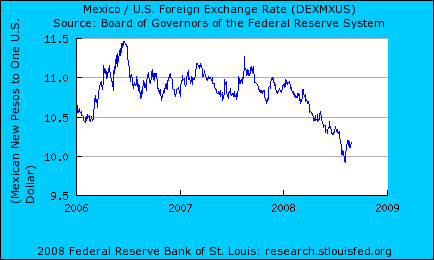

And what about that hopeless currency, the peso? Well, it’s on a roll this year. The peso is already up 7.5% for the year and earlier this month, it reached a six-year high. In my opinion, the rate gap between the U.S. and Mexico will only grow. The futures market seems certain that the Fed will hold steady for the rest of the year, but I think Banxico could very well raise rates again. Their next meeting is on September 19.

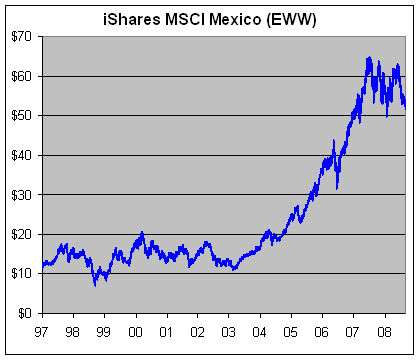

The most recent report for Mexican GDP showed that Q2 growth came in at 2.8%, which isn’t horrible but it was below expectations. The economy isn’t so fragile as to ward off monetary tightening. Retail sales are weak and the stock market is still hurting—the Bolsa is at a seven-month low. Of course, that comes on the heels of an enormous rally so some consolidation would be expected. Consider that shares of EWW, the Mexican ETF, more than quadrupled in five years.

What’s really hurting the economy is that less money is being sent home from workers living abroad. And by abroad, you can probably guess what country I mean. Speaking of which, Ortiz also favors, sit down for this one, stricter immigration controls in the U.S. so Mexico can hold on to its workers. Ortiz said, “I think Mexico needs its people. It would be best to keep its people in Mexico, and it would give incentives for Mexico to create the jobs that are needed.” Increíble!

I’m guessing Ortiz has some sympathy for Hank Paulson. When the Mexican financial system imploded, Ortiz was called into to clean up the mess. Paulson certainly has a tough task, but look at what Ortiz was facing—inflation reached 52% and investment fell by one-fourth. Thing got so bad that the former president basically can’t show his face Mexico and he’s been exiled to Ireland. By contrast, Senor Greenspan now works at Pimco! Thanks to Ortiz, Mexico righted itself and paid back its bailout money to the United States. In fact, Uncle Sam made a half-billion dollar profit.

The thing about finance, public or private, is that it’s really an issue of establishing confidence. If investors think you’re serious, then they’ll invest with you. So far, Ortiz seems to winning the battle of establishing credibility. The yield on Mexico’s long-term benchmark bond recently fell to its lowest level since June 6.

Mexico is a country with many deep rooted economic problems, however, the country has taken many steps in the right direction. For example, the election of the pro-market government of Felipe Calderon (cue Larry Kudlow) is helping to bring long-overdue economic reforms like privatizing the oil industry. Unfortunately, Calderon supports some poorly considered ideas like price controls. Unlike the United States, the Mexican government seems to be serious about fiscal discipline. Their legislature…er, not so much. One issue in particular that Ortiz wants addressed is reducing the government’s fuel subsidies. Good luck with that one, but at least he’s trying. (Incidentally, Ortiz wants to reduce the subsidies even though he thinks that will increase inflation in the near-term.)

The government recently announced that its current account deficit widen to over $2 billion which came as a shock to economists who were expecting a shortfall of $750 million. The trade deficit declined but that was helped by the increase in oil prices. The Mexican economy faces several significant challenges ahead. Most importantly, inflation is simply too high. But I think Ortiz realizes the difficulties and his current policies will help Mexico be well-prepared for the future. -

Looking at China’s Savings

Posted by Eddy Elfenbein on August 26th, 2008 at 9:45 amJohn Hempton at Bronte Capital has a novel explanation for China’s stratospheric savings rate. He says it’s due to their one-child policy. In any pre-Industrial economy, you’re retirement savings plan was very simple, you had children. Now you can’t so to compensate, you save, save, save. Hempton’s reckons “that the average Chinese person is saving maybe 46 percent of their income”.

This is an issue for us in the West because, as the theory goes, all that savings needs to be invested somewhere. And there’s simply too much money lying around, sooner or later it will go into dumb areas. Today, we’re at the later part. Hempton writes:My thesis – which will be expanded in future posts is that the brokers have become the intermediaries between this endless demand for products to save in (China, Petrodollars etc) and the endless willingness of the profligate in the West to spend. What they do is – through their trading, their securitisation and through other things they turn the complex financial instruments of the West (mostly but not entirely debt) into vanilla instruments that the Chinese and petrodollars want to buy.

In the Telegraph, Ambrose Evans-Pritchard notes a study by HSBC which claims that China is forcing its banks to buy dollars. In effect, the Chinese Fed is using its banking sector as a way to intervene in the currency markets.

Beijing has raised the reserve requirement for banks five times since March, quickening the pace with two half-point rises in late June.

This is having major spill-over effects into the currency markets because banks in China have been required over the last year to hold extra reserves in dollars rather than yuan. The latest moves have lifted the mandatory deposit from 15pc to 17.5pc of total lending since March.

“China has used the pretext of reserve requirement hikes to help slow yuan appreciation. We estimate that the PBOC [central bank] intervened by about $49.6bn in June,” said Daniel Hui, the bank’s Asia strategist.

Beijing has also slashed the amount of foreign debt banks operating in China can hold. The effect is to oblige the banks to become net buyers of dollars, halting the flow of foreign “hot money”. -

How Investment Banks Can Cut Costs

Posted by Eddy Elfenbein on August 26th, 2008 at 9:13 amFrom Andrew Ross Sorkin:

When Wall Street seeks to save money — “every dollar saved is a dollar made,” is the current catchphrase — it often turns to management consultants to help figure out which divisions should stay and which should go.

So McKinsey & Company published a helpful report last week on how investment banks can cut up to $2 billion in noncompensation costs. (We wouldn’t want to cut compensation, would we?)

“Initiatives to curb expenditures need not be extremely demoralizing to frontline employees,” McKinsey says, trying to find ways to save money without affecting the worker bees. So what does it recommend? Getting rid of the consultants. Yep, you read that correctly.Interesting. When Google went public, it tried to cut cost by eliminating the investment banks.

-

-

Archives

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His