-

Quote of the Day

Posted by Eddy Elfenbein on August 22nd, 2008 at 9:48 am“You always find out who’s been swimming naked when the tide goes out. We found out that Wall Street has been kind of a nudist beach,” said Buffett, who was called the world’s richest person by Forbes magazine.

-

Random Observation

Posted by Eddy Elfenbein on August 19th, 2008 at 1:04 pmIs it me or is everyday either a good day for commodities and commodity stocks and a rotten day for financials and value stocks, or an awful day for commodities and commodity stocks and a good day for financials and value stocks?

-

Flashback from 1998: NYT: Commodities’ Price Slide Victimizes Economies of Several Nations

Posted by Eddy Elfenbein on August 19th, 2008 at 11:39 amOn December 10, 1998, the price for oil reached a low of $10.72 a barrel. That was the lowest price since 1986, and it turns out, it was the beginning of a huge turnaround for the price of crude.

So the low prices were good news, right? Well, not exactly. The New York Times was able to find the downside: Market Place; Commodities’ Price Slide Victimizes Economies of Several Nations:

Victimizes?What worries analysts now is that the recent decline is a signal that prices will not turn around soon.

Matthew J. Sagers, the director of the energy service of Planecon, a consulting group specializing in the former Soviet Union and Eastern Europe, said the consensus on oil prices ”is that we are going to be here for several years.”

Mr. Brainard and other analysts argue that an extended period of lost economic growth and lower governmental revenues stemming from the drop in commodity prices will raise the pressure on many already troubled governments and economies. That could intensify investor concern and weaken currencies. To defend those currencies, central banks would have to raise their interest rates — which would mean even slower growth.

The impact on Russia, for example, has been stark. The country’s $87 billion in 1997 exports included $21.9 billion in oil, $16.4 billion in gas and $14 billion in metals — about 60 percent of the total.

But the prices of every one of these commodities have fallen sharply and are still declining. The price of platinum, for which Russia is the second major supplier, has dropped almost 12 percent just since July. The price of oil plunged 36 percent — from around $22 a barrel in October 1997 to around $14 in August — and has fallen another 23 percent, to $10.72, since November.At the time, Kofi Annan approved oil sales to Iraq for “humanitarian goods,” which apparently including several palaces for Saddam. According to a CNN article from 1998:

But Benon Sevan, executive director of the program, turned down Iraq’s request to improve its telecommunications system, saying Baghdad had not answered an October 30 letter requesting information on the subject.

Annan’s endorsement also excluded $20 million to upgrade Iraq’s banking system, a new item Baghdad had not previously discussed with the United Nations, according to a letter Sevan sent to Iraq’s outgoing U.N. ambassador Nizar Hamdoon.Mr. Sevan unfortunately couldn’t be with us today. It turns out that according to the Volcker Report, he was taking cash bribes from Saddam.

-

Medtronic Earns 72 Cents a Share

Posted by Eddy Elfenbein on August 19th, 2008 at 9:54 amThis morning, Medtronic (MDT) posted adjusted fiscal first-quarter earnings of 72 cents a share which topped Wall Street’s forecast of 69 cents a share. For last year’s Q1, the company earned an adjusted 62 cents a share, so that’s an impressive increase. Revenues rose 18.5% to $3.71 billion. Sales for its spinal biz rose 33%. Revenue outside the U.S. grew by 24% and accounted for nearly 40% of all revenue.

This is the latest is a string of good news for the company. A few weeks ago, the board increased the quarterly dividend by 50%. In May, the company said it expects earnings-per-share for 2009 to range between $2.94 and $3.02. After today’s report I wouldn’t be surprised to see that range revised higher. If Q2 earnings come in at 70 cents a share or better, than I think MDT should easily earn $3 this fiscal year.

Here’s a look at MDT’s sales and earnings for the past several quarters:

Quarter………..EPS………….Sales

Jul-01…………$0.28………..$1,455.70

Oct-01………..$0.29………..$1,571.00

Jan-02………..$0.30………..$1,592.00

Apr-02………..$0.34………..$1,792.00

Jul-02…………$0.32………..$1,713.90

Oct-02………..$0.34………..$1,891.00

Jan-03………..$0.35………..$1,912.50

Apr-03………..$0.40………..$2,148.00

Jul-03…………$0.37………..$2,064.20

Oct-03………..$0.39………..$2,163.80

Jan-04………..$0.40………..$2,193.80

Apr-04………..$0.48………..$2,665.40

Jul-04…………$0.43………..$2,346.10

Oct-04………..$0.44………..$2,399.80

Jan-05………..$0.46………..$2,530.70

Apr-05………..$0.53………..$2,778.00

Jul-05…………$0.50………..$2,690.40

Oct-05………..$0.54………..$2,765.40

Jan-06………..$0.55………..$2,769.50

Apr-06………..$0.62………..$3,066.70

Jul-06…………$0.55………..$2,897.00

Oct-06………..$0.59………..$3,075.00

Jan-07………..$0.61………..$3,048.00

Apr-07………..$0.66………..$3,280.00

Jul-07…………$0.62………..$3.127.00

Oct-07………..$0.58………..$3,124.00

Jan-08………..$0.63………..$3,405.00

Apr-08………..$0.78………..$3,860.00

Jul-08…………$0.72………..$3.706.00 -

PPI Rises at Fastest Rate Since 1981

Posted by Eddy Elfenbein on August 19th, 2008 at 9:29 amAh, it seems like old times. Not only is the Cold War coming back, but today’s report on producer prices indicates that wholesale inflation is at its highest level in 27 years.

The PPI jumped 1.2% last month which is more than double what economists were expecting. Even if you strip out food and energy and just look at the “core rate” wholesale inflation still rose by 0.7% or more than three times the 0.2% expected by economists.For July, wholesale energy prices jumped by 3.1 percent following a 6 percent gain in June. That increase reflected big jumps in the price of natural gas, home heating oil and liquefied petroleum gas, which offset a 0.2 percent dip in gasoline costs.

Food prices rose by 0.3 percent in July after a 1.5 percent surge in June. Beef prices jumped by 7.4 percent, the biggest increase in nearly four years. Milk prices shot up by 5 percent, the biggest gain in a year, while soft drink prices rose by 2.4 percent, the largest increase in four years.

Excluding energy and food, the 0.7 percent rise in core inflation reflected big gains in the prices of passenger cars and light trucks, pharmaceutical preparations and plastic products.Naturally there’s a bit of a lag to these numbers and the dramatic sell-off in oil prices will most likely be seen in next month’s report.

-

More Troubles on Wall Street

Posted by Eddy Elfenbein on August 18th, 2008 at 2:07 pmPart 1:

Part 2:

Part 3:

From Equity Private. -

From the Halls of Academia

Posted by Eddy Elfenbein on August 18th, 2008 at 1:50 pmFinally!

A New Value-Weighted Total Return Index for the Finnish Stock Market 1912-1969 -

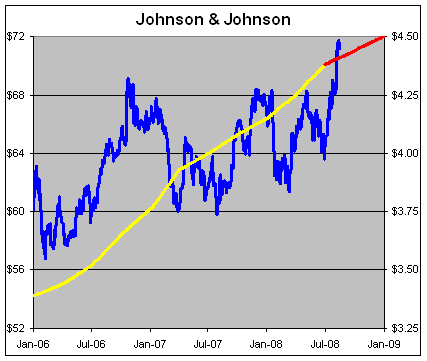

JNJ Hits New High

Posted by Eddy Elfenbein on August 18th, 2008 at 1:11 pmI really like the stock of Johnson & Johnson (JNJ). Few companies have been as stable long-term winners as JNJ. A few months ago, I said it was a good buy, especially under $60. Just recently, the shares finally took out their 2005 high. The company reported good earnings again last month. JNJ now sees 2008 EPS coming in at $4.45 to $4.50 which is almost certainly too low.

Here’s a look at JNJ’s stock (blue line, left scale) and earnings (gold line, right scale with EPS projection in red). The two lines are scaled at 16-to-1.

-

The Nasdaq Lauches for New Indexes

Posted by Eddy Elfenbein on August 18th, 2008 at 11:42 amThe Nasdaq has announced that it’s launching four new indexes; biotech, coal, steel and precious metals.

If anyone needs me, I’ll be shorting biotech, coal, steel and precious metals. -

The Plunge of Gold Continues

Posted by Eddy Elfenbein on August 18th, 2008 at 11:20 amA few weeks ago, I wrote about the recent peak in gold prices and said that we’re never quite sure if we’re in a bubble until it’s over. Perhaps one of the best signs that we’re in a bubble is that people will refuse to acknowledge that we’re in a bubble. If that’s any indication, the commentors on my post at Seeking Alpha definitely should have clued us in that gold was headed for a big fall.

Bloomberg reports this morning:Gold may fall for a sixth straight week, the longest slide in four years, as a strengthening dollar erodes the precious metal’s appeal as an alternative investment.

Twelve of 21 traders, investors and analysts surveyed from Mumbai to Chicago on Aug. 14 and Aug. 15 advised selling gold, which last week fell to $792.10 an ounce in New York, capping an 8.4 percent drop for the week that was the biggest in 25 years. Eight respondents said to buy, and one was neutral.

Gold, priced in dollars, generally moves in the opposite direction of the U.S. currency. Gold is down as much as 25 percent from a record $1,033.90 reached on March 17. The last time the metal fell for six straight weeks was in May 2004.If you have some time for a little cheap entertainment, this link will take you to the Yahoo Message board posts for Cisco’s stock on March 27, 2000. That was the highest day for the hottest stock of the era. These posters are so madly in love with their stock it’s almost funny. Absolutely no criticism is allowed. Just look at the posts. They have a religious intensity to them.

To scroll through the posts, just click on the > symbol right by the time stamp.

-

-

Archives

- May 2025

- April 2025

- March 2025

- February 2025

- January 2025

- December 2024

- November 2024

- October 2024

- September 2024

- August 2024

- July 2024

- June 2024

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014

- February 2014

- January 2014

- December 2013

- November 2013

- October 2013

- September 2013

- August 2013

- July 2013

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

- January 2013

- December 2012

- November 2012

- October 2012

- September 2012

- August 2012

- July 2012

- June 2012

- May 2012

- April 2012

- March 2012

- February 2012

- January 2012

- December 2011

- November 2011

- October 2011

- September 2011

- August 2011

- July 2011

- June 2011

- May 2011

- April 2011

- March 2011

- February 2011

- January 2011

- December 2010

- November 2010

- October 2010

- September 2010

- August 2010

- July 2010

- June 2010

- May 2010

- April 2010

- March 2010

- February 2010

- January 2010

- December 2009

- November 2009

- October 2009

- September 2009

- August 2009

- July 2009

- June 2009

- May 2009

- April 2009

- March 2009

- February 2009

- January 2009

- December 2008

- November 2008

- October 2008

- September 2008

- August 2008

- July 2008

- June 2008

- May 2008

- April 2008

- March 2008

- February 2008

- January 2008

- December 2007

- November 2007

- October 2007

- September 2007

- August 2007

- July 2007

- June 2007

- May 2007

- April 2007

- March 2007

- February 2007

- January 2007

- December 2006

- November 2006

- October 2006

- September 2006

- August 2006

- July 2006

- June 2006

- May 2006

- April 2006

- March 2006

- February 2006

- January 2006

- December 2005

- November 2005

- October 2005

- September 2005

- August 2005

- July 2005

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His

Eddy Elfenbein is a Washington, DC-based speaker, portfolio manager and editor of the blog Crossing Wall Street. His